Form 1040-ES Instructions: How to Calculate and Pay Quarterly Estimated Taxes 2026

Table of Contents

Hi, I'm Slava, CEO and co-founder of Jupid. After helping 60,000+ small business owners at Anna Money and now building Jupid, I've watched countless entrepreneurs get blindsided by their first quarterly tax bill. The IRS expects you to pay as you earn—not just once a year—and missing payments leads to penalties that add up fast.

If you're self-employed, a freelancer, or have significant income without withholding, quarterly estimated taxes aren't optional. Form 1040-ES is how you calculate and pay them. This guide walks you through every deadline, calculation, and strategy to stay compliant without overpaying.

What Are Estimated Taxes?

Estimated taxes are periodic payments you make to the IRS throughout the year on income that doesn't have taxes withheld. While W-2 employees have taxes automatically deducted from each paycheck, self-employed individuals must calculate and pay their own taxes quarterly.

Legal Basis: IRC §6654 requires individuals to pay estimated tax if they expect to owe $1,000 or more when filing their return.

Why Quarterly Payments Exist

The US tax system operates on a "pay-as-you-go" basis. You're supposed to pay taxes on income as you earn it, not wait until April of the following year. For employees, employers handle this through withholding. For the self-employed, you handle it yourself using Form 1040-ES.

Form 1040-ES (Estimated Tax for Individuals) is the IRS form that helps you:

- Calculate how much estimated tax you owe

- Pay those taxes quarterly using payment vouchers

Executive Summary: Estimated Tax Key Numbers 2026

| Item | 2026 Details |

|---|---|

| Threshold to Pay | Expect to owe $1,000+ after withholding |

| Q1 Deadline | April 15, 2026 |

| Q2 Deadline | June 16, 2026 |

| Q3 Deadline | September 15, 2026 |

| Q4 Deadline | January 15, 2027 |

| Safe Harbor (Under $150K AGI) | Pay 100% of prior year tax |

| Safe Harbor ($150K+ AGI) | Pay 110% of prior year tax |

| Penalty Rate | IRS interest rate (currently ~8% annually) |

Legal Basis: IRC §6654, IRS Publication 505 (Tax Withholding and Estimated Tax)

Who Must Pay Estimated Taxes?

You generally must make estimated tax payments if both of these apply:

- You expect to owe at least $1,000 in tax after subtracting withholding and credits

- Your withholding and credits will be less than the smaller of:

- 90% of the tax shown on your current year return, OR

- 100% of the tax shown on your prior year return (110% if prior year AGI exceeded $150,000)

You Likely Need to Pay If You're:

✅ Self-employed (sole proprietor, freelancer, independent contractor) ✅ Single-member LLC owner ✅ Partner in a partnership ✅ S Corporation shareholder (for your share of pass-through income) ✅ Receiving significant income without withholding (investments, rental income) ✅ Gig worker (Uber, DoorDash, Etsy seller, etc.)

You May NOT Need to Pay If:

❌ You expect to owe less than $1,000 in tax ❌ You had no tax liability last year AND were a US citizen/resident for the full year ❌ Your employer withholds enough from your W-2 to cover all taxes

Pro tip: If you have a W-2 job plus self-employment income, you can often increase your W-2 withholding to cover your self-employment tax, avoiding quarterly payments entirely.

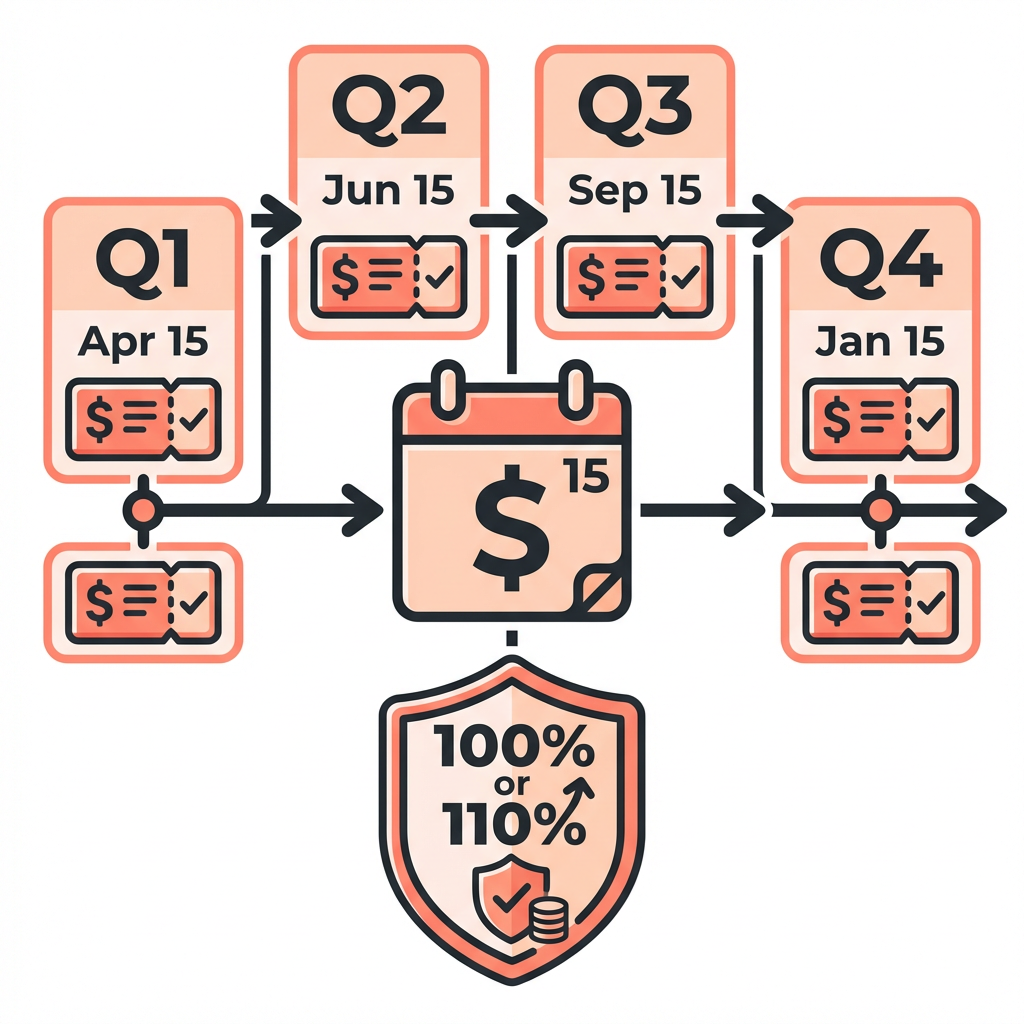

2026 Quarterly Payment Deadlines

Estimated taxes are due four times per year. Despite being called "quarterly," the periods aren't equal—Q2 is only two months.

| Payment Period | Income Earned | Due Date |

|---|---|---|

| Q1 | January 1 – March 31 | April 15, 2026 |

| Q2 | April 1 – May 31 | June 16, 2026 |

| Q3 | June 1 – August 31 | September 15, 2026 |

| Q4 | September 1 – December 31 | January 15, 2027 |

Important: If a deadline falls on a weekend or federal holiday, the due date moves to the next business day.

Exception: If you file your tax return and pay all tax owed by January 31, 2027, you can skip the Q4 estimated payment.

How to Calculate Your Estimated Taxes

Form 1040-ES includes a worksheet that walks you through the calculation. Here's the process simplified:

Step 1: Estimate Your Adjusted Gross Income (AGI)

Start with expected income from all sources:

- Self-employment income (Schedule C profit)

- Wages and salary (if any)

- Interest and dividends

- Capital gains

- Rental income

- Other income

Subtract adjustments to income:

- Self-employed health insurance deduction

- Self-employment tax deduction (50% of SE tax)

- Retirement contributions (SEP-IRA, Solo 401(k))

- Other adjustments

Step 2: Calculate Taxable Income

From your AGI, subtract:

- Standard deduction ($15,000 single, $30,000 married filing jointly for 2026)

- OR itemized deductions (if higher)

- Qualified Business Income (QBI) deduction (up to 20% of qualified income)

Step 3: Calculate Total Tax

Apply the 2026 tax brackets to your taxable income:

2026 Tax Brackets (Single)

| Taxable Income | Tax Rate |

|---|---|

| $0 – $11,925 | 10% |

| $11,926 – $48,475 | 12% |

| $48,476 – $103,350 | 22% |

| $103,351 – $197,300 | 24% |

| $197,301 – $250,525 | 32% |

| $250,526 – $626,350 | 35% |

| Over $626,350 | 37% |

Add self-employment tax:

- 15.3% on net self-employment earnings (up to Social Security wage base)

- 2.9% Medicare tax on earnings above Social Security wage base

See our Schedule SE Instructions Guide 2026 for detailed self-employment tax calculations.

Step 4: Subtract Credits and Withholding

Subtract:

- Tax credits (child tax credit, education credits, etc.)

- Estimated withholding from W-2 jobs (if any)

Step 5: Determine Required Annual Payment

The result is your required annual payment. Divide by 4 for quarterly payments (or allocate based on when income is earned).

Complete Calculation Example

Scenario: Sarah, a freelance designer

Estimated self-employment income: $120,000

Standard deduction: -$15,000

QBI deduction (20%): -$21,000

Taxable income: $84,000

Federal income tax: ~$13,500

Self-employment tax: ~$17,000

Total tax: ~$30,500

Credits and withholding: $0

Required annual payment: $30,500

Quarterly payment: $7,625

The Safe Harbor Rule: Avoid Penalties Guaranteed

The IRS won't penalize you for underpayment if you meet one of these "safe harbor" thresholds:

Option 1: Current Year Safe Harbor

Pay at least 90% of your current year tax liability through estimated payments and withholding.

Risk: If your income is higher than expected, you'll owe at tax time (possibly with penalties).

Option 2: Prior Year Safe Harbor (Recommended)

Pay 100% of your prior year's total tax liability. If your prior year AGI exceeded $150,000 ($75,000 if married filing separately), pay 110% instead.

Advantage: You know exactly how much to pay—it's right on last year's return. No guessing about future income.

Which Safe Harbor to Use?

| Situation | Best Safe Harbor |

|---|---|

| Income similar to last year | Either works |

| Income increasing significantly | Prior year (100%/110%) |

| Income decreasing significantly | Current year (90%) |

| Unpredictable income | Prior year (safest) |

| First year self-employed | Estimate conservatively |

Example:

Last year's total tax: $25,000

This year's expected tax: $35,000

Prior year AGI: $200,000 (over $150K threshold)

Prior year safe harbor: $25,000 × 110% = $27,500

Quarterly payment: $27,500 ÷ 4 = $6,875

Result: Pay $6,875/quarter to avoid penalties,

even if you owe $7,500 at tax time

How to Make Estimated Tax Payments

Option 1: IRS Direct Pay (Recommended)

The fastest, free way to pay:

- Go to IRS.gov/payments

- Select "Make a Payment"

- Choose "Estimated Tax" as payment type

- Select the tax year and quarter

- Enter bank account information

- Submit payment

Advantage: Immediate confirmation, no fees, no registration required.

Option 2: EFTPS (Electronic Federal Tax Payment System)

For recurring scheduled payments:

- Register at EFTPS.gov (allow 5-7 days)

- Schedule payments in advance

- Set up recurring quarterly payments

Advantage: Schedule all four payments at once. Set it and forget it.

Option 3: IRS2Go Mobile App

Pay from your phone using the IRS2Go app (available on iOS and Android). Same process as Direct Pay, mobile-friendly interface.

Option 4: Credit or Debit Card

Pay through IRS-approved payment processors. Fees apply:

- Credit cards: ~1.85% - 2%

- Debit cards: Flat fee ~$2

When this makes sense: If you need to float payment timing or earn significant credit card rewards.

Option 5: Mail Payment Vouchers

Include a payment voucher from Form 1040-ES with a check or money order. Mail to the address listed in the form instructions for your state.

Mailing addresses vary by state. Check Form 1040-ES Instructions for your specific address.

Tip: Mail early. The IRS uses the postmark date, but delays happen.

What If You Miss a Payment or Underpay?

Penalty Calculation

The IRS charges interest on underpaid estimated taxes. The penalty is calculated separately for each quarter based on:

- Amount of underpayment

- Number of days underpaid

- Current IRS interest rate (currently around 8% annually)

Avoiding or Reducing Penalties

Annualized Income Installment Method: If your income varies significantly throughout the year, you can use Form 2210 to calculate penalties based on when you actually earned income. This helps if you earned most income later in the year.

Example: You earned $10,000 in Q1 but $40,000 in Q4. The annualized method may reduce or eliminate penalties even if you paid less earlier.

Penalty Waivers

The IRS may waive penalties if:

- You retired after age 62 during the tax year

- You became disabled during the tax year

- The underpayment was due to casualty, disaster, or other unusual circumstance

- You can show reasonable cause

Estimated Taxes for Different Situations

First Year Self-Employed

No prior year tax to base safe harbor on? Use the current year 90% method, but estimate conservatively. Better to overpay and get a refund than underpay and owe penalties.

Strategy: Take your expected annual income, calculate taxes, add 10-15% buffer, divide by 4.

Mix of W-2 and Self-Employment Income

You have options:

- Increase W-2 withholding: Submit new W-4 to your employer to have extra tax withheld from paychecks

- Make quarterly payments: Pay estimated tax on self-employment income only

- Combination: Increase withholding somewhat, make smaller quarterly payments

Pro tip: Increasing W-2 withholding is treated as paid evenly throughout the year, even if done late. Estimated payments apply only to the quarter paid.

Seasonal or Variable Income

If income fluctuates significantly:

- Use the annualized income installment method (Form 2210)

- Pay more in high-income quarters, less in low-income quarters

- Keep detailed records of when income was earned

S Corporation Owners

If your S Corp pays you a reasonable salary, taxes are withheld from that salary. You may still need estimated payments for:

- Your share of S Corp profits (Schedule K-1)

- Distributions above salary

- Other pass-through income

Common Mistakes to Avoid

Mistake #1: Forgetting Self-Employment Tax

Many new freelancers calculate income tax but forget that self-employment income also incurs an additional 15.3% SE tax. This can nearly double your expected tax bill.

Solution: Always include SE tax in your calculations. Use our Self-Employment Tax Calculator to estimate your total liability.

Mistake #2: Using Last Year's Payment Without Adjustment

Your income may change year to year. Blindly paying last year's amount could leave you owing a large balance (or overpaying significantly).

Solution: Review your current year income quarterly. Adjust payments if income is significantly different.

Mistake #3: Missing the Deadlines

Estimated tax deadlines are firm. Late payments incur penalties from the due date, not your payment date.

Solution: Set calendar reminders. Better yet, use EFTPS to schedule all four payments at the beginning of the year.

Mistake #4: Not Paying Enough in Q4

Q4 covers September through December—often the highest-income months for many businesses. Paying the same amount as Q1-Q3 may leave you short.

Solution: If using the 90% current year method, recalculate in Q4 based on actual year-to-date income.

Mistake #5: Paying Estimated Taxes When Not Required

If you have sufficient W-2 withholding, you may not need to make estimated payments at all.

Solution: Check if you'll owe $1,000+ after withholding. If not, estimated payments are optional.

Form 1040-ES Worksheet Walkthrough

The Form 1040-ES includes a detailed worksheet. Here's a simplified version:

Line 1: Expected AGI

Your total expected income minus adjustments (self-employed health insurance, half of SE tax, retirement contributions).

Lines 2-3: Deductions

Subtract your standard deduction (or itemized deductions) and QBI deduction.

Line 4: Taxable Income

Line 1 minus Lines 2-3.

Lines 5-7: Tax Calculation

Apply tax rates to Line 4, add self-employment tax and other taxes.

Lines 8-9: Credits

Subtract expected credits (child tax credit, education credits, etc.).

Lines 10-11: Other Taxes

Add other taxes (alternative minimum tax, if applicable).

Line 12: Total Tax

Your expected total tax liability.

Lines 13-14: Required Payment

Calculate required annual payment based on safe harbor rules.

Line 15: Quarterly Payment

Divide Line 14 by 4. This is your quarterly estimated payment.

Automate Your Estimated Taxes With AI

Calculating estimated taxes requires tracking income throughout the year, understanding safe harbor rules, and remembering quarterly deadlines. Miss a payment or miscalculate, and you're facing IRS penalties.

What makes Jupid different:

✅ Real-time tax projection — Know your estimated tax liability as income comes in, not just at quarter-end

✅ Automatic payment reminders — Never miss a deadline with timely notifications

✅ Safe harbor calculations — We automatically calculate both safe harbor options and recommend the best approach

✅ Quarterly reconciliation — Adjust payments mid-year as your income changes

✅ Chat with your AI accountant — Ask questions like "How much should I pay in Q3?" and get instant, personalized answers

Example conversation:

- You: "What's my estimated tax payment for Q2?"

- Jupid: "Based on your year-to-date income of $62,000 and projected annual income of $130,000, your Q2 estimated payment should be $8,200. This keeps you within the safe harbor threshold based on last year's return."

Stop guessing about quarterly payments. Let Jupid handle the calculations while you focus on your business.

Action Checklist: Estimated Tax Payments

At the Start of the Year

- Estimate your annual income

- Calculate expected total tax (income tax + SE tax)

- Determine safe harbor amount (100% or 110% of prior year)

- Decide on payment method (Direct Pay, EFTPS, mail)

- Set calendar reminders for all four deadlines

Each Quarter

- Review year-to-date income

- Adjust quarterly payment if income changed significantly

- Make payment by deadline

- Keep confirmation for records

At Tax Time

- Gather all estimated payment confirmations

- Report payments on Form 1040, Line 26

- Review whether to adjust next year's strategy

Resources and Citations

IRS Forms and Instructions

- Form 1040-ES — Estimated Tax for Individuals

- Form 2210 — Underpayment of Estimated Tax

- Schedule SE — Self-Employment Tax

IRS Publications

- Publication 505 — Tax Withholding and Estimated Tax

- Publication 334 — Tax Guide for Small Business

Tax Code References

- IRC §6654 — Failure to pay estimated income tax

- IRC §6655 — Failure by corporation to pay estimated income tax

Payment Resources

- IRS Direct Pay — Free online payments

- EFTPS — Electronic Federal Tax Payment System

Final Thoughts

Estimated taxes are a pay-as-you-go obligation that catches many self-employed individuals off guard. The key principles:

- Know your threshold — Pay estimated taxes if you'll owe $1,000+

- Use safe harbor — 100% (or 110%) of prior year tax guarantees penalty-free

- Mark your calendar — April 15, June 15, September 15, January 15

- Adjust as needed — Recalculate quarterly if income changes

- Automate payments — Use EFTPS to schedule all payments at once

The goal isn't to pay the exact right amount—it's to pay enough to avoid penalties while not overpaying significantly. When in doubt, err on the side of paying slightly more. You'll get it back as a refund.

Disclaimer

This article provides general information about tax payments and should not be considered tax advice. Tax laws change frequently, and individual circumstances vary significantly. For advice specific to your situation, consult with a qualified tax professional.

Tax Year: 2026 Last Updated: January 27, 2026

Ready to simplify your finances?

Join 1,000+ businesses using Jupid to save time and money. Start simplifying your finances today.

30-day money-back guarantee