AI-Native Accounting Embedded in Your Platform

Complete business management suite—from company formation to AI bookkeeping and tax filing—integrated directly into your digital banking platform. White-labeled under your brand.

4-6 weeks

to go-live

No core

integration needed

Support Every Stage of the SMB Journey

From formation to accounting and tax compliance—embedded directly in your platform.

Free LLC Formation

Capture new businesses at formation—before national banks do. Free incorporation under your brand drives lower CAC and 7-year relationship value.

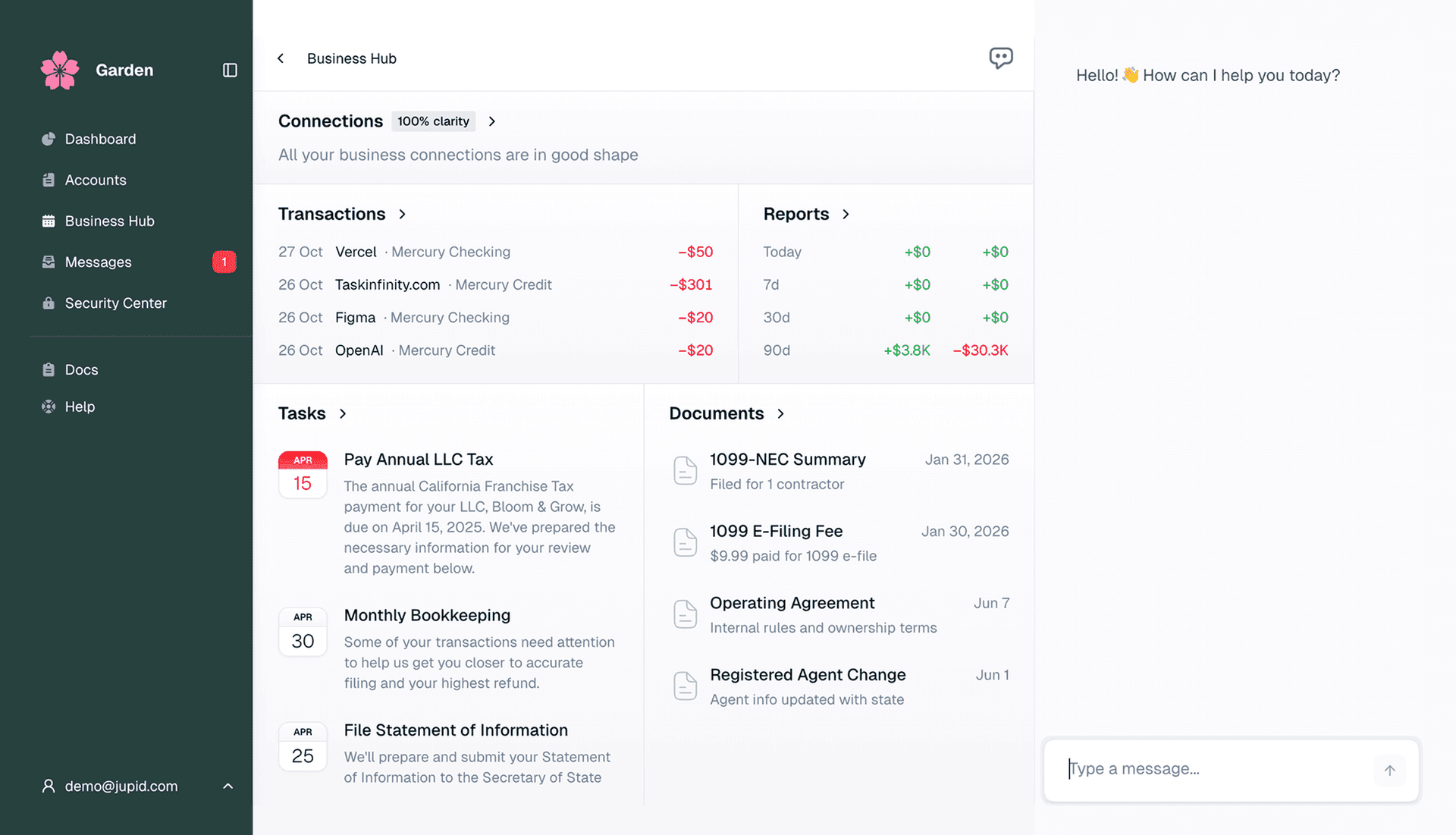

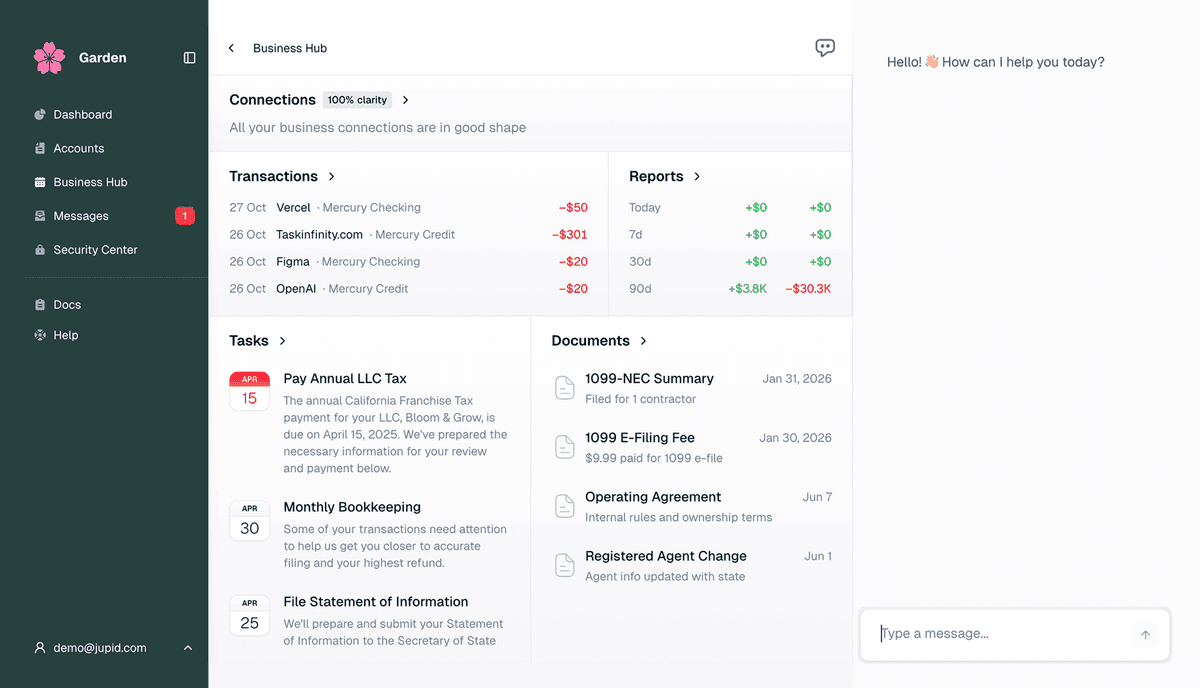

AI-Native Bookkeeping

Intelligent transaction categorization that learns your members' businesses. Context-aware, not just rule-based.

Conversational Interface

24/7 AI accountant via WhatsApp, iMessage, or embedded chat. Your members get help where they already work.

Tax & Compliance

Automated tax preparation and filing with CPA oversight. Keeps businesses compliant without extra effort.

Real-Time Insights

Business intelligence and cash flow analytics powered by AI. Helps your members make smarter decisions.

Seamless Integration

Embeds directly in Banno and other platforms. No core system changes required.

Your Business Customers Are Already Here

Capture the hidden SMBs within your existing retail base

Of retail customers run businesses through personal accounts

Of new LLCs never see your business banking offer—captured by incorporation platforms

Businesses filed in 2024—all looking for their first bank

Built for Your Platform

Seamless integration with leading digital banking platforms and hundreds of data sources.

Digital Banking Platforms

Banno

Live

Candescent

In Progress

Alkami

Roadmap

Financial Data

- All US Banks (via Plaid)

- Stripe, Deel

- QuickBooks, Xero

Communication

- WhatsApp, iMessage

- SMS

AI Infrastructure

- Anthropic Claude

- OpenAI

- 10+ AI providers

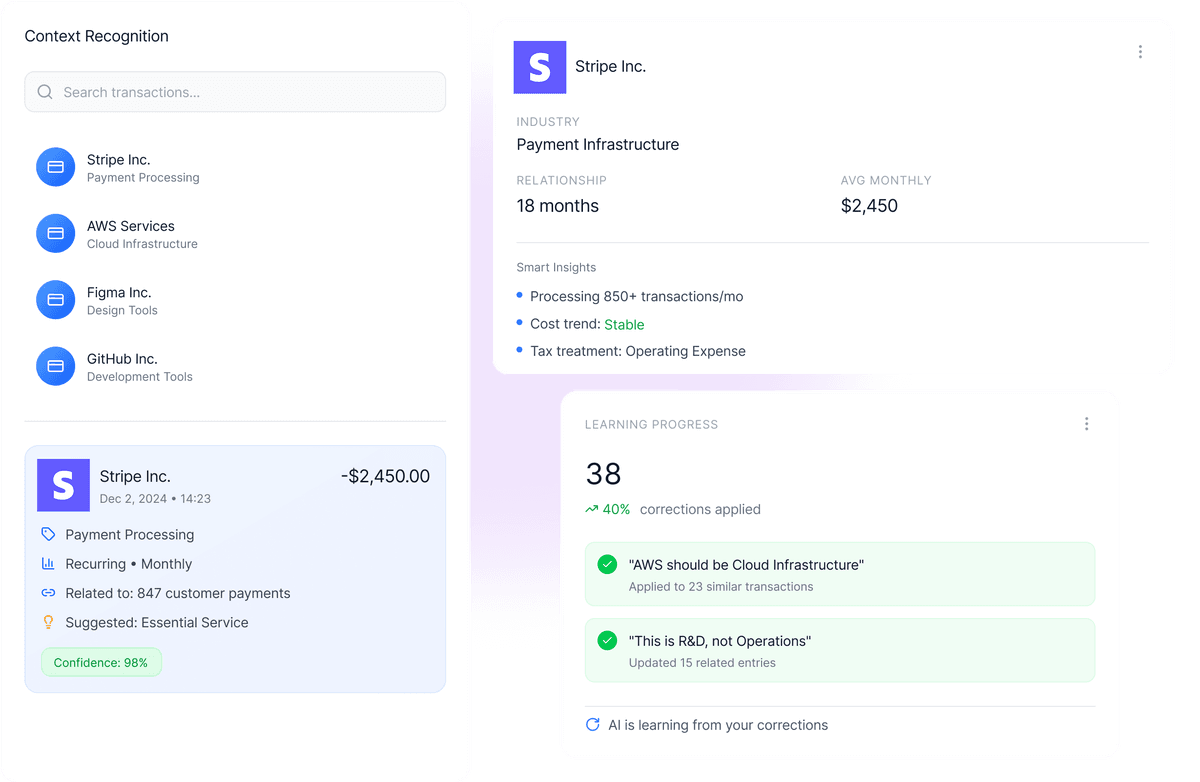

AI That Understands Business Context

Not just transaction categorization. Jupid's AI understands your members' businesses, their relationships, and their financial patterns to provide truly autonomous accounting.

AI That Learns From Every Transaction

Not just categorization—our AI understands context, learns from feedback, and adapts to each business:

- Learns industry-specific spending patterns

- Recognizes vendor relationships and contracts

- Understands transaction purpose, not just category

- Continuously improves with every transaction

Result: 95%+ categorization accuracy vs. 60-70% for traditional tools

AI Accountant in Messenger

Your members' businesses don't stop at 5pm. Neither does Jupid. Natural language AI assistant available anytime, anywhere:

- WhatsApp, iMessage, and embedded chat

- Send receipts by photo—instant processing

- Ask questions in plain English

- CPA oversight for complex matters

Saves business owners 8 work weeks annually in bookkeeping time

Fully White-Labeled

Jupid powers the experience, but your members see only your brand. Complete customization and control:

- Your logo, colors, and branding throughout

- Embedded directly in your digital banking

- Seamless experience under your brand

- Your brand builds trust and loyalty

Members stay in your ecosystem—no redirect to external platforms

Enterprise-Grade Technology Stack

Built for scale, security, and reliability. Everything you need to confidently offer business services.

Seamless Platform Integration

Direct integration with Banno (Jack Henry) and other digital banking platforms. No core system changes required—connects via APIs only.

Universal Data Access

Connect to any financial institution, payment processor, or business tool. Real-time transaction sync from all sources.

SOC 2 (In Progress)

Bank-level security with encryption, audit trails, and compliance monitoring. CPA oversight for all tax filings.

Multi-Provider AI

10+ AI provider redundancy ensures reliability. Automatic model routing for optimal performance and cost.

White-Glove Onboarding

Dedicated implementation team, ongoing partner success management, and 24/7 technical support.

Why Financial Institutions Choose Jupid

The only embedded solution that combines company formation, AI accounting, and tax compliance in one platform.

For Your Financial Institution

Capture at Formation

Free LLC incorporation captures businesses on day one—before national banks do.

New Revenue Stream

$120+ annual recurring revenue per business member with 20% margin.

Increase Share of Wallet

Members stay in your platform for banking + accounting + taxes.

Easy Implementation

4-6 weeks to go-live. No core system integration required.

Competitive Differentiation

Offer what only national banks and fintech companies could before.

For Your Business Members

Saves $5,000+ Annually

vs. traditional accountants and fragmented tools.

Saves 8 Work Weeks

AI automation eliminates manual bookkeeping tasks.

One Trusted Relationship

Banking, accounting, and taxes—all through their financial institution.

Zero Learning Curve

Conversational AI in WhatsApp and iMessage. No training needed.

Never Miss Deductions

AI finds every tax deduction automatically. No spreadsheet gymnastics.

Technology That Sets Us Apart

AI-Native Architecture

Built with AI from day one—not bolted on. Three-layer contextual intelligence understands company, relationships, and transactions.

Multi-Provider Redundancy

10+ AI providers ensure 99.9% uptime. Automatic failover and model routing for optimal performance.

Self-Improving Systems

Every transaction improves accuracy. DSPy-inspired architecture means prompts evolve automatically based on performance.

Ready to Transform Business Banking?

Join leading credit unions and community banks offering AI-powered business services. Capture members at formation, deepen relationships with embedded accounting, and generate new revenue.

4-6

weeks to go-live

No core

integration needed

Integrated with Banno (Jack Henry) • Candescent in progress • SOC 2 certification in progress