2025 Tax Year in Review: What Changed for Small Businesses

Table of Contents

Published: December 17, 2025

2025 was the most chaotic tax year for small businesses in recent memory.

Between regulatory reversals, new legislation, and court battles, keeping up with what's actually law became a full-time job. I've compiled everything you need to know—what changed, what it means, and how to prepare for 2026.

The Big Picture: What Actually Happened

The "One Big Beautiful Bill" (OBBBA) passed in 2025 brought sweeping changes, but not all provisions took effect immediately. Meanwhile, court injunctions, Treasury announcements, and IRS guidance created a constantly shifting landscape.

Here's the final status of major tax changes as we head into 2026.

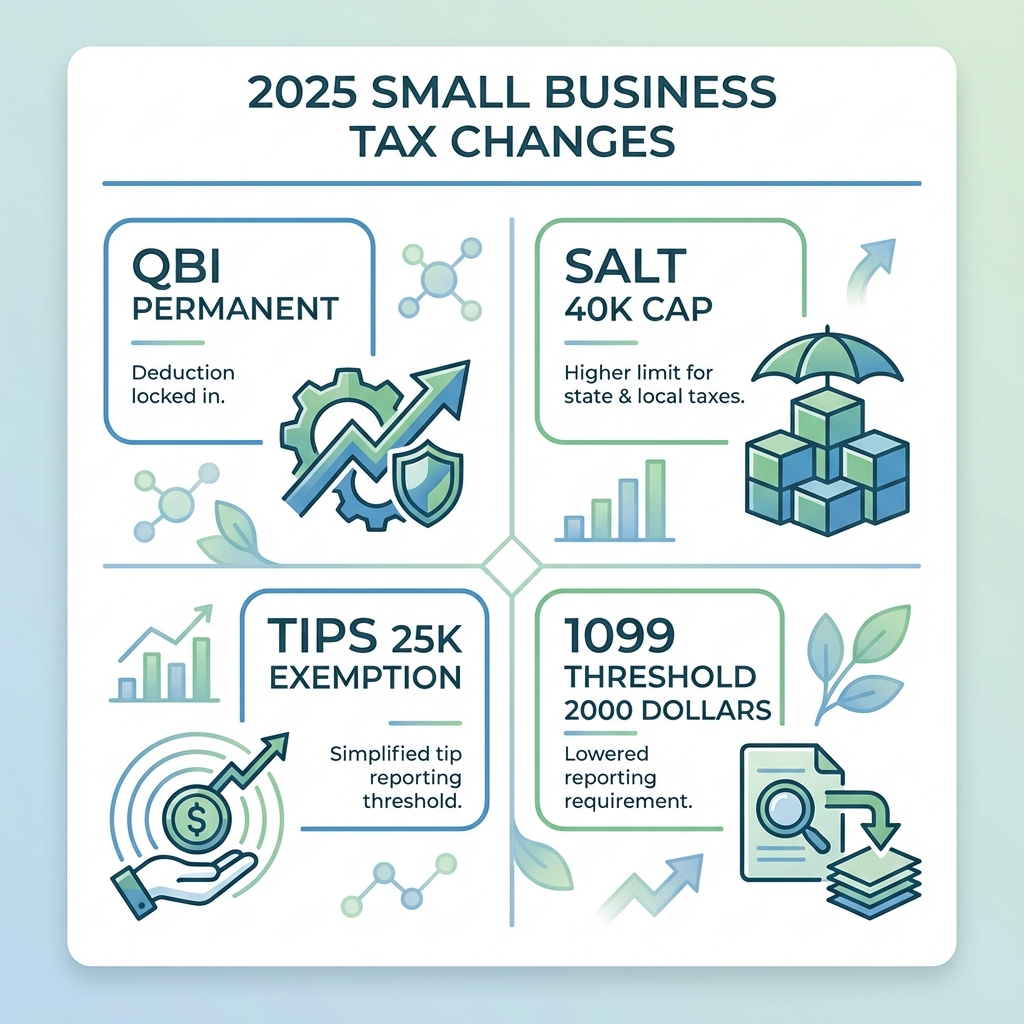

1. QBI Deduction Made Permanent

What changed: The 20% Qualified Business Income (QBI) deduction for pass-through entities is now permanent.

Previously: Set to expire after 2025.

Now: Locked in indefinitely, with enhancements:

- New $400 minimum deduction for businesses with active income exceeding $1,000 (effective 2026)

- Continues to allow eligible taxpayers to deduct up to 20% of qualified business income

Who benefits: Sole proprietors, partnerships, S-corps, and some LLCs.

Action item: If you've been hesitant to make long-term business structure decisions because of QBI uncertainty, that constraint is gone. Plan accordingly.

Source: Grant Thornton 2025 Legislative Analysis

2. SALT Cap Increased from $10K to $40K

What changed: The State and Local Tax (SALT) deduction cap increased from $10,000 to $40,000.

Who qualifies: Taxpayers with adjusted gross income (AGI) of $500,000 or less.

Timeline: 2025-2029, with a 1% annual increase. After 2029, reverts to $10,000.

Why it matters: Small business owners in high-tax states (California, New York, New Jersey) can now deduct significantly more state and local taxes on their federal returns.

The math:

- Previous max deduction: $10,000

- New max deduction: $40,000

- Potential federal tax savings: Up to $14,800 (at 37% bracket)

Action item: If you've been using SALT workarounds (like pass-through entity election), recalculate whether they're still beneficial under the new cap.

3. No Tax on Tips: The $25K Exemption

What changed: Qualifying tipped employees can deduct up to $25,000 in cash tips from federal taxable income.

Timeline: 2025-2028

Who qualifies:

- Individuals earning less than $150,000 annually

- Occupations that "customarily and regularly" received tips before December 31, 2024

- IRS published qualifying occupations list by October 2, 2025

Important nuance: This is a deduction, not a credit. Tips are still subject to Social Security and Medicare taxes.

For business owners: If you manage tipped employees, this changes your payroll calculations and employee communication. The IRS has provided guidance on updating withholding.

Action item: Review your payroll systems and employee communications for 2026.

Source: IRS One Big Beautiful Bill Provisions

4. 1099 Threshold Raised: $600 → $2,000

What changed: The threshold for issuing 1099 forms increased from $600 to $2,000, with inflation adjustments going forward.

Why it matters: Fewer forms to file. If you paid a contractor $1,500, you no longer need to issue a 1099.

Administrative relief:

- Reduced paperwork for small businesses

- Fewer opportunities for reporting errors

- Simplified year-end processes

Caution: This doesn't change your obligation to report income—it only reduces the paperwork burden. All income is still taxable.

Action item: Update your accounts payable thresholds and contractor management processes.

5. BOI Reporting: The Saga

What happened: The Beneficial Ownership Information (BOI) reporting requirement went through four reversals in 12 months.

Timeline:

- December 2024: Federal court issues nationwide injunction

- December 23, 2024: Injunction briefly lifted (deadline: January 13, 2025)

- December 26, 2024: Injunction reinstated

- February 2025: Injunction lifted again, deadline extended to March 21

- March 2025: Treasury suspends enforcement for domestic companies

Current status: BOI reporting requirements for domestic companies are suspended. Foreign reporting companies still must comply.

What this means: If you scrambled to file BOI reports in early 2025, you weren't wrong to be cautious—the landscape was genuinely uncertain. But for now, domestic small businesses are not required to file.

Action item: Monitor FinCEN announcements. A final rule is expected that may revise requirements.

Source: Associated Press - Treasury BOI Suspension

6. Enhanced Child Care Benefits (Effective 2026)

What changed: Multiple provisions enhance tax benefits for child care:

Employer-Provided Child Care Credit:

- Increased from 25% to 40% of qualified expenditures

- Small businesses: 50% credit rate

- Maximum credit: $500,000 ($600,000 for small businesses), up from $150,000

Dependent Care Assistance Program:

- Maximum annual benefit: $7,500, up from $5,000

Child and Dependent Care Tax Credit:

- Increased to 50% of expenditures (from 35%)

- Income thresholds adjusted

Why it matters: If you provide child care benefits or are considering it, the economics improved significantly.

Action item: Review your benefits package. Enhanced credits may make child care assistance cost-effective where it wasn't before.

7. Qualified Production Property Deduction

What changed: A new 100% deduction for the cost of qualified production property used in manufacturing.

Requirements:

- Construction begins after January 19, 2025, and before January 1, 2029

- Property placed in service before January 1, 2031

- Used for manufacturing, production, or refining within the United States

Who benefits: Small manufacturers and producers investing in new equipment or facilities.

Action item: If you're planning capital expenditures for production equipment, the timing window matters. Consider acceleration if you can meet the construction start date requirement.

What Didn't Change (But You Might Have Expected It To)

Section 199A phase-out: Still applies to specified service trades and businesses above income thresholds.

Self-employment tax: No changes to the 15.3% rate structure.

Estimated tax requirements: Quarterly deadlines and safe harbor rules unchanged.

Home office deduction: Simplified option ($5/sq ft, max 300 sq ft) still available alongside actual expense method.

Planning for 2026: Key Actions

Before December 31, 2025:

- Max out retirement contributions (Solo 401k, SEP-IRA)

- Consider income acceleration or deferral based on your rate situation

- Review SALT strategy under new $40K cap

- Evaluate entity structure with QBI permanence in mind

For Q1 2026:

- Update payroll systems for tips exemption (if applicable)

- Adjust 1099 tracking thresholds

- Review child care benefit offerings

- Monitor BOI final rule developments

Ongoing:

- Work with a qualified tax professional (these changes are complex)

- Track legislative developments—more changes are likely

- Document everything—enhanced deductions require enhanced documentation

The Bottom Line

2025 was a year of tax chaos, but the dust is settling into a more favorable landscape for small businesses:

- QBI permanent = long-term planning stability

- SALT cap raised = relief for high-tax state residents

- Tips exemption = real savings for hospitality businesses

- Higher 1099 threshold = less paperwork

- BOI suspended = one less compliance burden (for now)

The challenge now is execution. These benefits require understanding the rules and planning accordingly.

I'm Slava Akulov, CEO and Co-founder of Jupid. We're building AI-native accounting that understands context, not just data—helping small businesses capture every deduction they're entitled to. If you want to see how AI can simplify your tax compliance, reach out.

Sources

- IRS: One Big Beautiful Bill Provisions - 2025

- Grant Thornton: 2025 Tax Act Key Changes - 2025

- Duane Morris: 2025 Year-End Tax Planning Guide - December 2025

- Kiplinger: No Tax on Tips Approved - 2025

- Associated Press: Treasury BOI Reporting Suspension - March 3, 2025

- H&R Block: Current Tax Reform and Law Changes - 2025

Ready to simplify your finances?

Join 1,000+ businesses using Jupid to save time and money. Start simplifying your finances today.

30-day money-back guarantee