Schedule C (Form 1040) Instructions: Complete Line-by-Line Guide 2026

Table of Contents

Hi, I'm Slava, CEO and co-founder of Jupid. After scaling Anna Money to $40M ARR and working with over 60,000 small business owners, I've reviewed more Schedule C forms than I can count. The pattern is consistent: most sole proprietors either leave deductions on the table or make mistakes that invite IRS scrutiny.

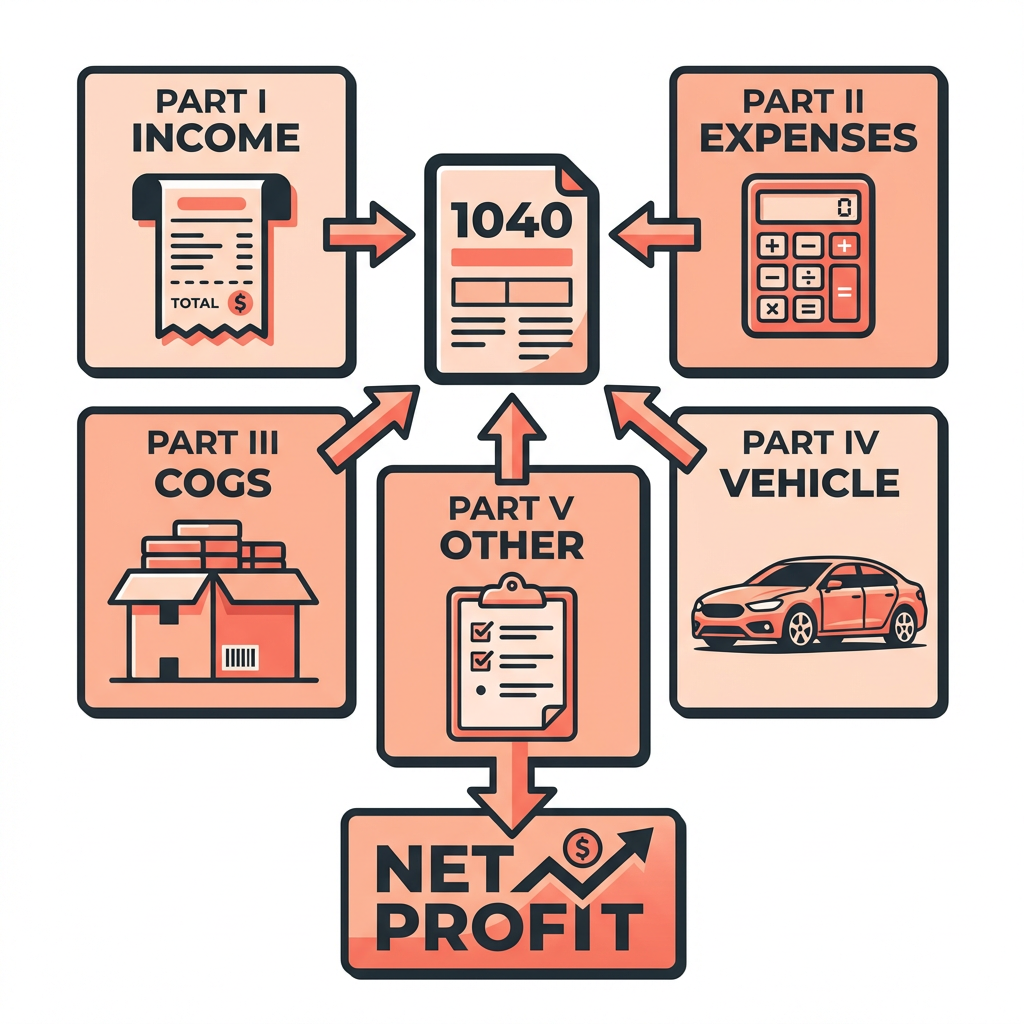

Schedule C is the tax form that determines how much you owe—and how much you save. It's the foundation of your entire tax return as a self-employed business owner. Yet most online guides skim over the details, leaving you guessing at what goes where.

This guide walks through every line, every part, with explanations that assume you're doing this for the first time.

What Is Schedule C?

Schedule C (officially "Form 1040 Schedule C: Profit or Loss From Business") reports income and expenses from your sole proprietorship or single-member LLC to the IRS. The net profit or loss from this form flows directly to your Form 1040 and determines both your income tax and self-employment tax.

Legal Basis: IRC §162 allows deductions for "ordinary and necessary expenses paid or incurred during the taxable year in carrying on any trade or business."

Who Files Schedule C?

✅ You file Schedule C if you're:

- Sole proprietor

- Single-member LLC (taxed as disregarded entity)

- Independent contractor or freelancer

- Gig worker (Uber, DoorDash, Etsy seller)

- Any self-employed individual

❌ You don't file Schedule C if you're:

- W-2 employee (your employer handles taxes)

- Partner in a partnership (use Schedule K-1)

- S Corporation or C Corporation (use Form 1120-S or 1120)

Key Point: Even if you have a "regular job" with W-2 income, you still file Schedule C for any self-employment income you earned on the side.

Executive Summary: Schedule C Key Numbers 2026

Before we go line by line, here are the key numbers you'll encounter:

| Item | 2026 Amount |

|---|---|

| Standard Mileage Rate | 72.5 cents/mile |

| Home Office Simplified Method | $5/sq ft (max 300 sq ft = $1,500) |

| Section 179 Deduction Limit | $1,220,000 |

| Business Meal Deduction | 50% of cost |

| De Minimis Safe Harbor | $2,500 per item |

Self-Employment Tax: If your Schedule C profit exceeds $400, you'll owe 15.3% self-employment tax (12.4% Social Security + 2.9% Medicare) on 92.35% of your net earnings, calculated on Schedule SE.

Legal Basis: IRC §162, §179, §280A; IRS Publication 334 (Tax Guide for Small Business)

Before You Start: Gather These Documents

Don't start filling out Schedule C until you have:

Income Documentation:

- All 1099-NEC forms (nonemployee compensation)

- 1099-K forms (payment processor income—Stripe, PayPal, Venmo)

- Invoices and payment records

- Bank statements showing business deposits

Expense Documentation:

- Receipts organized by category

- Bank and credit card statements

- Mileage log (if claiming vehicle expenses)

- Home office measurements (if claiming home office)

- Depreciation records for equipment

Business Information:

- Business name and address

- Employer Identification Number (EIN), if you have one

- Principal business code (6-digit NAICS code—we'll cover this)

Schedule C Header: Business Information (Lines A-J)

The header section identifies you and your business to the IRS. Most of this is straightforward.

Name of Proprietor

Enter your personal legal name, not your business name. Your Social Security Number goes in the box to the right.

Line A: Principal Business or Profession

Describe what your business does. Examples:

- "Freelance graphic design services"

- "Online retail of handmade jewelry"

- "Consulting services for small businesses"

- "Rideshare driving services"

Line B: Business Code (NAICS)

Enter the 6-digit code that best matches your business. The IRS instructions include a list, but here are common codes for self-employed individuals:

| Business Type | Code |

|---|---|

| Freelance writers, authors | 711510 |

| Graphic designers | 541430 |

| Web developers | 541511 |

| Consultants (management) | 541611 |

| Photographers | 541921 |

| Rideshare drivers | 485300 |

| Online retail | 454110 |

| Real estate agents | 531210 |

| Handmade goods (manufacturing) | 339910 |

Pro tip: Choose a manufacturing code (339XXX) if you make products. The IRS expects higher cost of goods sold for manufacturers, which can work in your favor.

Line C: Business Name

Enter your business name if you have one (DBA, trade name). Leave blank if you operate under your personal name.

Line D: Employer ID Number (EIN)

If you have an EIN, enter it here. If not, leave blank—you can use your SSN instead.

Should you get an EIN? Yes, even if not required. It's free, protects your SSN when sending W-9s to clients, and makes your business appear more professional. Apply at IRS.gov/EIN.

Line E: Business Address

Enter your business address. If you work from home and your home address matches your Form 1040, check the box and leave this blank.

Line F: Accounting Method

Choose how you record income and expenses:

- Cash (most common): You report income when you receive payment and expenses when you pay them

- Accrual: You report income when earned (even if not yet paid) and expenses when incurred

Most sole proprietors use cash basis—it's simpler and matches how you actually see money flow.

Line G: Material Participation

Check "Yes" if you worked in your business regularly. The IRS defines this as 500+ hours per year, but even significantly less can qualify if you're the only person working in the business.

Line H: Started or Acquired This Year

Check this box if this is your first year in business or you purchased the business this year.

Lines I & J: Payments Requiring 1099s

- Line I: Did you pay any individual $600+ for services? If yes, you may need to file Form 1099-NEC.

- Line J: If you answered yes to Line I, did you (or will you) file the required 1099s?

Part I: Income (Lines 1-7)

This section calculates your gross income—total business revenue before expenses.

Line 1: Gross Receipts or Sales

Enter your total business income for the year. This includes:

- All 1099-NEC payments

- All 1099-K payments (Stripe, PayPal, Square, etc.)

- Cash payments

- Checks

- Any other business revenue

Critical: Include ALL income, even if you didn't receive a 1099. Clients aren't required to issue 1099s for payments under $600, but that income is still taxable. The IRS receives copies of your 1099s—don't underreport.

Line 2: Returns and Allowances

Enter refunds you gave to customers and allowances for damaged goods. Most service businesses leave this blank.

Example: If you sold $50,000 in products but refunded $2,000 to customers, enter $2,000 here.

Line 3: Subtract Line 2 from Line 1

Simple math: Line 1 minus Line 2. This is your net receipts.

Line 4: Cost of Goods Sold

If you sell products (not services), enter the amount from Line 42 in Part III. Service businesses enter zero.

COGS includes:

- Raw materials and supplies that become part of your product

- Direct labor to produce goods (not your own labor)

- Inventory purchases for resale

COGS does NOT include:

- General business expenses

- Shipping to customers

- Packaging materials

We'll cover Part III (Cost of Goods Sold) in detail later.

Line 5: Gross Profit

Line 3 minus Line 4. This is your income after accounting for the cost of products you sold.

Line 6: Other Income

Enter business income not included in Line 1:

- Interest on business bank accounts

- State/local tax refunds for business taxes

- Credit card rewards earned from business spending

- Scrap sales

- Bad debts recovered

Line 7: Gross Income

Line 5 plus Line 6. This is your total gross income before expenses.

Part II: Expenses (Lines 8-27)

This is where you reduce your taxable income. Every legitimate business expense belongs somewhere in this section.

Line 8: Advertising

Marketing and promotional expenses:

- Online ads (Google, Facebook, LinkedIn, Instagram)

- Print advertising

- Business cards and flyers

- Website costs (hosting, domain, design)

- Promotional materials

- Trade show booth fees

Line 9: Car and Truck Expenses

Vehicle expenses for business use. You have two options:

Option 1: Standard Mileage Rate (Simpler)

Multiply your business miles by the IRS rate:

- 2026 rate: 72.5 cents per mile

Example:

Business miles driven: 8,000

Deduction: 8,000 × $0.725 = $5,800

Option 2: Actual Expenses (Often Higher)

Calculate total vehicle costs and multiply by business use percentage:

- Gas and oil

- Repairs and maintenance

- Insurance

- Registration

- Depreciation

- Lease payments

Example:

Total vehicle costs: $8,000

Business use: 70%

Deduction: $8,000 × 70% = $5,600

Which method is better? Generally, standard mileage is simpler and often higher for newer vehicles. Actual expenses can be higher for older vehicles with low value but high operating costs. You can calculate both and choose the higher amount.

For detailed guidance, see our Car and Mileage Deduction Guide 2026 or use our Mileage Deduction Calculator.

Required: If you claim Line 9, you must complete Part IV (vehicle information).

Line 10: Commissions and Fees

Payments to non-employees for services that generated sales:

- Referral fees

- Agent or broker commissions

- Platform fees (Etsy, Amazon, Fiverr seller fees)

- Payment processing fees (Stripe 2.9%, PayPal, Square)

- Affiliate commissions you paid out

Line 11: Contract Labor

Payments to independent contractors who performed services for your business. If you paid any contractor $600+ during the year, you should have issued them a Form 1099-NEC.

Different from Line 10: Contract labor is for services that helped operate your business (bookkeeper, virtual assistant, subcontractor), not for generating specific sales.

Line 12: Depletion

Only for businesses extracting natural resources (oil, gas, timber, minerals). Most businesses skip this.

Line 13: Depreciation and Section 179

Equipment, furniture, computers, and other business assets you're depreciating or expensing under Section 179.

De Minimis Safe Harbor: Items costing $2,500 or less can be expensed immediately (deducted in full) rather than depreciated. Just record them as expenses.

Section 179: Allows immediate deduction of certain business equipment up to $1,220,000 for 2026 (up from $1,160,000 in 2025).

What qualifies:

- Computers and electronics

- Office furniture

- Equipment and machinery

- Business vehicles (with limitations)

- Software

Complete Form 4562 for depreciation calculations and enter the total here. For detailed guidance, see our Section 179 Depreciation Guide 2026.

Line 14: Employee Benefit Programs

Benefits provided to employees (not yourself):

- Health insurance premiums

- Life insurance

- Dependent care assistance

Note: Your own health insurance is deducted elsewhere—on Schedule 1, Line 17 as an adjustment to income. See our Health Insurance Deduction Guide for Self-Employed 2026.

Line 15: Insurance (Other Than Health)

Business insurance premiums:

- General liability insurance

- Professional liability / Errors & Omissions

- Business property insurance

- Business interruption insurance

- Workers' compensation

- Cyber liability insurance

Line 16a: Interest (Mortgage)

Business portion of mortgage interest if you own property used for business (separate from home office).

Line 16b: Interest (Other)

Other business interest expenses:

- Business loan interest

- Business credit card interest

- Equipment financing interest

- Vehicle loan interest (if using actual expense method, not standard mileage)

Line 17: Legal and Professional Services

Professional fees for business services:

- Attorney fees

- CPA and accountant fees (including Jupid subscription!)

- Bookkeeping services

- Tax preparation fees for business portion

- Consulting fees

- Professional association dues

Line 18: Office Expense

Supplies and small office items consumed during the year:

- Office supplies (paper, pens, printer ink)

- Postage and shipping supplies

- Small equipment under $2,500

- Cleaning supplies for office

Line 19: Pension and Profit-Sharing Plans

Contributions to retirement plans for employees (not yourself).

Your own retirement: SEP-IRA, Solo 401(k), and SIMPLE IRA contributions are deducted on Schedule 1, Line 16—not here. See our Retirement Plan Deductions Guide for Self-Employed 2026.

Line 20a: Rent or Lease (Vehicles, Machinery, Equipment)

Lease payments for business vehicles and equipment.

Note: If using standard mileage for vehicles, do NOT include vehicle lease payments here—they're already factored into the mileage rate.

Line 20b: Rent or Lease (Other Business Property)

- Office rent

- Coworking space membership

- Storage unit rental

- Studio space

Line 21: Repairs and Maintenance

Costs to maintain (not improve) business property and equipment:

- Equipment repairs

- Computer repairs

- Vehicle repairs (if using actual expense method)

- Building maintenance (if you own business property)

Important: Repairs maintain current condition. Improvements increase value—those are depreciated on Line 13.

Line 22: Supplies

Materials and supplies consumed in your business that aren't inventory:

- Project materials for service businesses

- Cleaning supplies

- Safety equipment

- Small tools

Line 23: Taxes and Licenses

Business-related taxes and fees:

- Business licenses and permits

- State and local business taxes

- Employer portion of payroll taxes (if you have employees)

- Property tax on business assets

- Professional license renewals

Do NOT include:

- Federal income tax

- Self-employment tax

- Personal portion of property taxes

Line 24a: Travel

Travel expenses when away from home overnight for business:

- Airfare

- Hotels and lodging

- Rental cars

- Train and bus tickets

- Taxi, Uber, Lyft while traveling

- Parking and tolls

"Away from home" means overnight or long enough to require rest.

For detailed rules, see our Business Travel Deduction Guide 2026.

Line 24b: Deductible Meals

Business meals at 50% of cost:

- Meals with clients or prospects

- Meals while traveling for business

- Meals at business conferences

- Team meals (if you have employees)

Document: Date, place, business purpose, who attended.

See our Business Meal Deduction Guide 2026 for complete rules.

Line 25: Utilities

If you have a business location separate from home:

- Electric

- Gas/heating

- Water

- Internet (dedicated business line)

- Phone (dedicated business line)

Home office utilities: Claimed through home office deduction on Line 30, not here.

Line 26: Wages

Gross wages paid to employees (W-2 workers, not contractors). Report total wages before any withholding.

Line 27a: Other Expenses

Total from Part V (Line 48). This catches everything that doesn't fit above. Common items:

- Bank fees and service charges

- Software subscriptions (QuickBooks, Adobe, Zoom)

- Professional memberships and subscriptions

- Education and training directly related to business

- Business portion of phone and internet (if working from home)

- Uniforms and work clothing (if required and unsuitable for everyday wear)

- Bad debts from clients who didn't pay

Line 28: Total Expenses

Add Lines 8 through 27a. This is your total business expenses.

Line 29-31: Calculating Your Profit or Loss

Line 29: Tentative Profit or Loss

Line 7 (Gross Income) minus Line 28 (Total Expenses).

Line 30: Business Use of Home

If you have a qualifying home office, enter your deduction here.

Two methods:

Simplified Method:

- $5 per square foot

- Maximum 300 sq ft

- Maximum deduction: $1,500

Regular Method:

- Calculate actual expenses (rent/mortgage, utilities, insurance)

- Multiply by business use percentage

- Complete Form 8829

For detailed guidance, see our Home Office Deduction Guide 2026 or Form 8829 Instructions Guide 2026.

Line 31: Net Profit or Loss

Line 29 minus Line 30. This is your bottom line.

If positive (profit): This amount goes to:

- Schedule 1, Line 3 (additional income)

- Schedule SE (self-employment tax calculation)

- Form 1040 (total income)

If negative (loss): This reduces your other income on your tax return, subject to limitations.

Line 32: Loss Limitation

If you have a loss, you may need to check Box 32a or 32b regarding at-risk rules. Most small businesses with straightforward operations check 32a (all investment is at risk).

Part III: Cost of Goods Sold (Lines 33-42)

Service businesses skip this section entirely. It only applies if you:

- Manufacture products

- Buy products for resale

- Sell physical goods

Line 33: Inventory Method

Check the method you use:

- Cost — Most common; what you paid for inventory

- Lower of cost or market — Conservative; rarely used by small businesses

- Other — Specify if using something different

Line 34: Change in Method

Did you change how you value inventory this year? Most businesses answer "No."

Line 35: Beginning Inventory

If you filed Schedule C last year, use the number from last year's Line 41 (ending inventory). First-time filers enter zero.

Line 36: Purchases

Total inventory purchases during the year minus any items you withdrew for personal use.

Line 37: Cost of Labor

Labor costs directly related to producing your products. This is for employees helping manufacture goods—not yourself.

Line 38: Materials and Supplies

Raw materials and supplies that become part of your finished products.

Line 39: Other Costs

Other costs directly related to production (freight-in, containers, etc.)

Line 40: Total

Add Lines 35-39.

Line 41: Ending Inventory

Value of inventory on hand at year end. This amount becomes next year's beginning inventory (Line 35).

Line 42: Cost of Goods Sold

Line 40 minus Line 41. Enter this amount on Line 4 in Part I.

COGS Formula:

Beginning Inventory + Purchases + Labor + Materials - Ending Inventory = COGS

Example:

Beginning inventory: $5,000

+ Purchases: $20,000

+ Labor: $3,000

+ Materials: $2,000

- Ending inventory: ($8,000)

= COGS: $22,000

For more details, see our Inventory Tax Deduction Guide 2026.

Part IV: Vehicle Information (Lines 43-47)

Complete this section only if you claimed vehicle expenses on Line 9.

Line 43: Date Vehicle Placed in Service

When did you start using this vehicle for business?

Line 44: Miles Driven

| Category | Description |

|---|---|

| 44a: Business miles | Miles driven for business purposes |

| 44b: Commuting miles | Miles between home and regular workplace (not deductible) |

| 44c: Other miles | Personal, non-business miles |

Important: Total miles (a + b + c) should match your odometer.

Line 45: Vehicle Available for Personal Use?

Was your vehicle available for personal use during off-duty hours? Answer honestly—most people answer "Yes."

Line 46: Another Vehicle Available?

Do you have another vehicle available for personal use? Answering "Yes" supports that your claimed business vehicle is legitimately for business.

Line 47: Evidence to Support Deduction?

Do you have written records (mileage log, receipts) to support your deduction? Answer "Yes." If you answer "No," your deduction becomes much harder to defend in an audit.

47b: Written evidence? Is it written (not just memory)? Answer "Yes" if you kept a mileage log.

Part V: Other Expenses (Line 48)

List each expense type and amount for expenses reported on Line 27a.

Example:

| Expense | Amount |

|---|---|

| Software subscriptions | $1,200 |

| Professional memberships | $450 |

| Education/training | $800 |

| Bank fees | $180 |

| Internet (50% business) | $600 |

| Total Line 48 | $3,230 |

Common Mistakes to Avoid

Mistake #1: Not Reporting All Income

Problem: Only reporting 1099 income and ignoring cash, checks, or payments under $600.

Impact: The IRS cross-references your 1099s. Missing income triggers automatic notices.

Solution: Report ALL business income regardless of whether you received a 1099.

Mistake #2: Personal Expenses as Business Expenses

Problem: Deducting meals with friends, personal travel, or regular clothing as business expenses.

Impact: Disallowed deductions, penalties, potential audit.

Solution: Be strict about the "ordinary and necessary" test. Would a reasonable business owner in your field spend this money for business purposes?

Mistake #3: No Documentation

Problem: "I spent about $500 on supplies" without receipts or records.

Impact: Deductions disallowed in audit. Burden of proof is on you.

Solution: Keep receipts for everything over $75. Use bank statements with notes for smaller items. Apps like Jupid automatically categorize and store documentation.

Mistake #4: Mileage Without a Log

Problem: Claiming 15,000 business miles with no contemporaneous log.

Impact: IRS can disallow entire vehicle deduction.

Solution: Keep a mileage log with date, destination, business purpose, and miles. Apps make this easy—or use a simple spreadsheet.

Mistake #5: Mixing Accounting Methods

Problem: Using cash basis for income but accrual for expenses (or vice versa).

Impact: IRS notice, amended return required.

Solution: Pick one method (usually cash) and apply it consistently to both income and expenses.

What Happens After Schedule C

Your Schedule C profit flows to several places:

Schedule 1, Line 3: Business income added to Form 1040

Schedule SE: Self-employment tax calculation (if profit exceeds $400)

Form 1040: Combined with other income for your total tax

If your Schedule C shows a profit over $400, you'll owe self-employment tax of approximately 15.3% on your net earnings (after multiplying by 92.35%). This covers Social Security and Medicare taxes that W-2 employees split with their employers.

Quarterly Estimated Taxes: If you expect to owe $1,000+ in taxes, you should make quarterly estimated payments using Form 1040-ES. Deadlines are April 15, June 15, September 15, and January 15.

Simplify Your Schedule C With AI

Filling out Schedule C correctly requires tracking every business transaction, categorizing expenses accurately, and maintaining documentation the IRS demands. Most business owners either spend hours doing this manually or pay hundreds for professional help.

What makes Jupid different:

✅ Automatic transaction categorization — Connect your bank accounts and we sort every transaction into the right Schedule C line with 95.9% accuracy

✅ Expense documentation — Every receipt and record organized and stored automatically

✅ Real-time profit tracking — Know your Schedule C bottom line throughout the year, not just at tax time

✅ Chat with your AI accountant — Ask questions like "What's my total advertising spend?" or "How much can I deduct for mileage?" and get instant answers

Example conversation:

- You: "What expense category does my Canva subscription go in?"

- Jupid: "Software subscriptions like Canva go in Other Expenses (Line 27a/Part V). I've categorized your $155 annual Canva payment there. Your total Other Expenses so far this year is $2,340."

Instead of dreading tax season, you'll have your Schedule C numbers ready year-round.

Action Checklist: Filing Schedule C

Throughout the Year

- Track all income (even without 1099s)

- Save receipts for expenses over $75

- Keep mileage log if claiming vehicle expenses

- Separate business and personal expenses

- Make quarterly estimated tax payments

Before Filing

- Gather all 1099-NEC and 1099-K forms

- Total income from all sources

- Categorize expenses by Schedule C line

- Calculate home office deduction (if applicable)

- Calculate vehicle deduction (if applicable)

- Determine COGS (if selling products)

When Filing

- Complete Schedule C header (Lines A-J)

- Enter income in Part I (Lines 1-7)

- Enter expenses in Part II (Lines 8-27)

- Complete Part III if you sell products

- Complete Part IV if claiming vehicle

- List Part V other expenses

- Calculate net profit (Line 31)

- File Schedule SE if profit exceeds $400

Resources and Citations

IRS Forms and Instructions

- Schedule C (Form 1040) — Profit or Loss From Business

- Schedule C Instructions — Line-by-line guidance

- Form 8829 — Expenses for Business Use of Your Home

- Form 4562 — Depreciation and Amortization

- Schedule SE — Self-Employment Tax

IRS Publications

- Publication 334 — Tax Guide for Small Business

- Publication 463 — Travel, Gift, and Car Expenses

- Publication 535 — Business Expenses

- Publication 587 — Business Use of Your Home

Tax Code References

- IRC §162 — Trade or business expenses

- IRC §179 — Section 179 deduction

- IRC §280A — Business use of home

Final Thoughts

Schedule C is the foundation of your tax return as a self-employed business owner. Getting it right means:

- Capturing all income — Even payments without 1099s

- Claiming legitimate deductions — Every ordinary and necessary expense

- Maintaining documentation — Receipts, logs, and records that survive an audit

- Understanding the flow — How Schedule C connects to SE tax and your 1040

Most self-employed individuals leave money on the table by missing deductions or overpay by making preventable mistakes. With proper record-keeping and attention to detail, Schedule C becomes a tool for tax optimization rather than a source of stress.

Disclaimer

This article provides general information about tax filing and should not be considered tax advice. Tax laws change frequently, and individual circumstances vary significantly. For advice specific to your situation, consult with a qualified tax professional.

Tax Year: 2026 Last Updated: January 26, 2026

Ready to simplify your finances?

Join 1,000+ businesses using Jupid to save time and money. Start simplifying your finances today.

30-day money-back guarantee