Start-Up Expenses Tax Deduction 2026: How to Write Off Pre-Launch Business Costs

Table of Contents

Published: January 8, 2026 Tax Year: 2026

A Message from Slava

Before Jupid officially launched, we spent months—and tens of thousands of dollars—preparing. Market research, legal consultations for our LLC formation, travel to meet potential banking partners, and prototype development all happened before we had our first customer.

I remember asking my accountant: "Can I deduct these expenses? I spent $40,000 before the business even started!"

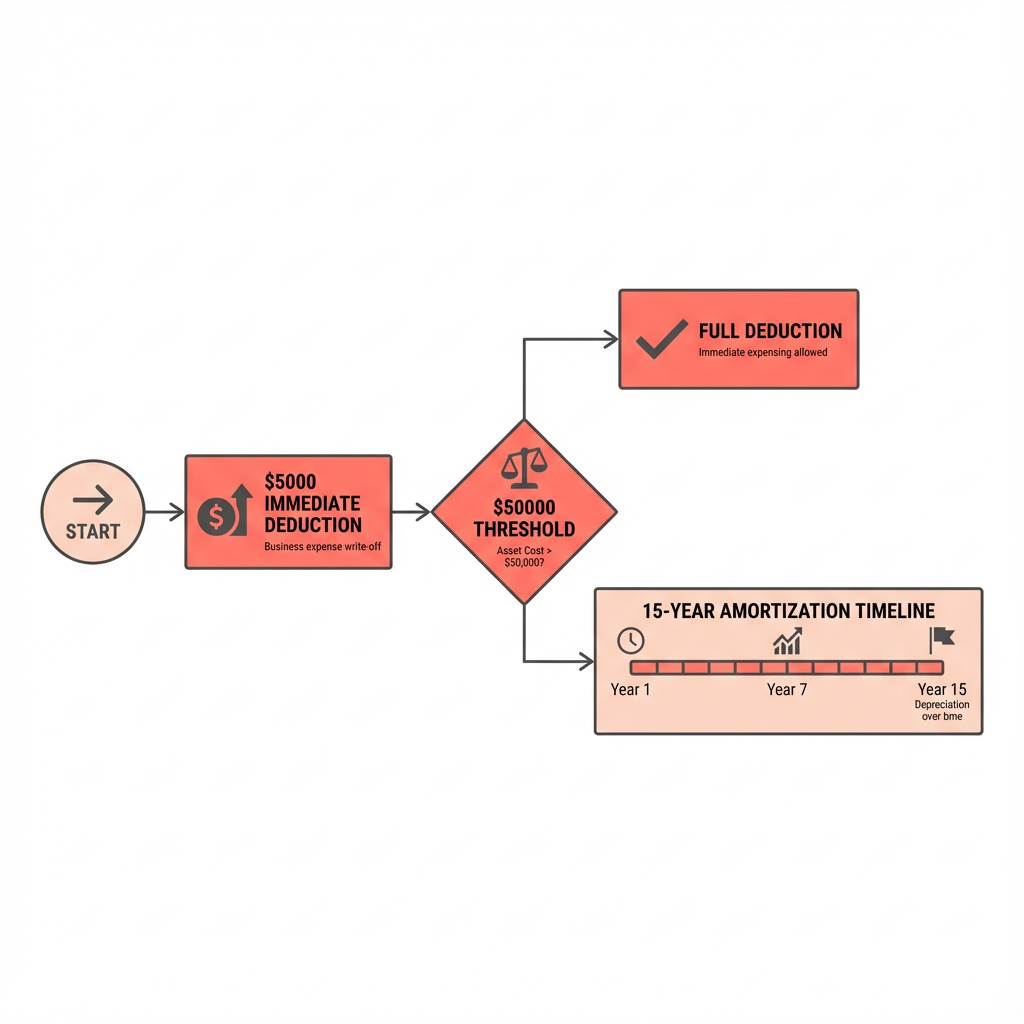

The answer was yes—but the rules are specific. Under IRC Section 195, you can deduct up to $5,000 of start-up expenses immediately, with the rest amortized over 15 years. Knowing these rules saved me significant taxes in our first year.

Yet most new entrepreneurs either don't know start-up expenses are deductible or don't track them properly. They throw away receipts, forget what they spent before officially "opening," and leave thousands in deductions on the table.

This guide will show you exactly how to maximize your start-up expense deductions and ensure every legitimate pre-launch cost counts toward your tax savings.

Executive Summary: Start-Up Expense Deduction Rules

The Basic Framework (IRC § 195):

| Expense Level | Immediate Deduction | Amortization |

|---|---|---|

| $0 - $50,000 | Up to $5,000 | Remainder over 180 months |

| $50,001 - $54,999 | $5,000 minus excess | Remainder over 180 months |

| $55,000+ | $0 | All expenses over 180 months |

Key Rules:

- Deduction allowed only in the year business begins operations

- 15-year (180-month) amortization period starts when business opens

- Must elect the deduction on your tax return

- Organizational expenses have separate $5,000 deduction

Legal Basis: IRC Section 195, IRC Section 248, IRS Publication 535

What Are Start-Up Expenses?

Start-up expenses are costs you incur before your business actually begins operations that would be deductible as ordinary business expenses if incurred after the business started.

The Two Key Requirements

1. Incurred Before Business Begins The expense must be paid or incurred before the business starts operating.

2. Would Be Deductible If Incurred After The expense must be something that would be a normal business deduction if the business were already operating.

Legal Citation: IRC § 195(c) defines start-up expenditures.

What Qualifies as a Start-Up Expense

✅ Qualifying start-up costs include:

- Market research - Analyzing potential customers, competitors, industry trends

- Advertising - Pre-launch marketing, website development, branding

- Training - Learning skills needed to run the business

- Travel - Trips to meet suppliers, scout locations, meet investors

- Professional fees - Consultants, accountants, attorneys (for business advice, not formation)

- Surveys and studies - Feasibility studies, customer surveys

- Salaries and wages - Employees hired for pre-opening activities

- Rent - Office or facility lease payments before opening

What Does NOT Qualify

❌ Not start-up expenses (different treatment):

- Inventory - Capital asset, deducted when sold (COGS)

- Equipment - Capital asset, depreciated or Section 179

- Organizational expenses - Separate category (see below)

- Land or buildings - Capital assets, not deductible

- Interest and taxes - Deductible under different rules

- Research and development - Separate R&D deduction rules apply

The $5,000 Immediate Deduction

How It Works

In the year your business begins operations, you can immediately deduct up to $5,000 of start-up expenses.

Example:

Pre-launch expenses: $8,000

Immediate deduction: $5,000

Remaining to amortize: $3,000

Amortization (180 months): $16.67/month

First year amortization (12 months): $200

Total first-year deduction: $5,200

The $50,000 Phase-Out

If your total start-up expenses exceed $50,000, the $5,000 deduction is reduced dollar-for-dollar.

Phase-out calculation:

Start-up expenses: $52,000

Excess over $50,000: $2,000

Reduced immediate deduction: $5,000 - $2,000 = $3,000

Amount to amortize: $52,000 - $3,000 = $49,000

Complete Phase-Out at $55,000

If start-up expenses reach $55,000 or more, the immediate deduction is completely eliminated.

Example:

Start-up expenses: $60,000

Immediate deduction: $0 (fully phased out)

Amount to amortize: $60,000

Monthly amortization: $333.33

First-year deduction (12 months): $4,000

Phase-Out Table

| Start-Up Expenses | Immediate Deduction | Amortization Base |

|---|---|---|

| $30,000 | $5,000 | $25,000 |

| $40,000 | $5,000 | $35,000 |

| $50,000 | $5,000 | $45,000 |

| $51,000 | $4,000 | $47,000 |

| $52,000 | $3,000 | $49,000 |

| $53,000 | $2,000 | $51,000 |

| $54,000 | $1,000 | $53,000 |

| $55,000+ | $0 | Full amount |

15-Year Amortization

How Amortization Works

Start-up expenses not immediately deducted must be amortized over 180 months (15 years), beginning in the month your business starts.

Monthly deduction formula:

Monthly amortization = Remaining start-up expenses ÷ 180

First-Year Calculation

If your business starts mid-year, you prorate the first year's amortization.

Example: Business starts July 1, 2026

Total start-up expenses: $45,000

Immediate deduction: $5,000

Amount to amortize: $40,000

Monthly amortization: $222.22

2026 deduction:

- Immediate: $5,000

- Amortization (July-December, 6 months): $1,333.33

- Total 2026: $6,333.33

2027-2040 deduction:

- Full year amortization: $2,666.67 per year

2041 deduction (final year):

- Remaining 6 months: $1,333.33

Filing Requirement

To claim start-up expense amortization, attach a statement to your tax return that includes:

- Description of the business

- Start date of the business

- Total amount of start-up expenses

- Amount being amortized

Use Form 4562, Part VI to report amortization.

Organizational Expenses: A Separate Deduction

Organizational expenses are a distinct category from start-up expenses, with their own $5,000 deduction.

What Are Organizational Expenses?

Costs directly related to creating the business entity:

✅ For Corporations (IRC § 248):

- State incorporation fees

- Legal fees for articles of incorporation

- Accounting fees related to organizing

- Expenses of temporary directors

- Organizational meeting costs

✅ For Partnerships/LLCs (IRC § 709):

- Legal fees for partnership/operating agreement

- Accounting services for setting up books

- Filing fees for LLC registration

- Negotiation costs among partners/members

The Two $5,000 Deductions

You can potentially claim both deductions:

Start-up expenses: $45,000

Organizational expenses: $8,000

Immediate start-up deduction: $5,000

Immediate organizational deduction: $5,000

Total immediate deductions: $10,000

Amortize start-up: $40,000 over 180 months

Amortize organizational: $3,000 over 180 months

Important: The $50,000 phase-out threshold applies separately to each category.

When Does a Business "Begin"?

The timing of when your business begins is critical—it determines:

- When you can first claim the deduction

- When the 15-year amortization period starts

- Whether expenses are "start-up" or regular business expenses

IRS Definition

A business begins when it starts the activities for which it was organized.

For product businesses: When you first offer products for sale to customers

For service businesses: When you first offer services

For retail: When you open doors to customers

Examples

Example 1: Retail Store

Timeline:

January-May: Signed lease, renovated space, stocked inventory

June 1: Grand opening

Business begins: June 1

Start-up expenses: January-May costs

Regular expenses: June forward

Example 2: Consulting Practice

Timeline:

March-April: Created website, networked, developed service offerings

April 15: First client engagement

Business begins: April 15

Start-up expenses: March-April 14 costs

Regular expenses: April 15 forward

Example 3: E-commerce Business

Timeline:

August: Built website, purchased initial inventory

September: Site went live, began accepting orders

October: First actual sale

Business begins: September (when site went live and orders could be placed)

Not October (don't need actual sales, just active offering)

Expanding an Existing Business

Important distinction: Expenses to expand an existing business into a new line of activity may be start-up expenses, while expansion within the same line is NOT.

Same Line of Business = Not Start-Up

Opening a second location of your existing restaurant is NOT a start-up expense—it's a regular business expense, fully deductible in the year incurred.

New Line of Business = Start-Up

A restaurant owner opening a catering business (new activity) would have start-up expenses for the catering operation.

Legal Citation: Treas. Reg. § 1.195-1(b) addresses expansion scenarios.

Buying an Existing Business

When you purchase an existing business, different rules apply.

What You're Buying

- Assets - Equipment, inventory, real estate, goodwill

- Going concern value - The value of the business as an operating entity

Treatment of Purchase Price

- Physical assets: Depreciated based on asset type

- Goodwill: Amortized over 15 years under IRC § 197

- Non-compete agreements: Amortized over 15 years

- Customer lists: Amortized over 15 years

Investigation Costs

Costs to investigate buying a business:

- If you buy the business: Amortized over 15 years with other intangibles

- If you don't buy: Start-up expenses (if in same/similar business) or non-deductible (if new business type)

What If Your Business Never Starts?

Bad news: If you incur start-up expenses but the business never actually begins, you generally cannot deduct those costs.

Complete Abandonment

If you abandon the business idea entirely before it starts:

- Start-up expenses become worthless

- Treated as a capital loss

- Limited deductibility ($3,000/year against ordinary income)

Partial Salvage

If you salvage assets from the failed venture:

- Reduce loss by fair market value of salvaged items

- Remaining loss is capital loss

Example:

Start-up expenses: $25,000

Equipment salvaged: $8,000

Capital loss: $17,000

2026 deduction (against ordinary income): $3,000

Carryforward: $14,000

Real-World Examples

Example 1: Tech Startup (Jupid's Story)

Pre-launch expenses:

- Market research and surveys: $5,000

- Legal consultations: $3,000

- Travel to banking conferences: $8,000

- Prototype development: $15,000

- Pre-launch marketing: $4,000

- Office setup before opening: $5,000

Total: $40,000

Organizational expenses (LLC formation):

- State filing fees: $500

- Operating agreement legal fees: $2,500

- Registered agent: $200

Total: $3,200

Business starts: March 1, 2026

2026 Deductions:

Start-up immediate: $5,000

Start-up amortization (10 months): $1,944.44

Organizational immediate: $3,200 (under $5,000)

Total: $10,144.44

Remaining start-up to amortize: $35,000 over remaining 170 months

Example 2: Restaurant Opening

Pre-opening costs:

- Lease payments (3 months before opening): $15,000

- Kitchen equipment training: $2,000

- Menu development: $3,000

- Marketing and signage: $8,000

- Staff training before opening: $12,000

- Health inspections and permits: $1,500

Total start-up: $41,500

Equipment purchase: $50,000 (NOT start-up - capital asset)

Inventory: $10,000 (NOT start-up - COGS when sold)

2026 Deductions:

Start-up immediate: $5,000

Start-up amortization: $2,430.56 (12 months × $202.55)

Equipment: Section 179 = $50,000 (separate deduction)

Total: $57,430.56

Example 3: High Start-Up Costs

Franchise purchase:

- Franchise fee: $50,000

- Pre-opening training: $10,000

- Market research: $5,000

- Travel for training: $3,000

Total start-up: $68,000

Start-up immediate deduction: $0 (exceeds $55,000)

Amortization: $68,000 ÷ 180 = $377.78/month

First year (12 months): $4,533.33

Total 15-year deduction: $68,000

Tax Planning Strategies

Strategy 1: Stay Under $50,000 If Possible

If you can control timing, keep start-up expenses under $50,000 to preserve the full $5,000 immediate deduction.

Example:

Planned expenses: $52,000

Option A: Spend all before business starts

Immediate deduction: $3,000 ($5,000 - $2,000 phase-out)

Option B: Delay $3,000 to after business starts

Pre-launch expenses: $49,000

Immediate deduction: $5,000

Plus regular deduction for $3,000 after opening: $3,000

Total first-year deduction: $8,000 (vs. $3,000 + amortization)

Strategy 2: Time the Business Start Date

If you have significant start-up expenses, starting earlier in the year maximizes first-year amortization.

Example:

$40,000 start-up expenses, $5,000 immediate deduction, $35,000 to amortize

Start January 1: 12 months amortization = $2,333.33

Start July 1: 6 months amortization = $1,166.67

Difference: $1,166.67 more deduction in Year 1

Strategy 3: Separate Start-Up from Organizational

Track organizational expenses separately to potentially claim two $5,000 deductions.

Strategy 4: Document Everything

Keep detailed records of all pre-launch expenses with:

- Date of expense

- Amount

- Business purpose

- Receipt/invoice

This protects your deductions in case of audit.

Common Mistakes to Avoid

Mistake #1: Not Tracking Pre-Launch Expenses

Problem: Failing to keep receipts and records before the business officially starts

Consequence: Lost deductions—can't prove expenses

Solution: Start tracking from day one of business planning. Use a separate account or category for pre-launch costs.

Mistake #2: Confusing Start-Up with Capital Expenses

Problem: Treating equipment or inventory as start-up expenses

Reality:

- Equipment → Section 179 or depreciation

- Inventory → Cost of Goods Sold when sold

- Start-up → Only qualifying pre-launch operating expenses

Mistake #3: Missing the Election

Problem: Not electing to deduct/amortize on first year's return

Consequence: May lose ability to claim deduction

Solution: File election statement with first year's tax return. The election is made by deducting the start-up costs on the return—no separate form needed.

Mistake #4: Wrong Business Start Date

Problem: Using LLC formation date instead of actual business start date

Reality: Business "begins" when you start offering products/services, not when you file paperwork

Impact: Could affect which expenses qualify as start-up vs. regular

Mistake #5: Deducting Failed Venture as Start-Up

Problem: Claiming start-up deduction for business that never launched

Reality: If business never starts, expenses are capital loss (not start-up deduction)

Solution: Understand the different treatment for abandoned business plans

Simplify Start-Up Expense Tracking With AI

Tracking pre-launch expenses, categorizing them correctly, and maximizing deductions shouldn't be complicated. At Jupid, our AI-powered platform automates the entire process.

What makes Jupid different for start-up expenses:

✅ Automatic categorization - AI distinguishes start-up vs. organizational vs. capital expenses

✅ Phase-out optimization - Alerts when you're approaching $50,000 threshold

✅ Timing recommendations - Suggests optimal business start date for deductions

✅ Amortization tracking - Calculates and tracks 15-year amortization schedule

✅ Document storage - Keep all pre-launch receipts organized and accessible

✅ Chat with your AI accountant - Ask questions like "Can I deduct my pre-launch website costs?" and get instant answers

Example conversation:

- You: "I spent $42,000 getting ready to launch my consulting business. What can I deduct?"

- Jupid: "Based on your $42,000 in pre-launch costs, here's your deduction breakdown: You can immediately deduct $5,000 in the year you start operations. The remaining $37,000 will be amortized over 180 months at $205.56/month. If you start in January, your first-year total deduction would be $7,466.72. I also noticed $3,500 in LLC formation fees—those qualify for a separate $3,500 organizational expense deduction, bringing your first-year total to $10,966.72."

Annual value: New business owners using Jupid capture an average of $2,800 more in start-up deductions compared to manual tracking, simply by:

- Not missing pre-launch expenses

- Properly categorizing start-up vs. capital costs

- Optimizing timing of business start

- Tracking amortization correctly

Learn more about how Jupid can help with your business launch →

Action Checklist: Maximizing Start-Up Deductions

Before Business Starts

- Open separate bank account/credit card for pre-launch expenses

- Document all expenses with date, amount, purpose

- Keep all receipts (digital photos are fine)

- Categorize: start-up vs. organizational vs. capital

- Track total to monitor $50,000 threshold

When Business Launches

- Document exact date business begins operations

- Calculate total start-up expenses

- Calculate immediate deduction (up to $5,000)

- Calculate amortization amount

At Tax Time

- Complete Form 4562, Part VI for amortization

- Attach required election statement

- Report immediate deduction on Schedule C or business return

- Report organizational expenses separately if applicable

Ongoing (15 Years)

- Track remaining amortization balance

- Claim monthly amortization deduction each year

- Update records if business is sold or closed

Resources and Citations

IRS Publications (Official Sources)

- IRS Publication 535 - Business Expenses (Chapter 8: Amortization)

- IRS Publication 583 - Starting a Business and Keeping Records

- Form 4562 - Depreciation and Amortization (Part VI)

Tax Code and Regulations

- IRC § 195 - Start-up expenditures

- IRC § 248 - Organizational expenditures (corporations)

- IRC § 709 - Treatment of partnership/LLC organizational costs

- Treas. Reg. § 1.195-1 - Treasury regulations on start-up expenses

- Treas. Reg. § 1.248-1 - Treasury regulations on organizational expenses

Key Numbers Summary

| Item | Amount |

|---|---|

| Start-up immediate deduction | $5,000 |

| Start-up phase-out begins | $50,000 |

| Start-up phase-out complete | $55,000 |

| Amortization period | 180 months (15 years) |

| Organizational immediate deduction | $5,000 |

| Organizational phase-out begins | $50,000 |

Final Thoughts

Start-up expenses represent a significant tax-saving opportunity that too many new business owners miss. By properly tracking and deducting pre-launch costs, you can reduce your tax burden in the critical early years of your business.

Key takeaways:

- Track everything - Start documenting expenses from day one of planning

- Know the limits - $5,000 immediate deduction, reduced above $50,000

- Separate categories - Start-up, organizational, and capital expenses each have different rules

- Time it right - Business start date affects when you can claim deductions

- Amortize the rest - Remaining expenses deducted over 15 years

Whether you're launching a tech startup, opening a restaurant, or starting a consulting practice, understanding IRC § 195 can save you thousands of dollars in taxes over the life of your business.

Disclaimer

This article provides general information about tax deductions and should not be considered tax advice. Tax laws are complex, and individual circumstances vary significantly. Start-up expense rules have nuances that may affect your specific situation. For advice specific to your situation, consult with a qualified tax professional.

Tax Year: 2026 Last Updated: January 8, 2026

Ready to simplify your finances?

Join 1,000+ businesses using Jupid to save time and money. Start simplifying your finances today.

30-day money-back guarantee