Photographer Tax Deductions 2026: Complete Guide to Write-Offs for Freelance Photographers

Table of Contents

Published: January 23, 2026 Tax Year: 2026

A Message from Slava

Photography is one of those professions where your gear IS your business. A professional camera body, quality lenses, lighting equipment, editing software—the investment adds up fast. The good news: virtually all of it is tax-deductible.

As a freelance photographer, you're running a business. Every piece of equipment, every mile driven to a shoot, every hour of editing software subscription—it's all an ordinary and necessary business expense under IRC § 162.

Through my work with creative professionals, I've seen photographers save $10,000-$20,000 per year by properly tracking and deducting their expenses. This guide covers every deduction you're entitled to, with exact IRS citations and real calculations.

Executive Summary: Photographer Tax Deductions for 2026

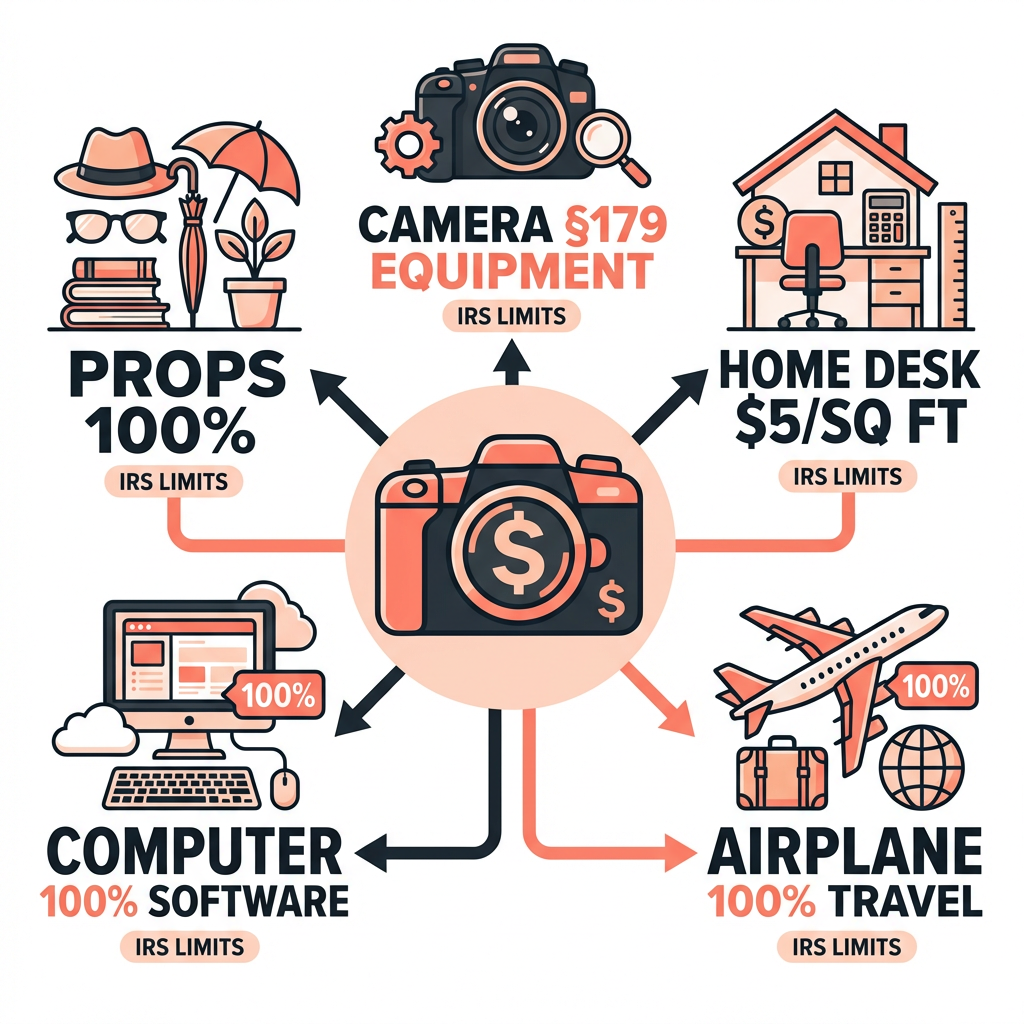

Key Deductions Available:

- Equipment: Section 179 allows full deduction of cameras, lenses, lighting in year of purchase

- Home Studio: $5 per sq ft simplified method (max $1,500) or actual expenses

- Software: Adobe Creative Cloud, Lightroom, Capture One—100% deductible

- Travel: Mileage (72.5¢/mile) plus lodging and meals for destination shoots

- Props and Styling: Backdrops, furniture, clothing for shoots

Tax Savings Potential for 2026:

For a freelance photographer earning $75,000 with typical expenses:

Equipment (Section 179): $8,000

Home studio (200 sq ft): $1,000

Software subscriptions: $1,200

Travel and mileage: $4,500

Props and supplies: $1,500

Marketing and portfolio: $2,000

Self-employment tax (50%): $5,299

Total deductions: $23,499

Tax savings at 24% bracket: $5,640

Legal Basis: IRC Section 162, IRC Section 179, IRS Publication 946, IRS Publication 463

Equipment Deductions: Your Biggest Write-Off

Photography equipment is expensive—but Section 179 allows you to deduct the full cost in the year of purchase rather than depreciating it over several years.

Section 179 Deduction

For 2026, you can deduct up to $1,250,000 in qualifying equipment purchases in the year you buy them (subject to business income limits).

Qualifying equipment:

- Camera bodies

- Lenses

- Lighting equipment (strobes, continuous lights, modifiers)

- Tripods and support equipment

- Memory cards and storage

- Drones (if used for business)

- Computers for editing

Calculation Example

New camera body: $3,500

Two lenses: $4,000

Lighting kit: $1,500

Drone for aerial photography: $2,000

Total equipment purchases: $11,000

Section 179 deduction: $11,000 (full amount)

Tax savings at 24% bracket: $2,640

Legal Citation: IRC § 179 and IRS Publication 946

Depreciation Alternative

If you prefer to spread the deduction over multiple years, you can use MACRS depreciation:

- Cameras and equipment: 5-year recovery period

- Computer equipment: 5-year recovery period

Most photographers prefer Section 179 for the immediate tax benefit.

Home Studio Deduction

If you have a dedicated space in your home for photography work—shooting, editing, client meetings—you can claim the home office deduction.

Requirements

The space must be:

- Used regularly and exclusively for business

- Your principal place of business OR where you meet clients

A home studio where you shoot portraits or product photography clearly qualifies.

Simplified Method

$5 per square foot, up to 300 square feet = $1,500 maximum

Studio space: 200 sq ft

Rate: × $5

Annual deduction: $1,000

Actual Expense Method

Calculate the percentage of your home used for business, then deduct that percentage of:

- Rent or mortgage interest

- Utilities

- Insurance

- Repairs

- Depreciation (for homeowners)

Home square footage: 1,600 sq ft

Studio square footage: 200 sq ft

Business use percentage: 12.5%

Annual home expenses: $24,000

Deductible amount (12.5%): $3,000

The actual method often yields a larger deduction for dedicated studios.

Try our Home Office Tax Deduction Calculator.

Software and Subscriptions

Photography software is 100% deductible as a business expense.

Deductible Software

✅ Editing software:

- Adobe Creative Cloud (Photoshop, Lightroom)

- Capture One

- Luminar

- DxO PhotoLab

- ON1 Photo RAW

✅ Business software:

- Studio management (HoneyBook, Dubsado, Studio Ninja)

- Invoicing and accounting software

- Client gallery platforms (Pixieset, ShootProof, Pic-Time)

- CRM software

✅ Storage and backup:

- Cloud storage (Dropbox, Google Drive, iCloud)

- Backup services (Backblaze, Carbonite)

- Photo hosting

Calculation Example

Adobe Creative Cloud: $660

Client gallery platform: $360

Studio management software: $400

Cloud storage: $120

Backup service: $100

Total software deduction: $1,640

Tax savings at 24% bracket: $394

Travel and Location Expenses

Travel for photography jobs—destination weddings, on-location shoots, scouting—is deductible.

Mileage Deduction

The 2026 standard mileage rate is 72.5 cents per mile.

✅ Deductible trips:

- Driving to client shoots

- Location scouting

- Equipment pickups and rentals

- Meeting vendors or second shooters

- Traveling to photography conferences

Annual business miles: 6,000

Standard mileage rate: × $0.725

Total mileage deduction: $4,350

Destination Shoots and Travel Jobs

For overnight travel (destination weddings, commercial shoots):

✅ Deductible:

- Airfare

- Hotel/lodging

- 50% of meals

- Ground transportation

- Baggage fees (especially for equipment)

- Travel insurance

Destination wedding expenses:

Airfare: $400

Hotel (2 nights): $300

Meals (50%): $75

Ground transportation: $100

Equipment shipping: $150

Total travel deduction: $1,025

Legal Citation: IRS Publication 463 - Travel, Gift, and Car Expenses

Props, Backdrops, and Styling

Items purchased for shoots are 100% deductible as ordinary and necessary business expenses.

Deductible Items

✅ Backdrops and surfaces:

- Seamless paper rolls

- Fabric backdrops

- Vinyl and canvas backdrops

- Textured surfaces and boards

- Flooring materials

✅ Props:

- Furniture for lifestyle shoots

- Decorative items

- Baby props (for newborn photographers)

- Food styling items (for food photographers)

- Seasonal decorations

✅ Styling:

- Client wardrobe pieces

- Accessories for styled shoots

- Flowers and florals

- Styling supplies

Calculation Example

Seamless paper (various colors): $200

Backdrop stands: $150

Newborn props and wraps: $400

Styling accessories: $200

Surface boards: $100

Total props deduction: $1,050

Tax savings at 24% bracket: $252

Marketing and Portfolio

Building your photography business requires marketing—all deductible.

Deductible Marketing Expenses

✅ Portfolio:

- Print portfolio books

- Portfolio website hosting

- Sample albums and prints

- Portfolio prints for displays

✅ Advertising:

- Social media ads (Instagram, Facebook)

- Google Ads

- Wedding directory listings (The Knot, WeddingWire)

- Print advertising

✅ Branding:

- Logo design

- Business cards

- Packaging and presentation materials

- Branded USB drives

✅ Networking:

- Industry conferences and workshops

- Professional memberships (PPA, WPPI)

- Styled shoot collaboration costs

Calculation Example

Website hosting and domain: $200

Wedding directory listing: $600

Print portfolio: $300

Business cards and branding: $400

Conference registration: $500

Total marketing deduction: $2,000

Tax savings at 24% bracket: $480

Education and Professional Development

Continuing education to improve your photography skills is deductible.

Deductible Education

✅ Courses and workshops:

- Online photography courses

- In-person workshops

- Mentorship programs

- Lighting and posing tutorials

✅ Educational materials:

- Photography books

- Educational subscriptions

- Tutorial platforms (CreativeLive, KelbyOne)

✅ Conferences:

- WPPI, Imaging USA, PhotoPlus Expo

- Travel to conferences (see Travel section)

- Conference workshops and classes

Note: Education that qualifies you for a NEW profession is not deductible. Education that improves skills in your CURRENT profession is deductible.

Insurance and Business Expenses

Deductible Insurance

✅ Business insurance:

- Equipment insurance

- Liability insurance

- Professional liability (E&O)

- Business property insurance

✅ Health insurance:

- Self-employed health insurance deduction (100% of premiums)

- Dental and vision

- Medicare premiums

Other Business Expenses

✅ Professional fees:

- Accountant/bookkeeper

- Legal fees for contracts

- Model releases and legal templates

✅ Banking and payment processing:

- Business bank account fees

- Credit card processing fees (PayPal, Square, Stripe)

- Invoicing platform fees

Self-Employment Tax Deduction

As a freelance photographer, you pay 15.3% self-employment tax on net earnings.

Deduct Half of Self-Employment Tax

Net photography income: $70,000

Self-employment tax (15.3%): $10,710

Deductible portion (50%): $5,355

Tax savings at 24% bracket: $1,285

Use our Self-Employment Tax Calculator.

Common Mistakes Photographers Make

Mistake #1: Not Using Section 179

Problem: Depreciating equipment over 5 years instead of deducting immediately

Impact: Waiting years for tax benefits on major purchases

Solution: Elect Section 179 for qualifying equipment to deduct the full cost in year one.

Mistake #2: Missing Home Studio Deduction

Problem: Thinking you need a "formal" studio to qualify

Impact: Missing $1,000-$3,000+ in annual deductions

Solution: A dedicated editing space or shooting area in your home qualifies.

Mistake #3: Forgetting Mileage

Problem: Not tracking drives to shoots, scouting, and meetings

Impact: Losing thousands in mileage deductions

Solution: Use a mileage tracking app from day one.

Mistake #4: Mixing Personal and Business

Problem: Using one account for everything

Impact: Difficulty proving deductions in an audit

Solution: Separate business bank account and credit card.

Track Your Photography Deductions With AI

Between shooting, editing, and client management, tracking expenses is tedious. Jupid automates the process.

What makes Jupid different for photographers:

✅ AI accountant in WhatsApp - Ask tax questions anytime, get instant answers backed by IRS guidance

✅ 95.9% accuracy in categorization - Connect your bank; Jupid automatically categorizes equipment purchases, software, and props

✅ Real-time financial insights - See your deductions and estimated tax liability throughout the year

✅ Automatic tax filing - From expense tracking to Schedule C, handled for you

Example conversation:

- You: "I bought a $2,800 lens for portrait work. How do I deduct it?"

- Jupid: "Great purchase! Under Section 179, you can deduct the full $2,800 in 2026. I've categorized it as 'Equipment - Section 179' on your Schedule C. This saves you $672 at the 24% bracket."

Action Checklist: Maximizing Your 2026 Deductions

Start of Year

- Set up a separate business bank account

- Track your home studio square footage

- Download a mileage tracking app

- Organize equipment purchase records

Throughout the Year

- Save all equipment receipts

- Track every business mile

- Keep records of software subscriptions

- Document props and backdrop purchases

- Set aside 25-30% of income for taxes

Before Year End

- Consider equipment purchases to maximize Section 179

- Make Q4 estimated tax payment

- Review all deductible expenses

- Consider retirement contributions (SEP IRA, Solo 401k)

At Tax Time

- Complete Schedule C with all income and expenses

- Elect Section 179 for qualifying equipment

- Calculate home office deduction (compare both methods)

- Complete Schedule SE for self-employment tax

- File by April 15 (or request extension)

Resources and Citations

IRS Publications (Official Sources)

- IRS Publication 946 - How to Depreciate Property (Section 179)

- IRS Publication 463 - Travel, Gift, and Car Expenses

- IRS Publication 587 - Business Use of Your Home

- Schedule C Instructions - Profit or Loss From Business

Tax Code and Regulations

- IRC § 162 - Trade or Business Expenses

- IRC § 179 - Election to Expense Certain Depreciable Business Assets

- IRC § 280A - Home Office Deduction

- IRS Notice 2026-10 - Standard Mileage Rates for 2026

2026 Key Numbers Summary

| Item | 2026 Limit |

|---|---|

| Section 179 limit | $1,250,000 |

| Standard mileage rate | 72.5¢ per mile |

| Simplified home office | $5/sq ft (max $1,500) |

| Meal deduction | 50% of cost |

| SE tax rate | 15.3% |

| SE tax deduction | 50% of SE tax |

Disclaimer

This article provides general information about tax deductions for photographers and should not be considered tax advice. Tax laws change frequently, and individual circumstances vary significantly. These deductions apply to self-employed photographers; employees have different rules. For advice specific to your situation, consult with a qualified tax professional.

Tax Year: 2026 Last Updated: January 23, 2026

Ready to simplify your finances?

Join 1,000+ businesses using Jupid to save time and money. Start simplifying your finances today.

30-day money-back guarantee