S Corp vs LLC 2026: Complete Tax Comparison for Small Business Owners

Table of Contents

Published: February 3, 2026 Tax Year: 2026

A Message from Slava

The S Corp question comes up in almost every conversation I have with small business owners. "Should I elect S Corp status?" is right up there with "Do I need an LLC?" as the most common question I hear.

At Anna Money, where we served 60,000+ small businesses across the UK, I saw a similar pattern: business owners either jumped into complex structures too early or stayed in simple ones too long. Both mistakes cost real money.

When I launched Jupid, I structured it as an LLC. The S Corp election came later, once revenue justified the added complexity of running payroll and filing a separate corporate return. That timing matters more than most guides acknowledge.

Here's what I've learned from watching thousands of business owners make this decision: the S Corp election is one of the most powerful tax-saving tools available to profitable small businesses, but it's not free. There's a real cost in complexity, compliance, and professional fees. The math needs to work in your favor before you flip that switch.

This guide breaks down exactly when the S Corp election saves you money, when it doesn't, and how to calculate the breakeven point for your specific situation.

Executive Summary: S Corp vs LLC in 2026

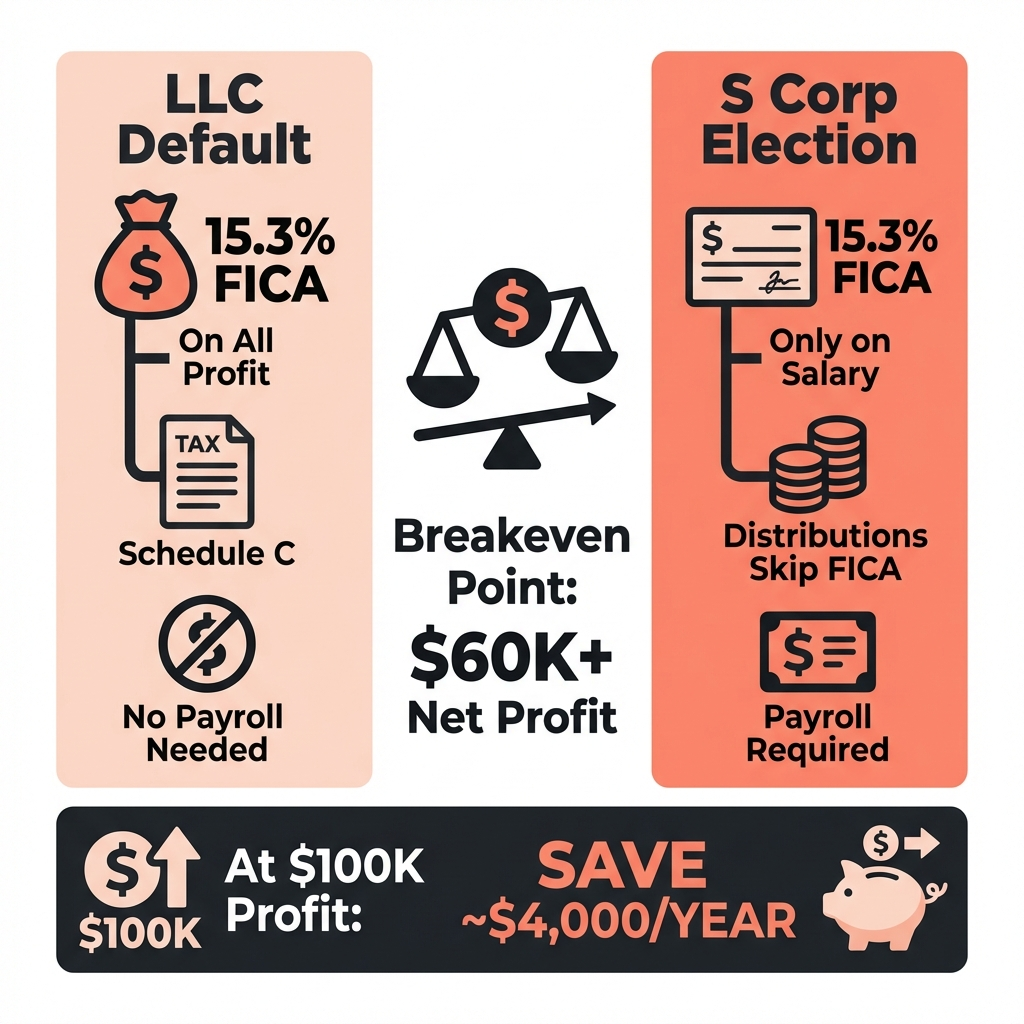

The core difference: An LLC is a legal business structure. An S Corp is a tax election. You don't choose one or the other — you form an LLC, then optionally elect S Corp tax treatment.

| Factor | LLC (Default Tax) | LLC with S Corp Election |

|---|---|---|

| Legal structure | LLC filed with state | Same LLC — no change |

| Federal tax filing | Schedule C (Form 1040) | Form 1120-S + Schedule K-1 |

| Self-employment tax | 15.3% on all net profit | 15.3% only on salary portion |

| Owner compensation | Distributions (flexible) | Reasonable salary required + distributions |

| Payroll required | No | Yes — must run W-2 payroll |

| Annual filing cost | $0-$200 (tax prep) | $1,000-$3,000 (1120-S + payroll) |

| Best for | Under $50K profit | Over $50K-60K profit |

The tax savings mechanism: As a default LLC, you pay 15.3% self-employment tax on every dollar of net profit. With an S Corp election, you pay yourself a "reasonable salary" (subject to payroll taxes) and take remaining profit as distributions — which skip the 15.3% self-employment tax entirely.

Legal basis: IRC §1361 (S Corp eligibility), IRC §1362 (S Corp election), IRS Form 2553, IRS Publication 542

What Is an LLC?

A Limited Liability Company is a state-level legal structure that separates your personal assets from your business. You form it by filing articles of organization with your state and paying a filing fee ($35-$500 depending on the state).

For federal tax purposes, the IRS treats a single-member LLC as a "disregarded entity." That means you report all income and expenses on Schedule C attached to your personal Form 1040. The business doesn't file its own tax return.

Tax treatment by default:

- All net profit is subject to self-employment tax (15.3%)

- All net profit flows to your personal return as ordinary income

- You pay both the employer and employee portions of FICA

- No payroll required — you take owner draws

For a deeper comparison of LLCs with sole proprietorships, see our sole proprietorship vs LLC guide.

Legal citation: IRC §301.7701-3 governs default entity classification for LLCs.

What Is an S Corp?

An S Corporation is not a type of business entity — it's a federal tax classification. You don't "form" an S Corp. Instead, you form an LLC (or corporation), then file Form 2553 with the IRS to elect S Corp tax treatment.

Once elected, the IRS treats your LLC differently:

- The business files its own tax return (Form 1120-S)

- Profit passes through to your personal return via Schedule K-1

- You must pay yourself a reasonable salary via W-2 payroll

- Profit above your salary passes through as distributions — not subject to self-employment tax

That last point is where the savings happen. The gap between your reasonable salary and your total profit escapes the 15.3% self-employment tax.

S Corp Eligibility Requirements

Not every business can elect S Corp status. IRC §1361 sets these requirements:

- Domestic entity — Must be a U.S. business

- Eligible shareholders — Individuals, certain trusts, and estates only (no partnerships, corporations, or non-resident aliens)

- Maximum 100 shareholders — Family members can elect to count as one

- One class of stock — All shares must have identical rights to distributions and liquidation proceeds

- Not an ineligible corporation — Certain financial institutions, insurance companies, and DISCs cannot elect S Corp status

For most single-member LLCs and small partnerships, these requirements aren't an issue.

Legal citation: IRC §1361(b) defines S Corporation eligibility requirements.

How the S Corp Tax Savings Work

The self-employment tax rate for 2026 is 15.3% — that's 12.4% for Social Security (on income up to $176,100) plus 2.9% for Medicare (no income cap). As a default LLC, you owe this on every dollar of net profit.

With an S Corp election, here's what changes:

- You pay yourself a W-2 salary — This salary is subject to payroll taxes (the employer and employee shares of FICA, totaling 15.3%)

- Remaining profit passes through as distributions — These distributions are NOT subject to self-employment tax or payroll taxes

- Both salary and distributions are still subject to federal and state income tax

The savings come entirely from the distributions that skip FICA.

The Math at Three Income Levels

Assumptions: Single filer, standard deduction ($15,700), no other income.

At $60,000 Net Profit:

LLC (Default):

Self-employment tax: $60,000 × 92.35% × 15.3% = $8,478

Deductible half of SE tax: $4,239

AGI: $55,761

Taxable income: $40,061

Federal income tax: ~$4,576

TOTAL FEDERAL TAX: $13,054

S Corp Election:

Reasonable salary: $40,000

Payroll taxes (employer + employee): $40,000 × 15.3% = $6,120

Distribution: $20,000 (no FICA)

Federal income tax on ~$57,000: ~$5,100

TOTAL FEDERAL TAX: $11,220

S Corp savings: ~$1,834/year

Minus added costs (~$2,000 payroll + tax prep): NET LOSS of ~$166

At $100,000 Net Profit:

LLC (Default):

Self-employment tax: $100,000 × 92.35% × 15.3% = $14,130

TOTAL FEDERAL TAX: ~$26,787

S Corp Election:

Reasonable salary: $60,000

Payroll taxes: $60,000 × 15.3% = $9,180

Distribution: $40,000 (no FICA)

Federal income tax on ~$95,400: ~$13,600

TOTAL FEDERAL TAX: ~$22,780

S Corp savings: ~$4,007/year

Minus added costs (~$2,500): NET SAVINGS of ~$1,507

At $200,000 Net Profit:

LLC (Default):

Self-employment tax: $200,000 × 92.35% × 15.3% = $28,259

TOTAL FEDERAL TAX: ~$59,659

S Corp Election:

Reasonable salary: $90,000

Payroll taxes: $90,000 × 15.3% = $13,770

Distribution: $110,000 (no FICA)

Federal income tax on ~$195,000: ~$35,400

TOTAL FEDERAL TAX: ~$49,170

S Corp savings: ~$10,489/year

Minus added costs (~$3,000): NET SAVINGS of ~$7,489

The pattern: Below about $50,000-60,000 in net profit, the tax savings from an S Corp election get eaten up by the added costs of payroll processing and a more complex tax return. Above that threshold, the savings grow rapidly with income.

Use our Self-Employment Tax Calculator to see your current tax burden and estimate potential S Corp savings.

The "Reasonable Salary" Requirement

This is the most scrutinized part of S Corp taxation. The IRS requires S Corp owner-employees to pay themselves a "reasonable salary" before taking distributions. You cannot set your salary at $10,000 and take $190,000 in distributions to minimize payroll taxes.

What Counts as Reasonable?

The IRS doesn't publish a specific number or formula. Instead, they look at several factors:

- Training and experience — Your qualifications for the work you perform

- Duties and responsibilities — What you actually do in the business

- Time and effort — How many hours you devote to the business

- Comparable compensation — What similar businesses pay for similar roles

- Company revenue and profits — Larger, more profitable businesses generally need higher salaries

- Compensation history — What you've paid yourself in prior years

- Distribution history — Large distributions with tiny salaries raise red flags

Reasonable Salary Benchmarks

While there's no universal rule, these ranges are commonly used as starting points:

| Net Profit | Typical Reasonable Salary Range |

|---|---|

| $60,000 | $35,000-$45,000 |

| $100,000 | $50,000-$70,000 |

| $150,000 | $65,000-$90,000 |

| $200,000+ | $80,000-$120,000 |

A common guideline: salary should represent roughly 50-70% of net profit for most service-based businesses. Businesses with significant capital investment or employees doing most of the work may justify a lower percentage.

IRS enforcement: The IRS has won multiple court cases against S Corp owners who paid unreasonably low salaries. In Watson v. Commissioner (2012), the Tax Court ruled that an accountant earning $200,000+ in S Corp distributions while paying himself zero salary owed back payroll taxes plus penalties.

For help determining your reasonable salary, try our S-Corp Salary Calculator.

Legal citation: IRS Revenue Ruling 74-44 and IRC §3121(a) govern reasonable compensation requirements.

S Corp Costs and Compliance

The S Corp election isn't free. Before you elect, understand the ongoing costs:

Mandatory Costs

| Item | Estimated Annual Cost |

|---|---|

| Payroll processing | $500-$1,500/year (Gusto, ADP, etc.) |

| Form 1120-S preparation | $800-$2,000 (CPA-prepared) |

| Quarterly payroll tax filings | Included in payroll service or $200-$400 |

| State franchise/corporate tax | Varies ($0-$800+ by state) |

| W-2 and year-end forms | Included in payroll service |

Total added cost: $1,500-$4,000/year above what you'd pay as a default LLC.

Compliance Requirements

Once you elect S Corp status, you must:

- Run W-2 payroll — Pay yourself at least monthly or per your state's requirements

- File Form 1120-S — Corporate information return, due March 15 (or September 15 with extension)

- Issue Schedule K-1 — Report each shareholder's share of income

- File quarterly payroll returns — Form 941 every quarter

- Pay employer payroll taxes — Employer's share of FICA (7.65%)

- Maintain corporate formalities — Meeting minutes, operating agreement, separate accounts

State-Specific Considerations

Some states add complications:

- California: $800 minimum franchise tax + 1.5% S Corp tax on net income

- New York: Fixed dollar minimum tax based on gross receipts ($25-$4,500)

- Texas: No state income tax, but franchise tax may apply

- Illinois: 1.5% replacement tax on S Corp income

Check our LLC Annual Tax and Fee Calculator for state-specific costs.

How to Elect S Corp Status

Step 1: Form Your LLC First

If you haven't already, file articles of organization with your state. You need a legal entity before you can make a tax election.

Step 2: Get an EIN

Apply for an Employer Identification Number from the IRS at irs.gov/ein. It's free and takes about 5 minutes online.

For a complete guide to EINs and LLC formation, see our EIN and LLC startup guide.

Step 3: File Form 2553

Form 2553 is the S Corp election form. File it with the IRS by:

- For existing businesses: No more than 2 months and 15 days after the beginning of the tax year you want the election to take effect

- For new businesses: Within 2 months and 15 days of formation

- For 2026 tax year: The deadline is March 16, 2026 (for calendar-year filers)

Late election relief: If you miss the deadline, the IRS may grant late election relief under Revenue Procedure 2013-30 if you can show reasonable cause. File Form 2553 with a statement explaining why you're late.

Step 4: Set Up Payroll

Before the election takes effect, set up a payroll system. You'll need:

- Payroll provider (Gusto, ADP, Paychex)

- State employer accounts (unemployment insurance, workers' comp)

- Federal payroll tax deposit schedule

Step 5: Start Paying Yourself

Begin processing W-2 payroll at your determined reasonable salary. Most S Corp owners pay themselves monthly or semi-monthly.

Legal citation: IRC §1362(b) governs the timing and requirements for S Corp elections.

S Corp vs LLC: Side-by-Side Decision Framework

Choose Default LLC When:

- Net profit is under $50,000 — Tax savings won't cover S Corp compliance costs

- Income is inconsistent — Hard to set a reasonable salary when revenue fluctuates month to month

- You're in your first year — Focus on building the business before adding tax complexity

- You prefer simplicity — No payroll, no corporate return, just Schedule C

- You're a California LLC earning under $80,000 — The 1.5% S Corp tax plus $800 franchise tax erodes savings

Choose S Corp Election When:

- Net profit consistently exceeds $60,000 — Savings meaningfully exceed added costs

- Income is relatively predictable — You can set a reasonable salary with confidence

- You have a CPA — Someone who can file Form 1120-S and advise on salary levels

- You're willing to run payroll — Monthly payroll processing is non-negotiable

- You plan to grow — The savings percentage increases as profit grows

The Breakeven Calculation

To find your breakeven point:

Added S Corp costs (payroll + tax prep): ~$2,000-$3,000/year

Self-employment tax savings formula:

(Net Profit - Reasonable Salary) × 15.3% = FICA savings

Breakeven when:

FICA savings > Added costs

Example:

At $70,000 profit with $45,000 salary:

($70,000 - $45,000) × 15.3% = $3,825 savings

Minus $2,500 in added costs = $1,325 net savings ✅

At $45,000 profit with $35,000 salary:

($45,000 - $35,000) × 15.3% = $1,530 savings

Minus $2,500 in added costs = -$970 net loss ❌

QBI Deduction: Applies to Both

Both default LLCs and S Corps qualify for the Qualified Business Income (QBI) deduction — a 20% deduction on qualified business income under IRC §199A.

Key difference for S Corps: The QBI deduction applies to your pass-through income (distributions), NOT your W-2 salary. Since your salary is W-2 income, it doesn't qualify for the QBI deduction. This means the S Corp election can slightly reduce your QBI deduction amount.

Example at $100,000 net profit:

Default LLC:

QBI deduction: $100,000 × 20% = $20,000

S Corp (salary $60,000, distributions $40,000):

QBI deduction: $40,000 × 20% = $8,000

(Salary is W-2 income, not QBI)

This QBI reduction partially offsets the self-employment tax savings. Your CPA should model both scenarios to find the optimal salary-to-distribution ratio.

Legal citation: IRC §199A governs the QBI deduction. IRC §199A(c)(4) excludes reasonable compensation from QBI.

Common Mistakes to Avoid

Mistake #1: Electing S Corp Too Early

Problem: A new business owner earning $40,000 reads about S Corp tax savings and immediately files Form 2553. They spend $2,500 on payroll and tax prep, saving only $1,200 in self-employment tax.

Impact: Net loss of $1,300, plus the headache of running payroll and filing a corporate return.

Solution: Wait until your net profit consistently exceeds $60,000 before electing. The keyword is "consistently" — one good month doesn't justify the ongoing compliance burden.

Mistake #2: Setting an Unreasonably Low Salary

Problem: An S Corp owner earning $150,000 pays themselves a $30,000 salary and takes $120,000 in distributions to maximize tax savings.

Impact: IRS reclassification of distributions as wages, plus back taxes, interest, and penalties. The IRS specifically targets this pattern.

Solution: Research comparable compensation using BLS wage data, industry surveys, and your CPA's guidance. Document your methodology. A salary of 50-70% of net profit is a defensible starting point for service businesses.

Mistake #3: Forgetting to Run Payroll

Problem: An S Corp owner takes owner draws instead of processing formal W-2 payroll, or skips payroll during slow months.

Impact: The IRS can reclassify all distributions as wages, eliminating any tax savings and adding penalties.

Solution: Set up automated payroll from day one of your S Corp election. Pay yourself consistently, even if it means adjusting the salary amount during the year.

Mistake #4: Ignoring State Tax Implications

Problem: Electing S Corp status without checking state-level taxes. California, for example, charges a 1.5% tax on S Corp net income in addition to the $800 minimum franchise tax.

Impact: State taxes can significantly reduce — or even eliminate — the federal tax savings.

Solution: Model the full tax picture including state taxes before electing. Some states are S Corp-friendly (Texas, Florida, Wyoming), while others add meaningful cost (California, New York, Illinois).

Track Your S Corp Finances With AI

Whether you're running a default LLC or have elected S Corp status, clean financial records are essential. For S Corp owners specifically, separating salary from distributions and tracking business expenses accurately determines both your tax liability and your audit risk.

What makes Jupid different:

✅ Automatic transaction categorization — Our AI categorizes your business expenses with 95.9% accuracy, matching them to the correct tax categories whether you file Schedule C or Form 1120-S

✅ Real-time financial insights — Ask your AI accountant questions like "What's my net profit this quarter?" and get instant answers via WhatsApp or iMessage

✅ Tax structure monitoring — Jupid tracks your income and alerts you when changing your tax election could save money

✅ Bank connection and auto-sync — Connect your business accounts and Jupid automatically separates business and personal transactions

Example conversation:

- You: "Based on my profit this year, would an S Corp election save me money?"

- Jupid: "Your net profit through September is $94,000. With a $58,000 reasonable salary, an S Corp election could save you approximately $5,500 in self-employment tax. After accounting for payroll costs, your net savings would be around $3,200."

Learn more about how Jupid keeps your business finances organized

Action Checklist: Evaluating the S Corp Election

Before You Decide

- Calculate your net profit for the last 12 months

- Estimate your net profit for the current year

- Research reasonable salary for your role and industry

- Use our Self-Employment Tax Calculator to see current SE tax liability

- Get quotes for payroll services ($500-$1,500/year)

- Get a quote for Form 1120-S preparation ($800-$2,000)

- Check your state's S Corp tax treatment

If You Decide to Elect

- Confirm your LLC is properly formed with the state

- Obtain an EIN if you don't have one

- File Form 2553 before the deadline (March 16, 2026 for calendar year)

- Set up a payroll provider

- Determine your reasonable salary with CPA guidance

- Open a separate business bank account if you haven't already

- Begin processing W-2 payroll

Ongoing Compliance

- Process payroll at least monthly

- File quarterly payroll returns (Form 941)

- File Form 1120-S by March 15 (or request extension to September 15)

- Issue K-1 to all shareholders

- Review reasonable salary annually as profit changes

- Keep business and personal finances strictly separate

- Read our guide on staying tax compliant as an LLC

Resources and Citations

IRS Publications (Official Sources)

- IRS Publication 542 — Corporations (covers S Corp taxation)

- IRS Publication 334 — Tax Guide for Small Business

- Form 2553 — Election by a Small Business Corporation

- Form 1120-S — U.S. Income Tax Return for an S Corporation

- Schedule K-1 (Form 1120-S) — Shareholder's Share of Income

- IRS: S Corporations — S Corp overview and requirements

Tax Code and Regulations

- IRC §1361 — S Corporation defined; eligibility requirements

- IRC §1362 — Election and termination of S Corp status

- IRC §1363 — Effect of S Corp election on corporation

- IRC §199A — Qualified Business Income deduction

- IRC §3121(a) — Definition of wages for FICA purposes

- Revenue Procedure 2013-30 — Late S Corp election relief

2026 Key Numbers

| Item | 2026 Amount |

|---|---|

| Self-employment tax rate | 15.3% (12.4% SS + 2.9% Medicare) |

| Social Security wage base | $176,100 |

| Standard deduction (single) | $15,700 |

| QBI deduction | Up to 20% of qualified business income |

| Additional Medicare tax | 0.9% on earnings over $200,000 |

| Form 2553 deadline (calendar year) | March 16, 2026 |

| Form 1120-S due date | March 15, 2026 (or Sept 15 with extension) |

Final Thoughts

The S Corp vs LLC decision is really about timing and math. An LLC gives you liability protection with minimal complexity. The S Corp election adds a tax optimization layer on top — but only when profit is high enough to justify the cost.

The key strategies:

- Start with a default LLC — Get the liability protection without the compliance burden

- Elect S Corp when the numbers work — Once net profit consistently exceeds $60,000 and you've accounted for payroll and tax prep costs

- Set a defensible salary — The IRS watches for unreasonably low salaries, so document your reasoning and stay in the 50-70% range for service businesses

The S Corp election is reversible (you can revoke it), and you can make the election at any point. There's no rush — getting it right matters more than getting it early.

Disclaimer

This article provides general information about S Corporation elections and LLC taxation and should not be considered legal or tax advice. Tax savings from S Corp elections vary significantly based on income level, state of residence, industry, and individual circumstances. The "reasonable salary" determination is fact-specific and should be made with guidance from a qualified tax professional. For advice specific to your situation, consult with a CPA or tax attorney.

Tax Year: 2026 Last Updated: February 3, 2026

Ready to simplify your finances?

Join 1,000+ businesses using Jupid to save time and money. Start simplifying your finances today.

30-day money-back guarantee