Self-Employment Tax 2026: Rates, Calculation, and How to Reduce What You Owe

Table of Contents

Published: February 10, 2026 Tax Year: 2026

A Message from Slava

Self-employment tax is the single biggest surprise for people transitioning from W-2 employment to working for themselves. When I started Jupid, the 15.3% rate hit differently than I expected — it's calculated before income tax, and unlike income tax, there's no standard deduction to reduce it.

At Anna Money, where we served 60,000+ small businesses in the UK, the equivalent system (National Insurance contributions) worked similarly — self-employed people pay more because there's no employer splitting the bill. The US version is straightforward once you understand the components, but the calculations have a few quirks that trip people up.

The most important thing to understand: self-employment tax is not optional, and it's not income tax. It's your contribution to Social Security and Medicare. Whether you're a freelance designer, a rideshare driver, or a consultant billing $300/hour, you owe it on every dollar of net profit.

This guide breaks down exactly how self-employment tax works, how to calculate it, and — most importantly — how to legally reduce what you owe.

Executive Summary: Self-Employment Tax for 2026

What is self-employment tax? Your contribution to Social Security and Medicare when you work for yourself. W-2 employees split this cost 50/50 with their employer. Self-employed individuals pay the full amount.

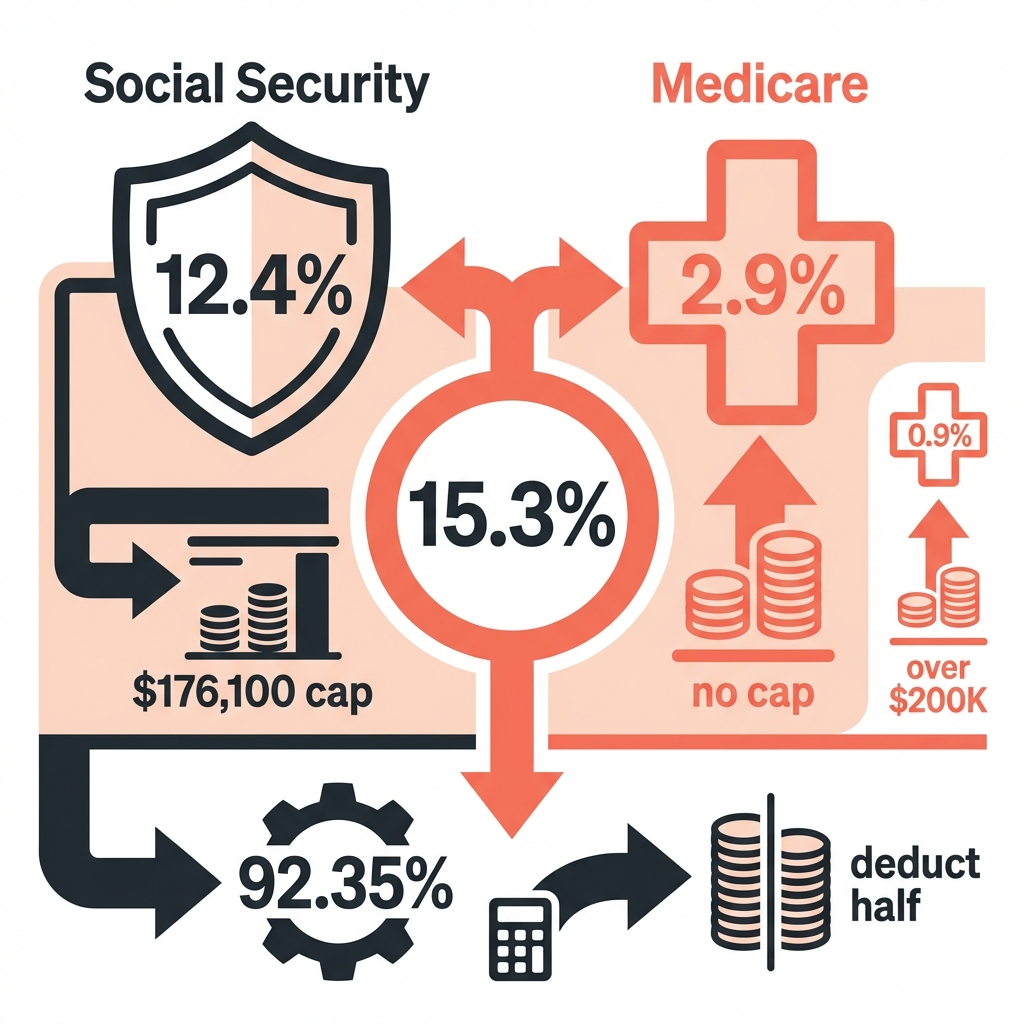

2026 Self-Employment Tax Rates:

| Component | Rate | Income Limit |

|---|---|---|

| Social Security | 12.4% | First $176,100 of net earnings |

| Medicare | 2.9% | No limit |

| Additional Medicare | 0.9% | Earnings over $200,000 (single) / $250,000 (MFJ) |

| Combined | 15.3% | On net earnings × 92.35% |

Quick calculation: Net profit × 92.35% × 15.3% = self-employment tax

Example: $100,000 net profit × 0.9235 × 0.153 = $14,130

Legal basis: IRC §1401 (SE tax rates), IRC §1402 (net earnings definition), Schedule SE (Form 1040)

How Self-Employment Tax Works

Who Pays It

You owe self-employment tax if you have net earnings from self-employment of $400 or more. This includes:

- Sole proprietors and single-member LLC owners

- Partners in a partnership (on their share of partnership income)

- Independent contractors and freelancers

- Gig economy workers (rideshare, delivery, freelance platforms)

- S Corp shareholders (on their W-2 salary only — not distributions)

The Two Components

Social Security (12.4%): Funds retirement benefits, disability benefits, and survivor benefits. Only applies to the first $176,100 of net earnings for 2026.

Medicare (2.9%): Funds Medicare health insurance. No income cap — applies to every dollar of net earnings.

Additional Medicare Tax (0.9%): Applies to net earnings above $200,000 (single) or $250,000 (married filing jointly). This brings the total Medicare rate to 3.8% on high earnings.

Why 92.35%?

The IRS applies your SE tax rate to 92.35% of net earnings, not 100%. This adjustment accounts for the employer-equivalent portion of the tax. W-2 employees don't pay income tax on their employer's share of FICA — the 92.35% multiplier gives self-employed individuals the same treatment.

Net profit: $80,000

× 92.35% = $73,880 (taxable SE earnings)

× 15.3% = $11,304 (self-employment tax)

Legal citation: IRC §1402(a) defines net earnings subject to SE tax. The 92.35% multiplier comes from IRC §1402(a)(12).

Step-by-Step Calculation

Standard Calculation (Under $176,100)

Step 1: Start with net profit from Schedule C

Net profit: $90,000

Step 2: Multiply by 92.35%

$90,000 × 0.9235 = $83,115

Step 3: Calculate Social Security tax

$83,115 × 12.4% = $10,306

Step 4: Calculate Medicare tax

$83,115 × 2.9% = $2,410

Step 5: Add together

$10,306 + $2,410 = $12,716

Self-employment tax: $12,716

High-Income Calculation (Over $176,100)

Step 1: Net profit from Schedule C

Net profit: $250,000

Step 2: Multiply by 92.35%

$250,000 × 0.9235 = $230,875

Step 3: Social Security tax (capped at $176,100)

$176,100 × 12.4% = $21,836

Step 4: Medicare tax (no cap)

$230,875 × 2.9% = $6,695

Step 5: Additional Medicare tax

($230,875 - $200,000) × 0.9% = $278

Step 6: Total

$21,836 + $6,695 + $278 = $28,809

Self-employment tax: $28,809

The Deduction for Half of SE Tax

After calculating your SE tax, you deduct half of it on Schedule 1, Line 15. This reduces your adjusted gross income (AGI), which reduces your income tax — but not your SE tax.

SE tax: $12,716

Deductible half: $6,358

AGI reduction: $6,358

Income tax savings at 22%: ~$1,399

Use our Self-Employment Tax Calculator to run your specific numbers.

Self-Employment Tax vs Income Tax

These are two separate taxes, and understanding the difference is critical for planning:

| Self-Employment Tax | Federal Income Tax | |

|---|---|---|

| Rate | 15.3% flat | 10-37% graduated |

| Based on | Net earnings × 92.35% | Taxable income (after deductions) |

| Reduced by | Only by lowering net profit | Standard deduction, QBI, itemized deductions |

| Standard deduction | Does NOT apply | $15,700 (single) reduces taxable income |

| QBI deduction | Does NOT apply | 20% of QBI reduces taxable income |

Key insight: The standard deduction and QBI deduction reduce your income tax but have zero effect on self-employment tax. The only way to reduce SE tax is to reduce your net earnings from self-employment — through business deductions, retirement contributions, or an S Corp election.

Five Strategies to Reduce Self-Employment Tax

Strategy 1: Maximize Business Deductions

Every dollar of legitimate business expense reduces your net profit, which reduces both your SE tax and income tax.

Example: $10,000 in additional deductions

SE tax reduction: $10,000 × 92.35% × 15.3% = $1,413

Income tax reduction (22% bracket): ~$2,200

Total savings: ~$3,613

Track every deductible expense: home office, vehicle mileage, software, phone/internet, professional services, health insurance, and more. See our tax write-offs for LLC guide.

Strategy 2: Contribute to Retirement Plans

Self-employed retirement contributions reduce your net self-employment income for SE tax purposes (with some plan types):

| Plan | 2026 Maximum | SE Tax Impact |

|---|---|---|

| SEP IRA | 25% of net earnings (~$70,000) | Reduces SE earnings |

| Solo 401(k) employer contribution | 25% of net earnings | Reduces SE earnings |

| Solo 401(k) employee contribution | $23,500 ($31,000 if 50+) | Does NOT reduce SE earnings |

Example: $100,000 net profit with $20,000 SEP IRA contribution

Without SEP: SE tax = $100,000 × 92.35% × 15.3% = $14,130

With SEP: SE tax = $80,000 × 92.35% × 15.3% = $11,304

SE tax savings: $2,826

Plus income tax savings: ~$4,400

Total savings: ~$7,226

See our retirement plan deductions guide.

Strategy 3: S Corp Election

The most powerful SE tax reduction strategy for profitable businesses. By paying yourself a reasonable salary and taking remaining profit as distributions, the distributions avoid the 15.3% SE tax.

$120,000 net profit:

Without S Corp:

SE tax: $120,000 × 92.35% × 15.3% = $16,956

With S Corp (salary $65,000):

Payroll taxes: $65,000 × 15.3% = $9,945

Distribution: $55,000 (no FICA)

FICA savings: $7,011/year

The S Corp election makes sense when net profit consistently exceeds $50,000-$60,000. See our S Corp vs LLC guide.

Strategy 4: Self-Employed Health Insurance Deduction

Deducting health insurance premiums reduces your AGI and can reduce SE tax depending on the calculation order. While the health insurance deduction is reported on Schedule 1 (not Schedule C), it still reduces your overall tax burden.

See our health insurance deduction guide.

Strategy 5: Hire Your Spouse

If your spouse works in your business, you can hire them as an employee. Their wages are a deductible business expense (reducing your SE tax), and the wages are subject to FICA at the employee/employer rates. This can also provide benefits:

- Spouse qualifies for Social Security benefits based on their own earnings record

- Spouse can contribute to retirement plans

- Can create access to employer health plan benefits

Caution: The employment must be genuine — real work for reasonable compensation. Sham employment arrangements are a known audit trigger.

Schedule SE: How to Complete It

Schedule SE calculates your self-employment tax. Most self-employed individuals use the Short Schedule SE.

Short Schedule SE (Most Filers)

| Line | Description | Example |

|---|---|---|

| 1a | Net farm profit | $0 |

| 1b | Net nonfarm profit (Schedule C, Line 31) | $90,000 |

| 2 | Combined net earnings | $90,000 |

| 3 | Multiply Line 2 by 92.35% | $83,115 |

| 4a | If Line 3 ≤ $176,100: Line 3 × 15.3% | $12,717 |

| 5 | Self-employment tax (to Schedule 2, Line 4) | $12,717 |

| 6 | Deductible half (to Schedule 1, Line 15) | $6,358 |

For detailed line-by-line instructions, see our Schedule SE guide.

Common Mistakes to Avoid

Mistake #1: Forgetting SE Tax Exists

Problem: New freelancers calculate only income tax and are shocked by the additional 15.3% self-employment tax on top.

Impact: Underpaying estimated taxes by thousands of dollars. At $60,000 net profit, SE tax alone is $8,478.

Solution: Factor SE tax into your quarterly estimates from day one. Total tax is roughly 25-30% of net profit for most self-employed individuals.

Mistake #2: Not Deducting Half of SE Tax

Problem: Filing your return without claiming the deduction for half of your self-employment tax on Schedule 1, Line 15.

Impact: Overpaying income tax. At $100,000 net profit, this deduction is $7,065 — worth roughly $1,500-$2,000 in income tax savings.

Solution: Most tax software handles this automatically, but verify it appears on your return if filing manually.

Mistake #3: Assuming the Social Security Cap Eliminates SE Tax

Problem: A high earner assumes they don't owe SE tax once earnings exceed $176,100 because the Social Security portion is capped.

Impact: The 2.9% Medicare portion has no cap. On $300,000 of net earnings, Medicare tax alone is $8,021.

Solution: Budget for Medicare tax on all earnings, plus Additional Medicare Tax (0.9%) on earnings above $200,000 (single).

Mistake #4: Not Considering the S Corp Election

Problem: A contractor earning $150,000 pays $21,195 in SE tax annually without exploring the S Corp election.

Impact: Missing potential savings of $5,000-$8,000 per year.

Solution: If net profit exceeds $50,000-$60,000, model the S Corp election. The payroll and tax prep costs are $2,000-$4,000/year, but the FICA savings are often much larger.

Calculate Your SE Tax Liability With AI

Estimating self-employment tax accurately is the foundation of proper tax planning. Under-estimate, and you face penalties. Over-estimate, and you tie up cash unnecessarily.

What makes Jupid different:

✅ Real-time profit tracking — Jupid monitors your income and expenses to calculate your running net profit

✅ Automatic SE tax estimates — Ask "How much SE tax do I owe?" and get current numbers via WhatsApp or iMessage

✅ Quarterly payment calculations — Jupid factors in both SE tax and income tax for accurate estimated payment amounts

✅ Bank connection and auto-sync — Connect your business accounts for automatic income and expense tracking

Example conversation:

- You: "What's my self-employment tax looking like for 2026?"

- Jupid: "Your net profit through August is $72,000. Projected full-year SE tax: approximately $15,900. You've paid $10,000 in estimated payments so far. Remaining balance: ~$5,900, due in Q3 and Q4 payments."

Learn more about how Jupid keeps your business finances organized

Action Checklist: Managing Self-Employment Tax

Understand Your Obligation

- Calculate your estimated net earnings for the year

- Apply the 92.35% multiplier and 15.3% rate

- Add the deductible half to your income tax planning

- Use our Self-Employment Tax Calculator

Minimize Your Tax

- Track and deduct all legitimate business expenses

- Claim the home office deduction if eligible

- Contribute to SEP IRA or Solo 401(k)

- Evaluate S Corp election if profit exceeds $50K-$60K

- Deduct health insurance premiums

Stay Compliant

- Make quarterly estimated payments on time

- Complete Schedule SE with your tax return

- Deduct half of SE tax on Schedule 1, Line 15

- File by April 15 or request extension

Resources and Citations

IRS Publications (Official Sources)

- IRS: Self-Employment Tax — Overview and current rates

- IRS Publication 334 — Tax Guide for Small Business

- IRS Publication 505 — Tax Withholding and Estimated Tax

- Schedule SE (Form 1040) — Self-Employment Tax

- Schedule SE Instructions — Line-by-line guidance

- Form 1040-ES — Estimated Tax for Individuals

Tax Code and Regulations

- IRC §1401 — Rate of self-employment tax (12.4% + 2.9%)

- IRC §1402 — Definition of net earnings from self-employment

- IRC §1402(a)(12) — The 92.35% multiplier

- IRC §164(f) — Deduction for half of SE tax

- IRC §3101(b)(2) — Additional Medicare Tax (0.9%)

2026 Key Numbers

| Item | 2026 Amount |

|---|---|

| SE tax rate | 15.3% |

| Social Security rate | 12.4% |

| Medicare rate | 2.9% |

| Social Security wage base | $176,100 |

| Additional Medicare Tax | 0.9% over $200,000 (single) |

| SE tax multiplier | 92.35% |

| Minimum earnings to file SE | $400 |

Final Thoughts

Self-employment tax is unavoidable for anyone earning more than $400 in net self-employment income. At 15.3%, it's often a larger tax bill than federal income tax for moderate earners.

The key strategies:

- Budget for it from day one — Set aside 25-30% of net income for all taxes, with SE tax being the largest component

- Reduce net earnings legally — Business deductions, retirement contributions, and the S Corp election all lower your SE tax base

- Don't confuse it with income tax — The standard deduction and QBI deduction don't reduce SE tax; only lowering net profit does

Understanding self-employment tax is the first step to managing it effectively.

Disclaimer

This article provides general information about self-employment tax and should not be considered tax advice. Self-employment tax rules, rates, and income thresholds are subject to annual changes. Your actual tax liability depends on your net earnings, filing status, and other income sources. For advice specific to your situation, consult with a qualified tax professional.

Tax Year: 2026 Last Updated: February 10, 2026

Ready to simplify your finances?

Join 1,000+ businesses using Jupid to save time and money. Start simplifying your finances today.

30-day money-back guarantee