QBI Deduction 2026: Maximize Your 20% Pass-Through Tax Deduction

Table of Contents

Published: December 9, 2025 Tax Year: 2026

A Message from Slava

Last year, my accountant called with urgent news: "Slava, if we restructure how you take income from Jupid, you could save an additional $42,000 this year through the QBI deduction." I had heard about Section 199A but didn't realize how powerful it could be—or how many business owners completely miss out on it.

The Qualified Business Income (QBI) deduction is arguably the most valuable tax break for pass-through business owners since the Tax Cuts and Jobs Act created it in 2018. It allows you to deduct up to 20% of your business income—not expenses, but actual income. For a business owner earning $300,000, that's a $60,000 deduction.

Yet according to IRS data, only 25% of eligible business owners fully maximize this deduction. Most either don't claim it at all or leave thousands of dollars on the table by not understanding the optimization strategies.

This guide will show you exactly how to maximize your QBI deduction in 2026, navigate the income thresholds and SSTB limitations, and implement strategies that could save you tens of thousands of dollars.

Executive Summary: The 20% QBI Deduction

What it is: A deduction of up to 20% of your qualified business income from pass-through businesses (sole proprietorships, S-Corps, partnerships, LLCs).

2026 Income Thresholds:

| Filing Status | Full Deduction | Phase-Out Range | Complete Phase-Out |

|---|---|---|---|

| Single | Up to $197,300 | $197,300 - $247,300 | Over $247,300 (if SSTB) |

| Married Filing Jointly | Up to $394,600 | $394,600 - $494,600 | Over $494,600 (if SSTB) |

Key Rules:

- ✅ Available for pass-through business owners (NOT W-2 employees)

- ✅ Deduct up to 20% of QBI from each business

- ✅ No limitations if income below threshold

- ⚠️ SSTB (Specified Service Trade or Business) limitations apply above threshold

- ⚠️ W-2 wages and qualified property tests apply above threshold

- ❌ Investment income and capital gains don't count

- ❌ Reasonable compensation (S-Corp W-2 wages) doesn't count

Potential savings:

- Business income: $300,000

- QBI deduction: $60,000

- Tax savings: $21,000 (at 35% rate)

Legal Citation: IRC § 199A - Qualified business income deduction

What Is the QBI Deduction?

The Basics

The Qualified Business Income (QBI) deduction, also known as the Section 199A deduction or "pass-through deduction," allows owners of pass-through businesses to deduct up to 20% of their qualified business income from their taxable income.

Created by: Tax Cuts and Jobs Act (2018) Originally set to expire: December 31, 2025 Updated by H.R.1 (2025): Made permanent with new $1,000 minimum QBI threshold

How it works:

Your business income: $200,000

QBI deduction (20%): $40,000

Your taxable income: $160,000 ($200,000 - $40,000)

Tax savings: $14,000 (at 35% tax rate)

Important: This is a deduction, not a credit. It reduces your taxable income, not your tax bill directly.

Who Qualifies for the QBI Deduction?

Pass-Through Business Owners

✅ You qualify if you own:

- Sole proprietorship

- S Corporation

- Partnership

- Limited Liability Company (LLC)

- Limited Partnership (LP)

- Trust or estate with business income

✅ Income sources that qualify:

- Schedule C income (sole proprietors)

- Schedule E income (rental real estate, royalties)

- Schedule K-1 income (S-Corps, partnerships, LLCs)

- REIT dividends

- Publicly traded partnership income

Who Does NOT Qualify

❌ You do NOT qualify if:

- You're a W-2 employee (no business ownership)

- Your only income is wages/salary

- You work for a C Corporation (even if you own it)

- Your business is a hobby (not a trade or business)

Key distinction:

- C Corporation owners: No QBI deduction (but corporate tax rate is 21%)

- Pass-through owners: QBI deduction (but taxed at individual rates up to 37%)

What Is Qualified Business Income (QBI)?

Definition

Qualified Business Income (QBI) is the net amount of income, gain, deduction, and loss from any qualified trade or business.

What counts as QBI:

- ✅ Net profit from your business

- ✅ Guaranteed payments to partners (for services)

- ✅ Income from rental real estate (if substantial services)

- ✅ Income from royalties

- ✅ Business income from trusts/estates

What does NOT count as QBI:

- ❌ W-2 wages (even from your own S-Corp)

- ❌ Guaranteed payments to partners (capital-based)

- ❌ Investment income (interest, dividends, capital gains)

- ❌ Income from outside the U.S.

- ❌ Reasonable compensation to S-Corp owners

Legal Citation: IRC § 199A(c) - Qualified business income defined

Example: Calculating QBI for Different Business Types

Sole Proprietor:

Schedule C net profit: $180,000

QBI: $180,000

QBI deduction: $36,000 (20%)

S Corporation Owner:

Total business income: $250,000

W-2 wages paid to yourself: $100,000

Remaining profit (K-1 distribution): $150,000

QBI: $150,000 (NOT $250,000)

QBI deduction: $30,000 (20% of $150,000)

Note: Your $100,000 W-2 wages are NOT QBI

Partnership Member:

K-1 business income: $200,000

Guaranteed payment for services: $50,000

QBI: $150,000 ($200,000 - $50,000)

QBI deduction: $30,000 (20%)

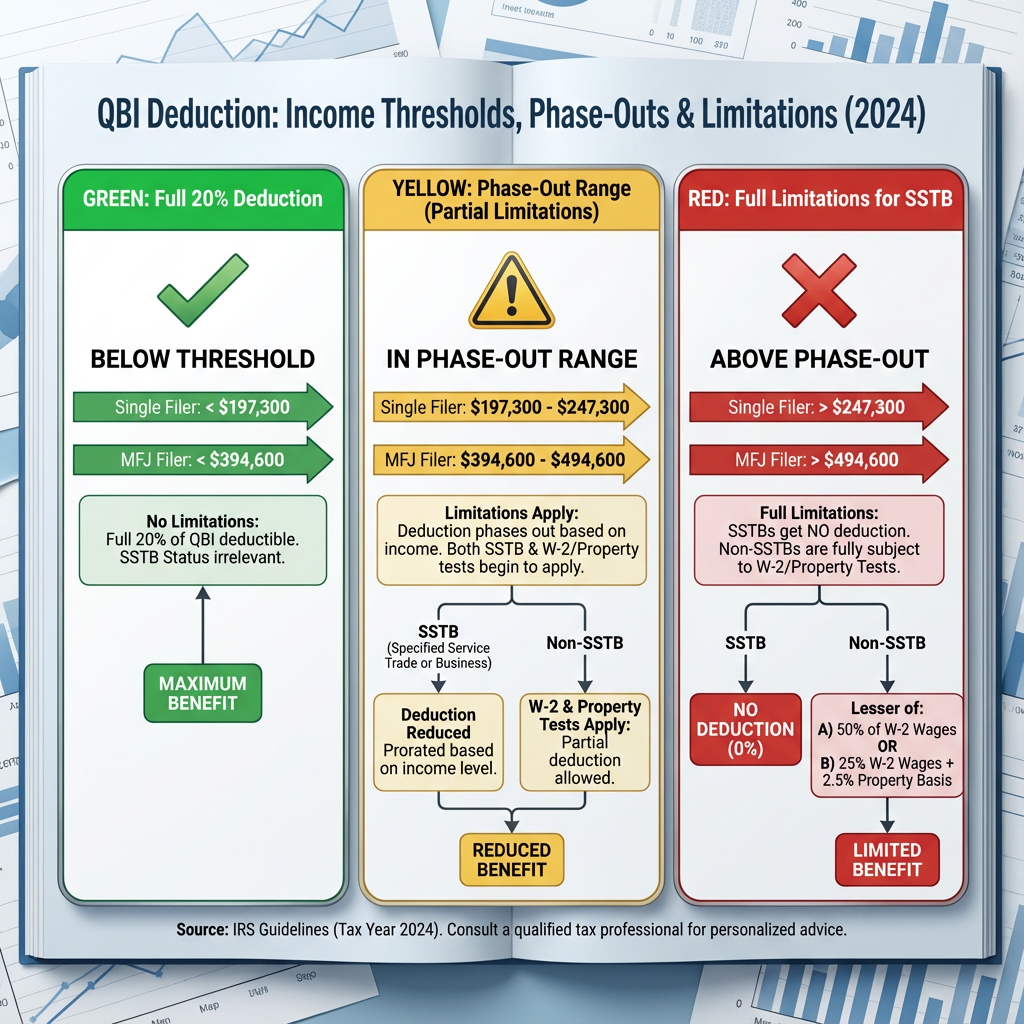

The Income Thresholds: Simple vs. Complex Rules

Below the Threshold: Simple 20% Deduction

If your taxable income is below the threshold, you automatically qualify for the full 20% QBI deduction—no questions asked, no limitations.

2026 Thresholds:

- Single: $197,300

- Married Filing Jointly: $394,600

How it works:

Example: Single taxpayer

Taxable income: $150,000

Business income (QBI): $150,000

QBI deduction: $30,000 (20% of $150,000)

Final taxable income: $120,000

✅ No limitations

✅ No SSTB restrictions

✅ No W-2 wage test

✅ Full 20% deduction

Above the Threshold: Limitations Apply

If your income exceeds the threshold, two major limitations can reduce or eliminate your QBI deduction:

- SSTB Limitation - If your business is a Specified Service Trade or Business

- W-2 Wages / Qualified Property Test - Limits deduction based on wages paid or property owned

Phase-out ranges:

- Single: $197,300 - $247,300

- Married Filing Jointly: $394,600 - $494,600

Within the phase-out range, limitations gradually phase in. Above the upper limit, full limitations apply.

Specified Service Trade or Business (SSTB): The Killer

What Is an SSTB?

A Specified Service Trade or Business (SSTB) is a business in certain service fields where the QBI deduction is phased out or eliminated for high-income taxpayers.

Legal Citation: IRC § 199A(d) - Specified service trades or businesses

SSTB Categories

SSTBs include businesses in these fields:

| Field | Examples |

|---|---|

| Health | Doctors, dentists, veterinarians, pharmacists, physical therapists, psychologists |

| Law | Attorneys, paralegals, legal consultants |

| Accounting | CPAs, tax preparers, bookkeepers, auditors |

| Actuarial science | Actuaries, pension consultants |

| Performing arts | Actors, musicians, directors, entertainers |

| Consulting | Management consultants, strategy advisors, business consultants |

| Athletics | Professional athletes, coaches, team managers |

| Financial services | Investment advisors, financial planners, wealth managers, brokers |

| Brokerage services | Real estate agents, insurance brokers, mortgage brokers |

| Trading | Securities traders, commodities traders (NOT inventory sales) |

| Investing/investment management | Investment fund managers, portfolio managers |

What is NOT an SSTB:

- ✅ Engineering

- ✅ Architecture

- ✅ Real estate development (non-brokerage)

- ✅ Equipment rental

- ✅ Manufacturing

- ✅ Retail

- ✅ Restaurants

- ✅ Software development

- ✅ E-commerce

- ✅ Construction

Legal Citation: Treas. Reg. § 1.199A-5(b) - Specified service trades or businesses

SSTB Limitation Rules

Below threshold income: No SSTB limitation (full 20% deduction)

Within phase-out range: Partial SSTB limitation (prorated reduction)

Above phase-out range:

- SSTB: QBI deduction completely eliminated (or limited to lesser of W-2/property test)

- Non-SSTB: QBI deduction limited by W-2 wages / qualified property test

SSTB Example

Scenario 1: Below Threshold (No Limitation)

Taxpayer: Single attorney

Taxable income: $180,000

QBI: $180,000

Status: BELOW $197,300 threshold

QBI deduction: $36,000 (full 20%)

✅ SSTB status doesn't matter

Scenario 2: Within Phase-Out Range (Partial Limitation)

Taxpayer: Single consultant

Taxable income: $220,000

QBI: $220,000

Status: WITHIN phase-out range ($197,300 - $247,300)

Reduction %: ($220K - $197.3K) / $50K = 45.4%

Without limitation: $44,000 (20% of $220K)

With SSTB reduction: $24,024 ($44K × 54.6%)

✅ Partial deduction

Scenario 3: Above Phase-Out Range (Full Limitation)

Taxpayer: Single attorney

Taxable income: $280,000

QBI: $280,000

W-2 wages paid to employees: $0

Status: ABOVE $247,300 threshold

SSTB: Yes (attorney)

W-2 wages test: $0

QBI deduction: $0

❌ Completely phased out

The W-2 Wages and Qualified Property Tests

When These Tests Apply

If your taxable income is above the threshold ($197,300 single / $394,600 married), your QBI deduction is limited to the greater of:

Option 1: W-2 Wage Limit

- 50% of W-2 wages paid by the business

Option 2: W-2 Wages + Property Limit

- 25% of W-2 wages paid by the business, PLUS

- 2.5% of the unadjusted basis of qualified property

You choose whichever gives you the larger deduction.

Legal Citation: IRC § 199A(b)(2) - W-2 wages and UBIA of qualified property

W-2 Wages Definition

W-2 wages include:

- ✅ Total wages paid to W-2 employees (including yourself if you're an S-Corp owner)

- ✅ Wages subject to federal income tax withholding

- ✅ Elective deferrals (401(k), 403(b), etc.)

- ✅ Employer contributions to retirement plans and HSAs

W-2 wages do NOT include:

- ❌ Independent contractor payments (1099)

- ❌ Owner distributions from S-Corps or LLCs

- ❌ Guaranteed payments to partners

Qualified Property Definition

Qualified property includes:

- ✅ Tangible property subject to depreciation

- ✅ Held by the business at the end of the year

- ✅ Used in the production of QBI

- ✅ Depreciation period hasn't ended

Property value used: Unadjusted basis (original cost, not depreciated value)

Examples of qualified property:

- Machinery and equipment

- Computers and office equipment

- Vehicles

- Buildings (but not land)

- Furniture and fixtures

- Technology and software

What is NOT qualified property:

- Land (not depreciable)

- Property held for investment

- Property not used in the business

W-2 Wages / Property Test Examples

Example 1: Solo Consultant (No W-2 Wages, No Property)

Taxable income: $300,000 (single)

QBI: $300,000

W-2 wages paid: $0

Qualified property: $0

Tentative deduction (20%): $60,000

W-2 wage limit: $0 (50% × $0)

Property limit: $0 (25% × $0 + 2.5% × $0)

QBI deduction: $0 ❌

(Limited to greater of wage or property test)

Result: Despite having $300K in business income, NO QBI deduction because no W-2 wages paid and no qualified property.

Example 2: S-Corp Owner (With W-2 Wages)

Taxable income: $300,000 (single)

Total S-Corp income: $300,000

W-2 wages to yourself: $120,000

K-1 distribution: $180,000

QBI: $180,000 (K-1 only, NOT W-2)

Qualified property: $0

Tentative deduction (20%): $36,000 (20% × $180K)

W-2 wage limit: $60,000 (50% × $120K)

Property limit: $30,000 (25% × $120K)

QBI deduction: $36,000 ✅

(Not limited because W-2 wage test is $60K > $36K)

Example 3: Real Estate Developer (With Property)

Taxable income: $450,000 (single)

QBI: $450,000

W-2 wages paid to employees: $80,000

Qualified property (buildings, equipment): $2,000,000

Tentative deduction (20%): $90,000

W-2 wage limit: $40,000 (50% × $80K)

Property limit: $70,000 (25% × $80K + 2.5% × $2M)

= $20,000 + $50,000

QBI deduction: $70,000 ✅

(Limited by property test, not wage test)

Key insight: Having substantial qualified property ($2M) significantly increases the deduction even though W-2 wages are modest.

Example 4: Manufacturing Business (High W-2 Wages)

Taxable income: $500,000 (single)

QBI: $500,000

W-2 wages paid: $600,000

Qualified property: $1,500,000

Tentative deduction (20%): $100,000

W-2 wage limit: $300,000 (50% × $600K)

Property limit: $187,500 (25% × $600K + 2.5% × $1.5M)

= $150,000 + $37,500

QBI deduction: $100,000 ✅

(Not limited; both tests exceed $100K)

Aggregation: Combining Multiple Businesses

What Is Aggregation?

Aggregation allows you to combine multiple business entities when calculating your QBI deduction. This can help you meet the W-2 wages and qualified property tests.

Legal Citation: IRC § 199A(b)(7) - Aggregation

Requirements for Aggregation

You can aggregate businesses if:

- Same person or group owns 50% or more of each business

- Ownership is maintained for the majority of the tax year

- All businesses are not SSTBs (or all are SSTBs)

- Businesses meet at least TWO of the following:

- Provide products/services that are the same or customarily offered together

- Share facilities or business elements

- Operate in coordination or reliance on each other

Aggregation Example

Scenario: Restaurant Owner With Multiple Entities

Entity 1: Restaurant LLC

- QBI: $200,000

- W-2 wages: $150,000

- Qualified property: $500,000

Entity 2: Equipment Rental LLC (rents equipment to Restaurant)

- QBI: $50,000

- W-2 wages: $0

- Qualified property: $300,000

WITHOUT AGGREGATION:

Restaurant: $40,000 QBI deduction (limited)

Equipment Rental: $0 QBI deduction (no W-2 wages)

Total: $40,000

WITH AGGREGATION:

Combined QBI: $250,000

Combined W-2 wages: $150,000

Combined property: $800,000

W-2 wage limit: $75,000 (50% × $150K)

Property limit: $57,500 (25% × $150K + 2.5% × $800K)

QBI deduction: $50,000 ✅

(20% of $250K, not limited)

Benefit of aggregation: +$10,000 deduction

Advanced Strategies to Maximize Your QBI Deduction

Strategy 1: Pay Yourself Reasonable W-2 Wages (S-Corps)

The Problem: S-Corp owners often minimize W-2 wages to reduce payroll taxes, but this hurts the QBI deduction above income thresholds.

The Solution: Increase your W-2 wages (within "reasonable compensation" limits) to create a larger W-2 wage base for the QBI calculation.

Example:

SCENARIO A: Low W-2 Strategy

Total S-Corp income: $400,000

W-2 wages: $60,000

K-1 distribution: $340,000

QBI: $340,000

Tentative deduction: $68,000 (20%)

W-2 wage limit: $30,000 (50% × $60K)

Actual deduction: $30,000 ❌

SCENARIO B: Optimized W-2 Strategy

Total S-Corp income: $400,000

W-2 wages: $140,000

K-1 distribution: $260,000

QBI: $260,000

Tentative deduction: $52,000 (20%)

W-2 wage limit: $70,000 (50% × $140K)

Actual deduction: $52,000 ✅

Net benefit: +$22,000 deduction

Tax savings: $7,700 (at 35% rate)

Trade-off: Higher W-2 wages = higher payroll taxes (15.3% on additional $80K = $12,240), but you gain $22,000 deduction worth $7,700 in tax savings. Net worse.

Better approach: Optimize to the point where W-2 wage limit exceeds 20% of QBI.

Strategy 2: Invest in Qualified Property

The Problem: Service businesses often have little qualified property, limiting the property-based calculation.

The Solution: Invest in depreciable property before year-end to increase your qualified property basis.

Qualifying investments:

- Office equipment and furniture

- Computers and technology

- Vehicles used in the business

- Machinery and equipment

- Software

- Building improvements (if you own the building)

Example:

BEFORE INVESTMENT:

QBI: $300,000

W-2 wages: $50,000

Qualified property: $100,000

W-2 limit: $25,000 (50% × $50K)

Property limit: $15,000 (25% × $50K + 2.5% × $100K)

QBI deduction: $25,000 (limited)

AFTER INVESTMENT ($400K in equipment before Dec 31):

QBI: $300,000

W-2 wages: $50,000

Qualified property: $500,000

W-2 limit: $25,000 (50% × $50K)

Property limit: $25,000 (25% × $50K + 2.5% × $500K)

= $12,500 + $12,500

QBI deduction: $25,000 (not improved)

Actually, property limit: $22,500

Need more property!

Better example:

AFTER INVESTMENT ($1,000,000 in equipment):

Property limit: $37,500 (25% × $50K + 2.5% × $1M)

= $12,500 + $25,000

QBI deduction: $37,500 ✅

(+$12,500 additional deduction)

Note: You get depreciation deduction PLUS higher QBI deduction.

Strategy 3: Avoid SSTB Classification

The Problem: SSTB businesses lose the QBI deduction entirely above phase-out income.

The Solution: Structure your business to fall outside SSTB definitions where possible.

Strategies:

A) Separate SSTB and non-SSTB activities:

Example: Law firm with software division

Option 1: Single entity (SSTB)

- Legal services: $400K

- Software sales: $100K

- Total: $500K

- Classification: SSTB (law)

- QBI deduction: $0 (above threshold, SSTB)

Option 2: Separate entities

- Law firm LLC: $400K (SSTB)

- Software LLC: $100K (not SSTB)

Law firm: $0 QBI deduction (SSTB)

Software: $20K QBI deduction (20% × $100K)

Net benefit: +$20,000 deduction

B) Shift to non-SSTB activities:

Example: Consultant shifting to product sales

Consulting (SSTB): $300K

Shift: Create online courses/software products

New model:

Consulting (SSTB): $150K

Product sales (not SSTB): $150K

At $350K income (above threshold):

Consulting: $0 deduction (SSTB, phased out)

Products: $30K deduction (20% × $150K, subject to wage/property test)

Strategy 4: Manage Your Taxable Income

The Problem: Crossing the income threshold by just $1 can cost you tens of thousands in QBI deductions.

The Solution: Use deductions and income timing to stay below thresholds.

Tactics:

A) Accelerate deductions into current year:

- Make retirement contributions (Solo 401(k): up to $69,000 in 2026)

- Buy equipment using Section 179/bonus depreciation

- Prepay expenses (if cash method)

- Take capital losses to offset gains

B) Defer income to next year:

- Delay year-end invoicing

- Defer bonuses or K-1 distributions

- Use installment sales

Example:

BEFORE OPTIMIZATION:

Gross income: $420,000

Deductions: $20,000

Taxable income: $400,000 (married)

Status: Exceeds $394,600 threshold

QBI deduction: Limited by W-2/property test

Result: $30,000 deduction (vs. $80,000 without limit)

Loss: $50,000 deduction

AFTER OPTIMIZATION:

Gross income: $420,000

Additional deductions:

- Solo 401(k) contribution: $69,000

- Equipment purchase (Section 179): $50,000

- HSA contribution: $8,900

Total deductions: $147,900

Taxable income: $272,100

Status: BELOW $394,600 threshold ✅

QBI deduction: FULL 20% with no limitations

Result: $84,420 deduction (20% of $422,100 QBI)

Benefit: +$54,420 deduction vs. limited scenario

Strategy 5: Use Trusts for Income Splitting

Advanced strategy for high-income business owners.

The Problem: High-income taxpayers face full SSTB phase-out and W-2/property limitations.

The Solution: Distribute income to multiple trusts or family members in lower tax brackets who qualify for full QBI deduction.

Example:

Parent (SSTB attorney): $600,000 income

QBI deduction: $0 (SSTB, above threshold)

Alternative structure:

Parent: $300,000 (below threshold)

Child 1 trust: $150,000

Child 2 trust: $150,000

Parent QBI deduction: $60,000 (20% × $300K)

Trust 1 QBI deduction: $30,000 (20% × $150K)

Trust 2 QBI deduction: $30,000 (20% × $150K)

Total QBI deduction: $120,000

vs. $0 under original structure

Tax savings: $42,000+

Caution: This strategy requires careful legal structuring and must comply with "kiddie tax" rules and trust taxation. Consult a tax attorney.

Real Estate and the QBI Deduction

Rental Real Estate

Question: Does rental real estate qualify for the QBI deduction?

Answer: It depends on whether the activity rises to the level of a "trade or business."

Safe Harbor (IRS Notice 2019-07):

Rental real estate qualifies as a trade or business if you meet ALL of these requirements:

-

Maintain separate books and records for each rental property

-

Perform 250+ hours of rental services per year, including:

- Advertising

- Negotiating and executing leases

- Verifying tenant information

- Collection of rent

- Daily operation, maintenance, and repair

- Managing the property

- Purchase of materials

- Supervision of employees and contractors

-

Maintain contemporaneous records (time logs)

-

Attach a statement to your tax return electing the safe harbor

Legal Citation: IRS Notice 2019-07 - Safe harbor for rental real estate

Example:

Taxpayer: Owns 3 rental properties

Total rental income: $120,000

Hours performing rental services: 280 hours

Maintains separate books: Yes

Timelog: Yes

Qualifies under safe harbor: ✅ Yes

QBI: $120,000

QBI deduction: $24,000 (20%)

If didn't qualify: $0 QBI deduction

Triple-Net Leases

Triple-net (NNN) leases generally do NOT qualify because the tenant is responsible for all property expenses, leaving minimal landlord involvement.

Result: Likely not a "trade or business" → No QBI deduction

Common Mistakes and How to Avoid Them

Mistake #1: Not Claiming the Deduction

❌ Problem: Business owners don't know about QBI deduction or forget to claim it

Consequences:

- Miss out on 20% deduction

- Overpay taxes by thousands/tens of thousands

✅ Solution:

- Always calculate QBI deduction

- Use tax software or professional that handles Section 199A

- File Form 8995 (or 8995-A if above threshold)

Mistake #2: Paying Too Little W-2 Wages (S-Corps)

❌ Problem: S-Corp owners minimize W-2 wages to save payroll taxes, not realizing it hurts QBI

Consequences:

- W-2 wage limitation drastically reduces QBI deduction

- Net tax increase despite payroll tax savings

✅ Solution:

- Calculate optimal W-2 amount that:

- Meets "reasonable compensation" requirement

- Maximizes QBI deduction

- Minimizes total tax (income + payroll)

- Generally aim for W-2 wages ≥ 40-50% of total S-Corp income

Mistake #3: Not Investing in Qualified Property

❌ Problem: Service businesses with no equipment miss the property-based calculation

Consequences:

- Limited or no QBI deduction above income thresholds

- Leave tens of thousands in deductions on the table

✅ Solution:

- Invest in depreciable property before year-end

- Buy equipment, vehicles, furniture, computers

- Get both depreciation deduction AND improved QBI calculation

Mistake #4: Mixing SSTB and Non-SSTB Activities

❌ Problem: Operating SSTB and non-SSTB businesses in the same entity

Consequences:

- Entire entity treated as SSTB

- Lose QBI deduction on non-SSTB income

- Could cost $20,000+ in lost deductions

✅ Solution:

- Separate SSTB and non-SSTB activities into different entities

- Document the separation clearly

- Ensure activities are truly distinct

Mistake #5: Not Aggregating Eligible Businesses

❌ Problem: Multiple businesses calculated separately when aggregation would help

Consequences:

- Some businesses fail W-2/property test individually

- Aggregate would pass the test

- Miss out on QBI deduction

✅ Solution:

- Analyze whether businesses qualify for aggregation

- File Form 8995-A with aggregation election

- Combine W-2 wages and property across entities

Tax Reporting: Forms You Need

Form 8995 (Simple Version)

Who uses it:

- Taxpayers with taxable income below phase-out threshold

- No SSTB limitations apply

- No aggregation

What it calculates:

- 20% of QBI from each business

- Total QBI deduction

- Transfers to Form 1040, Line 13

How to complete:

- List each qualified business

- Enter QBI from each business (from Schedule C, K-1, etc.)

- Multiply by 20%

- Sum total QBI deduction

Form 8995-A (Complex Version)

Who uses it:

- Taxpayers with taxable income in or above phase-out range

- SSTB businesses

- Aggregation elections

- W-2 wages / qualified property limitations apply

What it calculates:

- QBI for each business

- SSTB phase-out reduction

- W-2 wages limitation

- Qualified property limitation

- Aggregation calculations

- Final QBI deduction

Schedules:

- Schedule A: QBI, W-2 wages, property for each business

- Schedule B: Aggregation election

- Schedule C: Loss carryforwards

- Schedule D: SSTB calculations

Future of the QBI Deduction

Original Sunset Date

The QBI deduction was originally set to expire on December 31, 2025, reverting to pre-TCJA rules where pass-through owners received no special deduction.

H.R.1 Extension (2025)

The One Big Beautiful Bill Act (H.R.1), passed in 2025, made significant changes:

✅ Made the QBI deduction permanent (no longer expires after 2025)

✅ Added new $1,000 minimum QBI requirement - Starting in 2026, taxpayers must have at least $1,000 in QBI to claim the deduction

✅ Simplified rules for some taxpayers

Impact:

- Business owners can now plan long-term strategies around the QBI deduction

- No longer need to prepare for a 2026 "tax cliff"

- Deduction is a permanent part of the tax code

Legal Citation: H.R.1 § 11001 - Extension of qualified business income deduction

Simplify Your QBI Deduction With AI

Calculating the QBI deduction with all its income thresholds, SSTB limitations, W-2 wage tests, and qualified property calculations shouldn't require a CPA degree. At Jupid, our AI-powered platform handles all the complexity automatically.

What makes Jupid different for QBI optimization:

✅ Automatic QBI calculation - We calculate your QBI from all sources (Schedule C, K-1s, rentals)

✅ Income threshold monitoring - Real-time alerts when you're approaching phase-out thresholds

✅ SSTB classification - We analyze your business activities and determine SSTB status

✅ W-2 wage optimization - For S-Corps, we recommend the optimal W-2 amount to maximize QBI while minimizing total taxes

✅ Qualified property tracking - Automatic tracking of all depreciable assets and their unadjusted basis

✅ Strategy recommendations - AI suggests tactics to increase your QBI deduction based on your specific situation

✅ Multi-scenario modeling - See how different decisions (equipment purchases, W-2 changes, income timing) impact your QBI deduction

✅ Automatic Form 8995 / 8995-A - Generated automatically with your tax return

✅ Chat with your AI accountant - Ask questions like "If I buy $50K in equipment, how does it affect my QBI deduction?" and get instant answers

Example conversation:

- You: "I'm an S-Corp owner with $400K in income. I pay myself $80K W-2. Am I maximizing my QBI deduction?"

- Jupid: "No, you're leaving money on the table. Your current setup gives you a $32,000 QBI deduction, limited by your low W-2 wages. If you increase your W-2 to $140,000, you'll get a $52,000 QBI deduction—that's $20,000 more. Even after the additional $9,180 in payroll taxes, you'll save a net $2,820. Want me to model other scenarios?"

Annual value: Business owners using Jupid save an average of $12,400 more on QBI deductions compared to manual calculations, simply by:

- Not missing the deduction entirely

- Optimizing W-2 wages for S-Corps

- Strategic property purchases before year-end

- Avoiding SSTB classification mistakes

- Proper aggregation elections

Learn more about how Jupid can maximize your QBI deduction →

Action Checklist: Maximizing Your QBI Deduction

Before Year-End

- Calculate your projected taxable income for 2026

- Determine if you're below, within, or above the phase-out threshold

- Classify your business (SSTB or non-SSTB)

- Calculate your QBI from all sources

- Review your W-2 wages (if S-Corp)

- Inventory your qualified property (unadjusted basis)

- Consider equipment purchases to increase property basis

- Evaluate aggregation opportunities (multiple businesses)

- Project your QBI deduction under different scenarios

Tax Planning Strategies

- Optimize W-2 wages (S-Corps) to maximize QBI while minimizing total tax

- Invest in qualified property before December 31

- Time income and deductions to stay below thresholds (if close)

- Separate SSTB and non-SSTB activities (if applicable)

- Make retirement contributions (reduces taxable income)

- Consider aggregation election (multiple businesses)

When Filing Taxes

- Complete Form 8995 or Form 8995-A

- Report QBI from all sources (Schedule C, K-1s, rentals)

- Calculate SSTB phase-out (if applicable)

- Apply W-2 wages and qualified property tests (if above threshold)

- File aggregation election (if applicable)

- Transfer QBI deduction to Form 1040, Line 13

- Maintain supporting documentation for 7 years

Throughout the Year

- Track business income and expenses

- Monitor taxable income projections

- Document rental real estate hours (if applicable)

- Track qualified property additions

- Review QBI deduction quarterly

- Adjust estimated tax payments based on QBI deduction

Resources and Citations

IRS Publications (Official Sources)

- IRS Publication 535 - Business Expenses (Chapter 12: Section 199A Deduction)

- Form 8995 - Qualified Business Income Deduction Simplified Computation

- Form 8995-A - Qualified Business Income Deduction

- IRS FAQ on QBI - Official IRS guidance

Tax Code and Regulations

- IRC § 199A - Qualified business income deduction

- IRC § 199A(b) - Computation of deduction

- IRC § 199A(c) - Qualified business income defined

- IRC § 199A(d) - Specified service trade or business

- Treas. Reg. § 1.199A-1 - Operational rules

- Treas. Reg. § 1.199A-5 - Specified service trades or businesses

Notices and Guidance

- IRS Notice 2019-07 - Safe harbor for rental real estate

- IRS Notice 2025-15 - 2026 inflation adjustments

- Rev. Proc. 2019-38 - Aggregation rules

Legislative Updates

- Tax Cuts and Jobs Act (2017) - Created Section 199A

- H.R.1 (2025) - One Big Beautiful Bill Act - Made QBI deduction permanent

Final Thoughts

The QBI deduction is one of the most valuable—and most complex—tax benefits available to pass-through business owners. With the potential to deduct up to 20% of your business income, this deduction can save you tens of thousands of dollars annually.

The key is understanding:

- Your income thresholds and whether limitations apply

- Whether your business is an SSTB

- How W-2 wages and qualified property affect your deduction

- Strategic planning opportunities to maximize the deduction

For high-income business owners: Don't assume you can't benefit from the QBI deduction just because you're above the threshold. With proper planning—optimizing W-2 wages, investing in qualified property, aggregating businesses, and managing taxable income—you can still capture significant tax savings.

For SSTB owners: The phase-out is painful, but not insurmountable. Consider separating non-SSTB activities, shifting business models, or using income timing strategies to stay below the complete phase-out threshold.

Remember: The QBI deduction is now permanent (as of 2025), so you can plan long-term tax strategies around it. This isn't a temporary benefit—it's a fundamental part of running a profitable pass-through business.

Disclaimer

This article provides general information about tax deductions and should not be considered tax advice. The QBI deduction involves complex calculations and multiple limitations that vary by individual circumstances. Tax laws change frequently. For advice specific to your situation, consult with a qualified tax professional.

Tax Year: 2026 Last Updated: December 9, 2025

Ready to simplify your finances?

Join 1,000+ businesses using Jupid to save time and money. Start simplifying your finances today.

30-day money-back guarantee