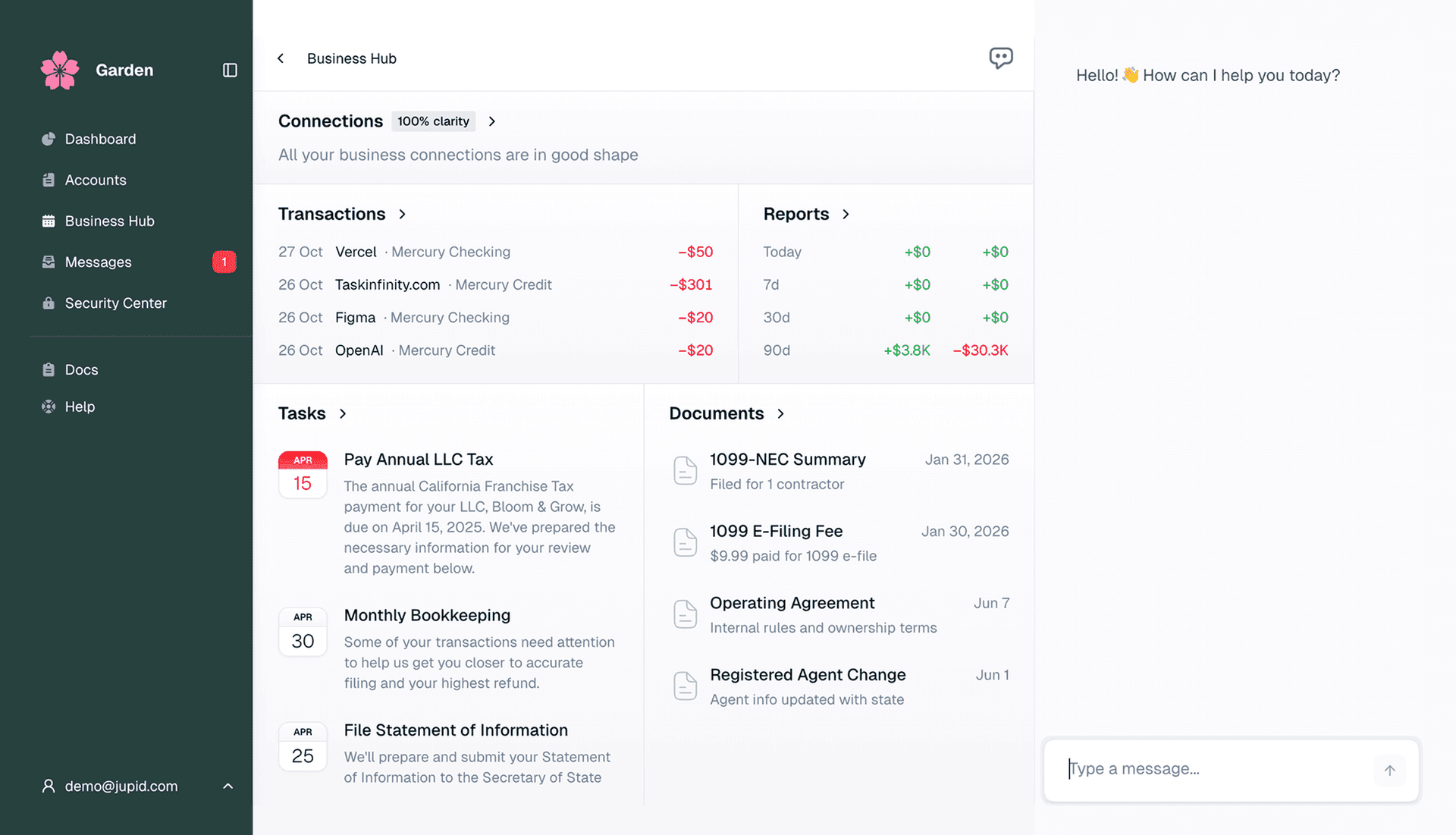

All-in-One Ecosystem for Small Businesses

Formation, accounting, and tax services embedded in your banking platform.

For Credit Unions, Community Banks & Regional FIs

Acquire

Activate

Deepen

Business Relationships Growth for Life

A three-stage strategy to acquire, activate, and deepen business banking relationships

ACQUIRE

Free Incorporation. Lower CAC. Capture new business owners at formation.

ACTIVATE

Business Account Opening. Maximize funded accounts. Offer state fee refund.

DEEPEN

AI-Native Accountant & Tax Services. Non-interest fee income. Increased share of wallet.

Your Business Customers Are Already Here

Capture the hidden SMBs within your existing retail base.

25%

Of retail customers run businesses through personal accounts

87%

Of new LLCs never see your business banking offer—captured by incorporation platforms

20M

Businesses filed in 2024—all looking for their first bank

Compete at Formation

National banks capture businesses through LegalZoom, Stripe Atlas, and incorporation platforms. Now you can too—under your brand.

Free LLC Formation + Account Opening

One-click business creation and banking. Be the trusted partner from day one.

Result: Lower customer acquisition cost. Higher lifetime value. First-mover advantage.

Keep Customers in Your Platform

Of businesses leave their FI for accounting/tax services

Want banking integrated with accounting tools

Embedded Accounting & Tax

AI accountant, tax filing, compliance—inside your digital banking. Saves business owners $5,000+ and 8 work weeks annually. New non-interest fee income for you.

Built for Your Digital Banking Platform

Seamless integration with your existing technology stack.

Seamless Integration

Embed Jupid directly into your digital banking platform. Works with Banno and more.

Universal Connectivity

Connect to Plaid, QuickBooks, Stripe, and hundreds of other data sources.

24/7 Support

WhatsApp, iMessage, and Email support for your business customers.

SOC2 (In Progress)

Secure by default with decisioning trails, audit trails, and always-on partner oversight.

Built for Digital Banking

Integrated in Banno (Jack Henry). Candescent—in progress.

Ready to Grow Business Banking?

Capture new business members at formation, deepen relationships with embedded accounting, and generate new non-interest fee income.

4–6

weeks to go-live

$120+

per member/year revenue

Zero

core integration required

Integrated with Banno (Jack Henry) • Candescent in progress