How to Pay Yourself from an LLC in 2026: Owner's Draw vs Salary

Table of Contents

Published: February 5, 2026 Tax Year: 2026

A Message from Slava

One of the questions I get asked most often is deceptively simple: "How do I actually get money out of my LLC?"

When I started Jupid, this confused me too. Coming from the UK where the rules are different, the American system of owner's draws, distributions, reasonable salaries, and guaranteed payments felt like a maze with tax implications at every turn.

At Anna Money, where we served 60,000+ small businesses, I saw the consequences of getting this wrong. Business owners who paid themselves incorrectly faced tax penalties, lost their liability protection by mixing personal and business finances, or missed opportunities to reduce their tax burden.

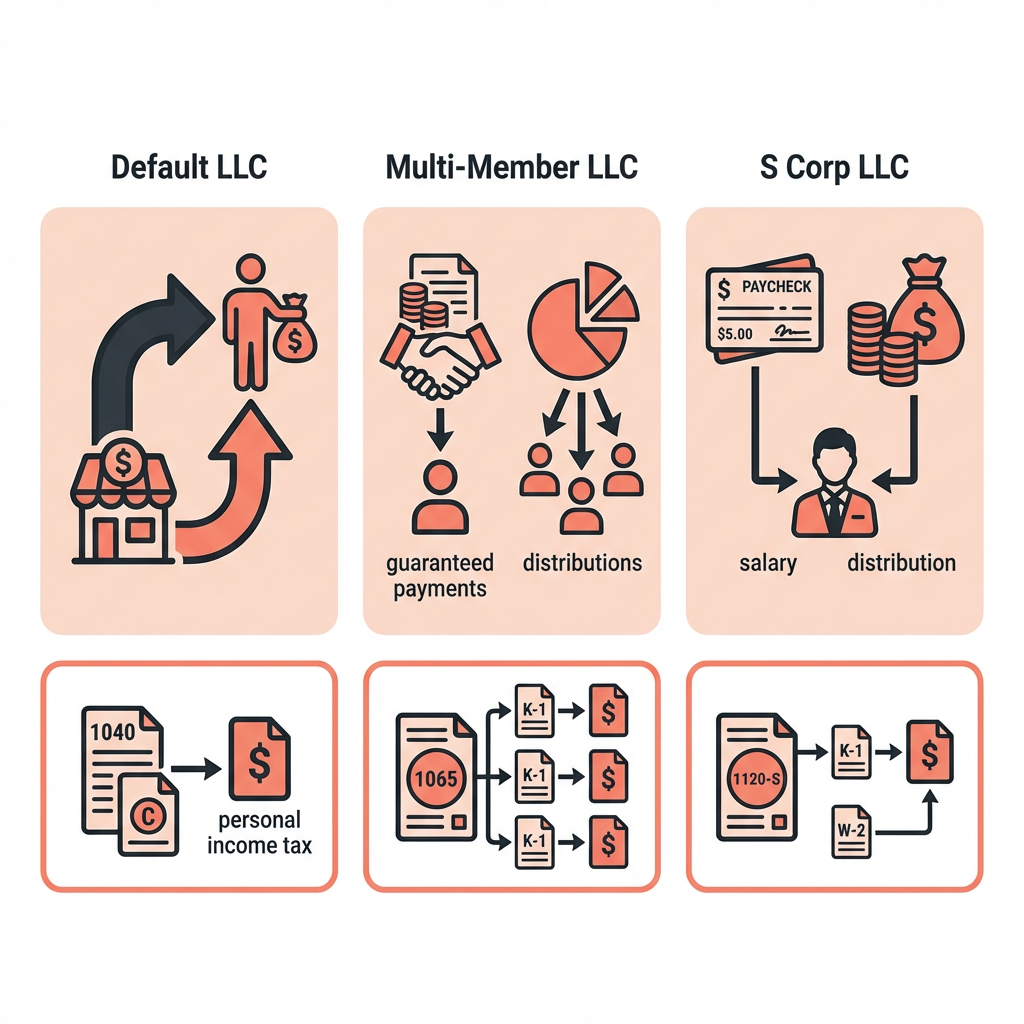

The good news: the rules are actually straightforward once you understand which method applies to your LLC type. A single-member LLC uses owner's draws. An S Corp LLC uses salary plus distributions. There's a right answer for each structure — not a judgment call.

This guide covers every scenario with specific dollar amounts so you know exactly how to move money from your LLC to your personal account — legally and tax-efficiently.

Executive Summary: Paying Yourself from an LLC

Your payment method depends on how your LLC is taxed:

| LLC Tax Type | Payment Method | Payroll Required? |

|---|---|---|

| Single-member (default) | Owner's draw | No |

| Multi-member (partnership) | Owner's draw + guaranteed payments | No |

| S Corp election | Reasonable salary + distributions | Yes |

| C Corp election | Salary (+ dividends if desired) | Yes |

Key rule: Owner's draws are not a business expense — they don't reduce your taxable income. They're simply a transfer of already-taxed profit from the business to you personally.

Tax impact example ($80,000 net profit, single-member LLC):

Owner's draw of $60,000:

Taxable income: $80,000 (the draw doesn't change this)

Self-employment tax: ~$11,304

Federal income tax: ~$7,800

You keep: $60,000 in your pocket, $20,000 left in business

S Corp salary of $50,000 + $30,000 distribution:

Payroll taxes: $50,000 × 15.3% = $7,650

Distribution: $30,000 (no FICA)

Estimated savings: ~$2,100/year vs default

Legal basis: IRC §731 (partnership distributions), IRC §1368 (S Corp distributions), IRS Publication 334

Method 1: Owner's Draw (Single-Member LLC)

If your LLC is taxed as a sole proprietorship (the default for single-member LLCs), you pay yourself through owner's draws. This is the simplest method and the one most LLC owners use.

How It Works

An owner's draw is a transfer of money from your business bank account to your personal bank account. That's it. There's no payroll, no withholding, no W-2.

Step by step:

- Calculate your net profit for the period

- Set aside money for taxes (roughly 25-30% of net profit)

- Set aside money for business expenses and reserves

- Transfer the remaining amount to your personal account

- Record the draw in your bookkeeping as an "owner's draw" or "owner's distribution"

Tax Treatment

Owner's draws are not deductible business expenses. They don't appear on Schedule C. Your tax liability is based on your net profit, regardless of how much you actually draw.

Example: Single-member LLC with $90,000 net profit

You draw $70,000 throughout the year for personal use.

You leave $20,000 in the business account.

Your taxes are based on: $90,000 (not $70,000)

Self-employment tax: $90,000 × 92.35% × 15.3% = $12,716

Income tax (after deductions): ~$9,400

Total tax: ~$22,116

The $20,000 you left in the business is still taxable income — you just haven't transferred it to your personal account yet.

How Often to Take Draws

There's no IRS rule on frequency. Common approaches:

- Weekly or biweekly — Mimics a paycheck, easiest for personal budgeting

- Monthly — After reviewing monthly profit

- As needed — Transfer when personal expenses arise

The best practice: set a consistent draw schedule and stick to it. This creates a paper trail and demonstrates that you treat your LLC as a separate entity.

Legal citation: IRS Publication 334 covers sole proprietor income reporting.

Method 2: Guaranteed Payments (Multi-Member LLC)

If your LLC has multiple members and is taxed as a partnership (the default for multi-member LLCs), each member can receive:

- Guaranteed payments — Fixed payments for services or capital, regardless of profit

- Profit distributions — Share of profits based on the operating agreement

Guaranteed Payments Explained

A guaranteed payment is compensation paid to a member for services performed or capital provided, determined without regard to the partnership's income. Think of it as a "salary-like" payment — but it's not a salary.

Example: Two-member LLC, 50/50 ownership

Total net income: $200,000

Member A (manages day-to-day): $60,000 guaranteed payment

Member B (passive investor): $0 guaranteed payment

Remaining profit: $200,000 - $60,000 = $140,000

Member A share (50%): $70,000

Member B share (50%): $70,000

Total income:

Member A: $60,000 + $70,000 = $130,000

Member B: $70,000

Tax Treatment

- Guaranteed payments are reported on Schedule K-1, Box 4

- They're subject to self-employment tax for the receiving member

- They're deductible by the partnership (reduce the partnership's ordinary income)

- Profit distributions follow the operating agreement allocation

Legal citation: IRC §707(c) defines guaranteed payments. IRC §731 governs partnership distributions.

Method 3: Salary + Distributions (S Corp LLC)

If your LLC has elected S Corp taxation, you must pay yourself a reasonable salary through W-2 payroll before taking any distributions. This is not optional — the IRS specifically requires it.

How It Works

- Set a reasonable salary based on your role, industry, and experience

- Process W-2 payroll — withhold federal/state income tax, Social Security, and Medicare

- Pay employer payroll taxes — employer's share of FICA (7.65%)

- Take remaining profit as distributions — no payroll taxes on this portion

The Math

S Corp LLC with $120,000 net profit:

Reasonable salary: $65,000

Employee FICA withheld: $65,000 × 7.65% = $4,973

Employer FICA: $65,000 × 7.65% = $4,973

Federal income tax withheld: ~$8,200

Take-home from salary: ~$51,827

Distribution: $120,000 - $65,000 - $4,973 (employer FICA) = $50,027

No additional FICA on distributions

Subject to income tax (reported on K-1)

Total payroll taxes: $9,945

Compare to default LLC SE tax: $120,000 × 92.35% × 15.3% = $16,956

FICA savings: $7,011

What's a "Reasonable Salary"?

The IRS doesn't give a specific number, but they expect your salary to reflect what a third party would pay someone for the work you perform. Factors include:

- Comparable salaries in your industry and location

- Your training, experience, and qualifications

- Time spent working in the business

- The company's revenue and profitability

A commonly used benchmark: 50-70% of net profit for service-based businesses. Use our S-Corp Salary Calculator to estimate yours.

For a deeper comparison, see our S Corp vs LLC guide.

Legal citation: IRC §3121(a) defines wages subject to FICA. IRS Revenue Ruling 74-44 addresses reasonable compensation.

How to Record Owner's Draws in Your Books

Proper bookkeeping for owner's draws is simple but essential:

For Single-Member LLCs

Every draw should be recorded as:

- Debit: Owner's Draw (equity account)

- Credit: Business Checking (asset account)

At year-end, the Owner's Draw account is closed to the Owner's Equity account. This doesn't affect your income statement or Schedule C — it's purely a balance sheet transaction.

Common Bookkeeping Mistakes

Don't record draws as "salary expense" — This inflates your deductions and underreports your profit. Owner's draws are equity transactions, not expenses.

Don't write checks to "cash" — Always make draws to your named personal account. Cash withdrawals create unclear audit trails.

Don't use draws for personal expenses directly — Transfer money to your personal account first, then pay personal expenses from there. This maintains the separation between business and personal.

How Much Should You Pay Yourself?

There's no perfect formula, but here's a framework:

The 30/30/40 Rule

A starting point for new LLC owners:

Net business profit: $100,000

30% for taxes: $30,000 (set aside for quarterly payments)

30% for business reinvestment: $30,000 (growth, reserves, equipment)

40% for owner's draw: $40,000 (personal income)

Adjusting Over Time

As your business matures and becomes more predictable:

Established LLC, $150,000 net profit:

25% for taxes: $37,500

15% for business reserves: $22,500

60% for owner's draw: $90,000

The key principle: always set aside taxes first. Underpaying estimated taxes results in penalties, and the IRS doesn't care that you needed the money for rent.

Use our Self-Employment Tax Calculator to estimate how much to set aside.

Paying Yourself: Common Scenarios

Scenario 1: Freelance Web Developer (Single-Member LLC)

Annual revenue: $95,000

Business expenses: $15,000

Net profit: $80,000

Tax set-aside (28%): $22,400

Owner's draws: $57,600 ($4,800/month)

Tax calculation:

SE tax: $80,000 × 92.35% × 15.3% = $11,304

Federal income tax: ~$7,800

Total federal tax: ~$19,104

Remaining after taxes: $60,896

Scenario 2: Consulting Firm (Multi-Member LLC, 60/40 split)

Annual net profit: $250,000

Member A (60%, active manager):

Guaranteed payment: $80,000

Profit distribution: ($250,000 - $80,000) × 60% = $102,000

Total income: $182,000

Member B (40%, limited role):

Profit distribution: ($250,000 - $80,000) × 40% = $68,000

Total income: $68,000

Scenario 3: Marketing Agency (S Corp LLC)

Annual net profit: $180,000

Reasonable salary: $85,000/year ($7,083/month)

Payroll taxes (employer + employee): $12,998

Federal income tax withheld: ~$14,000

Distributions: $180,000 - $85,000 - $6,499 (employer FICA) = $88,501

No additional FICA

Compared to default LLC:

Default SE tax: $180,000 × 92.35% × 15.3% = $25,425

S Corp payroll tax: $12,998

FICA savings: $12,427/year

Common Mistakes to Avoid

Mistake #1: Paying Yourself a "Salary" Without S Corp Election

Problem: A single-member LLC owner processes payroll and pays themselves a W-2 salary without having elected S Corp status.

Impact: Unnecessary payroll costs (payroll service fees, employer tax deposits) with no tax benefit. As a default LLC, you pay self-employment tax on all net profit regardless — the salary just adds complexity.

Solution: If you're a default single-member LLC, use owner's draws. Only set up payroll if you've filed Form 2553 for S Corp election.

Mistake #2: Taking Draws Without Setting Aside Taxes

Problem: An LLC owner draws all available cash from the business, leaving nothing for quarterly estimated tax payments.

Impact: Underpayment penalties plus a large, unexpected tax bill in April.

Solution: Before each draw, calculate and set aside your tax obligation. Transfer the tax amount to a separate savings account dedicated to taxes.

Mistake #3: Not Documenting Draws

Problem: Owner makes informal cash transfers, Venmos, or pays personal bills directly from the business account without recording them.

Impact: Messy bookkeeping, potential audit problems, and risk of "piercing the corporate veil" — losing your LLC's liability protection.

Solution: Record every draw in your accounting system. Transfer only to your personal bank account. Keep a paper trail.

Mistake #4: S Corp Owner Skipping Salary

Problem: An S Corp LLC owner takes $200,000 in distributions and pays $0 in salary to avoid payroll taxes.

Impact: IRS reclassification of distributions as wages, back payroll taxes, interest, and penalties. The IRS actively audits this pattern.

Solution: Set a reasonable salary (typically 50-70% of net profit for service businesses), run payroll consistently, and take distributions only after salary requirements are met.

Track Your LLC Payments With AI

Whether you take owner's draws or run payroll, tracking the money flowing between your LLC and your personal accounts is essential for tax compliance and clean bookkeeping.

What makes Jupid different:

✅ Automatic transaction categorization — Our AI categorizes business expenses with 95.9% accuracy, keeping your Schedule C clean

✅ Real-time profit tracking — Ask your AI accountant "What's my net profit this month?" and get an answer via WhatsApp or iMessage before deciding on your draw amount

✅ Tax set-aside reminders — Jupid monitors your income and reminds you when quarterly estimated payments are due

✅ Bank connection and auto-sync — Connect your business bank account and Jupid tracks income, expenses, and owner's draws automatically

Example conversation:

- You: "How much can I safely draw this month?"

- Jupid: "Your net profit for October is $8,200. Setting aside 28% for estimated taxes ($2,296), you can draw up to $5,904 while maintaining your current business reserves."

Learn more about how Jupid keeps your business finances organized

Action Checklist: Paying Yourself from Your LLC

Setting Up

- Determine your LLC's tax classification (default, S Corp, or C Corp)

- Open a dedicated business bank account (separate from personal)

- Set up bookkeeping software to track owner's draws

- If S Corp: set up payroll service and determine reasonable salary

- Calculate your estimated tax rate (use our Self-Employment Tax Calculator)

Each Pay Period

- Review current net profit

- Set aside estimated taxes (25-30% of net profit)

- Transfer draw amount to personal bank account

- Record the draw in your bookkeeping system

- If S Corp: process payroll with proper withholdings

Quarterly

- Pay estimated taxes (Form 1040-ES) by deadline

- Review your draw amount vs. actual profit

- Adjust draw schedule if income has changed

- If S Corp: file Form 941 (quarterly payroll return)

Annually

- Review total draws vs. net profit for the year

- Evaluate whether your LLC should elect S Corp status

- File taxes: Schedule C (default) or Form 1120-S (S Corp)

- Read our guide on staying tax compliant as an LLC

Resources and Citations

IRS Publications (Official Sources)

- IRS Publication 334 — Tax Guide for Small Business

- IRS Publication 541 — Partnerships

- IRS Publication 542 — Corporations

- IRS: Single Member LLCs — Disregarded entity rules

- Form 2553 — S Corp election

- Schedule K-1 (Form 1065) — Partner's share of income

Tax Code and Regulations

- IRC §731 — Partnership distributions (non-taxable to extent of basis)

- IRC §707(c) — Guaranteed payments to partners

- IRC §1368 — Distributions by S Corporations

- IRC §3121(a) — Definition of wages for FICA purposes

- IRC §1401 — Self-employment tax rates

2026 Key Numbers

| Item | 2026 Amount |

|---|---|

| Self-employment tax rate | 15.3% (12.4% SS + 2.9% Medicare) |

| Social Security wage base | $176,100 |

| Standard deduction (single) | $15,700 |

| Estimated tax penalty rate | ~8% annual |

| Form 1040-ES Q1 deadline | April 15, 2026 |

| Form 2553 deadline | March 16, 2026 |

Final Thoughts

Paying yourself from an LLC is straightforward once you know the rules for your tax classification. Default LLCs use owner's draws. S Corp LLCs use salary plus distributions. Multi-member LLCs use draws plus guaranteed payments.

The key strategies:

- Match your method to your tax type — Draws for default LLCs, payroll for S Corp LLCs

- Always set aside taxes first — The IRS gets paid before you do

- Keep it documented — Every transfer between business and personal accounts needs a record

Getting paid from your LLC isn't complicated. Getting paid in the most tax-efficient way — that's where the S Corp election and proper salary planning become worth the effort.

Disclaimer

This article provides general information about LLC owner compensation methods and should not be considered tax or legal advice. The appropriate payment method depends on your LLC's tax classification, state laws, and individual circumstances. S Corp reasonable salary determinations are fact-specific and subject to IRS scrutiny. For advice specific to your situation, consult with a qualified tax professional or business attorney.

Tax Year: 2026 Last Updated: February 5, 2026

Ready to simplify your finances?

Join 1,000+ businesses using Jupid to save time and money. Start simplifying your finances today.

30-day money-back guarantee