Quarterly Taxes for Self-Employed 2026: Deadlines, Calculations, and How to Pay

Table of Contents

Published: February 10, 2026 Tax Year: 2026

A Message from Slava

Quarterly estimated taxes are the part of self-employment that catches most people off guard. As a W-2 employee, taxes are withheld from every paycheck. As a self-employed person, you're responsible for paying the IRS four times a year — and the penalty for getting it wrong is real.

When I first started working for myself in the US after moving from the UK, the quarterly payment system felt counterintuitive. In the UK, self-employed people can file and pay once a year (with a payment on account system). In the US, the IRS expects you to estimate your income, calculate your tax, divide by four, and pay as you go.

The good news: there are "safe harbor" rules that protect you from penalties even if your estimate is off. Once you understand these rules, the quarterly system becomes manageable.

This guide covers everything: deadlines, calculation methods, payment options, safe harbor rules, and how to handle irregular income. If you're self-employed and haven't been making quarterly payments, start now — the penalty for missing them adds up fast.

Executive Summary: Quarterly Estimated Taxes for 2026

Who must pay: Self-employed individuals who expect to owe $1,000 or more in tax for the year after subtracting withholding and credits.

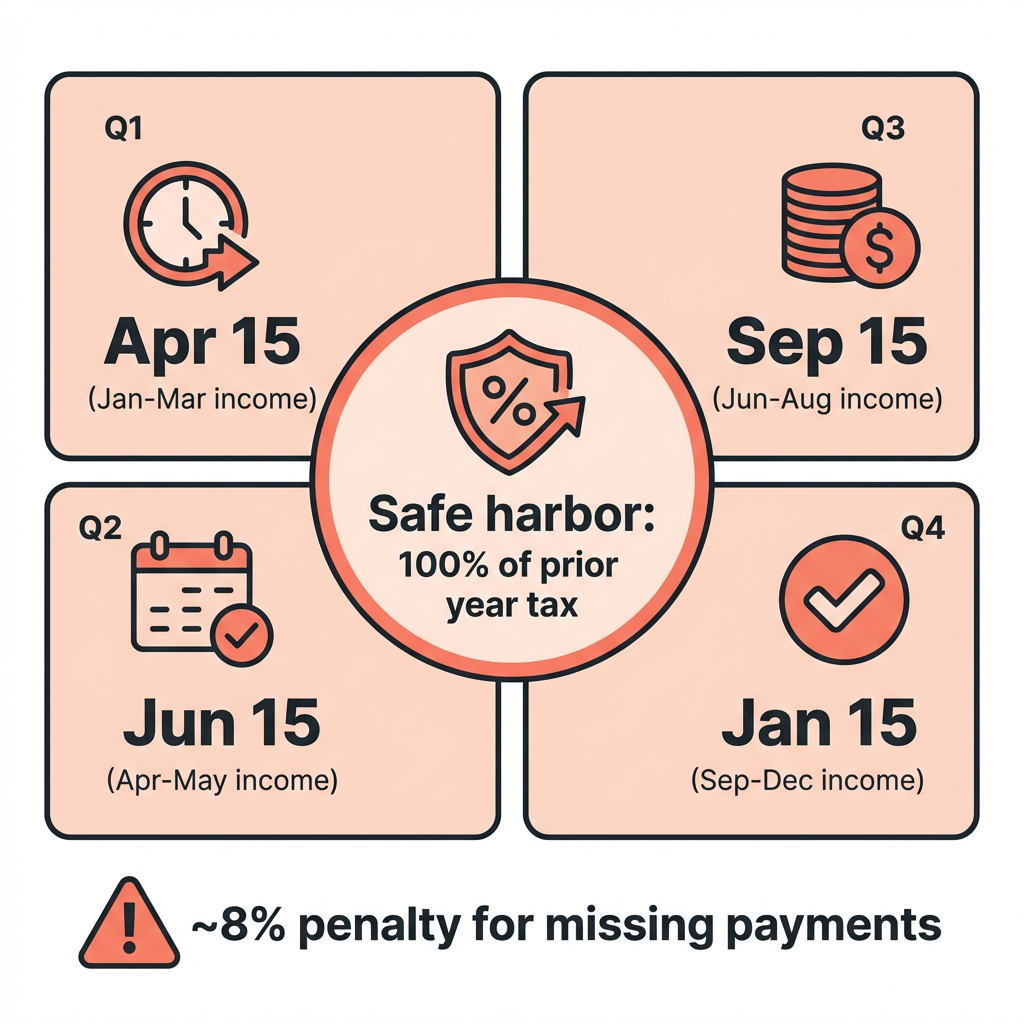

2026 Payment Deadlines:

| Quarter | Income Period | Due Date |

|---|---|---|

| Q1 | January - March | April 15, 2026 |

| Q2 | April - May | June 15, 2026 |

| Q3 | June - August | September 15, 2026 |

| Q4 | September - December | January 15, 2027 |

How much to pay: Either (a) 100% of last year's tax divided by four, or (b) 90% of this year's estimated tax divided by four.

Safe harbor rule: Pay at least 100% of your prior year's total tax liability in four equal installments, and you won't owe a penalty — even if you owe more at filing time. (110% if your prior year AGI exceeded $150,000.)

Legal basis: IRC §6654 (estimated tax penalty), IRS Publication 505, Form 1040-ES

Do You Need to Pay Quarterly?

Yes, if:

- You're self-employed and expect to owe $1,000+ in tax for the year

- You have income with no withholding (1099 income, investment income, rental income)

- Your withholding from W-2 jobs won't cover your total tax liability

No, if:

- Your expected tax liability (after withholding and credits) is less than $1,000

- You had no tax liability last year (you owed $0)

- You're a first-year self-employed person and have no prior year return to base safe harbor on (though you should still pay to avoid a balance due)

Legal citation: IRC §6654(e) defines the exceptions to estimated tax requirements.

How to Calculate Your Quarterly Payments

Method 1: Prior Year Safe Harbor (Simplest)

Take your total tax from last year's return and divide by four. Pay that amount each quarter.

Last year's total tax (Form 1040, Line 24): $18,000

Quarterly payment: $18,000 ÷ 4 = $4,500

Pay $4,500 on April 15, June 15, September 15, January 15

If your prior year AGI exceeded $150,000 ($75,000 if married filing separately), use 110% of last year's tax:

Last year's total tax: $30,000

Last year's AGI: $180,000 (over $150,000)

Safe harbor amount: $30,000 × 110% = $33,000

Quarterly payment: $33,000 ÷ 4 = $8,250

This method guarantees no penalty, regardless of how much more you earn this year. If your actual tax exceeds the safe harbor amount, you'll owe the difference at filing time — but no penalty.

Method 2: Current Year Estimate

Estimate your total tax for the current year based on expected income and expenses. Pay at least 90% of this amount in four installments.

Estimated 2026 income: $100,000

Estimated deductions: $25,000

Estimated taxable income: $75,000

Estimated taxes:

Self-employment tax: ~$14,130

Federal income tax: ~$8,000

Total estimated tax: ~$22,130

90% safe harbor: $22,130 × 90% = $19,917

Quarterly payment: $19,917 ÷ 4 = $4,979

Risk: If you underestimate and pay less than 90% of actual tax, you'll owe a penalty.

Method 3: Annualized Income Installment (For Uneven Income)

If your income varies significantly by quarter, you can use Form 2210, Schedule AI to calculate payments based on actual income earned in each period. This prevents overpaying early in the year when income is lower.

When to use this: Seasonal businesses, real estate agents, consultants with project-based income, or any situation where income is much higher in some quarters than others.

What's Included in "Total Tax"

Your quarterly estimated payment covers both:

- Self-employment tax — The 15.3% FICA tax on net earnings

- Federal income tax — Tax on your total taxable income

Many first-time self-employed people only calculate income tax and forget the SE tax — which is often the larger amount.

Example at $80,000 net profit:

Self-employment tax: $80,000 × 92.35% × 15.3% = $11,304

Federal income tax (after all deductions): ~$5,800

Total tax: ~$17,104

Quarterly payment: $17,104 ÷ 4 = $4,276

Use our Self-Employment Tax Calculator to estimate both components.

How to Make Payments

Online Options (Recommended)

IRS Direct Pay — irs.gov/directpay

- Free bank transfer

- Immediate confirmation

- Schedule payments in advance

EFTPS — eftps.gov

- Electronic Federal Tax Payment System

- Schedule payments up to 365 days ahead

- View payment history

- Requires enrollment (takes 5-7 days for PIN)

IRS Online Account — irs.gov/account

- View balance, payments, and transcripts

- Make payments via Direct Pay or card

Debit/Credit Card — Through IRS-approved processors

- Convenience fee: 1.85-1.98% for credit cards, $2.14-$2.50 for debit

- Not recommended due to fees unless earning rewards that offset the cost

Mail Payment

Send Form 1040-ES payment voucher with a check or money order to the address listed on the voucher. Allow 5-7 business days for processing.

IRS2Go App

Make payments via your mobile device using Direct Pay or card.

The Underpayment Penalty

If you don't pay enough estimated tax, the IRS charges a penalty. For 2026, the penalty rate is approximately 8% (annual rate), calculated on the underpaid amount for each quarter.

How the Penalty Is Calculated

The penalty runs from the due date of each quarterly payment to the earlier of the payment date or April 15 of the following year.

Example: You should have paid $5,000 on April 15 but paid $0

Penalty period: April 15, 2026 to April 15, 2027 = 12 months

Penalty: $5,000 × 8% = $400

If you paid on September 15 instead:

Penalty period: April 15 to September 15 = 5 months

Penalty: $5,000 × 8% × (5/12) = $167

How to Avoid the Penalty

✅ Pay 100% of prior year's tax (110% if AGI > $150,000) in four equal installments ✅ Pay 90% of current year's tax in four installments ✅ Owe less than $1,000 at filing time ✅ Have no tax liability from the prior year

The prior year safe harbor is the most popular method because it's certain — you know last year's tax, and dividing by four is simple.

Legal citation: IRC §6654(d) defines the required annual payment and safe harbor rules.

Handling Irregular Income

Many self-employed people earn different amounts each quarter. Here are three approaches:

Approach 1: Equal Payments (Simplest)

Use the prior year safe harbor regardless of when income arrives. Pay the same amount each quarter.

Best for: People with somewhat predictable income who want simplicity.

Approach 2: Adjusted Payments

Recalculate your estimated tax as income arrives. Pay more in quarters when you earn more.

Example: Consultant with seasonal income

Q1 net profit: $10,000 → Pay 28% = $2,800

Q2 net profit: $30,000 → Pay 28% = $8,400

Q3 net profit: $15,000 → Pay 28% = $4,200

Q4 net profit: $25,000 → Pay 28% = $7,000

Total: $22,400 (covers estimated tax on $80,000 net profit)

Best for: People with highly variable income who don't want to overpay in slow quarters.

Approach 3: Annualized Income Method

File Form 2210, Schedule AI with your tax return to prove that your unequal payments matched your actual income pattern. This eliminates penalties even if payments weren't equal.

Best for: People with extremely uneven income (e.g., most income in Q4) who would otherwise face penalties for low early-quarter payments.

First Year Self-Employed?

If this is your first year of self-employment, you don't have a prior year self-employment tax return to base the safe harbor on. Here's what to do:

- Estimate conservatively — Project your annual income and expenses

- Use 25-30% as a guideline — Set aside this percentage of net profit for all taxes

- Pay quarterly from Q1 — Don't wait until you have a full year of data

- Adjust as you go — Recalculate each quarter as actual income becomes clearer

- Consider overpaying slightly — A refund is better than a penalty

If you had W-2 income last year, your prior year total tax includes what was withheld. You can use the safe harbor on that amount if you want, even though your income sources changed.

For a complete first-year filing guide, see our independent contractor taxes guide.

Common Mistakes to Avoid

Mistake #1: Waiting Until April to Pay

Problem: Self-employed individual earns $80,000 throughout the year and pays nothing until April 15 of the following year.

Impact: Underpayment penalty of approximately $1,000-$1,500, plus cash flow stress from a large lump-sum payment.

Solution: Start quarterly payments immediately. Even late quarterly payments reduce the penalty compared to waiting until filing.

Mistake #2: Only Budgeting for Income Tax

Problem: Calculating estimated payments based only on income tax brackets, forgetting the 15.3% self-employment tax.

Impact: Underpaying by 30-50% of your actual liability. At $80,000 net profit, SE tax is $11,304 — often larger than income tax.

Solution: Include both SE tax and income tax in your quarterly calculations.

Mistake #3: Not Using the Safe Harbor

Problem: Trying to estimate this year's tax precisely and sometimes getting it wrong, resulting in penalties.

Impact: Penalties averaging $200-$800 per year for most self-employed individuals.

Solution: Use the prior year safe harbor. It's simple, it's certain, and it eliminates penalty risk entirely.

Mistake #4: Paying State Estimated Taxes Late

Problem: Making federal estimated payments on time but forgetting that most states also require quarterly payments.

Impact: State underpayment penalties (rules and rates vary by state).

Solution: Set up both federal and state quarterly payments. Many states follow the same deadlines as the IRS.

Track Your Estimated Tax Payments With AI

Calculating the right quarterly payment amount requires tracking income and expenses in real time — not guessing at the start of the year and hoping you're close enough.

What makes Jupid different:

✅ Automatic estimated tax calculations — Jupid tracks your income and expenses to calculate what you owe each quarter

✅ Payment deadline reminders — Get alerts via WhatsApp or iMessage before each quarterly deadline

✅ Year-to-date tax tracking — Ask "Am I on track with my estimated payments?" and get an instant answer

✅ Bank connection and auto-sync — Connect your business accounts and Jupid monitors your running tax liability

Example conversation:

- You: "How much should I pay for Q3 estimated taxes?"

- Jupid: "Based on your year-to-date net profit of $61,000 and projected annual income of $95,000, your Q3 estimated payment should be $5,400. You've paid $10,800 in Q1 and Q2. After Q3, you'll have $16,200 of an estimated $21,600 total liability covered."

Learn more about how Jupid keeps your business finances organized

Action Checklist: Quarterly Estimated Taxes

Setting Up

- Determine if you need to make estimated payments ($1,000+ expected tax)

- Choose your calculation method (prior year safe harbor or current year estimate)

- Set up EFTPS account for electronic payments

- Open a dedicated savings account for tax reserves

- Calendar all four quarterly deadlines

Each Quarter

- Calculate payment amount based on your chosen method

- Make payment by the deadline

- Keep confirmation of payment

- Review income vs. estimates — adjust future payments if needed

- Use our Self-Employment Tax Calculator to recalculate

At Tax Time

- Report all estimated payments on Form 1040, Line 26

- Reconcile total payments against actual tax liability

- If you owe more: pay the balance by April 15

- If you overpaid: receive refund or apply to next year's Q1 payment

- Review whether your estimation method worked well for future years

Resources and Citations

IRS Publications (Official Sources)

- IRS: Estimated Taxes — Overview and payment options

- IRS Publication 505 — Tax Withholding and Estimated Tax

- Form 1040-ES — Estimated Tax for Individuals

- Form 2210 — Underpayment of Estimated Tax

- IRS Direct Pay — Online payment system

- EFTPS — Electronic Federal Tax Payment System

Tax Code and Regulations

- IRC §6654 — Failure to pay estimated income tax

- IRC §6654(d)(1)(B) — Safe harbor: 100% of prior year tax

- IRC §6654(d)(1)(C) — High income exception: 110% for AGI > $150,000

- IRC §6654(e)(1) — De minimis exception ($1,000 threshold)

2026 Key Numbers

| Item | 2026 Amount |

|---|---|

| Estimated tax threshold | $1,000 owed |

| Safe harbor (standard) | 100% of prior year tax |

| Safe harbor (high income) | 110% if AGI > $150,000 |

| Underpayment penalty rate | ~8% annual |

| Q1 deadline | April 15, 2026 |

| Q2 deadline | June 15, 2026 |

| Q3 deadline | September 15, 2026 |

| Q4 deadline | January 15, 2027 |

Final Thoughts

Quarterly estimated taxes are a pay-as-you-go system. The IRS wants your money throughout the year, not in one lump sum. The system is predictable once you understand the safe harbor rules.

The key strategies:

- Use the prior year safe harbor — Pay 100% (or 110%) of last year's tax in four installments, and penalty risk drops to zero

- Set aside money automatically — Transfer 25-30% of every payment you receive to a dedicated tax savings account

- Include SE tax in your calculation — It's often the largest component of your estimated payment

The penalty for missed estimated payments is modest but avoidable. Get ahead of it once, and quarterly payments become automatic.

Disclaimer

This article provides general information about quarterly estimated tax payments and should not be considered tax advice. The estimated tax requirements, safe harbor rules, and penalty calculations described apply to federal taxes. Most states have separate estimated tax requirements with their own rules and deadlines. For advice specific to your situation, consult with a qualified tax professional.

Tax Year: 2026 Last Updated: February 10, 2026

Ready to simplify your finances?

Join 1,000+ businesses using Jupid to save time and money. Start simplifying your finances today.

30-day money-back guarantee