1099 vs W-2 in 2026: Key Differences for Workers and Businesses

Table of Contents

Published: February 8, 2026 Tax Year: 2026

A Message from Slava

The 1099 vs W-2 question affects both sides of the relationship: the business deciding how to classify workers, and the workers themselves understanding what their classification means for taxes.

At Jupid, we work with freelancers and contractors daily. At Anna Money, where we served 60,000+ small businesses, worker classification was one of the top five compliance questions we received. It makes sense — the tax difference between a 1099 contractor and a W-2 employee is significant, and getting it wrong can be costly for the business.

In 2026, the 1099-NEC reporting threshold increased from $600 to $2,000, which changes some paperwork requirements. But the fundamental rules about who qualifies as a contractor vs. an employee haven't changed. Those are based on the nature of the working relationship — not paperwork preferences.

This guide covers both perspectives: what you need to know as a business owner hiring workers, and what you need to know as a worker receiving either form.

Executive Summary: 1099 vs W-2 in 2026

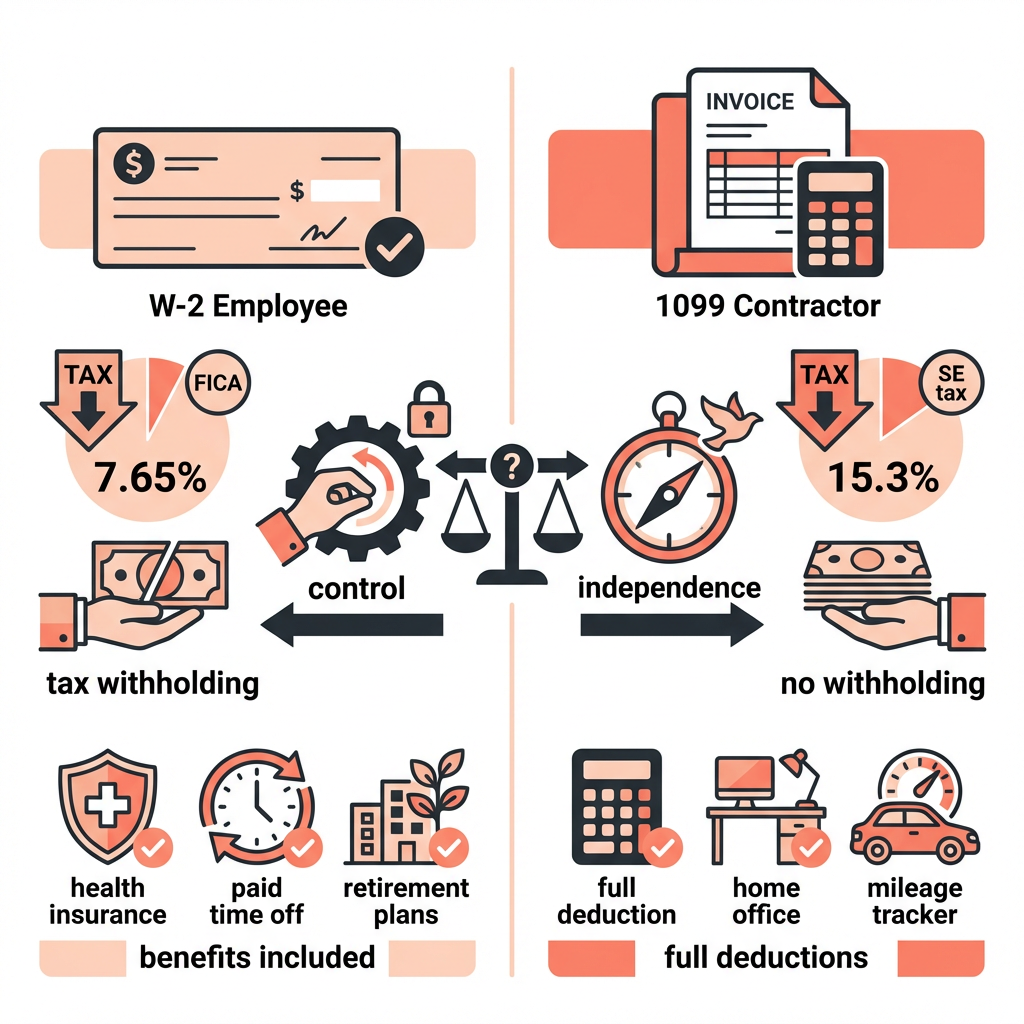

| Factor | W-2 Employee | 1099 Contractor |

|---|---|---|

| Tax withholding | Employer withholds income tax, Social Security, Medicare | No withholding — contractor pays own taxes |

| FICA taxes | Split 50/50 (employer 7.65%, employee 7.65%) | Contractor pays full 15.3% SE tax |

| Benefits | May receive health insurance, retirement, PTO | No employer-provided benefits |

| Tax forms | W-2 from employer | 1099-NEC from each client paying $2,000+ |

| Tax filing | Form 1040 + W-2 income | Form 1040 + Schedule C |

| Work control | Employer directs how, when, where | Contractor controls their own methods |

| Deductions | Limited (standard deduction) | Full business deductions on Schedule C |

| Unemployment | Covered by employer's UI insurance | Not eligible |

2026 change: The 1099-NEC reporting threshold increased from $600 to $2,000. Businesses only need to issue 1099-NEC forms for contractors paid $2,000 or more.

Legal basis: IRC §3401 (employee definition), IRC §3121 (FICA wages), IRS Publication 15-A, IRS Form SS-8

What Is a W-2?

A W-2 (Wage and Tax Statement) is the form employers issue to employees by January 31 each year. It reports total wages paid and taxes withheld during the prior year.

How W-2 Taxation Works

When you're a W-2 employee:

- Your employer withholds taxes from each paycheck — federal income tax, state income tax, Social Security (6.2%), and Medicare (1.45%)

- Your employer pays a matching amount — 6.2% Social Security + 1.45% Medicare (7.65% total)

- You file Form 1040 reporting your W-2 income

- You reconcile — If too much was withheld, you get a refund. If too little, you owe the balance.

W-2 employee earning $80,000:

Employee pays:

Social Security: $80,000 × 6.2% = $4,960

Medicare: $80,000 × 1.45% = $1,160

Total FICA: $6,120

Employer also pays:

Social Security: $4,960

Medicare: $1,160

Total employer FICA: $6,120

Combined FICA: $12,240 (15.3%)

Employee's share: $6,120 (7.65%)

The employee only sees 7.65% come out of their paycheck, but the total FICA cost is 15.3%.

What Is a 1099-NEC?

A 1099-NEC (Nonemployee Compensation) is the form businesses issue to independent contractors. For 2026, businesses must issue a 1099-NEC to any contractor paid $2,000 or more during the year (up from $600 previously).

How 1099 Taxation Works

When you're a 1099 contractor:

- No taxes are withheld from your payments — you receive the full amount

- You pay self-employment tax on net profit — the full 15.3% (both employer and employee shares)

- You file Schedule C reporting all business income and expenses

- You make quarterly estimated payments throughout the year

1099 contractor earning $80,000 (with $10,000 expenses):

Net profit: $70,000

Self-employment tax: $70,000 × 92.35% × 15.3% = $9,891

Deductible half of SE tax: $4,946

Federal income tax: ~$6,900

Total federal tax: ~$16,791

The contractor pays more in FICA taxes (the full 15.3% instead of 7.65%), but can deduct business expenses that W-2 employees cannot.

For detailed guidance on 1099-NEC reporting, see our 1099-NEC guide.

Tax Comparison: W-2 vs 1099

Here's a direct comparison at $80,000 gross income:

W-2 Employee at $80,000 salary:

Employee FICA: $6,120 (7.65%)

Federal income tax: ~$9,600

Total employee tax: ~$15,720

Take-home: ~$64,280

Employer cost beyond salary: $6,120 (FICA) + benefits

Total cost to employer: ~$90,000-$100,000+

1099 Contractor at $80,000 gross (with $10,000 expenses):

Self-employment tax: $9,891 (15.3% of net)

Federal income tax: ~$6,900

Total tax: ~$16,791

Take-home after taxes and expenses: ~$53,209

Cost to client: $80,000 (no additional taxes or benefits)

Key takeaway: The 1099 contractor pays more in FICA but can deduct business expenses. The client saves on employer taxes and benefits. The total tax burden is roughly similar, but the distribution is different.

The Hidden Advantages for 1099 Workers

1099 contractors have access to deductions that W-2 employees don't:

- Business expenses on Schedule C (home office, equipment, software, mileage)

- QBI deduction — 20% of qualified business income

- Retirement plans — SEP IRA, Solo 401(k) with higher contribution limits

- Health insurance deduction — Above-the-line deduction for premiums

Adjusted comparison at $80,000 gross:

1099 with deductions:

Gross income: $80,000

Business expenses: -$10,000

QBI deduction (20% of $70,000): -$14,000

Self-employed health insurance: -$8,000

Retirement (SEP IRA): -$14,000

Reduced taxable income: $34,000

SE tax: $9,891

Income tax: ~$2,300

Total tax: ~$12,191

The 1099 worker with proper deductions can pay

LESS total tax than the W-2 employee earning the same gross.

Employee vs Contractor: IRS Classification Rules

The IRS uses a multi-factor test to determine whether a worker is an employee or contractor. This matters — misclassifying an employee as a contractor can result in penalties, back taxes, and interest.

The Three-Factor Test

The IRS examines three categories:

1. Behavioral Control

Does the business control HOW the work is done?

| Employee (W-2) | Contractor (1099) |

|---|---|

| Business provides training | Worker uses own methods |

| Business sets hours and schedule | Worker sets own hours |

| Business provides tools and equipment | Worker uses own tools |

| Business dictates work sequence | Worker chooses how to complete tasks |

2. Financial Control

Does the business control the financial aspects of the worker's job?

| Employee (W-2) | Contractor (1099) |

|---|---|

| Paid hourly or salary | Paid per project or flat fee |

| Business reimburses expenses | Worker bears own expenses |

| One employer provides income | Serves multiple clients |

| No investment in facilities | Invests in own equipment/office |

3. Relationship Type

What is the nature of the relationship?

| Employee (W-2) | Contractor (1099) |

|---|---|

| Written employment contract | Written contractor agreement |

| Receives benefits (health, vacation) | No employee benefits |

| Relationship is indefinite | Project-based or term-limited |

| Work is core to the business | Work is supplemental or specialized |

No single factor is decisive. The IRS looks at the total picture. A worker who controls their own schedule but uses company equipment could go either way depending on other factors.

Form SS-8: If you're unsure about classification, you can file Form SS-8 with the IRS to request a determination.

Legal citation: IRS Publication 15-A and IRC §3401(d) define employee classification factors.

2026 Changes: New Reporting Threshold

The biggest 1099-related change for 2026: the 1099-NEC reporting threshold increased from $600 to $2,000.

What This Means

For businesses:

- You only need to issue 1099-NEC forms to contractors paid $2,000 or more (previously $600)

- Fewer 1099s to prepare and file

- Small payments to contractors no longer require a 1099

For contractors:

- You must still report ALL income on your tax return, even if you don't receive a 1099

- Income below $2,000 from a single client is still taxable — the client just doesn't have to report it

- Keep your own records of all payments received

1099-K threshold: Payment processors (PayPal, Venmo, Stripe) must issue 1099-K forms for transactions totaling $2,500+ (this threshold has been adjusted from the originally planned $600 level).

Key Filing Deadlines for 2026

| Form | Deadline | Who Files |

|---|---|---|

| 1099-NEC | January 31, 2027 | Businesses (to contractors and IRS) |

| 1099-K | January 31, 2027 | Payment processors |

| W-2 | January 31, 2027 | Employers (to employees and SSA) |

| Schedule C | April 15, 2027 | Contractors (with Form 1040) |

For Business Owners: Hiring Contractors vs Employees

When to Hire 1099 Contractors

✅ Project-based work with a defined scope and timeline ✅ Specialized skills you don't need year-round ✅ The worker serves multiple clients ✅ You don't need to control how the work gets done ✅ You want to avoid payroll taxes and benefits costs

When to Hire W-2 Employees

✅ Ongoing work that's core to your business ✅ You need to train the worker and control methods ✅ You want the worker dedicated to your business ✅ The work requires set hours or on-site presence ✅ You need workers' compensation and unemployment coverage

Cost Comparison for Businesses

Paying $80,000 for the same work:

Hiring a W-2 employee:

Salary: $80,000

Employer FICA (7.65%): $6,120

Workers' comp insurance: ~$1,200

Unemployment insurance: ~$600

Health insurance contribution: ~$6,000

Retirement match: ~$3,200

TOTAL COST: ~$97,120

Hiring a 1099 contractor:

Payment: $80,000

No FICA, no benefits, no insurance

TOTAL COST: $80,000

Business savings: ~$17,120

The savings are significant, which is exactly why the IRS scrutinizes worker classification. You can't call someone a contractor just to save on payroll costs — the actual working relationship must support the classification.

For detailed guidance on classification, see our employees vs contractors tax guide.

For Workers: Understanding Your Classification

If You Receive a W-2

Your tax situation is relatively straightforward:

- Income tax and FICA are already withheld

- File Form 1040 with your W-2 attached

- You may owe additional tax or receive a refund

- Limited deductions available (standard deduction primarily)

If You Receive 1099s

You're running a business, even if you don't think of it that way:

- Track all income from every client (whether or not they send a 1099)

- Track all business expenses for Schedule C deductions

- Make quarterly estimated payments to avoid underpayment penalties

- Pay self-employment tax (15.3%) on net profit

- Claim the QBI deduction (20% of qualified business income)

- Consider forming an LLC for liability protection

Use our Self-Employment Tax Calculator to estimate your tax liability.

See also: our guides on Schedule C and estimated tax payments.

Common Mistakes to Avoid

Mistake #1: Misclassifying Employees as Contractors

Problem: A business treats full-time workers as 1099 contractors to avoid payroll taxes and benefits — even though the workers have set hours, use company equipment, and take direction from management.

Impact: The IRS can reclassify the workers as employees, resulting in back payroll taxes (employer and employee shares), interest, penalties, and potential criminal charges for willful misclassification. States may add additional penalties.

Solution: Apply the IRS three-factor test honestly. If you control how, when, and where the work is done, the worker is likely an employee.

Mistake #2: Contractor Not Reporting All Income

Problem: A 1099 worker only reports income from clients who sent a 1099, ignoring smaller payments that fell below the reporting threshold.

Impact: The IRS receives copies of 1099s and can match them to your return. But they also receive payment processor data (1099-K). Unreported income can trigger audits, penalties, and interest.

Solution: Track ALL business income, regardless of whether you receive a 1099. The $2,000 threshold is for the payer's reporting obligation — not your tax obligation.

Mistake #3: Contractor Not Making Estimated Payments

Problem: A 1099 worker treats tax like an employee — waiting until April 15 to pay.

Impact: Underpayment penalty (currently ~8% annual rate on the underpaid amount).

Solution: Make quarterly estimated payments. Use the safe harbor: pay 100% of last year's tax in four equal installments (110% if AGI exceeded $150,000).

Mistake #4: Not Having a Written Agreement

Problem: Business engages a contractor without a written contract specifying the relationship, payment terms, and scope.

Impact: Without documentation, it's harder to prove contractor status if the IRS challenges the classification.

Solution: Use a written independent contractor agreement for every 1099 relationship. Include scope, payment terms, term/termination, and a statement that the worker is an independent contractor responsible for their own taxes.

Track Your 1099 Income and Expenses With AI

Whether you're a business managing contractors or a freelancer tracking multiple income sources, accurate record-keeping is essential for tax compliance.

What makes Jupid different:

✅ Automatic income tracking — Our AI identifies and categorizes income from multiple sources, matching payments to clients

✅ Expense categorization at 95.9% accuracy — Every business expense is automatically matched to the correct Schedule C category

✅ Estimated tax reminders — Jupid calculates your quarterly estimated payment and reminds you before deadlines via WhatsApp or iMessage

✅ Bank connection and auto-sync — Connect your business accounts and Jupid tracks every deposit and expense automatically

Example conversation:

- You: "How much 1099 income have I earned this year?"

- Jupid: "Through October, you've received $67,400 from 4 clients. Your largest: Acme Corp ($28,000), Design Co ($18,500), Tech LLC ($14,200), and StartupXYZ ($6,700). After $12,300 in expenses, your net profit is $55,100."

Learn more about how Jupid keeps your business finances organized

Action Checklist

For Business Owners Hiring Workers

- Evaluate each worker using the IRS three-factor test

- Use written contracts for all contractor relationships

- Collect Form W-9 from contractors before first payment

- Issue 1099-NEC by January 31 for contractors paid $2,000+

- Issue W-2 by January 31 for all employees

- File copies with IRS/SSA by the deadline

For 1099 Workers

- Track ALL income from every source (not just 1099'd amounts)

- Keep records of all business expenses with receipts

- Make quarterly estimated tax payments

- File Schedule C with Form 1040

- File Schedule SE for self-employment tax

- Claim QBI deduction on Form 8995

- Consider forming an LLC for liability protection

- Use our Self-Employment Tax Calculator for planning

Resources and Citations

IRS Publications (Official Sources)

- IRS Publication 15-A — Employer's Supplemental Tax Guide (worker classification)

- IRS Publication 334 — Tax Guide for Small Business

- IRS: Independent Contractor vs Employee — Classification overview

- Form SS-8 — Determination of Worker Status

- Form 1099-NEC — Nonemployee Compensation

- Instructions for Form 1099-NEC — Filing requirements

Tax Code and Regulations

- IRC §3401(d) — Definition of employer

- IRC §3121(d) — Definition of employee for FICA

- IRC §1402 — Self-employment tax

- IRC §199A — QBI deduction for pass-through income

- IRC §6721-6722 — Penalties for incorrect information returns

2026 Key Numbers

| Item | 2026 Amount |

|---|---|

| 1099-NEC reporting threshold | $2,000 |

| Self-employment tax rate | 15.3% |

| Social Security wage base | $176,100 |

| Employee FICA rate | 7.65% |

| Employer FICA rate | 7.65% |

| 1099-NEC filing deadline | January 31, 2027 |

| W-2 filing deadline | January 31, 2027 |

| Estimated tax penalty rate | ~8% |

Final Thoughts

The 1099 vs W-2 distinction is fundamentally about the nature of the working relationship — not a choice you make for tax convenience. Employers don't get to pick which classification saves them money. Workers don't get to choose which form they'd prefer.

The key strategies:

- For businesses — Classify workers correctly based on the IRS three-factor test, not on what's cheaper. The penalties for misclassification far exceed any tax savings.

- For 1099 workers — Treat yourself as a business. Track income, maximize deductions, make estimated payments, and use the QBI deduction.

- For everyone — Keep documentation. Written contracts, payment records, and proper tax forms protect both sides of the relationship.

Disclaimer

This article provides general information about worker classification and tax forms and should not be considered tax or legal advice. Worker classification is fact-specific and depends on the actual working relationship, not the preferred label of either party. The IRS and state agencies may reach different conclusions about the same worker. For advice specific to your situation, consult with a qualified tax professional or employment attorney.

Tax Year: 2026 Last Updated: February 8, 2026

Ready to simplify your finances?

Join 1,000+ businesses using Jupid to save time and money. Start simplifying your finances today.

30-day money-back guarantee