Table of Contents

Published: December 20, 2025

2025 was supposed to be a consolidation year for small business finance. Rising rates, tighter credit, cautious spending.

Instead, it became a year of fundamental shifts.

Here's my review of what actually happened—the technologies that gained traction, the regulatory chaos that created opportunity, and the trends that will carry into 2026.

The Big Picture: What Defined 2025

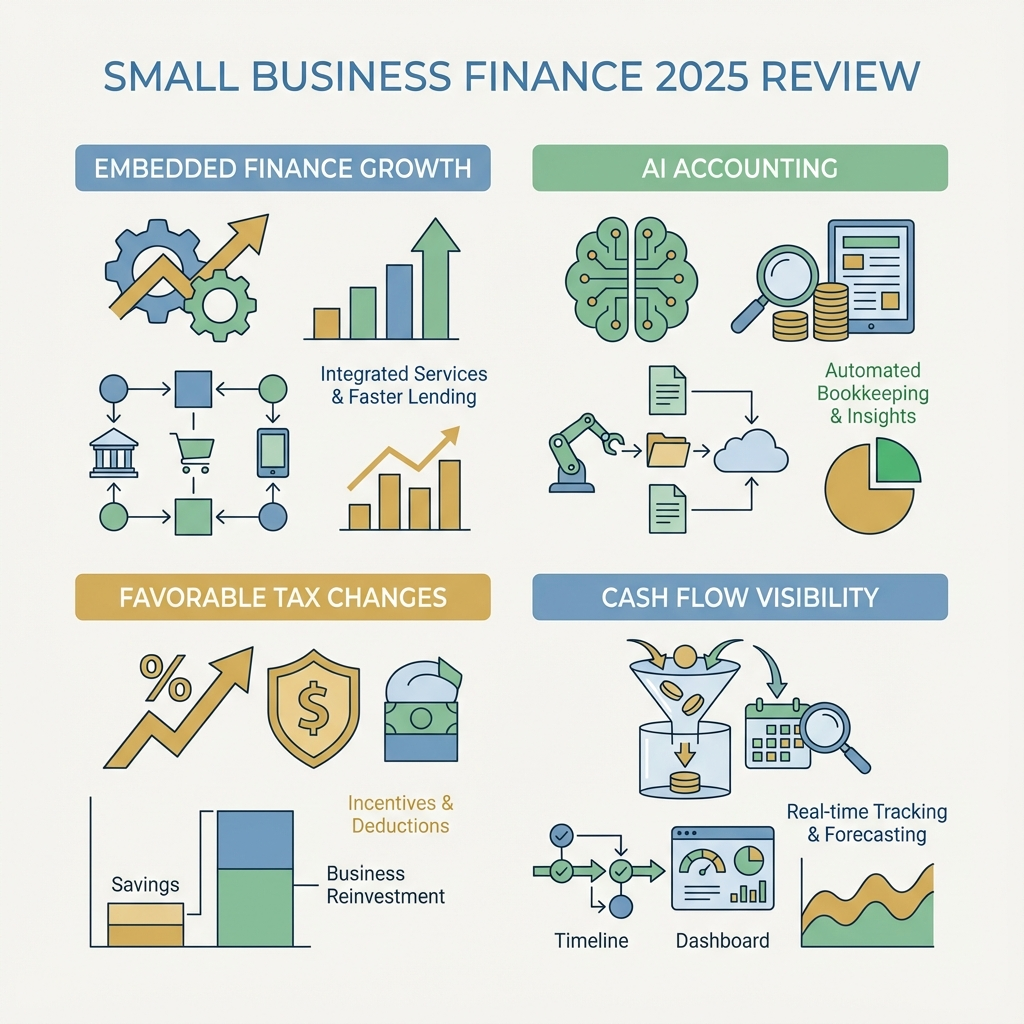

1. Embedded Finance Stopped Being a Buzzword

For years, "embedded finance" was conference-talk. In 2025, it became operational reality.

What changed:

Credit unions and community banks discovered they don't need to build everything in-house. Third-party platforms now deliver:

- Full underwriting using alternative data

- AI-driven cash flow analysis

- Automated servicing and collections

- Integrated compliance reporting

According to Rapid Finance CEO Will Tumulty:

"The growing adoption of embedded finance capabilities for small business lending has been one of the most significant advancements in credit union technology this year."

Why it matters:

The $1.7 trillion SMB lending market has been structurally underserved because:

- Megabanks want $1M+ loans

- Traditional underwriting costs don't scale down

- Community lenders lacked the technology

Embedded platforms change the economics. A $50K business loan can now be profitable.

The result: Small businesses gained access to credit they couldn't get before. Not predatory fintech rates—competitive rates from trusted local institutions.

2. AI-Native Accounting Emerged

We moved past "AI-assisted" to "AI-native."

The distinction:

- AI-assisted: Human does work, AI helps

- AI-native: AI does work, human supervises

What 2025 delivered:

- 46% of accountants now use AI daily (per Intuit QuickBooks survey)

- 81% report AI boosts productivity

- 86% say AI reduces mental load

- 95% adopted automation for processes like payroll and AP

For small businesses, this means:

- Real-time categorization instead of month-end data entry

- Automatic anomaly detection instead of manual review

- Proactive tax insights instead of April surprises

- Context-aware automation instead of rule-based systems

The shift: Accounting moved from recording history to enabling decisions.

3. Tax Chaos Created Net Benefits

2025's regulatory rollercoaster landed in a favorable position for small businesses.

What stuck:

- ✅ QBI deduction permanent — The 20% pass-through deduction is no longer temporary

- ✅ SALT cap raised to $40K — Major relief for high-tax state business owners

- ✅ Tips exemption — Up to $25K excluded from federal income tax

- ✅ 1099 threshold raised — From $600 to $2,000

- ✅ BOI suspended — Domestic reporting requirement on hold

What disappeared:

- ❌ BOI compliance burden (for now)

- ❌ Concern about QBI expiration

- ❌ Some complexity in SALT workarounds

Net effect: The small business tax environment heading into 2026 is more favorable than expected a year ago.

4. Cash Flow Visibility Became Table Stakes

The demand for real-time financial visibility exploded.

Driving factors:

- Interest rate volatility made cash timing critical

- Supply chain disruptions required faster adjustments

- Clients expected immediate answers to financial questions

Technology response:

- Bank integrations delivering same-day transaction data

- Automated cash flow forecasting becoming standard

- Real-time dashboards replacing monthly reports

Small business behavior shift:

Business owners increasingly expect:

- Morning summary of yesterday's transactions

- Automated alerts for unusual activity

- Predictive warnings before cash crunches

- Instant answers to "how much do I have?"

If your financial systems don't provide this, you're operating with last month's map.

5. The Advisory Relationship Transformed

Accountants became strategic partners, not just compliance providers.

The data:

- 79% of accountants expect advisory services to grow

- 38% average expected increase in advisory volume

- 94% believe advisory expansion will boost revenue

- 89% say it improves client relationships

What "advisory" means for small businesses:

Instead of just getting your taxes filed, expect your accountant to offer:

- Cash flow coaching — "Here's when you'll need capital"

- Tax planning — "Make this purchase before year-end"

- Performance analysis — "Your margins are below industry average because..."

- Technology guidance — "Switch to this system to save 10 hours/month"

- Strategic modeling — "Here's what hiring that person will cost you"

The trade: Advisory services cost more than basic compliance. But the ROI—in time saved, taxes reduced, and decisions improved—usually exceeds the premium.

Sector-Specific Highlights

Hospitality and Food Service

The tips exemption was the biggest news. Up to $25,000 in cash tips now excluded from federal income tax (2025-2028).

This matters because:

- Lower effective tax rates for tipped workers

- Potential labor cost implications for employers

- Payroll system changes required

- New documentation requirements

Professional Services

The QBI permanence ends years of uncertainty for consultants, freelancers, and professional service firms.

Planning implications:

- Long-term entity structure decisions can be made with confidence

- Retirement planning models stabilized

- Less need for aggressive income timing strategies

E-commerce and Retail

1099 threshold changes reduced paperwork burden significantly. If you work with many small contractors or affiliates, you'll issue far fewer forms.

But remember: income is still taxable regardless of 1099 issuance. This is paperwork relief, not tax relief.

Manufacturing

Qualified production property deduction offers 100% expensing for qualifying equipment. If you're planning capital investments, the timing window (construction start by January 1, 2029, placed in service by January 1, 2031) matters.

What Didn't Work in 2025

Not everything was progress:

Digital Transformation Stalled

Despite all the AI hype, 93% of bank digital transformations fell short.

The pattern:

- Technology purchased, but not integrated

- Staff expected to maintain operations AND implement change

- Vendor promises didn't match operational reality

- Budget allocated for software, not for labor

For small businesses: This means some of the digital banking improvements you were promised may take longer to arrive.

Cybersecurity Threats Accelerated

Fraud kept pace with digital adoption:

- 44% of financial institutions reported card/check fraud

- ~40% experienced fraudulent account openings

- AI-powered scams became more sophisticated

For small businesses: Your defenses need to match the threats. If you're accepting faster payments, you need faster fraud detection.

Talent Gaps Widened

80% of accounting firms reported hiring difficulties. The profession is struggling to attract people with both accounting knowledge and technology skills.

For small businesses: Finding a tech-savvy accountant or bookkeeper is harder than ever. When you find a good one, the relationship is worth maintaining.

Looking Ahead: 2026 Predictions

Based on 2025's trajectory:

-

AI-native becomes the default — Firms not using AI will struggle to compete on price or speed

-

Embedded finance expands — More credit unions and community banks will offer sophisticated SMB products through platforms

-

Real-time everything — Monthly reporting will feel antiquated; daily will be normal

-

Advisory premiums grow — The gap between compliance-only and advisory-inclusive pricing will widen

-

Consolidation continues — Smaller accounting firms will merge or join networks to access technology and talent

-

Regulatory stabilization — With major legislation passed, expect fewer surprises (but monitor BOI)

Action Items for Small Business Owners

Before Year-End 2025:

- Maximize retirement contributions

- Review SALT strategy under new cap

- Consider accelerating deductions if beneficial

- Document major business decisions

For Q1 2026:

- Update payroll systems for tips exemption (if applicable)

- Review entity structure with QBI permanence in mind

- Assess current financial systems against real-time expectations

- Evaluate your accounting relationship—compliance only or advisory?

Ongoing:

- Implement basic cybersecurity measures

- Monitor BOI developments

- Track cash flow in real-time

- Document everything

The Bottom Line

2025 was chaotic, but the dust settled favorably for small businesses.

The tax environment improved. The technology environment advanced. The financial services available expanded.

The challenge for 2026 isn't whether good options exist—it's whether you can navigate them effectively.

I'm Slava Akulov, CEO and Co-founder of Jupid. We built Jupid because we believe small business finance should be simpler—AI that understands your business context, delivered through iMessage, focused on saving you time and money. If you're tired of the complexity, let's talk.

Sources

Ready to simplify your finances?

Join 1,000+ businesses using Jupid to save time and money. Start simplifying your finances today.

30-day money-back guarantee