Estimated Tax Penalty 2026: How to Avoid It and What to Do If You Owe

Table of Contents

Published: February 11, 2026 Tax Year: 2026

A Message from Slava

The estimated tax penalty is one of those IRS rules that punishes people for not knowing about it. You earn self-employment income, you file your return on time, you pay everything you owe — and then the IRS tacks on an extra charge because you didn't pay quarterly.

When I launched Jupid, I learned about this penalty the hard way. My first year of US self-employment income came after years of working in the UK, where the payment-on-account system works differently. I paid my full tax bill by the filing deadline and assumed that was enough. It wasn't. The IRS assessed a penalty because I hadn't made quarterly installments throughout the year.

At Anna Money, where we served 60,000+ small businesses, I saw the UK equivalent — interest on late payments — catch business owners by surprise regularly. The US version is more structured: the IRS treats each quarter separately and charges a penalty on each underpaid quarter independently.

The good news is that the penalty is entirely avoidable. The safe harbor rules give you a clear, predictable way to pay enough each quarter so the penalty never applies — even if your actual tax ends up being much higher than your payments. This guide covers exactly how the penalty works, who owes it, how to avoid it, and what to do if you're already facing one.

Executive Summary: Estimated Tax Penalty for 2026

What is the estimated tax penalty? A charge the IRS assesses when you don't pay enough tax throughout the year via quarterly estimated payments or withholding.

2026 Penalty Overview:

| Factor | Details |

|---|---|

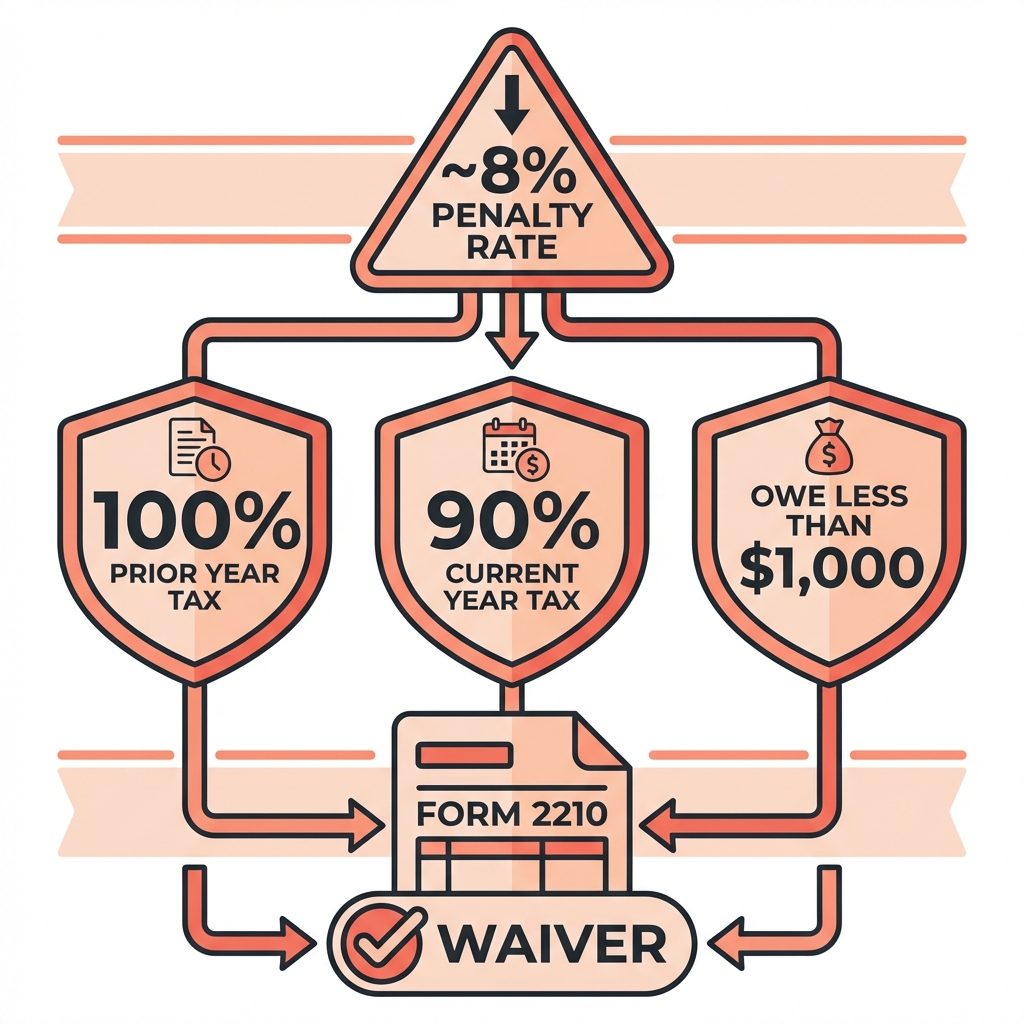

| Penalty rate | ~8% annual rate (adjusted quarterly by IRS) |

| Who owes it | Anyone who owes $1,000+ at filing time and didn't meet safe harbor |

| How it's calculated | Per quarter, on the underpaid amount, from due date to payment date |

| Safe harbor (standard) | Pay 100% of prior year's total tax in four installments |

| Safe harbor (high income) | Pay 110% if prior year AGI exceeded $150,000 |

| Current year alternative | Pay 90% of current year's actual tax |

| Form to calculate/waive | Form 2210 (Underpayment of Estimated Tax) |

Key point: The penalty is not discretionary. The IRS calculates it automatically when you file. You don't receive a separate notice — it's added to your tax bill.

Legal basis: IRC §6654 (estimated tax penalty), IRS Publication 505, Form 2210

What Is the Estimated Tax Penalty?

The estimated tax penalty — formally called the "underpayment of estimated tax penalty" — is a charge the IRS imposes when you fail to pay enough tax during the year through quarterly estimated payments or withholding.

The US tax system operates on a pay-as-you-go basis. W-2 employees have taxes withheld from every paycheck. Self-employed individuals, investors, retirees, and anyone with income that doesn't have withholding must make quarterly estimated payments instead.

If your quarterly payments fall short of the required amount, the IRS charges a penalty on the difference — calculated separately for each quarter.

This is not a late-filing penalty. You can file your return on time and still owe the estimated tax penalty if you didn't pay enough during the year. It's also separate from the late-payment penalty (which applies when you don't pay your balance due by April 15).

Legal citation: IRC §6654 governs the penalty for underpayment of estimated income tax by individuals.

Who Owes the Estimated Tax Penalty?

You're at Risk If You Are:

- Self-employed — Sole proprietors, freelancers, independent contractors, gig workers, single-member LLC owners

- A partner or S Corp shareholder — Receiving K-1 income without adequate withholding

- An investor — Earning dividends, capital gains, or rental income without withholding

- A retiree — Receiving pension or IRA distributions without sufficient withholding

- A W-2 employee with side income — If your W-2 withholding doesn't cover your total tax liability

You Won't Owe the Penalty If:

✅ You owe less than $1,000 at filing time (after subtracting withholding and credits)

✅ You paid at least 90% of your current year's tax liability through estimated payments and withholding

✅ You paid at least 100% of your prior year's total tax liability (110% if prior year AGI exceeded $150,000)

✅ You had no tax liability in the prior year (you were a US citizen/resident for the full year and your total tax was $0)

Legal citation: IRC §6654(e) lists the exceptions to the estimated tax penalty.

How the Penalty Rate Works

The IRS sets the estimated tax penalty rate quarterly. It's based on the federal short-term rate plus 3 percentage points.

For 2026, the penalty rate is approximately 8% annually. This rate is applied to each quarter's underpayment separately.

How the rate is applied:

The penalty runs from the due date of the quarterly payment to the earlier of:

- The date the underpayment is actually paid, or

- April 15 of the following year (the filing deadline)

Example: Q1 penalty calculation

Required Q1 payment: $5,000

Actual Q1 payment: $2,000

Underpayment: $3,000

Penalty period: April 15, 2026 to April 15, 2027 = 12 months

Penalty: $3,000 × 8% × (12/12) = $240

If you catch up and pay the $3,000 on June 15:

Penalty period: April 15 to June 15 = 2 months

Penalty: $3,000 × 8% × (2/12) = $40

The penalty is calculated separately for each quarter. Missing Q1 and catching up in Q2 results in a smaller penalty than missing all four quarters.

Legal citation: IRC §6621(a)(2) sets the underpayment rate at the federal short-term rate plus 3 percentage points.

How the Penalty Is Calculated: Quarter by Quarter

The IRS doesn't look at your total annual payments and compare them to your total tax. It examines each quarter independently.

The Four Quarterly Periods

| Quarter | Income Period | Payment Due Date | Penalty Runs Through |

|---|---|---|---|

| Q1 | Jan 1 - Mar 31 | April 15, 2026 | April 15, 2027 (or earlier payment date) |

| Q2 | Apr 1 - May 31 | June 15, 2026 | April 15, 2027 (or earlier payment date) |

| Q3 | Jun 1 - Aug 31 | September 15, 2026 | April 15, 2027 (or earlier payment date) |

| Q4 | Sep 1 - Dec 31 | January 15, 2027 | April 15, 2027 (or earlier payment date) |

Required Payment Per Quarter

For each quarter, you must pay at least 25% of either:

- 90% of your current year's tax, OR

- 100% of your prior year's tax (110% if prior year AGI > $150,000)

Example: Full-year penalty calculation

Annual tax liability: $24,000

Prior year tax: $18,000

Prior year AGI: $120,000 (under $150,000)

Required quarterly payment (safe harbor): $18,000 ÷ 4 = $4,500

Actual payments: Q1: $2,000 | Q2: $2,000 | Q3: $2,000 | Q4: $2,000

Underpayment per quarter: $4,500 - $2,000 = $2,500

Q1 penalty: $2,500 × 8% × (12/12) = $200

Q2 penalty: $2,500 × 8% × (10/12) = $167

Q3 penalty: $2,500 × 8% × (7/12) = $117

Q4 penalty: $2,500 × 8% × (3/12) = $50

Total penalty: $534

This is in addition to the $6,000 balance due ($24,000 total tax minus $8,000 in payments minus any refundable credits).

The Safe Harbor Rules: Your Penalty Shield

Safe harbor rules are the most reliable way to avoid the estimated tax penalty. If you meet either safe harbor threshold, the IRS cannot assess a penalty — regardless of how much you actually owe at filing time.

Safe Harbor #1: Prior Year Tax (Most Popular)

Pay 100% of your prior year's total tax liability in four equal quarterly installments.

Prior year total tax (Form 1040, Line 24): $20,000

Quarterly payment: $20,000 ÷ 4 = $5,000

Pay $5,000 on April 15, June 15, September 15, January 15 → No penalty

If your prior year AGI exceeded $150,000 ($75,000 if married filing separately), the threshold increases to 110%:

Prior year total tax: $30,000

Prior year AGI: $200,000 (exceeds $150,000)

Safe harbor: $30,000 × 110% = $33,000

Quarterly payment: $33,000 ÷ 4 = $8,250

This method works because you know last year's tax with certainty. There's no guessing or estimating required.

Legal citation: IRC §6654(d)(1)(B) establishes the prior year safe harbor. IRC §6654(d)(1)(C) establishes the 110% threshold for high-income taxpayers.

Safe Harbor #2: Current Year Tax

Pay 90% of your current year's actual tax liability in four installments.

Actual 2026 tax: $25,000

Required payments: $25,000 × 90% = $22,500

Quarterly payment: $22,500 ÷ 4 = $5,625

This method carries risk: if you underestimate your income and pay less than 90% of actual tax, the penalty applies. The prior year method is safer because you know the exact number in advance.

Legal citation: IRC §6654(d)(1)(A) defines the current year payment requirement.

Which Safe Harbor to Use?

| Situation | Best Safe Harbor |

|---|---|

| Income increasing this year | Prior year (pay less, no penalty) |

| Income decreasing this year | Current year (pay less based on lower income) |

| Income unpredictable | Prior year (certain number, guaranteed protection) |

| First year self-employed | Current year (no prior year SE return to reference) |

Four Exceptions That Eliminate the Penalty

Beyond the safe harbor rules, four specific exceptions can eliminate the penalty entirely:

Exception 1: De Minimis Rule

If you owe less than $1,000 at filing time, no penalty applies. The IRS calculates this as your total tax minus withholding and credits.

Total tax: $18,000

Withholding from W-2: $15,000

Estimated payments: $2,200

Total payments: $17,200

Balance due: $800 → Under $1,000 → No penalty

This exception helps W-2 employees with small amounts of side income.

Legal citation: IRC §6654(e)(1)

Exception 2: No Prior Year Tax Liability

If your total tax in the prior year was $0 and you were a US citizen or resident for the entire prior year, no penalty applies for the current year — regardless of how much you owe.

This commonly applies to:

- People who had no income in the prior year

- Those whose deductions and credits wiped out all tax liability

- Individuals who were students or not working in the prior year

Legal citation: IRC §6654(e)(2)

Exception 3: Casualty, Disaster, or Unusual Circumstance

The IRS can waive the penalty if the underpayment was caused by a casualty event, disaster, or other unusual circumstance where imposing the penalty would be inequitable.

Examples:

- Natural disaster that disrupted your business

- Federally declared disaster affecting your area

- Significant financial hardship caused by events beyond your control

You must apply for this waiver — it's not automatic. Use Form 2210 and attach documentation.

Legal citation: IRC §6654(e)(3)(A)

Exception 4: Newly Retired or Disabled

If you retired (after reaching age 62) or became disabled during the tax year or the prior tax year, and the underpayment was due to reasonable cause rather than willful neglect, the IRS may waive the penalty.

This exception recognizes that newly retired or disabled individuals may not immediately adjust to making estimated payments on retirement income.

Legal citation: IRC §6654(e)(3)(B)

How to Request a Penalty Waiver: Form 2210

Form 2210 (Underpayment of Estimated Tax by Individuals, Estates, and Trusts) serves two purposes:

- Calculate the penalty you owe (if any)

- Request a waiver if you qualify for an exception

When You Must File Form 2210

You're required to file Form 2210 if:

- You owe a penalty and want to use the annualized income installment method to reduce it

- You're requesting a waiver based on casualty, disaster, or retirement/disability

- You want to show that you owed no penalty even though your payments were unequal (using the annualized income method)

When You Don't Need to File Form 2210

The IRS will calculate the penalty for you and send a notice if:

- You want the IRS to figure the penalty using the regular method

- You're not requesting a waiver

- You're not using the annualized income method

In most cases, you can skip Form 2210 entirely and let the IRS calculate the penalty. They'll send you a bill.

How to Request a Waiver

Step 1: Check Box A, B, C, or D in Part II of Form 2210 to indicate which exception applies

Step 2: Complete Schedule AI (Annualized Income Installment Method) if applicable

Step 3: Attach supporting documentation for casualty, disaster, or retirement/disability exceptions

Step 4: File Form 2210 with your Form 1040

Pro tip: If you're requesting a waiver for reasonable cause, write a clear explanation letter. Include specific dates, amounts, and circumstances. The IRS reviews these requests manually.

Common Scenarios With Calculations

Scenario 1: Freelancer Who Didn't Know About Quarterly Payments

Situation: A graphic designer earned $85,000 in net self-employment income in 2026. She made no estimated payments and had no withholding. Prior year tax: $0 (first year self-employed).

Self-employment tax: $85,000 × 92.35% × 15.3% = $12,001

Federal income tax (single, standard deduction): ~$7,200

Total tax: ~$19,201

Required quarterly payment (90% current year): $19,201 × 90% = $17,281

Per quarter: $17,281 ÷ 4 = $4,320

Underpayment per quarter: $4,320

Q1 penalty: $4,320 × 8% × (12/12) = $346

Q2 penalty: $4,320 × 8% × (10/12) = $288

Q3 penalty: $4,320 × 8% × (7/12) = $202

Q4 penalty: $4,320 × 8% × (3/12) = $86

Total penalty: $922

Total owed at filing: $19,201 + $922 = $20,123

Lesson: The $922 penalty is avoidable with quarterly payments. For guidance on setting up quarterly payments, see our quarterly estimated taxes guide.

Scenario 2: W-2 Employee With Significant Side Income

Situation: A software engineer earns $120,000 W-2 salary with $25,000 withholding. He also earns $40,000 from freelance consulting. Prior year total tax: $28,000.

Prior year tax: $28,000

Prior year AGI: $145,000 (under $150,000)

Required safe harbor payment: $28,000 ÷ 4 = $7,000/quarter

W-2 withholding per quarter: $25,000 ÷ 4 = $6,250

Additional estimated payment needed: $7,000 - $6,250 = $750/quarter

If he pays $750/quarter in estimated payments: No penalty

If he pays nothing: $750 × 4 quarters underpaid → Penalty of ~$180

Lesson: W-2 withholding counts toward the safe harbor. You only need estimated payments for the gap. Alternatively, increase your W-2 withholding by filing a new W-4.

Scenario 3: Business Owner With Seasonal Income

Situation: A landscaping business earns most of its income in Q2 and Q3. Annual net profit: $120,000. Prior year tax: $30,000. Prior year AGI: $110,000.

Income by quarter:

Q1: $5,000

Q2: $45,000

Q3: $50,000

Q4: $20,000

Using prior year safe harbor: $30,000 ÷ 4 = $7,500/quarter

Pay $7,500 each quarter regardless of when income arrives → No penalty

Using annualized income method (Form 2210, Schedule AI):

Q1 required: Based on $5,000 annualized → Lower payment

Q2 required: Based on $50,000 cumulative annualized → Higher payment

Q3 required: Based on $100,000 cumulative annualized → Higher payment

Q4 required: Based on $120,000 actual → Highest payment

Lesson: The annualized income method lets seasonal businesses pay less in slow quarters without penalty. But the prior year safe harbor is simpler and still works.

Scenario 4: High-Income Consultant

Situation: A management consultant earned $300,000 net profit in 2025 and expects $350,000 in 2026. Prior year AGI: $290,000 (over $150,000 threshold).

Prior year total tax: $85,000

Safe harbor (110%): $85,000 × 110% = $93,500

Quarterly payment: $93,500 ÷ 4 = $23,375

Pay $23,375 each quarter → No penalty, even if actual 2026 tax is $110,000+

Remaining balance at filing: $110,000 - $93,500 = $16,500

(Due by April 15, but no penalty on this amount)

Lesson: High-income taxpayers must use the 110% threshold, but it still provides penalty protection regardless of how much actual tax increases.

The Annualized Income Installment Method

If your income arrives unevenly throughout the year, the annualized income installment method prevents you from being penalized for low payments in quarters when you earned little.

How It Works

Instead of dividing your annual tax by four, you calculate your actual tax liability based on income earned through each quarterly cutoff, then annualize it.

| Period | Months | Annualization Factor |

|---|---|---|

| January 1 - March 31 | 3 | × 4 |

| January 1 - May 31 | 5 | × 2.4 |

| January 1 - August 31 | 8 | × 1.5 |

| January 1 - December 31 | 12 | × 1 |

Example: Consultant who earned $10,000 in Q1 and $60,000 in Q2

Q1 annualized income: $10,000 × 4 = $40,000

Q1 annualized tax: ~$7,500

Q1 required payment: $7,500 × 22.5% = $1,688

Q2 annualized income: $70,000 × 2.4 = $168,000

Q2 annualized tax: ~$42,000

Q2 required cumulative: $42,000 × 45% = $18,900

Q2 payment: $18,900 - $1,688 = $17,212

When to Use This Method

✅ Seasonal businesses with most income in certain quarters

✅ Real estate agents with large commission checks in specific months

✅ Consultants who complete major projects at irregular intervals

✅ Anyone whose income pattern would result in penalties under the equal-payment method

❌ Not worth the complexity if the prior year safe harbor eliminates your penalty

You report this method on Form 2210, Schedule AI.

Strategies to Eliminate or Reduce the Penalty

Strategy 1: Increase W-2 Withholding

If you have a W-2 job in addition to self-employment income, you can increase your withholding by submitting a new Form W-4 to your employer. W-2 withholding is treated as paid evenly throughout the year — even if the extra withholding happens entirely in Q4.

This is a powerful strategy because it retroactively covers earlier quarters. If you realize in October that you're short on estimated payments, increasing W-2 withholding for the rest of the year can eliminate penalties for Q1-Q3.

Strategy 2: Make a Late Payment (Better Than No Payment)

The penalty is calculated from the due date to the payment date. A late payment reduces the penalty compared to waiting until April 15.

Q1 payment due: $5,000 on April 15

You pay $0 on April 15 and $5,000 on July 15

Penalty with late payment: $5,000 × 8% × (3/12) = $100

Penalty if you wait until April 15 next year: $5,000 × 8% × (12/12) = $400

Savings from late payment: $300

Strategy 3: Catch-Up Payments

You can make estimated payments at any time. If you missed Q1, pay the Q1 amount along with Q2 on the Q2 due date. The penalty for Q1 will be smaller because the underpayment lasted only two months instead of twelve.

Strategy 4: Apply Prior Year Refund

When you file your prior year return, you can choose to apply any refund to your current year's estimated tax. This is applied to Q1 automatically.

Common Mistakes to Avoid

Mistake #1: Assuming the Penalty Is Avoidable After the Fact

Problem: A self-employed person misses all quarterly payments, then assumes they can file an extension to avoid the penalty.

Impact: Filing an extension extends the time to file your return — not the time to pay. The estimated tax penalty is based on quarterly payment dates, not your filing date. An extension does nothing to reduce or eliminate this penalty.

Solution: Make quarterly payments on time. If you've already missed payments, make a catch-up payment as soon as possible to shorten the penalty period.

Mistake #2: Confusing the $1,000 Threshold

Problem: A business owner thinks the $1,000 threshold means they only owe a penalty if the penalty itself exceeds $1,000.

Impact: Misunderstanding leads to no quarterly payments. The $1,000 threshold applies to the tax owed at filing time — not the penalty amount. If you owe more than $1,000 at filing and didn't meet safe harbor, the penalty applies.

Solution: The $1,000 test is simple: total tax minus (withholding + estimated payments + refundable credits). If the result is $1,000 or more, you needed to make estimated payments.

Mistake #3: Forgetting Self-Employment Tax in the Calculation

Problem: A freelancer calculates estimated payments based only on income tax brackets, forgetting that self-employment tax adds 15.3% on net earnings.

Impact: Underpaying by 30-50% of actual liability. At $80,000 net profit, SE tax alone is $11,304 — often larger than income tax for single filers.

Solution: Always include both income tax and SE tax when calculating estimated payments. Use our Self-Employment Tax Calculator for accurate numbers.

Mistake #4: Not Tracking the 110% Threshold

Problem: A business owner with $160,000 AGI in the prior year uses 100% of prior year tax as the safe harbor.

Impact: Since the prior year AGI exceeded $150,000, the safe harbor threshold is 110%, not 100%. Paying only 100% leaves the taxpayer exposed to a penalty on the 10% difference.

Solution: Check your prior year AGI. If it exceeded $150,000 (or $75,000 married filing separately), multiply the prior year tax by 110% for the correct safe harbor amount.

Mistake #5: Ignoring State Estimated Tax Penalties

Problem: Making federal estimated payments on time but forgetting that most states also require quarterly payments with their own penalty rules.

Impact: State-level underpayment penalties (rates and rules vary by state). Some states have lower thresholds and higher rates than the IRS.

Solution: Check your state's estimated tax requirements. Most states follow the same quarterly deadlines but may have different safe harbor rules. Pay both federal and state estimated taxes quarterly.

Manage Your Estimated Tax Payments With AI

Avoiding the estimated tax penalty requires tracking your income in real time and calculating the right quarterly payment — not guessing at the start of the year.

What makes Jupid different:

Jupid is an AI-powered financial assistant built specifically for self-employed individuals and small business owners. It handles the math that causes penalties.

✅ Automatic quarterly tax calculations — Jupid monitors your income and expenses throughout the year to calculate exactly what you owe each quarter

✅ Safe harbor tracking — Jupid knows your prior year tax and tells you whether you're on track to meet the 100% or 110% safe harbor threshold

✅ Payment deadline reminders via WhatsApp or iMessage — Get alerts before each quarterly deadline so you never miss a payment

✅ 95.9% categorization accuracy — Your expenses are automatically categorized, so your net profit calculation (and estimated tax) is accurate

✅ Bank connection and auto-sync — Connect your business accounts and Jupid monitors your running tax liability in real time

Example conversation:

- You: "Am I going to owe a penalty this year?"

- Jupid: "You've paid $12,000 in estimated taxes through Q2. Your prior year tax was $22,000, so your safe harbor is $22,000. You need $5,500 each in Q3 and Q4 to reach $22,000 and avoid any penalty. Your Q3 payment is due September 15."

Start tracking your estimated taxes with Jupid

Action Checklist: Avoiding the Estimated Tax Penalty

Before the Tax Year

- Look up your prior year total tax (Form 1040, Line 24)

- Check if your prior year AGI exceeded $150,000 (determines 100% vs 110% safe harbor)

- Calculate your required quarterly payment amount

- Set up EFTPS or IRS Direct Pay for electronic payments

- Calendar all four quarterly deadlines

Each Quarter

- Make your estimated payment by the deadline

- Keep payment confirmation records

- Review year-to-date income against projections

- Adjust future payments if income is significantly different than expected

- Check both federal and state payment requirements

At Filing Time

- Report all estimated payments on Form 1040, Line 26

- Compare total payments to safe harbor threshold

- If you owe a penalty, consider Form 2210 to calculate or request a waiver

- If income was uneven, evaluate whether the annualized income method reduces the penalty

- Apply any refund toward next year's Q1 estimated payment

If You Already Owe a Penalty

- Check if any of the four exceptions apply

- Consider filing Form 2210 to request a waiver

- Make a catch-up payment immediately to stop the penalty clock

- If you have W-2 income, increase withholding via Form W-4

Resources and Citations

IRS Publications (Official Sources)

- IRS: Estimated Taxes — Overview of estimated tax requirements

- IRS Publication 505 — Tax Withholding and Estimated Tax (comprehensive guide)

- Form 2210 — Underpayment of Estimated Tax by Individuals, Estates, and Trusts

- Form 2210 Instructions — Line-by-line instructions for penalty calculation and waiver requests

- Form 1040-ES — Estimated Tax for Individuals

- IRS Direct Pay — Free online payment system

Tax Code and Regulations

- IRC §6654 — Failure to pay estimated income tax (penalty rules)

- IRC §6654(d)(1)(A) — Required annual payment: 90% of current year tax

- IRC §6654(d)(1)(B) — Safe harbor: 100% of prior year tax

- IRC §6654(d)(1)(C) — High income threshold: 110% for AGI > $150,000

- IRC §6654(e)(1) — De minimis exception: $1,000 threshold

- IRC §6654(e)(2) — No prior year tax liability exception

- IRC §6654(e)(3)(A) — Casualty, disaster, and unusual circumstance waiver

- IRC §6654(e)(3)(B) — Retirement or disability waiver

- IRC §6621(a)(2) — Underpayment interest rate calculation

Related Jupid Guides

- Quarterly Estimated Taxes Guide 2026 — How to calculate and pay quarterly taxes

- Self-Employment Tax Guide 2026 — Understanding the 15.3% SE tax

- Form 1040-ES Instructions Guide 2026 — Line-by-line instructions for estimated tax vouchers

- Self-Employment Tax Calculator — Calculate your SE tax and estimated payments

2026 Key Numbers

| Item | 2026 Amount |

|---|---|

| Estimated tax penalty rate | ~8% annual |

| De minimis threshold | $1,000 owed at filing |

| Safe harbor (standard) | 100% of prior year tax |

| Safe harbor (high income) | 110% if AGI > $150,000 |

| SE tax rate | 15.3% |

| Social Security wage base | $176,100 |

| Standard deduction (single) | $15,700 |

| Q1 deadline | April 15, 2026 |

| Q2 deadline | June 15, 2026 |

| Q3 deadline | September 15, 2026 |

| Q4 deadline | January 15, 2027 |

Final Thoughts

The estimated tax penalty is a mechanical calculation — not a judgment call by the IRS. If your quarterly payments fall short of the safe harbor threshold and none of the four exceptions apply, the penalty is assessed automatically.

The key strategies:

- Use the prior year safe harbor — Pay 100% (or 110% for high earners) of last year's total tax in four equal installments, and penalty risk is eliminated entirely

- Pay something if you're behind — A late payment reduces the penalty compared to waiting until April 15. Every day the underpayment remains outstanding increases the charge

- Track income in real time — The penalty exists because the IRS expects pay-as-you-go. Tracking your income throughout the year keeps your estimated payments accurate

The penalty itself is relatively modest — usually a few hundred dollars for most self-employed individuals. But it's money you keep by simply making quarterly payments on time.

Disclaimer

This article provides general information about the estimated tax penalty and should not be considered tax advice. Penalty rates, safe harbor thresholds, and exception criteria are subject to annual changes by the IRS. Your actual penalty depends on your specific payment history, income timing, and filing status. State estimated tax penalties have separate rules and rates. For advice specific to your situation, consult with a qualified tax professional.

Tax Year: 2026 Last Updated: February 11, 2026

Ready to simplify your finances?

Join 1,000+ businesses using Jupid to save time and money. Start simplifying your finances today.

30-day money-back guarantee