Tax Write-Offs for LLC 2026: 20 Deductions Every Owner Should Claim

Table of Contents

Published: February 6, 2026 Tax Year: 2026

A Message from Slava

The average LLC owner misses $3,000-$5,000 in deductions every year. Not because the deductions are obscure — because they don't track expenses consistently or don't know what qualifies.

When I built Anna Money for 60,000+ small businesses in the UK, the most common financial mistake was under-claiming deductions. Business owners would keep receipts for big purchases but miss the daily expenses: software subscriptions, mileage, home internet, phone bills, professional development courses. Each one is small. Together, they add up to thousands.

At Jupid, we built AI-powered transaction categorization specifically to solve this problem. When your bank transactions are automatically matched to IRS expense categories, you stop missing deductions.

This guide covers 20 specific write-offs available to LLC owners, with the IRS rules and dollar amounts for each. Bookmark it, review it quarterly, and make sure you're claiming everything you're entitled to.

Executive Summary: LLC Tax Write-Offs for 2026

The IRS rule: You can deduct any expense that is "ordinary and necessary" for your business under IRC §162. "Ordinary" means common in your industry. "Necessary" means helpful and appropriate (not indispensable).

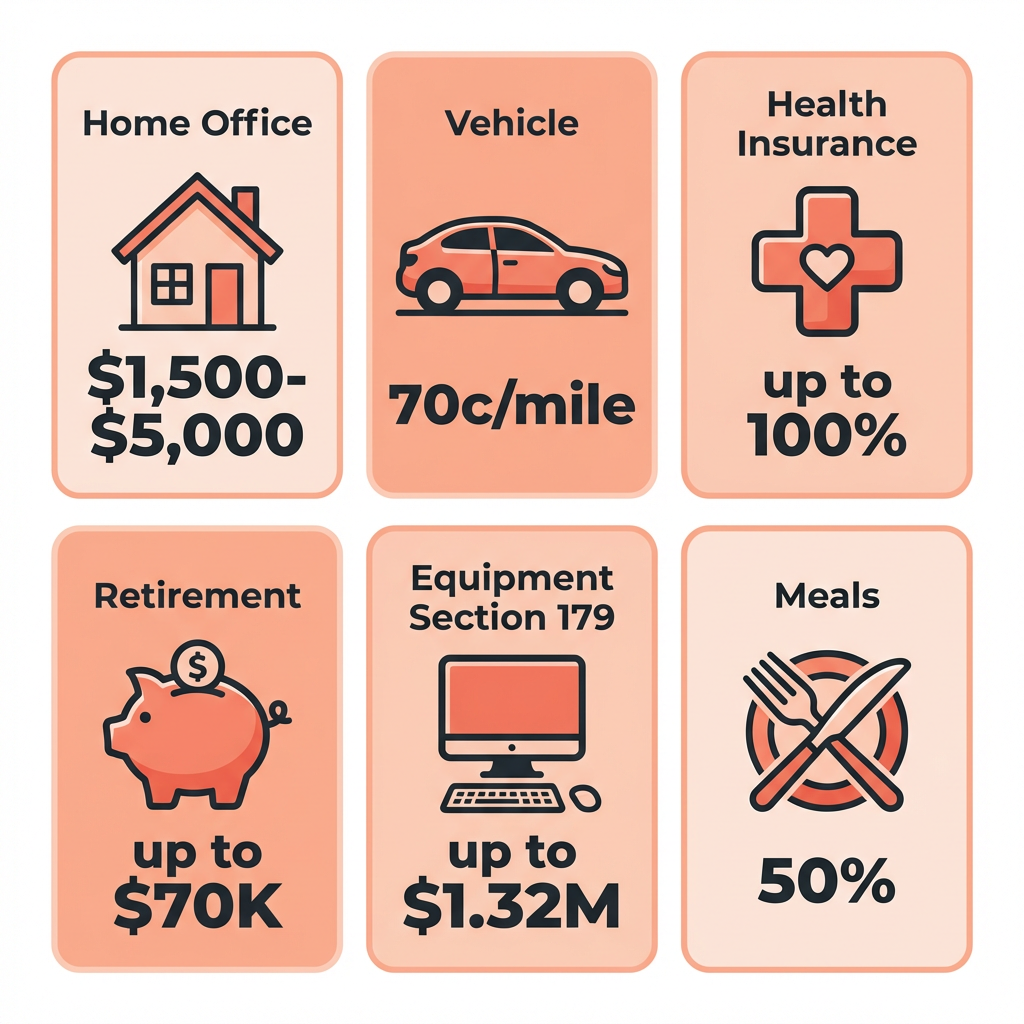

Top deductions by dollar value:

| Deduction | Potential Annual Value | IRS Reference |

|---|---|---|

| Self-employed health insurance | $5,000-$30,000 | IRC §162(l) |

| Retirement contributions | Up to $70,000 | IRC §404 |

| Home office | $1,500-$5,000+ | IRC §280A |

| Vehicle/mileage | $2,000-$15,000 | IRC §162, §274 |

| Section 179 equipment | Up to $1,320,000 | IRC §179 |

| QBI deduction (20%) | Varies by income | IRC §199A |

Tax savings example ($100,000 net revenue):

Gross revenue: $100,000

Total deductions: -$35,000

Net profit: $65,000

Without deductions: ~$26,800 in federal tax

With deductions: ~$16,400 in federal tax

Tax savings: ~$10,400

Legal basis: IRC §162 (business expenses), IRS Publication 535 (Business Expenses), IRS Publication 334 (Tax Guide for Small Business)

Operating Expense Write-Offs

1. Home Office Deduction

If you use a dedicated space in your home regularly and exclusively for business, you can deduct home office expenses.

Two methods:

- Simplified: $5 per square foot, max 300 sq ft = $1,500/year

- Regular: Actual expenses (mortgage interest/rent, utilities, insurance, repairs, depreciation) × business percentage

Example (regular method):

Home: 1,500 sq ft, office: 200 sq ft (13.3%)

Annual mortgage interest: $18,000

Utilities: $3,600

Insurance: $1,800

Repairs: $1,200

Total home expenses: $24,600

Deduction: $24,600 × 13.3% = $3,272

For detailed calculations, see our home office deduction guide.

Legal citation: IRC §280A and IRS Publication 587

2. Business Vehicle and Mileage

Deduct the business use of your vehicle using one of two methods:

- Standard mileage rate (2026): 70 cents per mile

- Actual expenses: Gas, insurance, maintenance, depreciation × business-use percentage

15,000 business miles × $0.70 = $10,500 deduction

You must keep a mileage log with date, destination, purpose, and miles for each trip.

Legal citation: IRC §162 and §274(d) — IRS Notice 2025-XX sets 2026 mileage rate

3. Office Supplies and Equipment

All supplies used for business operations: paper, ink, pens, cleaning supplies, postage, shipping materials.

For equipment over $2,500: use Section 179 expensing (see #16 below) or depreciate.

Legal citation: IRC §162(a) — Ordinary and necessary business expenses

4. Software and Technology

Monthly or annual subscriptions for business software:

- Accounting software (QuickBooks, FreshBooks)

- Project management (Asana, Monday)

- Communication (Zoom, Slack, Teams)

- Design (Adobe, Canva)

- Cloud storage (Google Workspace, Dropbox)

- Website hosting and domains

- Industry-specific tools

Deduction: 100% of cost if used entirely for business. If mixed personal/business use, deduct only the business percentage.

5. Phone and Internet

Deduct the business-use percentage of your phone plan and home internet.

Monthly phone: $100 (70% business use) = $70/month = $840/year

Monthly internet: $80 (50% business use) = $40/month = $480/year

Total: $1,320

Keep records: Log business vs. personal usage to support your percentage.

6. Business Insurance

Fully deductible insurance premiums include:

- General liability insurance

- Professional liability (E&O) insurance

- Commercial property insurance

- Workers' compensation

- Business interruption insurance

- Cyber liability insurance

Legal citation: IRC §162(a) — Insurance as ordinary business expense

People-Related Write-Offs

7. Self-Employed Health Insurance

Deduct 100% of health, dental, and vision insurance premiums for yourself, your spouse, and dependents. This is an "above the line" deduction that reduces AGI.

Requirements:

- Must have net profit from self-employment

- Can't be eligible for employer-sponsored health insurance (through a spouse's job, for example)

- Deduction can't exceed net business profit

For a complete breakdown, see our health insurance deduction guide.

Legal citation: IRC §162(l)

8. Retirement Plan Contributions

LLC owners have access to powerful tax-deferred retirement accounts:

| Plan | 2026 Maximum | Best For |

|---|---|---|

| SEP IRA | 25% of net earnings (up to ~$70,000) | Simple administration |

| Solo 401(k) | $23,500 employee + 25% employer match | Maximum contribution |

| SIMPLE IRA | $16,500 + employer match | LLCs with employees |

| Traditional IRA | $7,000 ($8,000 if 50+) | Supplemental savings |

Example: $100,000 net profit, Solo 401(k)

Employee contribution: $23,500

Employer contribution (25% of net): $25,000

Total: $48,500 deduction

Tax savings at 24% bracket: $11,640

See our retirement plan deductions guide.

Legal citation: IRC §404 (employer contributions), IRC §402(g) (employee deferrals)

9. Contractor Payments

Payments to independent contractors are fully deductible. You must issue Form 1099-NEC to any contractor paid $600+ during the year.

Legal citation: IRC §162(a) — Compensation for services

10. Employee Wages and Benefits

If your LLC has employees, deduct:

- Gross wages

- Employer's share of FICA (7.65%)

- Health insurance contributions

- Retirement plan contributions

- Workers' compensation insurance

- Unemployment insurance

Legal citation: IRC §162(a)(1) — Employee compensation

Professional Services Write-Offs

11. Accounting and Tax Preparation

- CPA fees for business tax returns

- Bookkeeping services

- Payroll processing fees

- Tax planning and advisory fees

- Audit representation

Note: The cost of preparing the business portion of your tax return is deductible. Personal tax preparation is not.

12. Legal Fees

Business-related legal expenses:

- Contract drafting and review

- LLC formation and operating agreement

- Trademark and intellectual property

- Business dispute resolution

- Regulatory compliance

Not deductible: Legal fees for personal matters or acquiring business assets (these are capitalized, not deducted).

Legal citation: IRC §162 (deductible legal fees) vs. IRC §263 (capitalized fees)

13. Professional Development

- Industry conferences and seminars

- Online courses related to your business

- Professional certifications and licenses

- Books, subscriptions, and publications

- Professional organization memberships

Rule: The education must maintain or improve skills for your current business. Courses to qualify for a new career are not deductible.

Legal citation: Treas. Reg. §1.162-5

Marketing and Sales Write-Offs

14. Advertising and Marketing

- Google Ads, Facebook/Instagram ads, LinkedIn ads

- Website design and maintenance

- SEO services

- Email marketing platforms

- Business cards and printed materials

- Trade show booth fees and materials

- Sponsorships and promotional events

All advertising costs to promote your business are 100% deductible in the year incurred.

15. Business Meals

Deduct 50% of meal costs when:

- The meal has a clear business purpose

- You or an employee is present

- The expense is not "lavish or extravagant"

Client lunch: $120

Deductible: $120 × 50% = $60

Documentation required: Date, location, attendees, business purpose, and amount. Keep the receipt.

Legal citation: IRC §274(k) limits meal deductions to 50%

Asset and Capital Write-Offs

16. Section 179 Expensing

Immediately deduct the full cost of qualifying business assets instead of depreciating them over time.

2026 limits:

- Maximum deduction: $1,320,000

- Phase-out threshold: $3,290,000

- Bonus depreciation: 60% (for assets not fully covered by §179)

Qualifying assets:

- Computers and electronics

- Office furniture

- Machinery and equipment

- Business vehicles (subject to luxury limits)

- Certain building improvements

See our Section 179 depreciation guide.

Legal citation: IRC §179

17. Startup Costs

If you launched your LLC in 2026:

- Deduct up to $5,000 in startup costs in your first year

- The $5,000 limit reduces dollar-for-dollar if startup costs exceed $50,000

- Remaining costs are amortized over 180 months

Startup costs include: market research, training, advertising before opening, and travel to set up the business.

Legal citation: IRC §195

Travel and Transportation Write-Offs

18. Business Travel

Deduct 100% of travel expenses when away from your "tax home" overnight for business:

- Airfare or train tickets

- Hotel or lodging

- Rental car or rideshare

- Baggage fees

- Tips related to travel services

- Dry cleaning while traveling

The trip must be primarily for business. If you add personal days to a business trip, only the business-related expenses are deductible.

Legal citation: IRC §162(a)(2) and IRS Publication 463

19. Parking and Tolls

Business-related parking fees and tolls are deductible even if you use the standard mileage rate for vehicle expenses. These are separate deductions.

Not deductible: Commuting costs from home to your regular office.

Financial Write-Offs

20. Business Interest and Bank Fees

- Interest on business loans and credit lines

- Business credit card interest (business charges only)

- Business bank account fees

- Payment processing fees (Stripe, Square, PayPal)

- Merchant account fees

Limitation: The business interest deduction under IRC §163(j) is limited to 30% of adjusted taxable income for businesses with average annual gross receipts over $30 million. This rarely affects small LLCs.

Legal citation: IRC §163 (interest deduction)

Deductions You Cannot Claim

Not everything is deductible. Common items that LLC owners try to write off but shouldn't:

❌ Personal expenses — Groceries, personal clothing, personal entertainment

❌ Commuting costs — Driving from home to a regular office (home office changes this)

❌ Political contributions — Donations to campaigns or PACs

❌ Fines and penalties — Traffic tickets, IRS penalties, legal fines

❌ Clothing — Unless it's a uniform or protective gear required for work (a suit doesn't count)

❌ Personal portion of mixed expenses — Only the business percentage of phone, internet, vehicle, etc.

❌ Capital expenses — Generally must be depreciated, not deducted (unless Section 179 applies)

Common Mistakes to Avoid

Mistake #1: Not Tracking Small Expenses

Problem: LLC owners track big purchases but ignore $10-$50 expenses throughout the year.

Impact: Those small expenses add up to $2,000-$5,000 annually in missed deductions — $500-$1,200 in tax savings gone.

Solution: Connect your business bank account to accounting software or use Jupid's AI categorization to capture every transaction automatically.

Mistake #2: Missing the Home Office Deduction

Problem: LLC owners who work from home don't claim the home office deduction because they think it triggers audits.

Impact: Missing $1,500-$5,000+ per year in deductions.

Solution: If you have a dedicated workspace used regularly and exclusively for business, claim it. The simplified method ($5/sq ft) is easy to calculate and defend.

Mistake #3: No Documentation for Meals and Travel

Problem: Taking the deduction without recording who attended, the business purpose, or keeping receipts.

Impact: Deductions disallowed during an audit, plus potential penalties.

Solution: Record the business purpose immediately after each meal or trip. Use your phone to photograph receipts. Note: "Client meeting with [name] to discuss [project]" is sufficient.

Mistake #4: Deducting Personal Expenses as Business

Problem: Writing off personal meals, entertainment, clothing, or vacations as business expenses.

Impact: Audit triggers, disallowed deductions, accuracy penalties (20% of underpayment), and potential fraud charges for egregious cases.

Solution: Be honest. If an expense has both personal and business elements, deduct only the clearly documented business portion.

Track Your Write-Offs Automatically With AI

The biggest barrier to maximizing deductions isn't knowledge — it's consistent tracking. Knowing that software subscriptions are deductible doesn't help if you forget to categorize them throughout the year.

What makes Jupid different:

✅ Automatic transaction categorization — Our AI categorizes business expenses with 95.9% accuracy, matching them to the correct Schedule C lines

✅ Real-time deduction totals — Ask your AI accountant "What are my total deductions this quarter?" via WhatsApp or iMessage

✅ Missing deduction alerts — Jupid identifies expense patterns and flags potential deductions you might be missing

✅ Bank connection and auto-sync — Connect your business bank account and every transaction is automatically categorized

Example conversation:

- You: "How much have I spent on software subscriptions this year?"

- Jupid: "You've spent $4,280 on software subscriptions in 2026. Your largest: Adobe Creative Cloud ($660), QuickBooks ($540), Zoom ($200), and 8 others. All are categorized as Office Expense on Schedule C, Line 18."

Learn more about how Jupid keeps your business finances organized

Action Checklist: Maximizing LLC Tax Write-Offs

Start of Year

- Set up a dedicated business bank account and credit card

- Connect accounts to accounting software or Jupid for auto-categorization

- Review prior year's return for any missed deductions

- Establish a system for mileage logging

Throughout the Year

- Categorize all business transactions weekly (or use auto-categorization)

- Keep receipts for all expenses over $75 (and meals of any amount)

- Log mileage for every business trip

- Track home office expenses monthly

- Note the business purpose for meals and entertainment

Before Year-End

- Review all 20 deduction categories — are you missing any?

- Make retirement contributions before December 31 (SEP IRA by April 15)

- Consider Section 179 purchases before December 31

- Pre-pay January expenses if it benefits your current year tax position

- Use our Self-Employment Tax Calculator to estimate your tax liability

At Tax Time

- Complete Schedule C with all expense categories

- Complete Form 8829 (home office) if using regular method

- Complete Form 4562 (depreciation and Section 179)

- Verify QBI deduction on Form 8995 or 8995-A

- File by April 15, 2026 (or October 15 with extension)

Resources and Citations

IRS Publications (Official Sources)

- IRS Publication 535 — Business Expenses

- IRS Publication 334 — Tax Guide for Small Business

- IRS Publication 463 — Travel, Gift, and Car Expenses

- IRS Publication 587 — Business Use of Your Home

- IRS Publication 946 — How to Depreciate Property

- Schedule C (Form 1040) — Profit or Loss From Business

Tax Code and Regulations

- IRC §162 — Trade or business expenses (general deduction authority)

- IRC §179 — Election to expense business assets

- IRC §162(l) — Self-employed health insurance deduction

- IRC §199A — Qualified Business Income deduction

- IRC §274 — Meals, entertainment, and travel limitations

- IRC §280A — Home office deduction rules

- IRC §195 — Startup cost deduction

- IRC §163 — Business interest deduction

2026 Key Numbers

| Item | 2026 Amount |

|---|---|

| Standard mileage rate | 70 cents/mile |

| Section 179 maximum | $1,320,000 |

| Bonus depreciation | 60% |

| Meal deduction | 50% |

| Home office (simplified) | $5/sq ft (max $1,500) |

| Startup cost deduction | Up to $5,000 |

| SEP IRA max | ~$70,000 |

| Solo 401(k) employee limit | $23,500 ($31,000 if 50+) |

Final Thoughts

LLC tax write-offs aren't complicated — there are 20 categories that cover the vast majority of deductible business expenses. The challenge is tracking them consistently.

The key strategies:

- Automate expense tracking — Manual record-keeping leads to missed deductions

- Know the big-ticket items — Health insurance, retirement, home office, and mileage typically provide the largest deductions

- Document everything — The IRS allows generous deductions but requires records to support them

Every dollar of legitimate business expense you track is a dollar less of taxable income. At a 30% combined tax rate, $10,000 in missed deductions costs you $3,000 in unnecessary taxes.

Disclaimer

This article provides general information about LLC tax deductions and should not be considered tax advice. Deduction eligibility depends on your specific business activities, industry, and circumstances. Dollar amounts and limits are based on 2026 tax law and are subject to change. The IRS requires that all deductions be "ordinary and necessary" for your specific trade or business. For advice specific to your situation, consult with a qualified tax professional.

Tax Year: 2026 Last Updated: February 6, 2026

Ready to simplify your finances?

Join 1,000+ businesses using Jupid to save time and money. Start simplifying your finances today.

30-day money-back guarantee