Nurse Tax Deductions 2026: Complete Guide for RNs, Travel Nurses, and Healthcare Workers

Table of Contents

Published: January 24, 2026 Tax Year: 2026

A Message from Slava

Nurses work incredibly demanding jobs—12-hour shifts, weekends, holidays—and many pay for their own scrubs, continuing education, and professional licenses. The tax rules for nurses changed significantly in 2018, and many healthcare workers don't realize which deductions they can still claim.

Here's the key distinction: W-2 employees (staff nurses at hospitals) lost most deductions after the 2017 Tax Cuts and Jobs Act. But travel nurses, per diem nurses, and self-employed nurses still have significant tax deductions available.

This guide covers the rules for both employee nurses and travel nurses, with specific strategies for maximizing your tax savings.

Executive Summary: Nurse Tax Deductions for 2026

Key Deductions by Employment Type:

| Expense | W-2 Staff Nurse | Travel Nurse (W-2 with stipends) | Self-Employed Nurse |

|---|---|---|---|

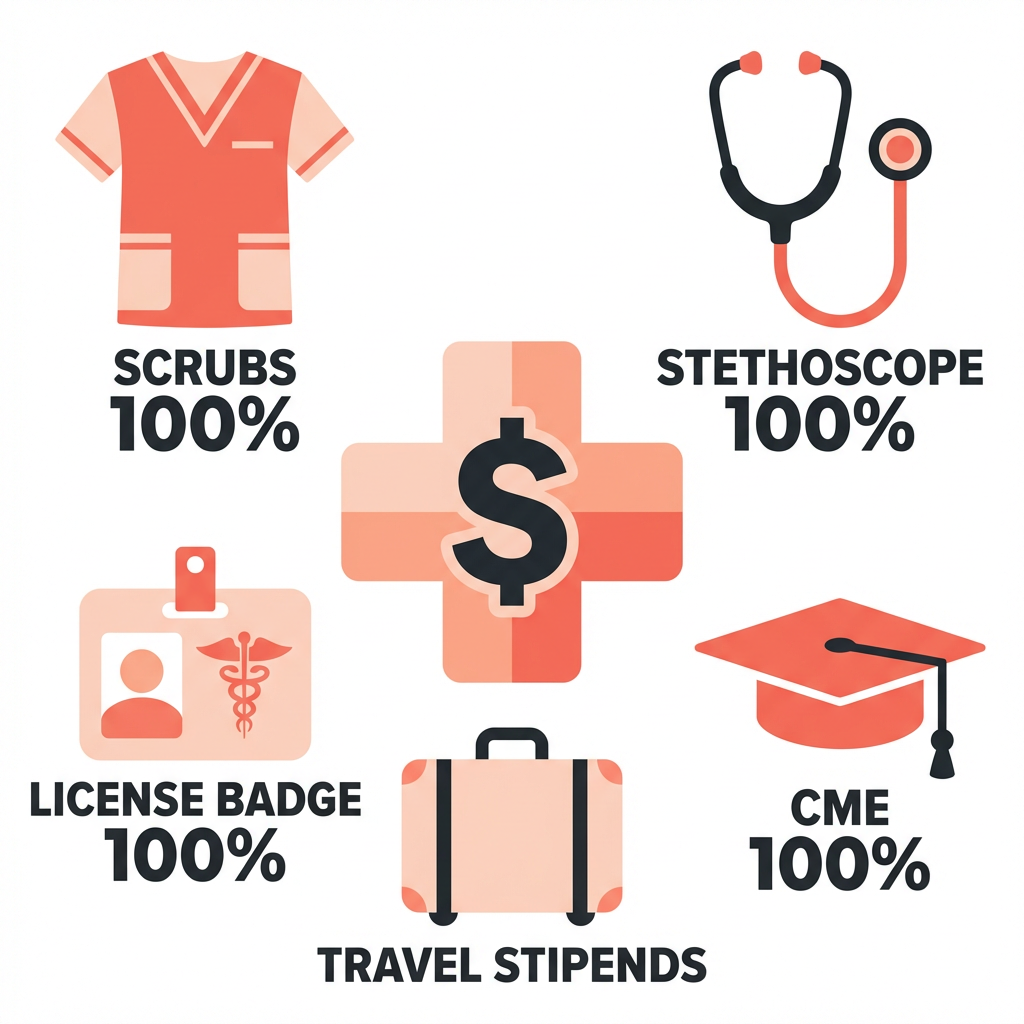

| Scrubs/Uniforms | ❌ Not deductible | ❌ Not deductible | ✅ 100% deductible |

| License fees | ❌ Not deductible | ❌ Not deductible | ✅ 100% deductible |

| CME/Education | ❌ Not deductible* | ❌ Not deductible* | ✅ 100% deductible |

| Stethoscope/equipment | ❌ Not deductible | ❌ Not deductible | ✅ 100% deductible |

| Travel stipends | N/A | ✅ Tax-free if rules met | N/A |

| Mileage | ❌ Not deductible | Varies | ✅ 72.5¢/mile |

*May qualify for education credits

Tax Savings Potential for Travel Nurses:

For a travel nurse earning $100,000 with proper tax home:

Tax-free housing stipend: $24,000

Tax-free M&IE stipend: $12,000

Total tax-free income: $36,000

Tax savings (not taxed at 24%): $8,640

Legal Basis: IRC Section 162, IRS Publication 463, IRS Publication 529

W-2 Staff Nurses: What You Can and Can't Deduct

The 2018 Change That Affected Nurses

Before 2018, W-2 employees could deduct unreimbursed job expenses (scrubs, license fees, CEU costs) on Schedule A if they exceeded 2% of adjusted gross income.

After the Tax Cuts and Jobs Act (2018-2025+): These deductions are suspended for W-2 employees. You can no longer deduct:

- Scrubs and uniforms

- Stethoscopes and medical equipment

- License renewal fees

- Continuing education (as an employee expense)

- Professional memberships

- Work shoes

What W-2 Nurses CAN Still Claim

✅ Education Credits:

- Lifetime Learning Credit: Up to $2,000 for tuition/courses

- Applies to qualifying courses at eligible institutions

✅ Health Insurance (if applicable):

- HSA contributions

- Pre-tax benefits through employer

✅ State Tax Deductions:

- Some states (CA, NY, others) still allow unreimbursed employee expenses

- Check your state's rules

Travel Nurse Tax Rules: Understanding Stipends

Travel nurses have unique tax situations. When done correctly, a significant portion of your compensation can be tax-free.

Tax-Free Stipends: How They Work

Travel nurses typically receive:

- Taxable hourly wage (reported on W-2)

- Tax-free housing stipend (not reported as income)

- Tax-free meals & incidental expenses (M&IE) stipend

The stipends are tax-free because they reimburse you for "duplicating" living expenses—maintaining a home AND living in a temporary location.

The Critical "Tax Home" Requirement

To receive tax-free stipends, you MUST maintain a tax home. This is the most important concept for travel nurses.

IRS Definition of Tax Home: Your tax home is your regular place of business or post of duty, regardless of where you live.

To have a tax home, you must:

✅ Maintain a residence in your home area that you pay for (rent, mortgage, or fair rent to family) ✅ Return regularly to your tax home (at least once every 12 months) ✅ Have duplicate expenses (paying for both your permanent home AND temporary housing)

What Qualifies as Maintaining a Tax Home

| Situation | Tax Home Status |

|---|---|

| Pay rent/mortgage on apartment while traveling | ✅ Valid tax home |

| Pay fair market rent to live with family | ✅ Valid tax home |

| Rent out your home while traveling | ❌ May lose tax home |

| No permanent residence, move contract to contract | ❌ No tax home ("itinerant") |

| Use storage unit + P.O. box only | ❌ No tax home |

If You DON'T Have a Tax Home

If the IRS determines you don't have a valid tax home, your stipends become fully taxable. This can result in:

- Owing back taxes on years of stipends

- Penalties and interest

- Potential audit issues

This is serious. Many travel nurses unknowingly violate these rules.

Calculating Travel Nurse Tax Savings

Example: Proper Tax Home Structure

Total compensation: $100,000

Breakdown:

Taxable wages: $64,000

Tax-free housing stipend: $24,000

Tax-free M&IE stipend: $12,000

Taxable income: $64,000 (not $100,000)

Tax on $64,000 (22% bracket): $14,080

Tax if fully taxable (22% on $100k): $22,000

Tax savings from stipends: $7,920

Example: No Tax Home (Itinerant)

Total compensation: $100,000

All income is taxable: $100,000

Tax on $100,000 (22% bracket): $22,000

Plus potential penalties for prior years...

Per Diem and Agency Nurses

Per diem nurses and agency nurses who are W-2 employees follow the same rules as staff nurses—limited deductions.

However, if you work as a 1099 independent contractor (which is rare but possible for certain nursing roles), you can deduct:

✅ Deductible for 1099 nurses:

- Scrubs and uniforms (100%)

- Stethoscope and medical equipment (100%)

- License fees (100%)

- Continuing education (100%)

- Mileage to assignments (72.5¢/mile)

- Professional liability insurance (100%)

- Professional memberships (100%)

Self-Employed Nurses: Full Deduction Access

Self-employed nurses (nurse practitioners with their own practice, nurse consultants, legal nurse consultants, etc.) can deduct all ordinary and necessary business expenses.

Deductible Expenses

✅ Uniforms and equipment:

- Scrubs and lab coats

- Stethoscope, BP cuff, otoscope

- Medical bag and supplies

- Shoes (if required for work only)

✅ Licensing and certification:

- State nursing license renewal

- National certification (ANCC, AANP)

- DEA registration (if prescribing)

- Specialty certifications

✅ Continuing education:

- Required CE credits

- Conferences and seminars

- Professional workshops

- Medical journals and subscriptions

✅ Professional expenses:

- Malpractice insurance

- Professional memberships (ANA, specialty organizations)

- Background checks

✅ Business expenses:

- Home office (if applicable)

- Mileage to patients/clients

- Business phone and internet

- EHR/EMR software subscriptions

Calculation Example: Self-Employed NP

Scrubs and equipment: $500

License renewals: $300

CE courses and conferences: $1,500

Malpractice insurance: $2,000

Professional memberships: $400

EHR software: $1,200

Mileage (5,000 miles × $0.725): $3,625

Home office (150 sq ft × $5): $750

Total deductions: $10,275

Tax savings at 24% bracket: $2,466

Education Credits for All Nurses

Even W-2 nurses can claim education credits for qualifying courses.

Lifetime Learning Credit

- Credit amount: 20% of first $10,000 in tuition = up to $2,000

- Income limits (2026): Phases out at $80,000-$90,000 (single)

- Qualifying expenses: Tuition at eligible institutions (not employer-provided CE)

Example:

BSN to MSN tuition: $8,000

Lifetime Learning Credit (20%): $1,600

Direct tax reduction: $1,600

Common Mistakes Nurses Make

Mistake #1: Deducting W-2 Employee Expenses

Problem: Trying to deduct scrubs, licenses, and CE as a W-2 employee

Impact: IRS denies deductions, potential penalties

Solution: W-2 employees cannot deduct these expenses federally (check state rules).

Mistake #2: Travel Nurses Without Valid Tax Home

Problem: Not maintaining a true permanent residence

Impact: All stipends become taxable, plus back taxes and penalties

Solution: Maintain and document your tax home properly.

Mistake #3: Renting Out Your Tax Home

Problem: Renting out your permanent residence while on assignment

Impact: May lose tax home status, making stipends taxable

Solution: Keep your tax home available for your use; paying rent to family is fine.

Mistake #4: Missing Education Credits

Problem: Not claiming Lifetime Learning Credit for nursing courses

Impact: Missing $1,000-$2,000 in tax credits

Solution: Claim education credits on Form 8863 for qualifying tuition.

Track Your Nursing Deductions With AI

Whether you're a travel nurse tracking stipends or a self-employed NP managing expenses, Jupid automates the process.

What makes Jupid different for healthcare workers:

✅ AI accountant in WhatsApp - Ask tax questions anytime, get instant answers backed by IRS guidance

✅ 95.9% accuracy in categorization - Connect your bank; Jupid automatically categorizes scrubs, CE courses, and license fees

✅ Real-time financial insights - See your deductions and estimated tax liability throughout the year

✅ Automatic tax filing - From expense tracking to your tax return, handled for you

Example conversation:

- You: "I'm a travel nurse. Are my housing stipends taxable?"

- Jupid: "If you maintain a valid tax home (permanent residence you pay for and return to), housing stipends are tax-free under IRS per diem rules. Do you want me to help you verify your tax home status?"

Action Checklist by Nurse Type

W-2 Staff Nurses

- Check if your state allows unreimbursed employee expenses

- Maximize pre-tax benefits (HSA, FSA)

- Claim education credits for qualifying tuition

- Track expenses in case federal rules change

Travel Nurses

- Document your tax home (lease, receipts, utility bills)

- Return to your tax home at least once per 12 months

- Keep records of duplicate expenses

- Track assignment dates and locations

- Consult a travel nurse tax specialist

Self-Employed Nurses

- Save all receipts for supplies and equipment

- Track mileage to patients/clients

- Document CE and licensing expenses

- Set aside 25-30% of income for taxes

- Make quarterly estimated tax payments

Resources and Citations

IRS Publications (Official Sources)

- IRS Publication 463 - Travel, Gift, and Car Expenses

- IRS Publication 529 - Miscellaneous Deductions

- IRS Publication 970 - Tax Benefits for Education

- IRS Topic 511 - Business Travel Expenses

Tax Code and Regulations

- IRC § 162 - Trade or Business Expenses

- IRC § 67 - 2% Floor (suspended for employees)

- IRC § 25A - Education Credits

- IRS Notice 2026-10 - Standard Mileage Rates for 2026

2026 Key Numbers Summary

| Item | 2026 Limit |

|---|---|

| Standard mileage rate | 72.5¢ per mile |

| Simplified home office | $5/sq ft (max $1,500) |

| Lifetime Learning Credit | Up to $2,000 |

| GSA per diem (M&IE) | $59-$79/day (varies by location) |

| SE tax rate | 15.3% |

| W-2 employee expenses | NOT deductible federally |

Disclaimer

This article provides general information about tax deductions for nurses and should not be considered tax advice. Tax laws change frequently, and individual circumstances vary significantly. Travel nurse tax rules are complex—maintaining a valid tax home is critical and should be verified with a tax professional familiar with travel healthcare. For advice specific to your situation, consult with a qualified tax professional.

Tax Year: 2026 Last Updated: January 24, 2026

Ready to simplify your finances?

Join 1,000+ businesses using Jupid to save time and money. Start simplifying your finances today.

30-day money-back guarantee