Sole Proprietorship vs LLC 2026: Which Structure Saves You More?

Table of Contents

Published: February 2, 2026 Tax Year: 2026

A Message from Slava

When I moved from the UK to launch Jupid, I faced a question every founder faces: sole proprietorship or LLC?

At Anna Money, where we grew to serve 60,000+ small businesses and $40M+ in annual revenue, I watched thousands of business owners wrestle with this exact decision. Some overpaid for LLC formation they didn't need yet. Others stayed as sole proprietors too long and faced personal liability when things went sideways.

The right answer depends on where you are right now — your revenue, your risk exposure, and your growth plans. Not where some blog tells you "most businesses" should be.

I chose an LLC for Jupid because of the liability separation and tax flexibility. But if I were freelance writing on the side, I'd probably stay a sole proprietor. Context matters.

This guide breaks down the real differences with actual tax calculations so you can make a decision based on numbers, not marketing copy from LLC formation services.

Executive Summary: Sole Proprietorship vs LLC in 2026

At a glance:

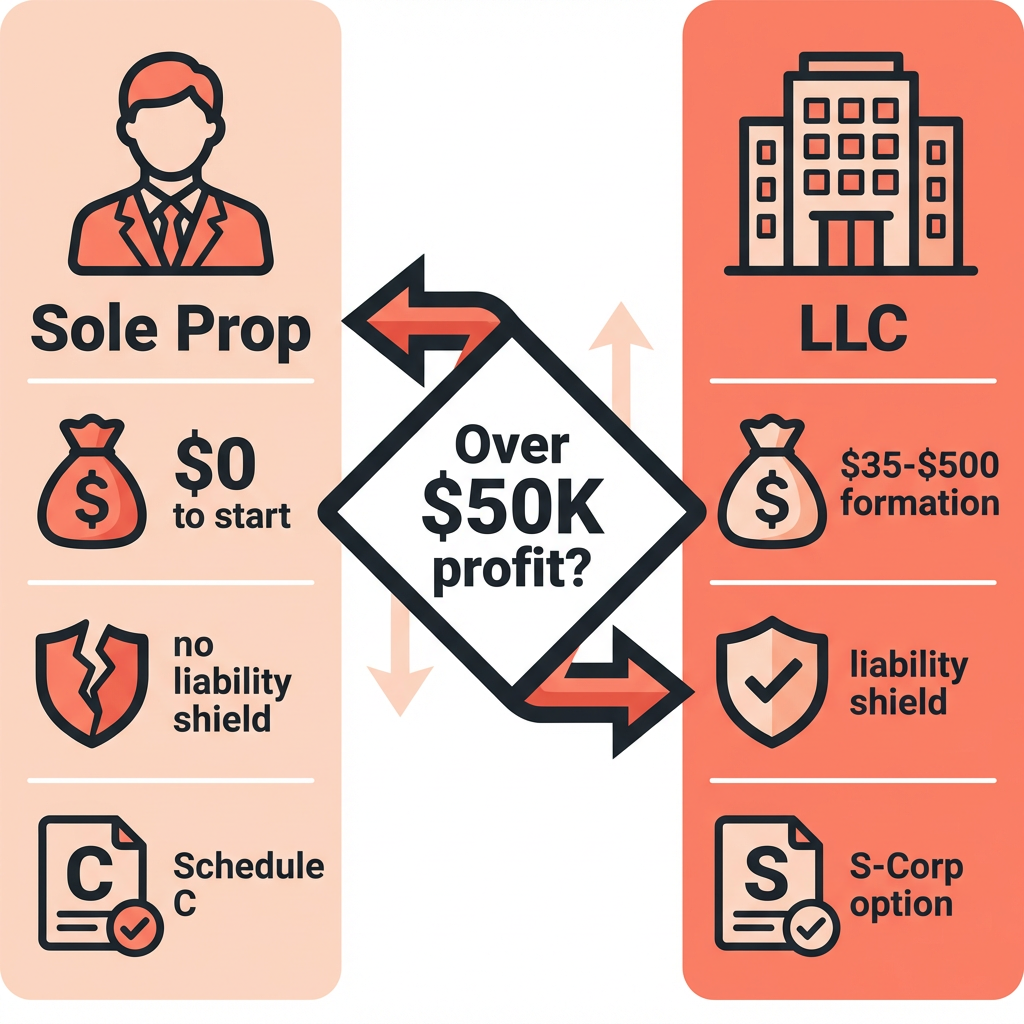

| Factor | Sole Proprietorship | LLC |

|---|---|---|

| Formation cost | $0 (free by default) | $35-$500 (varies by state) |

| Liability protection | None — personal assets at risk | Yes — business debts stay separate |

| Tax filing | Schedule C on personal return | Same by default, but can elect S-Corp |

| Self-employment tax | 15.3% on all net profit | Same by default, reducible via S-Corp |

| Annual maintenance | Minimal | Annual reports + fees in most states |

| Credibility | Informal | "LLC" signals established business |

The quick decision: If your net profit stays under $30,000 and your business carries low liability risk, a sole proprietorship works fine. Once you cross $50,000+ in profit or face meaningful liability exposure, an LLC starts paying for itself.

Legal basis: IRC §301.7701-2 (entity classification), IRS Publication 334, IRS Publication 583

What Is a Sole Proprietorship?

A sole proprietorship isn't something you form — it's what you are by default when you earn business income as an individual. If you sell handmade candles on Etsy, drive for DoorDash, or consult on marketing strategy, you're already a sole proprietor.

No paperwork with the state. No formation fees. You report your income and expenses on Schedule C attached to your personal 1040.

What this means in practice:

- Your business doesn't exist as a separate legal entity

- You and the business are the same thing in the eyes of the law and the IRS

- All profits flow directly to your personal tax return

- All debts and legal obligations are personally yours

About 23 million Americans operate as sole proprietors, according to IRS data. It's the most common business structure in the country.

When a Sole Proprietorship Makes Sense

A sole proprietorship is a perfectly valid long-term structure when:

- You're a freelancer, consultant, or gig worker

- Your business has low liability risk (no employees, no physical products)

- Your annual revenue is under $50,000

- You want zero ongoing compliance costs

- You're testing a business idea before committing

Legal citation: IRS Publication 334 covers tax reporting requirements for sole proprietors.

What Is an LLC?

A Limited Liability Company is a business structure you create by filing articles of organization with your state. Once formed, the LLC exists as a separate legal entity from you.

The "limited liability" part is the entire point: your personal assets — home, car, savings account — are protected from business debts and lawsuits. If your business gets sued or can't pay its bills, creditors generally cannot come after your personal property.

How LLCs Are Taxed

Here's what confuses most people: a single-member LLC is taxed exactly like a sole proprietorship by default. The IRS treats it as a "disregarded entity" for income tax purposes.

You still file Schedule C. You still pay self-employment tax on all net profit. The tax math is identical.

The difference? An LLC can elect to be taxed differently:

- Default: Disregarded entity (same as sole proprietorship)

- S-Corp election (Form 2553): Owner pays themselves a reasonable salary, and remaining profit avoids self-employment tax

- C-Corp election (Form 8832): Business pays corporate income tax (21%) — rarely beneficial for small businesses

That S-Corp election is where the real tax savings happen for profitable businesses. More on that below.

Legal citation: IRC §301.7701-3 allows LLCs to elect their tax classification.

Liability Protection: The Biggest Difference

This is the single most important distinction between a sole proprietorship and an LLC.

Sole Proprietorship: No Protection

As a sole proprietor, you are personally liable for everything. A few scenarios where this matters:

- A client sues you for breach of contract — your personal bank account is at risk

- A customer gets injured by your product — your personal assets can be seized

- Your business can't pay a vendor — they can come after your personal savings

- Business debt doesn't stay with the business — it's your personal debt

LLC: Personal Assets Are Protected

With an LLC, the business is a separate legal entity. Creditors of the business can only go after business assets, not your personal ones.

There are exceptions. An LLC won't protect you if you:

- Personally guarantee a loan (which most banks require for small businesses)

- Commit fraud or illegal activity

- Fail to keep business and personal finances separate ("piercing the corporate veil")

- Cause personal injury through your own negligence

The practical takeaway: An LLC isn't a magic shield, but it creates a meaningful legal barrier between your business obligations and your personal wealth. The more assets you accumulate personally, the more this protection matters.

Tax Comparison: Real Numbers

Here's where things get concrete. Let's compare the tax burden across three income levels.

Scenario: Single filer, no other income, standard deduction

Self-employment tax rate for 2026: 15.3% (12.4% Social Security + 2.9% Medicare) on the first $176,100 of net earnings. The 2.9% Medicare portion has no income cap.

At $50,000 Net Profit:

Sole Proprietorship / LLC (default):

Self-employment tax: $50,000 × 92.35% × 15.3% = $7,065

Deductible half of SE tax: $3,532

Adjusted gross income: $46,468

Standard deduction: $15,700

Taxable income: $30,768

Federal income tax: ~$3,467

TOTAL FEDERAL TAX: $10,532

LLC taxed as S-Corp:

Reasonable salary: $35,000

Payroll taxes (employer + employee): $35,000 × 15.3% = $5,355

Pass-through income: $15,000 (no SE tax)

Federal income tax on $50,000: ~$3,860

TOTAL FEDERAL TAX: $9,215

S-Corp savings: ~$1,317/year

At $100,000 Net Profit:

Sole Proprietorship / LLC (default):

Self-employment tax: $100,000 × 92.35% × 15.3% = $14,130

Deductible half of SE tax: $7,065

Adjusted gross income: $92,935

Standard deduction: $15,700

Taxable income: $77,235

Federal income tax: ~$12,657

TOTAL FEDERAL TAX: $26,787

LLC taxed as S-Corp:

Reasonable salary: $60,000

Payroll taxes: $60,000 × 15.3% = $9,180

Pass-through income: $40,000 (no SE tax)

Federal income tax on ~$95,400: ~$13,600

TOTAL FEDERAL TAX: $22,780

S-Corp savings: ~$4,007/year

At $150,000 Net Profit:

Sole Proprietorship / LLC (default):

Self-employment tax: $150,000 × 92.35% × 15.3% = $21,195

TOTAL FEDERAL TAX: ~$41,895

LLC taxed as S-Corp:

Reasonable salary: $75,000

Payroll taxes: $75,000 × 15.3% = $11,475

TOTAL FEDERAL TAX: ~$34,475

S-Corp savings: ~$7,420/year

The pattern is clear: the more you earn above your reasonable salary, the more the S-Corp election saves. Below about $40,000-50,000 in net profit, the savings don't justify the added complexity and payroll costs.

QBI Deduction Applies to Both

Both sole proprietors and LLC owners can claim the Qualified Business Income (QBI) deduction — a 20% deduction on qualified business income. This applies regardless of entity structure, though income limitations and restrictions can reduce or eliminate it for higher earners.

Formation Costs and Ongoing Fees

Sole Proprietorship: Essentially Free

| Item | Cost |

|---|---|

| State formation | $0 (automatic) |

| DBA/trade name (optional) | $10-$100 |

| Business license (if required) | Varies by city |

| EIN from IRS (optional) | Free |

LLC: State Filing Fees

State filing fees vary significantly. Here are some common examples:

| State | Formation Fee | Annual Fee |

|---|---|---|

| California | $70 | $800 franchise tax (minimum) |

| Texas | $300 | $0 (no annual fee, but franchise tax may apply) |

| Florida | $125 | $138.75 annual report |

| New York | $200 | $25 biennial report + publication requirement ($500-$1,500) |

| Wyoming | $100 | $60 annual report |

| Delaware | $90 | $300 annual franchise tax |

California is the most expensive state for LLCs. That $800 minimum franchise tax applies even if your business earns $0. If you're a California-based freelancer earning $30,000, that $800 fee eats heavily into any potential benefit.

For a detailed breakdown of LLC costs in your state, try our LLC Annual Tax and Fee Calculator.

When to Switch from Sole Proprietorship to LLC

There's no universal income threshold, but these signals suggest it's time to form an LLC:

Form an LLC When:

✅ Your net profit consistently exceeds $50,000 — The S-Corp election starts saving meaningful money on self-employment tax

✅ You have personal assets to protect — Home equity, savings, investments that could be at risk

✅ You're hiring employees or contractors — Employment-related liability increases your risk

✅ Clients require it — Some enterprise clients and government contracts require vendors to be LLCs or corporations

✅ You're taking on business debt — LLC separates business and personal debt obligations

✅ Your industry carries liability risk — Construction, consulting, healthcare, and product-based businesses face higher lawsuit risk

Stay a Sole Proprietor When:

❌ You're earning under $30,000 — Formation fees and compliance costs may exceed the benefits

❌ You're testing a new business idea — Wait until you validate the concept

❌ Your business has minimal liability risk — Writing, tutoring, or other low-risk services

❌ You're in California earning under $50,000 — The $800 minimum franchise tax makes it expensive

Common Mistakes to Avoid

Mistake #1: Forming an LLC Before You Need One

Problem: New entrepreneurs rush to form an LLC because online services make it look essential. They pay $300+ in formation fees, $100-800 in annual fees, plus ongoing compliance costs — all before earning meaningful revenue.

Impact: Wasted money that could go toward growing the business.

Solution: Start as a sole proprietor. Form an LLC when you hit the income or liability thresholds described above. You can always convert later.

Mistake #2: Thinking an LLC Automatically Reduces Taxes

Problem: Many business owners believe forming an LLC immediately lowers their tax bill. It doesn't. By default, a single-member LLC is taxed identically to a sole proprietorship.

Impact: Paying for LLC formation and compliance without any tax benefit.

Solution: The tax savings come from the S-Corp election, not the LLC itself. And that election only makes sense at higher income levels ($50,000+ net profit).

Mistake #3: Not Separating Personal and Business Finances

Problem: LLC owners mix personal and business bank accounts, credit cards, and expenses.

Impact: A court can "pierce the corporate veil" and hold you personally liable — eliminating the entire point of forming an LLC.

Solution: Open a dedicated business bank account. Pay business expenses from the business account. Pay yourself a documented distribution or salary. Keep records.

Mistake #4: Ignoring State-Specific Requirements

Problem: Forming an LLC without understanding your state's ongoing requirements — annual reports, franchise taxes, publication requirements.

Impact: Late fees, penalties, or even involuntary dissolution of your LLC.

Solution: Research your specific state's requirements. Some states (like New York) have expensive publication requirements. Others (like California) charge a minimum $800 franchise tax regardless of income.

Track Your Business Structure With AI

Managing your business finances correctly matters whether you're a sole proprietor or LLC owner. The difference between these structures affects how you report income, which deductions you can claim, and how much you owe in self-employment tax.

What makes Jupid different:

✅ Automatic transaction categorization — Our AI categorizes your business expenses with 95.9% accuracy, matching them to the right Schedule C categories

✅ Real-time financial insights — Ask your AI accountant questions like "What are my deductible expenses this month?" and get instant answers via WhatsApp or iMessage

✅ Tax compliance tracking — Jupid monitors your income and flags when you're approaching thresholds where changing your business structure could save you money

✅ Bank connection and auto-sync — Connect your business accounts and Jupid automatically separates business and personal transactions

Example conversation:

- You: "Am I earning enough to benefit from an S-Corp election?"

- Jupid: "Based on your current net profit of $87,000, an S-Corp election with a $55,000 reasonable salary could save you approximately $4,900 in self-employment tax this year."

Learn more about how Jupid keeps your business finances organized

Action Checklist: Choosing Your Business Structure

If Starting a New Business

- Calculate projected annual revenue for Year 1

- Assess your liability risk (industry, employees, products)

- Check your state's LLC formation and annual fees

- If projected revenue < $50K and low risk: start as sole proprietor

- If projected revenue > $50K or meaningful risk: form an LLC

- Get an EIN from the IRS (free, useful for either structure)

If Currently a Sole Proprietor

- Review your last 12 months of net profit

- Calculate potential self-employment tax savings from S-Corp election

- Use our Self-Employment Tax Calculator to see your current liability

- If net profit exceeds $50,000: consult a CPA about LLC + S-Corp election

- If you have significant personal assets: consider LLC for liability protection

After Forming an LLC

- Open a dedicated business bank account

- Apply for a new EIN (even if you had one as sole proprietor)

- Update all contracts, invoices, and agreements with your LLC name

- Review your state's annual report and franchise tax requirements

- Read our guide on staying tax compliant as an LLC

- Consider S-Corp election if net profit exceeds $50,000

Resources and Citations

IRS Publications (Official Sources)

- IRS Publication 334 — Tax Guide for Small Business

- IRS Publication 583 — Starting a Business and Keeping Records

- IRS: Limited Liability Company — LLC tax classification overview

- IRS: Single Member LLCs — Disregarded entity treatment

- Form 8832 — Entity Classification Election

- Form 2553 — Election by a Small Business Corporation

Tax Code and Regulations

- IRC §301.7701-2 — Business entity classification

- IRC §301.7701-3 — Election of entity classification

- IRC §199A — Qualified Business Income deduction

- IRC §1402 — Self-employment tax computation

2026 Key Numbers

| Item | 2026 Amount |

|---|---|

| Self-employment tax rate | 15.3% (12.4% SS + 2.9% Medicare) |

| Social Security wage base | $176,100 |

| Standard deduction (single) | $15,700 |

| QBI deduction | Up to 20% of qualified business income |

| Additional Medicare tax | 0.9% on earnings over $200,000 |

Final Thoughts

The sole proprietorship vs LLC decision comes down to two factors: liability protection and tax savings potential.

The key strategies:

- Start simple — A sole proprietorship costs nothing and works well for businesses earning under $50,000 with low liability exposure

- Form an LLC when the math works — The combination of liability protection and S-Corp tax savings justifies the cost once you're consistently profitable

- Keep your finances separate — Regardless of structure, maintaining clean financial records is what protects you during an audit or legal dispute

Your business structure isn't permanent. You can form an LLC at any time, and you can elect S-Corp status at any time. The goal is to match your structure to your current situation, not to the situation you hope to be in someday.

Disclaimer

This article provides general information about business structures and taxation and should not be considered legal or tax advice. State laws governing LLCs vary significantly, and individual circumstances affect which structure is optimal. Formation costs, annual fees, and tax implications differ by state and are subject to change. For advice specific to your situation, consult with a qualified tax professional or business attorney.

Tax Year: 2026 Last Updated: February 2, 2026

Ready to simplify your finances?

Join 1,000+ businesses using Jupid to save time and money. Start simplifying your finances today.

30-day money-back guarantee