Schedule SE (Form 1040) Instructions: Self-Employment Tax Guide 2026

Table of Contents

Hi, I'm Slava, CEO and co-founder of Jupid. When I first started working for myself in the US, I was shocked to discover that self-employed individuals pay nearly double the Social Security and Medicare taxes that W-2 employees pay. That 15.3% "surprise" hits hard the first time you see it—and most new freelancers don't budget for it.

Schedule SE is where you calculate this self-employment tax. Understanding how it works helps you plan better, set aside the right amount, and take advantage of the deduction that reduces your income tax burden.

What Is Self-Employment Tax?

Self-employment tax is the Social Security and Medicare tax that self-employed individuals pay on their net earnings. It's the equivalent of FICA taxes that W-2 employees split with their employers.

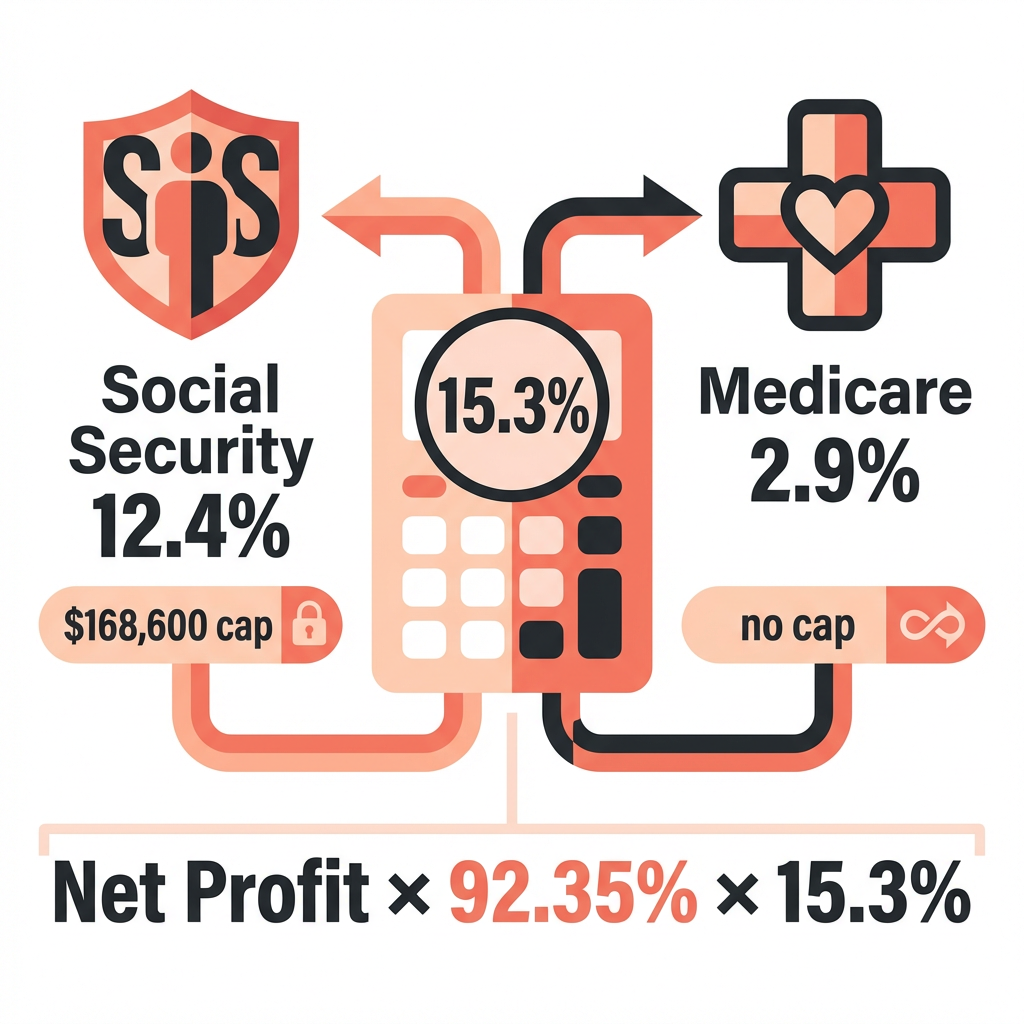

The total rate is 15.3%:

- 12.4% for Social Security (old-age, survivors, and disability insurance)

- 2.9% for Medicare (hospital insurance)

Legal Basis: IRC §1401 imposes self-employment tax on "self-employment income" as defined in IRC §1402.

Why Self-Employed Pay More

When you're an employee:

- You pay 7.65% (6.2% Social Security + 1.45% Medicare)

- Your employer pays the other 7.65%

- Total contribution: 15.3%

When you're self-employed:

- You pay the full 15.3% yourself

- BUT you get to deduct half of it from your income

The net effect: Self-employed individuals pay a bit more in total, but the half-SE-tax deduction partially compensates.

Executive Summary: Self-Employment Tax 2026

| Item | 2026 Amount |

|---|---|

| Total SE Tax Rate | 15.3% |

| Social Security Rate | 12.4% |

| Medicare Rate | 2.9% |

| Social Security Wage Base | $176,100 |

| Net Earnings Factor | 92.35% (0.9235) |

| Threshold to File | $400 net earnings |

| Additional Medicare Tax | 0.9% over $200K (single) / $250K (MFJ) |

Key Formula:

SE Tax = (Schedule C Net Profit × 0.9235) × 15.3%

Legal Basis: IRC §1401, IRC §1402; IRS Publication 334 (Tax Guide for Small Business)

Who Must Pay Self-Employment Tax?

You must file Schedule SE and pay self-employment tax if:

✅ Net self-employment earnings are $400 or more

This includes income from:

- Sole proprietorship (Schedule C)

- Single-member LLC

- Partnership (your share of partnership income)

- Independent contractor work

- Freelance and gig work

- Any trade or business you operate

You Do NOT Pay SE Tax On:

❌ Wages from an employer (already subject to FICA) ❌ Interest and dividends ❌ Capital gains ❌ Rental income (in most cases) ❌ S Corporation distributions (only salary is subject to employment taxes)

Note: S Corp owners must pay themselves a "reasonable salary" which is subject to payroll taxes. Distributions above that salary avoid SE tax, but the salary requirement is strictly enforced.

How to Calculate Self-Employment Tax

Schedule SE walks you through the calculation. Here's the process:

Step 1: Start with Net Self-Employment Income

This is your profit from Schedule C (Line 31) or your share of partnership income from Schedule K-1.

Schedule C Line 31: $80,000

Step 2: Multiply by 92.35%

The IRS allows you to reduce your net earnings by 7.65% before calculating SE tax. This approximates the employer portion of FICA that employers don't pay on.

Net SE earnings: $80,000 × 0.9235 = $73,880

Why 92.35%? This adjustment mirrors what employees experience—employers pay half of FICA, which effectively reduces the employee's taxable base.

Step 3: Calculate Social Security Tax

Apply 12.4% to net SE earnings, up to the Social Security wage base.

2026 Social Security Wage Base: $176,100

If net SE earnings ≤ $176,100:

Social Security tax = Net SE earnings × 12.4%

Example: $73,880 × 0.124 = $9,161

If your combined wages and SE earnings exceed $176,100, only the amount under the cap is subject to Social Security tax.

Step 4: Calculate Medicare Tax

Apply 2.9% to ALL net SE earnings (no cap).

Medicare tax = $73,880 × 0.029 = $2,143

Step 5: Add Additional Medicare Tax (If Applicable)

If your total self-employment income exceeds these thresholds, you owe an additional 0.9% Medicare tax:

| Filing Status | Threshold |

|---|---|

| Single | $200,000 |

| Married Filing Jointly | $250,000 |

| Married Filing Separately | $125,000 |

This additional tax applies only to the amount above the threshold.

Step 6: Total Self-Employment Tax

Add Social Security tax + Medicare tax (+ additional Medicare if applicable).

Social Security: $9,161

Medicare: $2,143

Total SE Tax: $11,304

Complete Calculation Example

Scenario: Marcus, a freelance consultant

Schedule C Net Profit: $100,000

Step 1: Net SE earnings

$100,000 × 0.9235 = $92,350

Step 2: Social Security tax

$92,350 × 12.4% = $11,451

Step 3: Medicare tax

$92,350 × 2.9% = $2,678

Step 4: Total SE Tax

$11,451 + $2,678 = $14,129

Step 5: Deductible half

$14,129 ÷ 2 = $7,065 (deduction on Schedule 1)

The Half SE Tax Deduction

One of the most valuable benefits for self-employed individuals: You can deduct half of your self-employment tax as an adjustment to income.

Where it goes: Schedule 1, Line 15 → reduces your Adjusted Gross Income (AGI)

What it affects:

- Lowers your income tax

- May help you qualify for other deductions and credits

- Reduces AGI-based thresholds

What it doesn't affect:

- The SE tax itself (you still pay the full amount)

Example Impact

Self-employment income: $100,000

SE Tax: $14,129

Half SE Tax deduction: $7,065

Without deduction: Taxable income based on $100,000

With deduction: Taxable income based on $92,935

Tax savings (24% bracket): $7,065 × 24% = $1,696

Schedule SE: Line-by-Line Instructions

Schedule SE has two sections: Short Schedule SE and Long Schedule SE. Most self-employed individuals use the Short version.

Part I: Self-Employment Tax (Short Schedule SE)

Use Short Schedule SE if:

- Your only income subject to SE tax is from self-employment

- You had no church employee income

- Your wages (if any) were $160,200 or less

- You're not using optional methods to calculate SE tax

Line 1a: Net Farm Profit

Enter net profit from Schedule F (farming). Most non-farmers skip this line.

Line 1b: Net Profit from Schedule C

Enter the amount from Schedule C, Line 31. If you have multiple Schedule Cs, add them together.

Schedule C, Line 31: $80,000

Line 2: Partnership Income

Enter net self-employment income from partnerships (from Schedule K-1).

Line 3: Total Net Earnings

Add Lines 1a + 1b + 2. This is your total net self-employment income.

Line 4: Multiply by 92.35%

Line 3 × 0.9235 = Net earnings subject to SE tax

$80,000 × 0.9235 = $73,880

Line 5: Self-Employment Tax

If Line 4 is $176,100 or less:

Line 4 × 0.153 = SE Tax

$73,880 × 0.153 = $11,304

If Line 4 exceeds $176,100, use the worksheet in the instructions to calculate the Social Security portion up to the wage base, then add unrestricted Medicare.

Line 6: Deduction for Half of SE Tax

Line 5 ÷ 2 = $5,652

Enter this amount on Schedule 1, Line 15.

Long Schedule SE: When You Need It

Use Long Schedule SE (Part II) if:

- You had church employee income of $108.28 or more

- You're using optional methods to calculate SE tax

- You received tips subject to Social Security/Medicare tax

- You had wages and SE earnings that together exceed the Social Security wage base

Optional Methods

The Long Schedule SE includes optional methods that can benefit some taxpayers:

Farm Optional Method: Allows you to report at least $6,740 of farm SE earnings even if your actual earnings were less. Helps maintain Social Security credits in low-income years.

Nonfarm Optional Method: Similar benefit for non-farm self-employment. Can only be used if:

- Net nonfarm SE earnings were less than $6,740

- You had net SE earnings of at least $400 in 2 of the prior 3 years

- You haven't used this method more than 4 times previously

SE Tax When You Have Multiple Income Sources

Self-Employment + W-2 Wages

If you have both self-employment income and W-2 wages:

-

Social Security wage base applies to combined income

- Your employer already withheld Social Security on your wages

- Your SE earnings are only subject to Social Security tax up to the remaining amount under the wage base

-

Medicare applies to all income

- No cap on Medicare tax

- Both wages and SE earnings are subject to full Medicare rate

Example:

W-2 wages: $120,000 (employer withheld SS and Medicare)

SE earnings: $80,000

Social Security wage base: $176,100

Already used by wages: $120,000

Remaining for SE: $56,100

SE Social Security tax: $56,100 × 0.9235 × 12.4% = $6,425

SE Medicare tax: $80,000 × 0.9235 × 2.9% = $2,143

Total SE tax: $8,568

Multiple Self-Employment Activities

If you have multiple businesses (multiple Schedule Cs):

- Add all net profits together

- Calculate SE tax on the combined total

- File one Schedule SE for all activities

Common Mistakes to Avoid

Mistake #1: Forgetting the 92.35% Factor

Problem: Calculating SE tax as simply 15.3% × net profit.

Impact: You'll overestimate your tax and overpay.

Solution: Always multiply net earnings by 0.9235 first, then apply 15.3%.

Mistake #2: Not Taking the Half SE Tax Deduction

Problem: Paying SE tax without claiming the adjustment to income.

Impact: You're paying more income tax than necessary.

Solution: Always enter half your SE tax on Schedule 1, Line 15.

Mistake #3: Exceeding the Social Security Wage Base

Problem: Paying Social Security on earnings above the cap when you also have W-2 wages.

Impact: Overpayment of Social Security tax.

Solution: Calculate remaining wage base after W-2 wages. Use Long Schedule SE if combined income exceeds the cap.

Mistake #4: Confusing SE Tax with Income Tax

Problem: Thinking SE tax replaces income tax.

Impact: Underpaying total taxes owed.

Solution: SE tax is in addition to income tax. Your total tax = income tax + SE tax.

Mistake #5: Not Making Quarterly Estimated Payments

Problem: Waiting until April to pay SE tax.

Impact: Underpayment penalties.

Solution: Include SE tax when calculating quarterly estimated payments. See our Form 1040-ES Instructions Guide 2026.

Strategies to Reduce Self-Employment Tax

1. Maximize Business Deductions

Every dollar of business deduction reduces both income tax AND SE tax.

$1,000 deduction saves:

Income tax (24% bracket): $240

SE tax (15.3%): $153

Total savings: $393

2. Retirement Contributions

SEP-IRA and Solo 401(k) contributions reduce your income tax but NOT your SE tax. However, they're still valuable:

- SEP-IRA: Up to 25% of net SE earnings (max $69,000 for 2026)

- Solo 401(k): Up to $23,000 employee contribution + 25% employer contribution

3. S Corporation Election

For higher earners, electing S Corp taxation can reduce SE tax:

- Pay yourself a "reasonable salary" (subject to payroll taxes)

- Take remaining profits as distributions (not subject to SE tax)

Caution: This only makes sense above certain income levels (typically $80,000+), and you must pay yourself a reasonable salary. The IRS scrutinizes S Corp owners who pay themselves too little.

4. Health Insurance Deduction

Self-employed health insurance premiums reduce your income tax, lowering your AGI. While it doesn't directly reduce SE tax, the tax savings are significant.

See our Health Insurance Deduction Guide for Self-Employed 2026.

How Schedule SE Connects to Other Forms

From Schedule C

Your Schedule C net profit (Line 31) flows to Schedule SE as the starting point for your SE tax calculation.

See our Schedule C Instructions Guide 2026.

To Schedule 1

Half of your SE tax (Schedule SE, Line 6) is entered on Schedule 1, Line 15, reducing your AGI.

To Form 1040

- Full SE tax (Schedule SE, Line 5) → Form 1040, Line 23 (added to total tax)

- Half SE tax deduction reduces AGI → flows through to Line 11

To Form 1040-ES

When calculating quarterly estimated taxes, include your expected SE tax in the calculation.

See our Form 1040-ES Instructions Guide 2026.

Calculate Your SE Tax With AI

Self-employment tax calculations involve multiple steps, thresholds, and interactions with other forms. Getting it wrong means either overpaying or facing IRS penalties.

What makes Jupid different:

✅ Real-time SE tax calculation — See your estimated SE tax as income comes in throughout the year

✅ Wage base tracking — If you have W-2 income, we automatically calculate remaining Social Security exposure

✅ Quarterly payment planning — We include SE tax in your estimated payment calculations

✅ Half SE tax optimization — We ensure you're always taking this valuable deduction

✅ Chat with your AI accountant — Ask questions like "What's my self-employment tax so far this year?" and get instant answers

Example conversation:

- You: "How much SE tax will I owe on my $95,000 profit?"

- Jupid: "Based on $95,000 net profit, your self-employment tax is $13,433. That's $95,000 × 0.9235 × 15.3%. You can deduct $6,717 (half) on Schedule 1, reducing your income tax by approximately $1,600 at the 24% bracket."

Stop being surprised by SE tax. Know your liability in real-time.

Action Checklist: Schedule SE

Before Filing

- Calculate total net SE earnings from all Schedule Cs

- Determine if you have W-2 wages that affect Social Security wage base

- Calculate net earnings × 0.9235

- Check if you exceed Additional Medicare Tax threshold

When Filing

- Complete Schedule SE (Short or Long as applicable)

- Enter SE tax on Form 1040, Line 23

- Enter half SE tax deduction on Schedule 1, Line 15

- Verify calculations match

Throughout the Year

- Include SE tax in quarterly estimated payments

- Track net SE earnings to project annual liability

- Set aside approximately 15% of net profit for SE tax

Resources and Citations

IRS Forms and Instructions

- Schedule SE (Form 1040) — Self-Employment Tax

- Schedule SE Instructions — Line-by-line guidance

- Schedule C (Form 1040) — Profit or Loss From Business

IRS Publications

- Publication 334 — Tax Guide for Small Business

- Publication 225 — Farmer's Tax Guide (for farm optional method)

- Publication 505 — Tax Withholding and Estimated Tax

Tax Code References

- IRC §1401 — Self-employment tax rates

- IRC §1402 — Definition of self-employment income

- IRC §164(f) — Deduction for half of SE tax

2026 Key Numbers

| Item | 2026 Amount |

|---|---|

| Social Security wage base | $176,100 |

| Social Security rate (SE) | 12.4% |

| Medicare rate (SE) | 2.9% |

| Additional Medicare Tax | 0.9% over threshold |

| Net earnings factor | 92.35% |

Final Thoughts

Self-employment tax is a significant expense for freelancers, contractors, and business owners—often totaling 15% or more of net earnings. Understanding how Schedule SE works helps you:

- Plan accurately — Set aside the right amount throughout the year

- Claim your deductions — Never miss the half SE tax deduction

- Optimize your structure — Know when S Corp election might save money

- Avoid penalties — Include SE tax in quarterly estimated payments

The 15.3% rate may seem high, but remember: you're building Social Security credits for retirement and qualifying for Medicare benefits. It's the cost of being your own employer.

Disclaimer

This article provides general information about tax calculations and should not be considered tax advice. Tax laws change frequently, and individual circumstances vary significantly. For advice specific to your situation, consult with a qualified tax professional.

Tax Year: 2026 Last Updated: January 28, 2026

Ready to simplify your finances?

Join 1,000+ businesses using Jupid to save time and money. Start simplifying your finances today.

30-day money-back guarantee