Form 1099-NEC Guide: What Freelancers Need to Know 2026

Table of Contents

Hi, I'm Slava, CEO and co-founder of Jupid. Every January, millions of freelancers and contractors receive their 1099-NECs—and many are surprised by what they see. The income looks familiar, but the tax implications often aren't. If you received a 1099-NEC, you're not an employee—you're self-employed, and that changes everything about how you file your taxes.

This guide explains what Form 1099-NEC means, what to do when you receive one (or several), and how to properly report this income on your tax return.

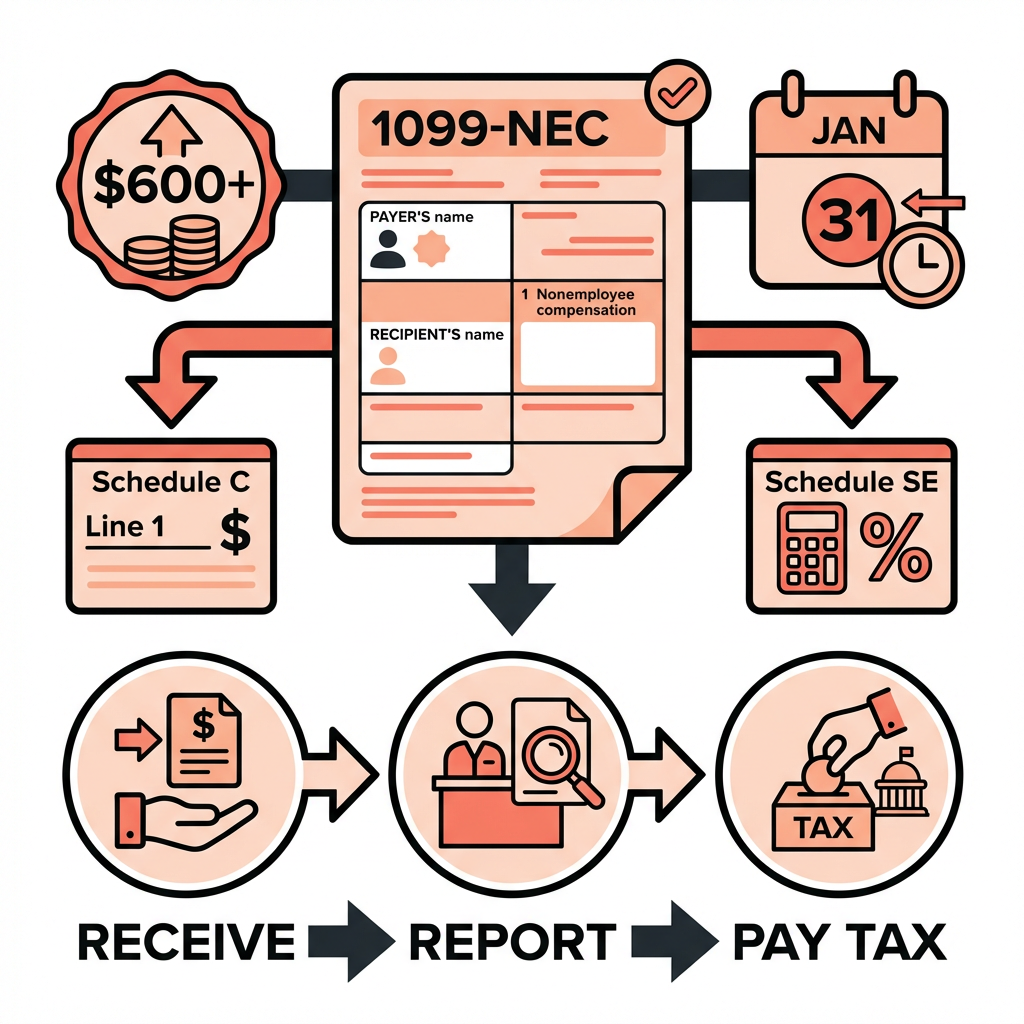

What Is Form 1099-NEC?

Form 1099-NEC (Nonemployee Compensation) reports payments made to independent contractors, freelancers, and other self-employed individuals. It was reintroduced in 2020 after a 40-year hiatus, replacing the "nonemployee compensation" box on Form 1099-MISC.

"NEC" stands for: Nonemployee Compensation

Who sends it: Businesses that paid you $600 or more for services during the year

Who receives it: Freelancers, independent contractors, consultants, gig workers, and any self-employed individuals

Legal Basis: IRC §6041 requires information returns for payments of $600 or more in the course of a trade or business.

Executive Summary: 1099-NEC Key Facts 2026

| Item | Details |

|---|---|

| Reporting threshold | $600 or more |

| Deadline to receive | January 31, 2026 |

| Where to report | Schedule C, Line 1 |

| Also required | Schedule SE (if profit > $400) |

| Estimated tax payments | Required if owe > $1,000 |

| Key difference from W-2 | No taxes withheld; you're responsible |

Legal Basis: IRC §6041, IRC §6721 (penalties); IRS Instructions for Forms 1099-MISC and 1099-NEC

Who Receives a 1099-NEC?

You'll receive Form 1099-NEC if:

✅ You provided services to a business (not as an employee) ✅ You were paid $600 or more during the year ✅ The payment was for services, not products

Common Recipients

- Freelancers: Writers, designers, developers, marketers

- Consultants: Business, management, IT consultants

- Contractors: Construction, repair, professional services

- Gig workers: Uber, Lyft (some income), DoorDash, TaskRabbit

- Professional service providers: Attorneys, accountants, healthcare providers

- Creatives: Photographers, videographers, musicians

- Influencers: Paid promotions, sponsored content

You Won't Receive a 1099-NEC If:

❌ You were paid less than $600 by that client ❌ You were a W-2 employee (you'll get a W-2 instead) ❌ You were paid via credit card/PayPal (1099-K instead) ❌ You're a corporation (with some exceptions)

Important: Even if you don't receive a 1099-NEC, you must still report all income. The $600 threshold is for reporting requirements, not tax obligations.

What Does the 1099-NEC Show?

A 1099-NEC contains several key pieces of information:

Box 1: Nonemployee Compensation

The total amount you were paid for services. This is the most important number—it's what you'll report as income.

Box 1: $15,000

Box 2: Reserved for Future Use

Currently blank.

Box 4: Federal Income Tax Withheld

In rare cases, if backup withholding was applied (usually because you didn't provide a correct TIN), this shows taxes already withheld. Most freelancers will see $0 here.

Box 5-7: State Information

If applicable, shows state ID, state income, and state tax withheld.

Payer Information

The company or individual who paid you, including their:

- Name and address

- Taxpayer Identification Number (TIN)

- Phone number (sometimes)

Recipient Information

Your information:

- Name and address

- Social Security Number or EIN

What to Do When You Receive a 1099-NEC

Step 1: Verify the Information

Check that all information is correct:

- Your name and address

- Your Social Security Number or EIN

- The amount in Box 1

If the amount seems wrong: Review your invoices and payment records for that client. The 1099 should match total payments received (not invoiced—received).

Step 2: Collect All Your 1099-NECs

If you worked for multiple clients, you'll receive multiple 1099-NECs. Wait until you have all of them before filing (deadline is January 31).

What if you're missing one?

- Contact the client/company directly

- File your return with your best records

- Report all income even without a 1099

Step 3: Calculate Your Total Income

Add up Box 1 from all 1099-NECs, plus any income under $600 that wasn't reported on a 1099.

Client A: $15,000 (1099-NEC)

Client B: $8,500 (1099-NEC)

Client C: $450 (no 1099—still report it)

Total income: $23,950

Step 4: Gather Your Business Expenses

Before you panic about the tax bill, remember: You can deduct legitimate business expenses. Common deductions include:

- Home office expenses

- Computer and equipment

- Software subscriptions

- Professional development

- Business travel

- Marketing and advertising

- Professional services (accounting, legal)

- Health insurance (separate deduction)

See our Schedule C Instructions Guide 2026 for complete expense categories.

Step 5: Report on Your Tax Return

1099-NEC income is reported on Schedule C (Profit or Loss From Business), which flows to your Form 1040.

How to Report 1099-NEC Income

Schedule C: Profit or Loss From Business

Line 1: Enter your total gross receipts (all 1099-NEC amounts plus unreported income)

Lines 8-27: Enter your business expenses

Line 31: Net profit (or loss) = Gross income minus expenses

Example:

Total 1099-NEC income: $75,000

Business expenses: $15,000

Net profit (Line 31): $60,000

This net profit flows to:

- Schedule 1, Line 3: Added to your other income

- Schedule SE: Used to calculate self-employment tax

Schedule SE: Self-Employment Tax

If your Schedule C net profit exceeds $400, you must file Schedule SE to calculate self-employment tax.

Self-employment tax rate: 15.3% (on 92.35% of net earnings)

Net profit: $60,000

Net SE earnings: $60,000 × 0.9235 = $55,410

SE Tax: $55,410 × 15.3% = $8,478

See our Schedule SE Instructions Guide 2026 for detailed calculations.

Form 1040: Your Tax Return

Your Schedule C profit appears on Form 1040 as part of your total income. Combined with any W-2 income or other sources, this determines your income tax.

Don't forget:

- Deduct half of SE tax on Schedule 1, Line 15

- Report estimated tax payments already made on Line 26

1099-NEC vs. 1099-MISC: What's the Difference?

The IRS split these forms in 2020. Here's how they differ:

| Type of Payment | Form |

|---|---|

| Freelance/contractor services | 1099-NEC |

| Rent payments | 1099-MISC |

| Prizes and awards | 1099-MISC |

| Royalties | 1099-MISC |

| Medical/healthcare payments | 1099-MISC |

| Fishing boat proceeds | 1099-MISC |

| Attorney payments (non-services) | 1099-MISC |

The key distinction: 1099-NEC is specifically for services you performed. 1099-MISC covers various other types of income.

1099-NEC vs. 1099-K: What's the Difference?

You may also receive a 1099-K if you were paid through payment processors.

| Payment Method | Form |

|---|---|

| Direct payment (check, ACH, wire) | 1099-NEC |

| Credit card | 1099-K |

| PayPal, Venmo | 1099-K |

| Stripe, Square | 1099-K |

| Platform payments (Uber, Etsy) | 1099-K |

Important: If you're paid via payment processor, you generally receive a 1099-K instead of (not in addition to) a 1099-NEC. Don't double-count!

1099-K threshold for 2026: $600 (reduced from the original $20,000/200 transactions)

Estimated Taxes for 1099 Workers

Unlike W-2 employees, freelancers don't have taxes automatically withheld. You're responsible for paying throughout the year via quarterly estimated payments.

Who Must Pay Estimated Taxes?

If you expect to owe $1,000 or more in taxes (after withholding from any W-2 jobs), you should make estimated payments.

2026 Quarterly Deadlines

| Quarter | Income Period | Due Date |

|---|---|---|

| Q1 | Jan-Mar | April 15, 2026 |

| Q2 | Apr-May | June 16, 2026 |

| Q3 | Jun-Aug | September 15, 2026 |

| Q4 | Sep-Dec | January 15, 2027 |

How Much to Pay

Quick estimate: Set aside 25-30% of your net profit (after expenses) for taxes.

Net profit: $60,000

Estimated taxes needed: $60,000 × 30% = $18,000

Quarterly payment: $4,500

For detailed guidance, see our Form 1040-ES Instructions Guide 2026.

What If the 1099-NEC Is Wrong?

Amount Is Incorrect

- Contact the payer immediately

- Request a corrected 1099-NEC

- If they refuse/don't respond, file with your correct amount

- Attach a statement explaining the discrepancy

You Didn't Receive a 1099

- Contact the payer and request a copy

- If still not received by mid-February, call the IRS (1-800-829-1040)

- File with your best records

- Report all income regardless

Wrong SSN/TIN

- Contact the payer immediately for correction

- A wrong SSN could cause IRS matching issues

- May result in backup withholding next year if not corrected

Common Mistakes to Avoid

Mistake #1: Not Reporting Income Without a 1099

Problem: Client paid you $500, no 1099 required, you don't report it.

Impact: The IRS may not catch it immediately, but it's still tax evasion.

Solution: Report ALL income, whether you received a 1099 or not.

Mistake #2: Confusing Gross Income with Net Profit

Problem: Receiving $75,000 in 1099s and thinking you owe taxes on $75,000.

Impact: Overpaying taxes or panicking unnecessarily.

Solution: Deduct your legitimate business expenses first. You're taxed on profit, not revenue.

Mistake #3: Not Making Estimated Payments

Problem: Waiting until April to pay all taxes owed.

Impact: Underpayment penalties plus a large tax bill.

Solution: Make quarterly estimated payments throughout the year.

Mistake #4: Double-Counting 1099-K and 1099-NEC

Problem: Same income reported on both a 1099-NEC and 1099-K.

Impact: Reporting income twice, overpaying taxes.

Solution: Understand which form covers which payments. Generally, payment-processor income (1099-K) replaces 1099-NEC for those payments.

Mistake #5: Missing Deductions

Problem: Only reporting income, not claiming business expenses.

Impact: Paying significantly more tax than necessary.

Solution: Track and deduct all ordinary and necessary business expenses.

Tax Deductions for 1099 Workers

As a 1099 contractor, you can deduct business expenses to reduce your taxable income. Common deductions include:

Home Office

- Simplified: $5/sq ft, max $1,500

- Regular: Actual expenses × business %

- See our Form 8829 Instructions Guide 2026

Vehicle/Mileage

- 2026 rate: 72.5 cents/mile

- OR actual vehicle expenses

- See our Car and Mileage Deduction Guide 2026

Equipment and Software

- Computers, phones, tablets

- Software subscriptions

- Section 179 for larger purchases

- See our Section 179 Depreciation Guide 2026

Health Insurance

- 100% deductible for self-employed

- Deducted on Schedule 1 (not Schedule C)

- See our Health Insurance Deduction Guide 2026

Retirement Contributions

- SEP-IRA, Solo 401(k), SIMPLE IRA

- Reduce income tax (not SE tax)

- See our Retirement Plan Deductions Guide 2026

Professional Services

- Accounting and bookkeeping

- Legal fees

- Business consulting

Education and Training

- Courses related to your business

- Professional development

- Industry conferences

Manage Your 1099 Income With AI

Tracking multiple 1099s, calculating expenses, and managing quarterly payments can be overwhelming. Most freelancers either spend hours on spreadsheets or miss deductions that could save thousands.

What makes Jupid different:

✅ Automatic income tracking — We import your 1099 amounts and match them to your bank transactions

✅ Expense categorization — Every business expense automatically sorted into the right Schedule C line

✅ Quarterly tax estimates — Real-time calculations of what you owe and when

✅ 1099 reconciliation — We flag discrepancies between what clients reported and what you received

✅ Chat with your AI accountant — Ask questions like "How much do I owe in estimated taxes?" and get instant, accurate answers

Example conversation:

- You: "I received three 1099-NECs totaling $82,000. What's my estimated tax?"

- Jupid: "Based on $82,000 in gross income and $14,200 in deductible expenses I've tracked, your net profit is $67,800. Your estimated tax liability is approximately $19,100 ($8,600 income tax + $10,500 self-employment tax). You should make quarterly payments of about $4,775."

Stop guessing about your 1099 taxes. Know exactly what you owe, when.

Action Checklist: 1099-NEC Tax Filing

When You Receive 1099-NECs (January)

- Verify all information is correct

- Check amounts match your records

- Request corrections if needed

- Compile all 1099s from all clients

Before Filing

- Add up all 1099-NEC income

- Add any income below $600 (not on 1099s)

- Gather all business expense records

- Calculate net profit (income minus expenses)

When Filing

- Complete Schedule C with income and expenses

- File Schedule SE if net profit > $400

- Report Schedule C profit on Form 1040

- Deduct half of SE tax on Schedule 1

- Report any estimated payments made

Throughout the Year

- Track all business income

- Save receipts for expenses

- Make quarterly estimated payments

- Update W-4 if you also have a W-2 job

Resources and Citations

IRS Forms and Instructions

- Form 1099-NEC — Nonemployee Compensation

- Instructions for Forms 1099-MISC and 1099-NEC — Combined instructions

- Schedule C (Form 1040) — Profit or Loss From Business

- Schedule SE (Form 1040) — Self-Employment Tax

IRS Publications

- Publication 334 — Tax Guide for Small Business

- Publication 505 — Tax Withholding and Estimated Tax

- Publication 535 — Business Expenses

Tax Code References

- IRC §6041 — Information returns ($600+ payments)

- IRC §6721 — Penalties for failure to file correct information returns

- IRC §162 — Trade or business expenses

Final Thoughts

Receiving a 1099-NEC means you're running a business—even if it's just you. The IRS treats you as self-employed, with all the responsibilities and opportunities that brings:

- You're responsible for your own taxes — No employer withholds for you

- You can deduct business expenses — This significantly reduces what you owe

- You pay self-employment tax — 15.3% on top of income tax

- You should make quarterly payments — Avoid penalties by paying as you earn

- You have retirement options — SEP-IRA, Solo 401(k) with higher limits than employees

The 1099-NEC is just the starting point. What matters is how you manage the income, expenses, and taxes throughout the year.

Disclaimer

This article provides general information about tax filing and should not be considered tax advice. Tax laws change frequently, and individual circumstances vary significantly. For advice specific to your situation, consult with a qualified tax professional.

Tax Year: 2026 Last Updated: January 31, 2026

Ready to simplify your finances?

Join 1,000+ businesses using Jupid to save time and money. Start simplifying your finances today.

30-day money-back guarantee