Independent Contractor Taxes 2026: Complete Guide to Filing and Paying

Table of Contents

Published: February 9, 2026 Tax Year: 2026

A Message from Slava

The shift to independent work is one of the biggest economic trends I've seen over the past decade. At Anna Money, we served 60,000+ small businesses in the UK, and a growing share of them were solo operators — freelancers, consultants, and contractors running their own show.

When I moved to the US and started Jupid, I experienced the independent contractor tax system firsthand. The biggest surprise wasn't the tax rate — it was the quarterly payment schedule and the fact that no one withholds taxes for you. After years of PAYE in the UK where taxes were handled automatically, suddenly I was responsible for calculating and paying everything myself.

The system isn't difficult, but it's different from what most people are used to as employees. This guide covers everything an independent contractor needs to know about taxes: what you owe, when you owe it, how to calculate it, and how to reduce it legally.

Executive Summary: Independent Contractor Taxes for 2026

What you owe as an independent contractor:

| Tax | Rate | Applies To |

|---|---|---|

| Self-employment tax | 15.3% | Net earnings × 92.35% |

| Federal income tax | 10-37% | Taxable income after deductions |

| State income tax | 0-13.3% | Varies by state |

| Additional Medicare | 0.9% | Earnings over $200,000 (single) |

Example at $75,000 net earnings:

Self-employment tax: $75,000 × 92.35% × 15.3% = $10,597

Federal income tax (after deductions): ~$5,200

Total federal tax: ~$15,797

Effective federal rate: ~21.1%

Key forms:

- Schedule C — Report income and expenses

- Schedule SE — Calculate self-employment tax

- Form 1040-ES — Quarterly estimated tax payments

- Form 8995 — QBI deduction

Legal basis: IRC §1401 (SE tax), IRC §6654 (estimated tax), IRS Publication 334, IRS Publication 505

The Four Taxes You Pay

As an independent contractor, you're responsible for four types of tax. Nobody withholds anything for you — it all comes from your pocket.

Tax 1: Self-Employment Tax (15.3%)

This is the combined Social Security (12.4%) and Medicare (2.9%) tax. W-2 employees split this with their employer, but as a contractor you pay both halves.

2026 self-employment tax calculation:

Net earnings from self-employment: $90,000

Multiply by 92.35%: $83,115

SE tax: $83,115 × 15.3% = $12,717

Social Security portion (12.4%): $10,306

(Applies to first $176,100 of earnings)

Medicare portion (2.9%): $2,410

(No income cap)

You can deduct half of your SE tax ($6,358 in this example) on Schedule 1, which reduces your adjusted gross income.

For detailed calculations, see our Schedule SE guide.

Legal citation: IRC §1401 sets self-employment tax rates. IRC §164(f) allows the deduction for half of SE tax.

Tax 2: Federal Income Tax (10-37%)

After subtracting the half-SE-tax deduction, the standard deduction ($15,700 for single filers), and the QBI deduction, your remaining taxable income is taxed at graduated rates:

| Bracket | Single Filer Income |

|---|---|

| 10% | $0 - $11,925 |

| 12% | $11,926 - $48,475 |

| 22% | $48,476 - $103,350 |

| 24% | $103,351 - $197,300 |

| 32% | $197,301 - $250,525 |

| 35% | $250,526 - $626,350 |

| 37% | Over $626,350 |

Tax 3: State Income Tax

Most states tax your income on top of federal taxes. Rates range from 0% (in states like Florida, Texas, and Wyoming) to 13.3% (California's top rate).

Tax 4: Additional Medicare Tax

If your net self-employment earnings exceed $200,000 (single) or $250,000 (married filing jointly), you owe an additional 0.9% Medicare tax on earnings above that threshold.

Quarterly Estimated Tax Payments

The IRS expects taxes paid as you earn. As a contractor with no withholding, this means quarterly estimated payments using Form 1040-ES.

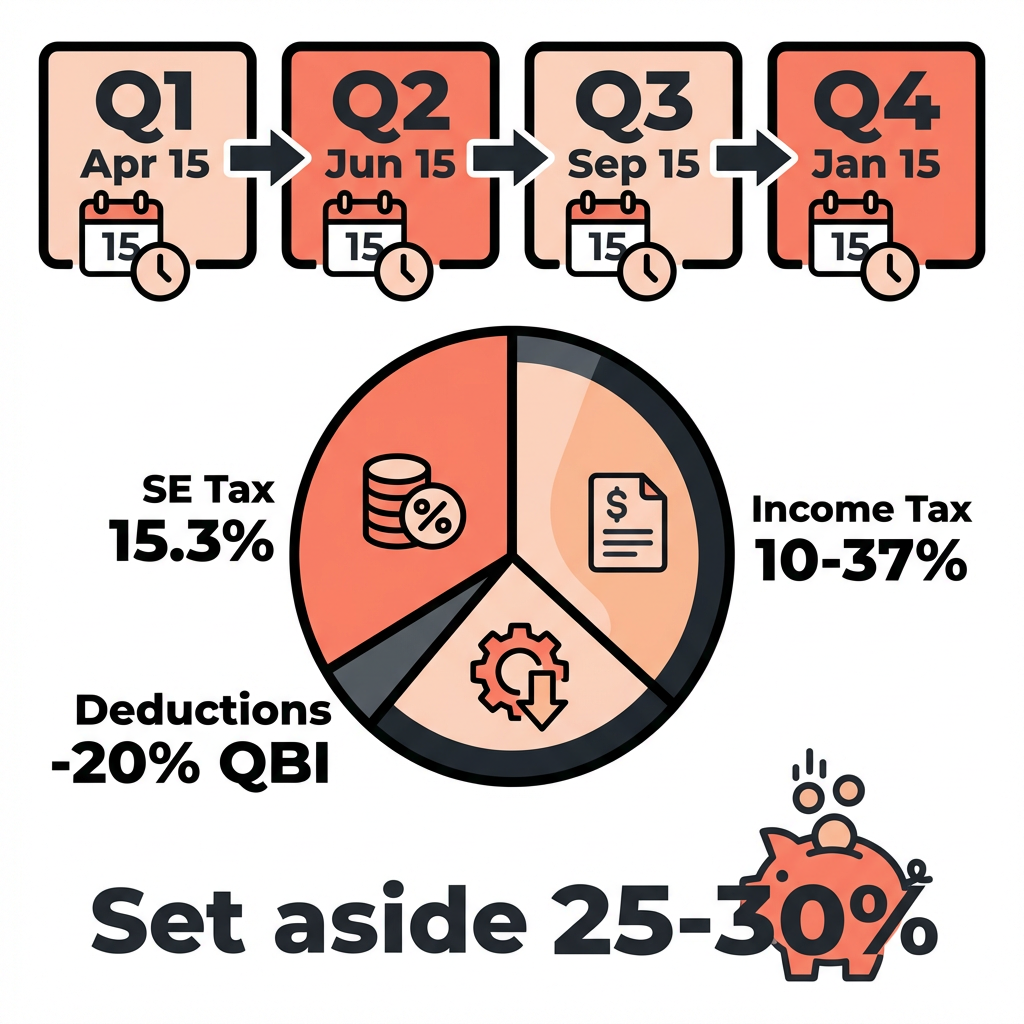

When to Pay

| Quarter | Covers | Due Date |

|---|---|---|

| Q1 | January - March | April 15, 2026 |

| Q2 | April - May | June 15, 2026 |

| Q3 | June - August | September 15, 2026 |

| Q4 | September - December | January 15, 2027 |

How Much to Pay

Method 1: Current year estimate Estimate your total tax liability for the year, divide by four, and pay that amount quarterly.

Method 2: Prior year safe harbor Pay 100% of last year's total tax in four equal installments. If your AGI exceeded $150,000 last year, pay 110%.

Example: Last year's total tax was $20,000

Safe harbor quarterly payment: $20,000 ÷ 4 = $5,000/quarter

Even if you earn more this year, you won't owe a penalty

as long as you paid at least $5,000/quarter.

(You'll owe the balance at filing time, but no penalty.)

How to Pay

- Online: IRS Direct Pay at irs.gov/directpay

- EFTPS: Electronic Federal Tax Payment System at eftps.gov

- Mail: Form 1040-ES vouchers with check or money order

- IRS2Go app: Mobile payment option

For step-by-step estimated tax instructions, see our Form 1040-ES guide.

Legal citation: IRC §6654 establishes estimated tax requirements and penalties.

Filing Your Taxes: Step by Step

Step 1: Collect All Income Records

- 1099-NEC forms from clients ($2,000+ threshold for 2026)

- 1099-K from payment processors ($2,500+ threshold)

- Bank statements showing all deposits

- Invoice records and payment confirmations

Report ALL income — even if you don't receive a 1099 from a client, the income is still taxable.

Step 2: Compile Business Expenses

Gather receipts and records for all deductible business expenses (see full deduction list below).

Step 3: Complete Schedule C

Report your total income (Part I) and deduct expenses (Part II) to calculate net profit (Line 31).

For line-by-line instructions, see our Schedule C guide.

Step 4: Complete Schedule SE

Calculate your self-employment tax on net earnings of $400 or more.

Step 5: Complete Form 8995

Calculate your QBI deduction — 20% of qualified business income for most contractors earning under $200,000.

Step 6: File Form 1040

Combine everything on your personal tax return:

- Schedule C net profit on Schedule 1, Line 3

- Half of SE tax deduction on Schedule 1, Line 15

- Self-employment tax on Schedule 2, Line 4

- QBI deduction on Form 1040, Line 13

Filing deadline: April 15, 2026 (or October 15 with automatic extension via Form 4868)

Deductions That Reduce Your Tax Bill

As an independent contractor, business deductions reduce both your income tax AND your self-employment tax (since SE tax is based on net profit).

Top Deductions for Contractors

| Deduction | Potential Savings | Where to Claim |

|---|---|---|

| Home office | $1,500-$5,000/year | Schedule C, Line 30 |

| Health insurance | $5,000-$30,000/year | Schedule 1, Line 17 |

| Retirement contributions | Up to $70,000/year | Schedule 1, Line 16 |

| Vehicle/mileage | $2,000-$12,000/year | Schedule C, Line 9 |

| Software & tools | $500-$5,000/year | Schedule C, Line 18 |

| Professional development | $500-$5,000/year | Schedule C, Line 27a |

| Phone & internet | $500-$2,000/year | Schedule C, Line 25 |

| Professional services | $500-$5,000/year | Schedule C, Line 17 |

QBI Deduction (20%)

The Qualified Business Income deduction lets you deduct 20% of your net business income from your taxable income. Made permanent in 2025, this applies to most contractors earning under ~$200,000 (single) or ~$400,000 (MFJ).

Net profit: $80,000

QBI deduction: $80,000 × 20% = $16,000

Tax savings at 22% bracket: $3,520

Half of Self-Employment Tax

You deduct half of your SE tax when calculating AGI. This is an automatic deduction — no special form needed beyond including it on Schedule 1.

For a complete list of write-offs, see our tax write-offs for LLC guide.

Real Tax Calculation: Three Income Levels

Assumptions: Single filer, standard deduction, no other income, claiming QBI deduction.

At $50,000 Net Profit:

Self-employment tax: $50,000 × 92.35% × 15.3% = $7,065

Half SE tax deduction: $3,532

AGI: $46,468

Standard deduction: $15,700

QBI deduction (20% of $50,000): $10,000

Taxable income: $20,768

Federal income tax: ~$2,273

TOTAL FEDERAL TAX: $9,338

Effective rate: 18.7%

Quarterly payment: ~$2,335

At $100,000 Net Profit:

Self-employment tax: $100,000 × 92.35% × 15.3% = $14,130

Half SE tax deduction: $7,065

AGI: $92,935

Standard deduction: $15,700

QBI deduction (20% of $100,000): $20,000

Taxable income: $57,235

Federal income tax: ~$7,807

TOTAL FEDERAL TAX: $21,937

Effective rate: 21.9%

Quarterly payment: ~$5,484

At $200,000 Net Profit:

Self-employment tax: $200,000 × 92.35% × 15.3% = $28,259

Additional Medicare (0.9% over $200K): ~$0 (at exactly $200K)

Half SE tax deduction: $14,130

AGI: $185,870

Standard deduction: $15,700

QBI deduction (20% of $200,000): $40,000

Taxable income: $130,170

Federal income tax: ~$22,831

TOTAL FEDERAL TAX: $51,090

Effective rate: 25.5%

Quarterly payment: ~$12,773

Use our Self-Employment Tax Calculator to run your specific numbers.

Common Mistakes to Avoid

Mistake #1: Not Setting Aside Money for Taxes

Problem: Spending all contractor income without reserving money for quarterly payments. April 15 arrives and there's nothing left.

Impact: Scrambling to pay, possibly incurring penalties, interest, and taking on debt to cover the tax bill.

Solution: Open a dedicated savings account for taxes. Transfer 25-30% of every payment you receive immediately. Treat it as money that was never yours.

Mistake #2: Not Making Quarterly Estimated Payments

Problem: Waiting until April 15 to pay the full year's tax.

Impact: Underpayment penalty of approximately 8% annual rate. On a $20,000 tax bill, that's roughly $800-$1,200 in penalties.

Solution: Pay quarterly. Use the prior-year safe harbor method if your income is unpredictable.

Mistake #3: Not Tracking Business Expenses

Problem: Only reporting income and not deducting business expenses, or deducting less than you're entitled to.

Impact: Overpaying taxes significantly. A contractor with $10,000 in legitimate expenses who doesn't deduct them overpays by $2,500-$4,000.

Solution: Use accounting software or connect your bank to Jupid for automatic categorization. Review expenses monthly, not yearly.

Mistake #4: Mixing Personal and Business Finances

Problem: Using the same bank account and credit card for everything.

Impact: Difficulty identifying business expenses, increased audit risk, and if you have an LLC, potential loss of liability protection.

Solution: Open a separate business checking account and credit card. Use them exclusively for business transactions.

Reduce Your Tax Bill With an LLC or S Corp

Independent contractors earning above certain thresholds should consider business structure changes:

Form an LLC

An LLC doesn't change your taxes by default, but it provides:

- Liability protection (personal assets shielded from business debts)

- Professional credibility

- The option to elect S Corp tax treatment later

See our sole proprietorship vs LLC guide.

Elect S Corp Status

Once net profit consistently exceeds $50,000-$60,000, the S Corp election can save significant self-employment tax:

At $100,000 net profit:

Default SE tax: $14,130

S Corp (salary $60,000): $9,180

FICA savings: $4,950

Minus added costs (~$2,500): Net savings ~$2,450

See our S Corp vs LLC guide for the full analysis.

Track Your Contractor Income and Taxes With AI

Independent contractors manage multiple income sources, variable monthly revenue, and dozens of deductible expenses. Tracking all of this manually is where most contractors fall behind.

What makes Jupid different:

✅ Automatic income and expense categorization — 95.9% accuracy matching transactions to Schedule C categories

✅ Estimated tax calculations — Jupid tracks your income in real time and calculates what you owe each quarter

✅ Deadline reminders — Get alerts via WhatsApp or iMessage before quarterly payment deadlines

✅ Bank connection and auto-sync — Connect your business accounts and every transaction is tracked automatically

Example conversation:

- You: "How much should I pay in estimated taxes this quarter?"

- Jupid: "Based on your year-to-date net profit of $52,000, your estimated Q3 payment should be approximately $3,700. This covers $2,100 in self-employment tax and $1,600 in income tax."

Learn more about how Jupid keeps your business finances organized

Action Checklist: Independent Contractor Tax Compliance

When You Start Contracting

- Get an EIN from the IRS (free, takes 5 minutes online)

- Open a separate business bank account

- Set up a savings account for tax reserves (25-30% of income)

- Collect Form W-9 from clients before starting work

- Consider forming an LLC for liability protection

Every Quarter

- Calculate net profit for the quarter

- Pay estimated taxes by the deadline (April 15, June 15, Sept 15, Jan 15)

- Review and categorize all business expenses

- Update mileage log and receipt records

At Year-End

- Collect all 1099-NEC and 1099-K forms by early February

- Verify total income matches your records

- Maximize deductions (retirement contributions, health insurance, etc.)

- Consider Section 179 for any equipment purchases

At Tax Time

- Complete Schedule C (income and expenses)

- Complete Schedule SE (self-employment tax)

- Complete Form 8995 (QBI deduction)

- File Form 1040 by April 15 (or extend to October 15)

- Pay any remaining balance

Resources and Citations

IRS Publications (Official Sources)

- IRS: Self-Employed Individuals Tax Center — Central hub for self-employed taxpayers

- IRS Publication 334 — Tax Guide for Small Business

- IRS Publication 505 — Tax Withholding and Estimated Tax

- IRS Publication 535 — Business Expenses

- IRS: Estimated Taxes — Payment requirements and methods

- Form 1040-ES — Estimated Tax for Individuals

Tax Code and Regulations

- IRC §1401 — Self-employment tax rates

- IRC §1402 — Definition of self-employment income

- IRC §6654 — Estimated tax penalty

- IRC §162 — Business expense deductions

- IRC §199A — Qualified Business Income deduction

- IRC §164(f) — Deduction for half of SE tax

2026 Key Numbers

| Item | 2026 Amount |

|---|---|

| Self-employment tax rate | 15.3% (12.4% SS + 2.9% Medicare) |

| Social Security wage base | $176,100 |

| Additional Medicare tax | 0.9% over $200,000 (single) |

| Standard deduction (single) | $15,700 |

| QBI deduction | Up to 20% (permanent) |

| SE tax filing threshold | $400 net earnings |

| Estimated tax penalty rate | ~8% annual |

| 1099-NEC threshold | $2,000 |

Final Thoughts

Independent contractor taxes follow a predictable pattern: earn income, deduct expenses, calculate SE tax and income tax, pay quarterly. The math isn't complex, but the discipline of paying quarterly and tracking expenses consistently is where most contractors struggle.

The key strategies:

- Automate tax savings — Set aside 25-30% of every payment into a dedicated tax account

- Pay quarterly — The estimated tax penalty is easily avoided by following the prior-year safe harbor

- Maximize deductions — Home office, health insurance, retirement, and QBI can reduce your effective rate by 5-10 percentage points

The more organized you are throughout the year, the less painful tax season becomes.

Disclaimer

This article provides general information about independent contractor taxation and should not be considered tax advice. Tax rates, deduction limits, and filing requirements change annually. Your actual tax liability depends on your total income, filing status, state of residence, and specific circumstances. For advice specific to your situation, consult with a qualified tax professional.

Tax Year: 2026 Last Updated: February 9, 2026

Ready to simplify your finances?

Join 1,000+ businesses using Jupid to save time and money. Start simplifying your finances today.

30-day money-back guarantee