Home Office Deduction 2026: Complete Guide to Maximizing Your Tax Savings

Table of Contents

Hi, I'm Slava, CEO and co-founder of Jupid. After scaling Anna Money to $30M and helping thousands of small business owners optimize their finances, I've seen how the home office deduction can save business owners thousands annually—yet an estimated 5 million eligible taxpayers don't claim it.

Whether you're a freelancer, consultant, e-commerce seller, or run any type of home-based business, understanding this deduction could be one of the most valuable tax strategies you implement this year.

What Is the Home Office Deduction?

The home office deduction allows business owners to deduct expenses associated with using part of their home for business purposes. This deduction is authorized under Internal Revenue Code Section 280A and applies whether you own or rent your home.

Legal Basis: IRC §280A permits deductions for "a portion of a dwelling unit which is exclusively used on a regular basis as the principal place of business for any trade or business of the taxpayer."

The deduction isn't just for traditional "offices"—it applies to:

- Home offices

- Studios

- Workshops

- Labs

- Any dedicated business workspace in your home

Why This Deduction Matters

According to IRS data, only about one-third of eligible taxpayers claim this deduction. For a business owner with a 300 square foot home office in a $2,000/month apartment, this could mean:

- Rent deduction: $6,000+ annually

- Utilities deduction: $1,200+ annually

- Total tax savings: $2,500-3,500+ (depending on your tax bracket)

Who Qualifies for the Home Office Deduction?

The good news: If you run a business from home, you likely qualify. The bad news: The IRS has specific requirements you must meet.

Eligible Business Owners

✅ You CAN claim if you are:

- Sole proprietor

- Independent contractor or freelancer

- Partnership member

- LLC owner

- S Corporation owner

- Self-employed professional

❌ You CANNOT claim if you are:

- W-2 employee (unless special circumstances apply)

- Hobby participant (not a business)

- Investor managing personal investments

Important: The Tax Cuts and Jobs Act (TCJA) eliminated the home office deduction for W-2 employees for tax years 2018-2025. This provision is scheduled to change in 2026.

The Three Threshold Requirements

To qualify for the home office deduction, you must first meet three fundamental requirements as specified in IRS Publication 587:

1. Regular Use

You must use your home office regularly for business purposes.

What "regular" means:

- Continuing basis (not occasional or incidental)

- Courts have held that 12 hours per week is sufficient (Green v. Commissioner, 79 TC 428 (1982))

- Even fewer hours may qualify if consistent

Example:

✅ Sarah uses her home office 15 hours per week, every week → Qualifies

❌ Tom uses his home office once a month for paperwork → Doesn't qualify

2. Exclusive Use

You must use your home office space exclusively for business—not for personal activities.

What "exclusive" means:

- The space is used ONLY for business purposes

- No personal use of the space (even minor use disqualifies you)

- Exception: Inventory storage and day care centers

Common Scenarios:

| Scenario | Qualifies? |

|---|---|

| Dedicated spare bedroom used only as office | ✅ Yes |

| Corner of living room with desk, used only for work | ✅ Yes |

| Guest bedroom with desk that hosts guests occasionally | ❌ No |

| Den with business desk and personal TV viewing | ❌ No |

Pro Tip: You don't need an entire room. You can use part of a room as long as that specific area is used exclusively for business. Consider using room dividers or furniture placement to clearly delineate your workspace.

3. Trade or Business Use

You must actually be conducting a trade or business, not a hobby or investment activity.

Profit Presumption: If you show a profit in 3 out of 5 consecutive years, the IRS presumes you're in business (not a hobby).

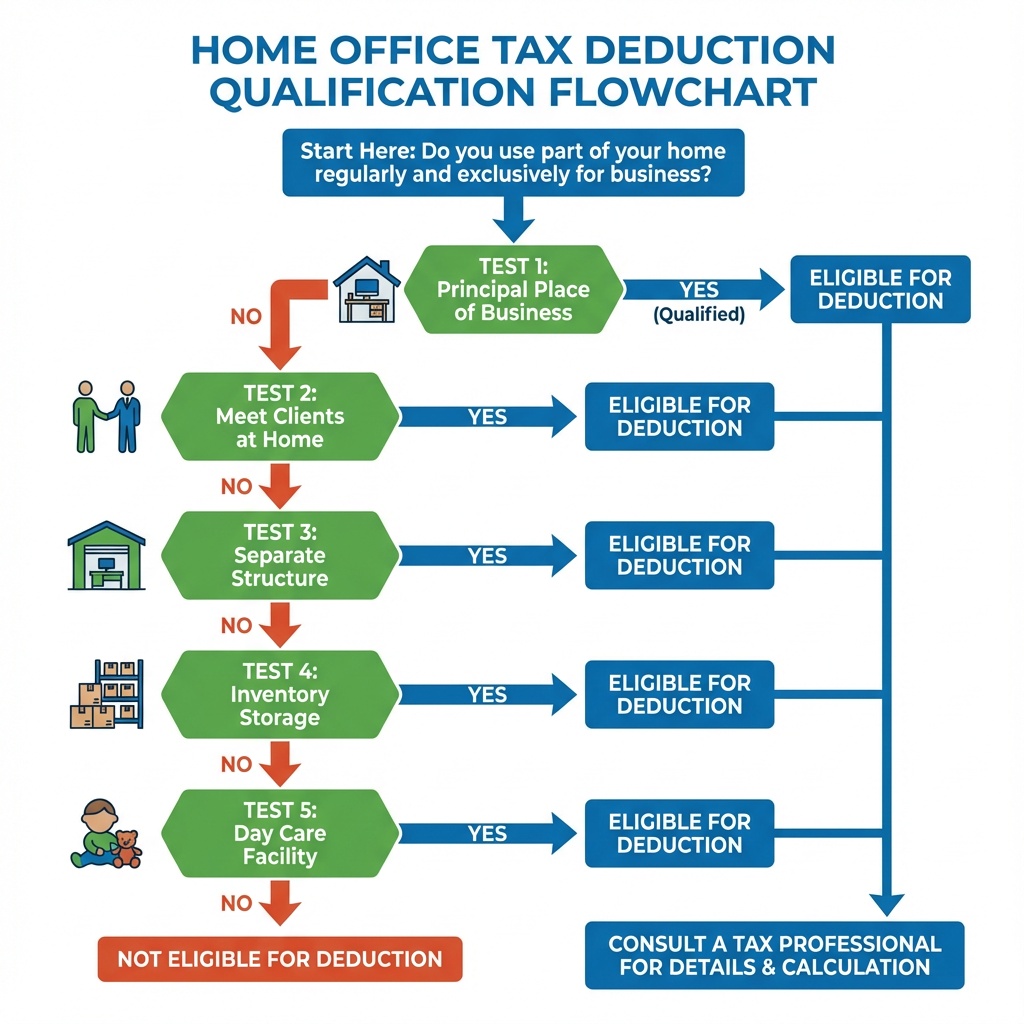

Additional Qualifying Tests

After meeting the three threshold requirements, you must satisfy at least one of these five additional tests:

Test #1: Principal Place of Business

Your home office qualifies if it's your principal place of business.

You meet this test if:

A) You work only from home

- Straightforward case—your home is clearly your principal place of business

- Example: Writer who writes exclusively at home

B) You work in multiple locations, but do your most important work at home

- "Most important" = activities that directly generate your income

- Example: Software developer codes at home (30 hrs/week) and meets clients offsite (10 hrs/week) → Home is principal place

C) You perform administrative/management activities at home with no other fixed location

- You can do most work elsewhere, BUT

- You handle all administrative tasks at home

- No other fixed location for admin work

Administrative/Management Activities Include:

- Billing clients/customers

- Keeping books and records

- Ordering supplies

- Setting up appointments

- Writing reports

- Research and planning

Real-World Example:

Maria the Contractor

Maria is a general contractor who spends 80% of her time at job sites. She has a home office where she:

- Prepares bids and estimates

- Orders materials

- Does bookkeeping

- Schedules jobs

- Meets with subcontractors occasionally

Result: Maria qualifies! Even though most of her work happens at job sites, her home office is where she conducts all administrative activities, and she has no other fixed office location.

Test #2: Meet Clients/Customers at Home

You qualify if you physically meet with clients, customers, or patients at your home office regularly.

Requirements:

- Physical meetings (phone calls don't count)

- Regular basis (IRS indicates 1-2 days per week is sufficient)

- Exclusive use (the meeting space must be used only for business)

Pro Tip: Keep an appointment book or calendar showing client visits to document this requirement.

Test #3: Separate Structure

You qualify if you use a separate freestanding structure on your property exclusively and regularly for business.

Qualifying Structures:

- Detached garage

- Studio

- Barn

- Greenhouse

- Workshop

- Guest house (if used exclusively for business)

Test #4: Inventory Storage

You qualify if you:

- Sell retail or wholesale products

- Store inventory or product samples at home

- Have no other business location

- Regularly use a specific space for storage

Special Benefit: You don't need exclusive use for inventory storage—just regular use of a specific area.

Test #5: Day Care Facility

You qualify if you operate a licensed day care facility in your home for:

- Children

- Adults 65 or older

- Physically or mentally disabled individuals

How to Calculate Your Deduction

Once you've confirmed you qualify, it's time to calculate your deduction. The IRS offers two methods.

Method 1: Simplified Method

Introduced: Revenue Procedure 2013-13 (available from 2013 forward)

How it works:

- $5 per square foot of home used for business

- Maximum 300 square feet

- Maximum deduction: $1,500

Advantages: ✅ Extremely simple—no detailed record keeping ✅ No depreciation deduction (so no depreciation recapture when you sell your home) ✅ Can claim full home-related itemized deductions on Schedule A

Disadvantages: ❌ Capped at $1,500 ❌ Cannot carry forward unused deduction ❌ Usually results in smaller deduction than regular method

Example Calculation:

Home office size: 200 square feet

Calculation: 200 sq ft × $5 = $1,000 deduction

Method 2: Regular Method (Actual Expenses)

Legal Basis: IRC §280A, IRS Publication 587

How it works:

- Determine percentage of home used for business

- Calculate actual expenses

- Multiply expenses by business percentage

- Claim depreciation on business portion of home

Step 1: Calculate Your Business Percentage

You can use either approach (choose the one that gives you a larger percentage):

Option A: Square Footage Method

Business Percentage = (Office Square Feet ÷ Total Home Square Feet) × 100

Example:

Office: 400 sq ft

Home: 1,600 sq ft

Business %: (400 ÷ 1,600) × 100 = 25%

Pro Tip: You can exclude common areas (hallways, stairs, landings) and areas not used for business (attics, garages) from your total to increase your percentage.

Option B: Room Method

Business Percentage = (Rooms Used for Business ÷ Total Rooms) × 100

Requirements:

- All rooms must be approximately the same size

- Don't count bathrooms, closets, storage areas

Why Room Method Often Works Better: Unless you live in a mansion or have unusually large rooms, the room method typically yields a higher percentage and larger deduction.

Step 2: Identify Deductible Expenses

Direct Expenses

Definition: Expenses that benefit ONLY your home office.

Examples:

- Painting your office

- Office carpet or flooring

- Office repairs

- Office improvements

Deduction: 100% deductible

Indirect Expenses

Definition: Expenses that benefit your entire home, including your office.

Examples:

- Mortgage interest or rent

- Property taxes

- Homeowners/renters insurance

- Utilities (electric, gas, water, sewer, trash)

- Home repairs and maintenance

- Security system

Deduction: Business percentage only

Example:

Your annual home expenses:

- Rent: $24,000

- Utilities: $3,600

- Insurance: $1,200

- Total: $28,800

Business percentage: 25% Deduction: $7,200 ($28,800 × 25%)

Step 3: Calculate Depreciation

If you own your home, you can also depreciate the business portion.

Depreciation Calculation:

1. Determine your home's adjusted basis (usually purchase price minus land value)

2. Multiply by your business percentage

3. Divide by 39 years (for residential property)

4. Result = Annual depreciation deduction

Important: When you sell your home, you must recapture (pay tax on) the depreciation you claimed. This is taxed at a maximum rate of 25%. However, the home sale exclusion (up to $250,000 for single, $500,000 for married) still applies to the rest of your gain.

Complete Regular Method Example

Scenario:

- Home: 2,000 sq ft

- Office: 300 sq ft (15%)

- Annual expenses:

- Mortgage interest: $12,000

- Property taxes: $4,000

- Insurance: $1,500

- Utilities: $3,000

- Repairs/maintenance: $2,000

- Direct office expenses: $500

- Home basis (building only): $200,000

Calculation:

| Expense | Amount | Business % | Deduction |

|---|---|---|---|

| Mortgage interest | $12,000 | 15% | $1,800 |

| Property taxes | $4,000 | 15% | $600 |

| Insurance | $1,500 | 15% | $225 |

| Utilities | $3,000 | 15% | $450 |

| Repairs | $2,000 | 15% | $300 |

| Direct expenses | $500 | 100% | $500 |

| Depreciation | $200,000 ÷ 39 | 15% | $769 |

| TOTAL | $4,644 |

Tax Savings (assuming 30% effective tax rate):

$4,644 × 30% = $1,393 in tax savings

Simplified vs Regular Method: Which to Choose?

Decision Framework

Choose Simplified Method if: ✅ Your home office is small (under 300 sq ft) ✅ You want minimal paperwork ✅ You plan to sell your home soon (avoid depreciation recapture)

Choose Regular Method if: ✅ Your home office is larger than 300 sq ft ✅ You have high housing costs (rent/mortgage) ✅ You want to maximize your deduction ✅ You're willing to maintain detailed records

Quick Calculation to Decide

- Calculate your business percentage

- Estimate total eligible expenses

- Multiply: Expenses × Business % = Potential regular method deduction

- Compare to simplified method: Square footage × $5 (max $1,500)

- Choose the higher amount

Special Rules for Different Business Structures

Sole Proprietors & Single-Member LLCs

Tax Form: Schedule C (Form 1040), attach Form 8829

Profit Limitation: Your home office deduction cannot exceed your net business income before the deduction. However, you can carry forward unused amounts to future years.

S Corporations

Best Practice for S Corps: Set up an accountable reimbursement plan. Calculate your home office expenses and submit monthly or quarterly expense reports to your corporation for reimbursement.

C Corporations

Current rules (2018-2025):

- Cannot claim home office deduction as employee

- Must use accountable reimbursement plan

- Corporation deducts reimbursement

- You receive tax-free reimbursement

Common Mistakes to Avoid

Mistake #1: Mixing Personal and Business Use

❌ Wrong: Using your home office for business during the day and watching TV there at night

✅ Right: Using the space exclusively for business, keeping all personal activities in other areas

Mistake #2: Failing the "Regular Use" Test

❌ Wrong: Setting up a desk but using it only occasionally

✅ Right: Using your home office consistently (ideally daily or at minimum several times per week)

Mistake #3: Claiming Excessive Square Footage

❌ Wrong: Claiming your entire 1-bedroom apartment as office space when you clearly need somewhere to sleep

✅ Right: Being realistic about the space actually used exclusively for business

Mistake #4: Poor Documentation

❌ Wrong: No measurements, no receipts, no records

✅ Right: Documented measurements, photos of office setup, organized expense receipts

Mistake #5: Not Taking the Deduction at All

❌ Wrong: Skipping the deduction due to audit fears or complexity

✅ Right: Claiming legitimate deductions you're entitled to

Reality check: Audit rates for small businesses are low (typically 1-2%), and proper documentation means you're protected if audited.

Record Keeping Requirements

Essential Documentation

For All Taxpayers

1. Home Office Measurements

- Diagram or floor plan showing office location

- Square footage calculations

- Photos of home office setup

- Documentation that space is used exclusively for business

2. Expense Records

- Receipts for all deductible expenses

- Bank statements and canceled checks

- Credit card statements

- Mortgage statements or lease agreement

- Utility bills

- Insurance policies

- Repair and maintenance invoices

3. Business Use Documentation

- Calendar or log showing regular business use

- Client meeting records (if claiming meeting space)

- Business activity records

Retention Period

| Record Type | Retention Period |

|---|---|

| General home office records | 3 years from filing date |

| Records if you understated income by 25%+ | 6 years |

| Depreciation and home basis records | 3 years after you sell home |

| Employment tax records | 4 years |

| Property records (basis, improvements) | Indefinitely (until 3 years after sale) |

IRS Source: IRS Publication 583 - Starting a Business and Keeping Records

Tax Savings Examples

Example 1: Freelance Writer (Simplified Method)

Profile:

- Freelance writer

- 200 sq ft home office

- Works exclusively from home

- Gross income: $80,000

- Other business expenses: $15,000

Calculation:

Simplified method: 200 sq ft × $5 = $1,000

Tax savings (25% rate + 15.3% SE tax): $403

Example 2: Consultant (Regular Method)

Profile:

- Business consultant

- 350 sq ft office in 1,500 sq ft rented apartment

- Monthly rent: $2,500

- Annual utilities, insurance: $6,000

Calculation:

Business percentage: 350 ÷ 1,500 = 23.3%

Annual rent: $30,000 × 23.3% = $6,990

Other expenses: $6,000 × 23.3% = $1,398

Total deduction: $8,388

Tax savings (30% effective rate): $2,516

Example 3: E-commerce Seller (Inventory Storage)

Profile:

- Online product seller

- 500 sq ft garage used 50% for inventory

- 2,000 sq ft home

- Owns home ($300,000 basis)

- Annual home expenses: $18,000

Calculation:

Storage space: 250 sq ft (50% of garage)

Business percentage: 250 ÷ 2,000 = 12.5%

Indirect expenses: $18,000 × 12.5% = $2,250

Depreciation: $300,000 ÷ 39 × 12.5% = $962

Total deduction: $3,212

Tax savings (28% effective rate): $899

Action Steps: Claiming Your Home Office Deduction

Step 1: Verify You Qualify

- Confirm you run a trade or business (not a hobby)

- Document regular and exclusive use of your space

- Identify which additional test you meet

- Take photos of your home office setup

Step 2: Measure and Calculate

- Measure your home office square footage

- Measure total home square footage

- Calculate business use percentage

- Draw simple floor plan showing office location

Step 3: Gather Expense Records

- Collect rent or mortgage interest statements

- Gather utility bills (full year)

- Find insurance policies and costs

- Document repairs and maintenance

- Compile direct office expenses

- Calculate depreciation (if applicable)

Step 4: Choose Your Method

- Calculate simplified method ($5/sq ft, max $1,500)

- Calculate regular method (actual expenses)

- Compare results and choose higher deduction

Step 5: Complete Tax Forms

- Complete Form 8829 (if using regular method)

- Transfer deduction to Schedule C, Line 30

- Keep all documentation with tax records

- Store digital copies in secure backup

Resources and Citations

IRS Publications (Official Sources)

- IRS Publication 587 - Business Use of Your Home

- IRS Revenue Procedure 2013-13 - Simplified Method for Home Office Deduction

- Form 8829 - Expenses for Business Use of Your Home

- Schedule C - Profit or Loss From Business

Tax Code and Regulations

- Internal Revenue Code Section 280A - Business use of home deductions

- 26 CFR § 1.280A-2 - Treasury Regulations on home office deductions

Case Law Referenced

- Green v. Commissioner, 79 TC 428 (1982) - Regular use standard

- Soliman v. Commissioner, 506 U.S. 168 (1993) - Principal place of business test

- Popov v. Commissioner, 246 F.3d 1190 (9th Cir. 2001) - Administrative activities test

Simplify Your Tax Deductions With AI

At Jupid, we understand that tracking home office expenses, calculating deductions, and maintaining IRS-compliant documentation can be overwhelming. That's why we built an AI-powered accounting platform that handles all of this complexity under the hood.

What makes Jupid different:

✅ Automatic expense tracking - Connect your bank accounts and we categorize every transaction

✅ Smart home office calculations - We automatically calculate your deduction using both methods and recommend the best one

✅ IRS-compliant documentation - Every receipt, measurement, and calculation is stored and organized

✅ Chat with your AI accountant - Ask questions like "How much can I deduct for my home office?" and get instant, personalized answers

✅ Year-round tax planning - Not just during tax season—we help you optimize throughout the year

Think of Jupid as your personal accountant in your pocket. Instead of spending hours reading IRS publications or paying hundreds of dollars for consultations, you can simply chat with Jupid like you would with your accountant—but get instant answers 24/7.

Example conversation:

- You: "I use 250 sq ft of my 1,500 sq ft apartment for my consulting business. What's my deduction?"

- Jupid: "Based on your setup, I can calculate both methods for you. Regular method would give you approximately $4,200 in deductions (16.7% of your rent and utilities), while simplified method would be $1,250. I recommend the regular method for $2,950 more in tax savings."

Learn more about how Jupid can help optimize your tax deductions →

Final Thoughts

The home office deduction is one of the most valuable tax benefits available to small business owners—yet millions of eligible taxpayers miss out on thousands of dollars in annual savings.

The key is understanding the requirements, maintaining proper documentation, and claiming the deduction correctly. With this guide, you now have the knowledge to confidently claim your home office deduction and keep more of your hard-earned income.

Remember:

- You don't need a separate room—just exclusive business use of a defined space

- Regular use means consistent, not necessarily full-time

- Proper documentation protects you in an audit

- The deduction applies whether you own or rent

- You can switch methods year to year to maximize benefits

Disclaimer

This article provides general information about tax deductions and should not be considered tax advice. Tax laws change frequently, and individual circumstances vary significantly. For advice specific to your situation, consult with a qualified tax professional.

Published: December 3, 2025 Tax Year: 2026

Ready to simplify your finances?

Join 1,000+ businesses using Jupid to save time and money. Start simplifying your finances today.

30-day money-back guarantee