Business Expense Categories 2026: Complete IRS Guide for Small Businesses

Table of Contents

Published: February 7, 2026 Tax Year: 2026

A Message from Slava

Expense categorization sounds like the most boring part of running a business — and it might be. But getting it right is worth thousands of dollars every year.

When we built Jupid, one of the first features we developed was AI-powered transaction categorization. The reason: at Anna Money, where we served 60,000+ small businesses, the single most common tax mistake was miscategorizing expenses. Business owners would throw everything into "Other Expenses" or skip categorizing small purchases entirely.

The IRS has specific categories for a reason. Each line on Schedule C maps to a different type of expense, and some categories have special rules about what's deductible. Putting $5,000 of advertising costs on the wrong line won't trigger an audit by itself, but consistently miscategorized expenses can.

This guide covers every IRS business expense category — what goes where, what qualifies, and how to document it. Use it as a reference throughout the year, not just at tax time.

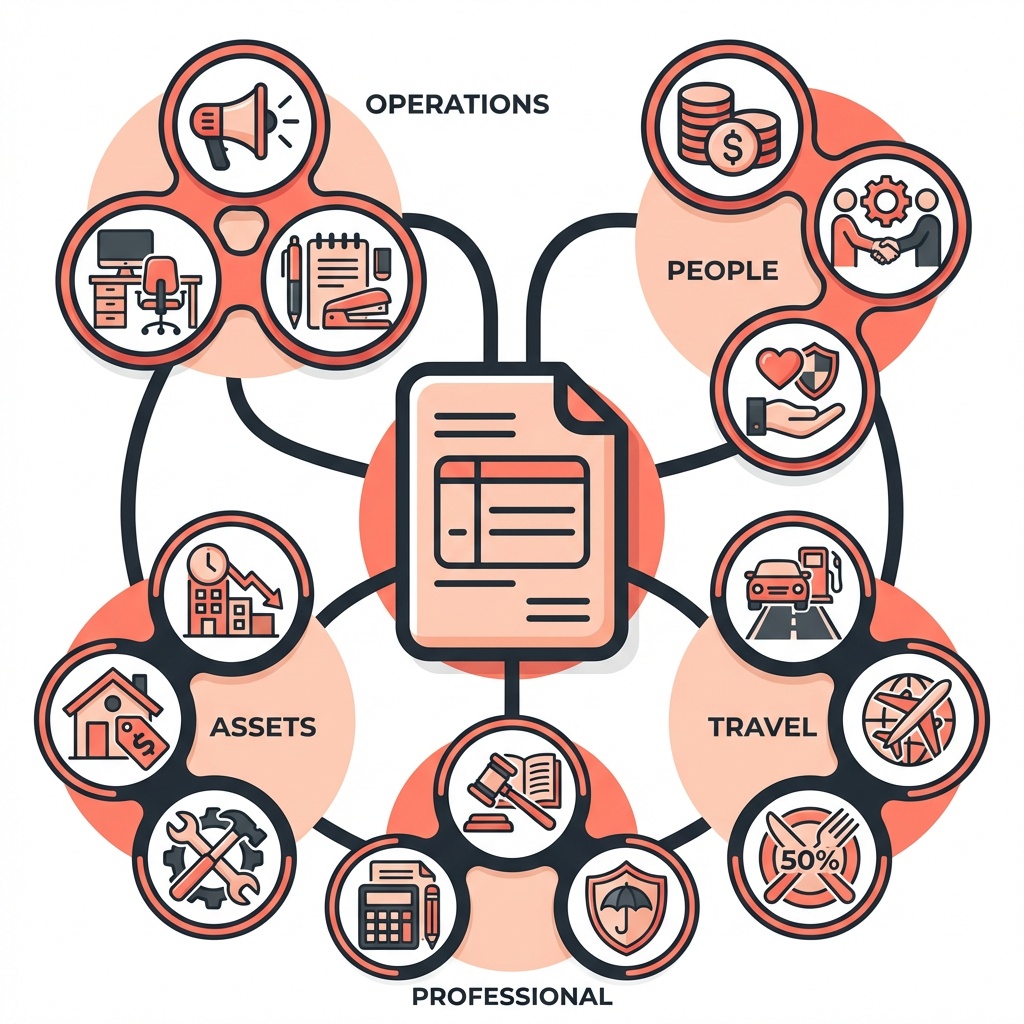

Executive Summary: Business Expense Categories

The IRS framework: Business expenses are reported on Schedule C (Form 1040), Part II (Lines 8-27) and Part V (Lines 48). Each line represents a specific category of deductible expense.

Schedule C Expense Lines at a Glance:

| Line | Category | What It Covers |

|---|---|---|

| 8 | Advertising | Marketing and promotional costs |

| 9 | Car and truck | Vehicle expenses for business |

| 10 | Commissions and fees | Payments to agents, subcontractors |

| 11 | Contract labor | Payments to independent contractors |

| 12 | Depletion | Natural resource extraction |

| 13 | Depreciation | Asset write-offs (Form 4562) |

| 14 | Employee benefit programs | Health insurance, retirement for employees |

| 15 | Insurance (other than health) | Business insurance premiums |

| 16a | Mortgage interest | Interest on business property mortgage |

| 16b | Other interest | Business loan and credit line interest |

| 17 | Legal and professional | CPA, attorney, consulting fees |

| 18 | Office expense | Supplies, software, office costs |

| 19 | Pension/profit-sharing | Employer retirement contributions |

| 20 | Rent: vehicles, machinery | Leased equipment |

| 21 | Rent: other business property | Office or retail space rent |

| 22 | Repairs and maintenance | Fixing or maintaining business property |

| 23 | Supplies | Materials consumed in business |

| 24a | Travel | Business travel (airfare, hotels) |

| 24b | Meals | Business meals (50% deductible) |

| 25 | Utilities | Phone, internet, electricity |

| 26 | Wages | Employee salaries |

| 27a | Other expenses | Everything else (listed on Line 48) |

| 30 | Business use of home | Home office deduction |

Legal basis: IRC §162 (business expenses), IRS Publication 535, Schedule C Instructions

Category 1: Advertising (Line 8)

What qualifies: Any cost to promote your business to potential or existing customers.

Examples:

- Google Ads, Facebook/Meta ads, LinkedIn ads

- Print advertising (newspapers, magazines, flyers)

- Business cards and brochures

- Website design, hosting, and maintenance

- SEO and digital marketing services

- Trade show and event sponsorships

- Promotional merchandise (branded pens, shirts)

- Social media management tools

- Email marketing platforms (Mailchimp, ConvertKit)

What doesn't qualify:

- Lobbying or political advertising

- Advertising for personal items

- Goodwill advertising that promotes a political agenda

Record-keeping: Keep invoices, receipts, and screenshots of digital ad spend showing business purpose.

Category 2: Car and Truck Expenses (Line 9)

What qualifies: Business use of your vehicle. Choose one method for the entire year:

Standard mileage rate (2026): 70 cents per mile

15,000 business miles × $0.70 = $10,500

Plus parking and tolls for business trips

Actual expenses method:

- Gas and oil

- Insurance

- Repairs and maintenance

- Registration and licenses

- Depreciation (or lease payments)

- Tires

- Garage rent

Multiply total by your business-use percentage.

Critical rule: You must keep a mileage log. Record date, destination, business purpose, and miles for every business trip. Without this log, the IRS can disallow the entire deduction.

What doesn't qualify:

- Commuting from home to a regular office

- Personal errands

- Personal portion of mixed-use trips

Legal citation: IRC §274(d) requires "adequate records" for vehicle deductions.

Category 3: Commissions and Fees (Line 10)

What qualifies: Payments to non-employee agents, brokers, or facilitators who earn commissions or fees for their services.

Examples:

- Sales agent commissions

- Referral fees

- Payment processing fees (Stripe, Square, PayPal)

- Platform fees (Amazon, Etsy, Shopify transaction fees)

- Broker fees

- Finder's fees

Note: If you pay someone $600+ during the year, you must issue a 1099-NEC.

Category 4: Contract Labor (Line 11)

What qualifies: Payments to independent contractors who perform services for your business.

Examples:

- Freelance designers, writers, or developers

- Virtual assistants

- Bookkeepers (if not employees)

- Consultants

- Photographers and videographers

1099-NEC requirement: Issue Form 1099-NEC to any contractor paid $600+ during the calendar year. The deadline is January 31.

Important distinction: If someone works under your direction and control on a regular schedule, they may be an employee — not a contractor. Misclassifying employees as contractors can result in back taxes, penalties, and interest. See our employees vs contractors guide for the IRS classification rules.

Category 5: Depreciation and Section 179 (Line 13)

What qualifies: The cost of business assets that have a useful life beyond one year.

Instead of deducting the full cost in the year of purchase, you spread the deduction over the asset's useful life (depreciation). Alternatively, Section 179 lets you deduct the full cost immediately.

2026 depreciation options:

| Method | What It Does | 2026 Limit |

|---|---|---|

| Section 179 | Full deduction in Year 1 | $1,320,000 |

| Bonus depreciation | Percentage deduction in Year 1 | 60% |

| MACRS | Spread over useful life | Based on asset class |

Common asset classes:

| Asset | Depreciation Period |

|---|---|

| Computers and peripherals | 5 years |

| Office furniture | 7 years |

| Vehicles | 5 years |

| Buildings (nonresidential) | 39 years |

| Building improvements | 15 years |

Form 4562 is required for depreciation and Section 179 claims.

See our Section 179 depreciation guide for complete details.

Legal citation: IRC §167 (depreciation), IRC §179 (expensing election)

Category 6: Employee Benefits and Wages (Lines 14, 19, 26)

Three related lines on Schedule C:

Line 14: Employee benefit programs

- Health insurance premiums for employees

- Life insurance premiums

- Dependent care assistance

- Educational assistance (up to $5,250/employee)

- Employee discount programs

Note: Self-employed health insurance for the owner is NOT reported here — it's deducted on Schedule 1, Line 17.

Line 19: Pension and profit-sharing plans

- Employer contributions to employee retirement plans

- 401(k) matching contributions

- SEP IRA employer contributions

- SIMPLE IRA employer match

Line 26: Wages

- Gross wages paid to employees

- Bonuses

- Commissions paid to employees (not contractors)

- Does NOT include employer's share of payroll taxes

Legal citation: IRC §162(a)(1) — Reasonable compensation for services

Category 7: Insurance (Line 15)

What qualifies: Business insurance premiums (excluding employee health insurance, which goes on Line 14).

Examples:

- General liability insurance

- Professional liability / errors & omissions (E&O)

- Commercial property insurance

- Business interruption insurance

- Cyber liability insurance

- Product liability insurance

- Workers' compensation insurance

- Commercial auto insurance (if not using standard mileage)

What doesn't qualify on this line:

- Self-employed owner's health insurance (Schedule 1, Line 17)

- Employee health insurance (Line 14)

- Personal insurance policies

Category 8: Interest (Lines 16a-16b)

Line 16a: Mortgage interest on business property

- Mortgage on a business building you own

Line 16b: Other business interest

- Business loan interest

- Business credit card interest (business charges only)

- Line of credit interest

- Equipment financing interest

What doesn't qualify:

- Personal loan interest

- Personal credit card interest

- Interest on tax underpayments (that's a penalty, not a deductible expense)

Legal citation: IRC §163 — Business interest deduction

Category 9: Legal and Professional Services (Line 17)

What qualifies: Fees paid to professionals for business-related services.

Examples:

- CPA and tax preparation fees (business portion only)

- Attorney fees for business matters

- Bookkeeping and accounting services

- Business consulting

- Payroll service fees

- Financial advisory fees (business-related)

What doesn't qualify:

- Personal tax preparation fees

- Legal fees for personal matters

- Fees to acquire a business asset (capitalized, not deducted)

Category 10: Office Expense (Line 18)

What qualifies: Supplies, materials, and services used in your office.

Examples:

- Stationery, paper, ink cartridges

- Postage and shipping supplies

- Software subscriptions (QuickBooks, Adobe, Zoom, Slack)

- Cloud storage (Google Workspace, Dropbox)

- Small office supplies (under $200 each)

- Cleaning supplies for office

Threshold: Items over $2,500 with a useful life beyond one year should generally be depreciated (Line 13) or expensed under Section 179, not listed as office expense.

Category 11: Rent (Lines 20-21)

Line 20: Rent — vehicles, machinery, equipment

- Leased vehicles (if not using standard mileage)

- Leased equipment (copiers, medical equipment)

- Tool and equipment rentals

Line 21: Rent — other business property

- Office space rent

- Retail store rent

- Warehouse or storage rent

- Co-working space membership

- Temporary workspace rentals

What doesn't qualify:

- Rent on your personal home (unless claiming home office — see Line 30)

- Rent for property you own

Category 12: Repairs and Maintenance (Line 22)

What qualifies: Costs to keep your business property in ordinary operating condition.

Examples:

- Equipment repairs

- Vehicle maintenance (if using actual expenses method)

- Building repairs (painting, plumbing, electrical)

- Computer and technology repairs

- Website maintenance and updates

Important distinction: Repairs maintain current condition; improvements add value. A repair is deductible immediately. An improvement must generally be capitalized and depreciated.

| Repair (deductible) | Improvement (capitalize) |

|---|---|

| Fixing a broken window | Installing new windows |

| Patching a roof leak | Replacing the entire roof |

| Repairing a machine | Upgrading a machine |

Category 13: Supplies (Line 23)

What qualifies: Materials and supplies consumed or used in your business operations.

Examples:

- Raw materials for products you make

- Packaging materials

- Cleaning supplies for a business location

- Tools with a useful life under one year

- Safety equipment (gloves, masks)

- Lab or medical supplies

Distinction from Office Expense (Line 18): Office expenses are for administrative and office items. Supplies are for materials used in the actual production or delivery of your service or product.

Category 14: Travel (Line 24a)

What qualifies: Transportation and lodging when traveling away from your tax home for business purposes.

Deductible travel expenses:

- Airfare, train, or bus tickets

- Hotel or lodging

- Rental car or rideshare during business trips

- Baggage fees

- Tips for travel-related services

- Laundry and dry cleaning during overnight trips

- Conference registration (travel portion)

Rules:

- You must be away from your "tax home" overnight

- The primary purpose of the trip must be business

- Personal extensions to a business trip: deduct only the business days

Record-keeping: Keep receipts for every expense and document the business purpose of each trip.

Legal citation: IRC §162(a)(2) and IRS Publication 463

Category 15: Meals (Line 24b)

Deduction rate: 50% of the cost

What qualifies:

- Meals during business travel

- Meals with clients or potential clients (business purpose required)

- Meals during business meetings

- Food and beverages at business events

Documentation required for every meal:

- Amount

- Date and place

- Business purpose

- Name and business relationship of people present

What doesn't qualify:

- Personal meals (even while working)

- Lavish or extravagant meals

- Entertainment (sporting events, concerts — not deductible at all since 2018)

Legal citation: IRC §274(k) limits the meal deduction to 50%

Category 16: Utilities (Line 25)

What qualifies: Utility costs for your business location.

Examples:

- Electricity for office or commercial space

- Water and sewer for business property

- Gas/heating for business property

- Business phone line

- Business internet service

- Cell phone (business-use percentage)

- Home internet (business-use percentage, if no home office deduction)

Mixed-use utilities: If you use your phone or internet for both business and personal purposes, calculate and deduct only the business percentage.

Category 17: Other Expenses (Line 27a / Line 48)

What qualifies: Any ordinary and necessary business expense that doesn't fit into Lines 8-26.

Common "Other Expenses":

- Professional association memberships and dues

- Business licenses and permits

- Continuing education and training courses

- Industry subscriptions and publications

- Bank fees and service charges

- Credit card annual fees (business card)

- Trade publications and research materials

- Uniforms and protective clothing

- Bad debts (business accounts receivable you can't collect)

List these individually on Line 48 with a description and amount for each.

Category 18: Business Use of Home (Line 30)

What qualifies: A portion of your home expenses if you use a dedicated space regularly and exclusively for business.

Two methods:

Simplified method: $5 per square foot, maximum 300 sq ft = $1,500/year

Regular method (Form 8829): Calculate actual expenses × business percentage:

- Rent or mortgage interest

- Property taxes

- Utilities

- Insurance

- Repairs (whole home: proportional; office-only: 100%)

- Depreciation (if you own)

Example: 200 sq ft office in 1,800 sq ft home = 11.1%

Total home expenses: $30,000/year

Deduction: $30,000 × 11.1% = $3,330

For complete home office calculations, see our home office deduction guide.

Legal citation: IRC §280A and IRS Publication 587

Record-Keeping Requirements

The IRS can disallow deductions if you don't have adequate records. Here's what to keep:

General Rule

For every business expense, maintain:

- What: Description of the expense

- How much: Amount paid

- When: Date of the transaction

- Why: Business purpose

- Who: Name and relationship (for meals and entertainment)

Retention Periods

| Situation | Keep Records For |

|---|---|

| Standard | 3 years from filing date |

| Underreported income >25% | 6 years |

| Loss from worthless securities | 7 years |

| Didn't file or filed fraudulently | Indefinitely |

| Employment tax records | 4 years |

| Asset/depreciation records | Until asset is fully depreciated + 3 years |

Digital Records

The IRS accepts digital copies of receipts and records. You don't need to keep paper originals if you have clear digital images. This includes photographs of receipts, bank and credit card statements, and digital invoices.

Common Mistakes to Avoid

Mistake #1: Putting Everything in "Other Expenses"

Problem: Dumping all expenses into Line 27a because it's easier than categorizing.

Impact: Increases audit risk (the IRS flags unusually large "Other Expenses") and makes it harder to identify patterns in your spending.

Solution: Use the specific Schedule C lines. Only put truly miscellaneous items in "Other Expenses."

Mistake #2: Mixing Personal and Business Expenses

Problem: Using one bank account for everything, then trying to separate at tax time.

Impact: Missed deductions, inaccurate categorization, and potential loss of LLC liability protection.

Solution: Use a dedicated business bank account and credit card. Every transaction in those accounts is a business transaction.

Mistake #3: Not Keeping Receipts for Meals

Problem: Deducting meals without documenting who attended and the business purpose.

Impact: The entire meal deduction can be disallowed in an audit.

Solution: Write the business purpose and attendees on the receipt immediately, or log it in your phone. "Lunch with [client name] to discuss [project]" is sufficient.

Mistake #4: Confusing Repairs with Improvements

Problem: Deducting a $15,000 roof replacement as a repair instead of capitalizing it.

Impact: Overstated deductions in the current year, potential accuracy penalty.

Solution: Repairs maintain current condition (deductible). Improvements add value or extend useful life (capitalize and depreciate).

Categorize Your Expenses Automatically With AI

Manually categorizing every transaction is the most common reason business owners miss deductions. Automating this process eliminates the gap between "what's deductible" and "what you actually claim."

What makes Jupid different:

✅ 95.9% categorization accuracy — Our AI matches transactions to the correct Schedule C line automatically

✅ Real-time categorization — Expenses are categorized as they happen, not at tax time

✅ Custom category rules — Teach Jupid your specific categorization preferences via WhatsApp or iMessage

✅ Bank connection and auto-sync — Connect your business bank account and every transaction gets categorized

Example conversation:

- You: "How are my expenses breaking down by category this quarter?"

- Jupid: "Q3 breakdown: Advertising $3,200 (Line 8), Contract Labor $8,400 (Line 11), Office Expense $1,850 (Line 18), Travel $2,100 (Line 24a), Meals $680 (Line 24b at 50% = $340 deductible). Total deductible: $15,890."

Learn more about how Jupid keeps your business finances organized

Action Checklist: Organizing Business Expenses

Setup (Do Once)

- Open a dedicated business bank account

- Get a business credit card

- Set up accounting software or connect Jupid

- Create a system for storing receipts (digital is fine)

- Download Schedule C to understand the categories

Weekly

- Review and categorize new transactions

- Save receipts for any cash purchases

- Log mileage for business trips

- Note business purpose for any meals

Monthly

- Reconcile bank statements with categorized expenses

- Review categories for accuracy

- Check for any uncategorized transactions

- Ensure contractor payments are tracked for 1099 filing

At Tax Time

- Complete Schedule C with all categorized expenses

- Review each line for completeness

- Prepare supporting documentation

- File 1099-NEC forms for contractors by January 31

- Use our Self-Employment Tax Calculator to estimate your liability

Resources and Citations

IRS Publications (Official Sources)

- IRS Publication 535 — Business Expenses

- IRS Publication 334 — Tax Guide for Small Business

- IRS Publication 463 — Travel, Gift, and Car Expenses

- IRS Publication 587 — Business Use of Your Home

- Schedule C Instructions — Line-by-line guide

- IRS: Guide to Business Expense Resources — Comprehensive resource list

Tax Code and Regulations

- IRC §162 — Trade or business expenses

- IRC §167 — Depreciation

- IRC §179 — Expensing business assets

- IRC §274 — Meals, travel, and entertainment limitations

- IRC §280A — Home office deduction

- IRC §195 — Startup cost deduction

2026 Key Numbers

| Item | 2026 Amount |

|---|---|

| Standard mileage rate | 70 cents/mile |

| Meal deduction | 50% |

| Home office (simplified) | $5/sq ft, max $1,500 |

| Section 179 maximum | $1,320,000 |

| De minimis safe harbor | $2,500 per item |

| Startup cost deduction | Up to $5,000 |

Final Thoughts

Business expense categories aren't arbitrary — they map directly to IRS reporting requirements on Schedule C. Getting the categorization right means accurate tax filing, maximum deductions, and clean records if the IRS ever asks questions.

The key strategies:

- Categorize in real time — Don't wait until tax season to sort through 12 months of transactions

- Use the right Schedule C line — Each expense type has a designated line for a reason

- Document everything — A receipt plus a business purpose note is all you need for most expenses

The difference between a well-organized LLC and a disorganized one isn't sophistication — it's consistency.

Disclaimer

This article provides general information about business expense categorization for tax purposes and should not be considered tax advice. Deduction eligibility depends on your specific business, industry, and circumstances. The IRS requires expenses to be "ordinary and necessary" for your particular trade or business. Some expense categories have specific documentation requirements and limitations not fully detailed here. For advice specific to your situation, consult with a qualified tax professional.

Tax Year: 2026 Last Updated: February 7, 2026

Ready to simplify your finances?

Join 1,000+ businesses using Jupid to save time and money. Start simplifying your finances today.

30-day money-back guarantee