LLC Tax Benefits 2026: 7 Advantages That Save Small Business Owners Money

Table of Contents

Published: February 4, 2026 Tax Year: 2026

A Message from Slava

When I formed the LLC for Jupid, people assumed the main reason was tax savings. It wasn't — at least not immediately. The primary motivation was liability protection and credibility with financial institution partners.

But as revenue grew, the tax benefits became significant. The ability to choose how your LLC is taxed — as a disregarded entity, partnership, S Corp, or even C Corp — gives you a level of flexibility that no other business structure matches.

At Anna Money, I worked with 60,000+ small business owners in the UK. Many of them chose structures equivalent to LLCs specifically because of tax flexibility. The US version is even more powerful, thanks to the QBI deduction and the S Corp election.

The problem? Most LLC owners only know about one or two of these benefits. They file their Schedule C, pay their self-employment tax, and never realize they're leaving money on the table.

This guide covers seven concrete tax advantages of operating as an LLC — with real numbers so you can see what applies to your situation.

Executive Summary: LLC Tax Benefits for 2026

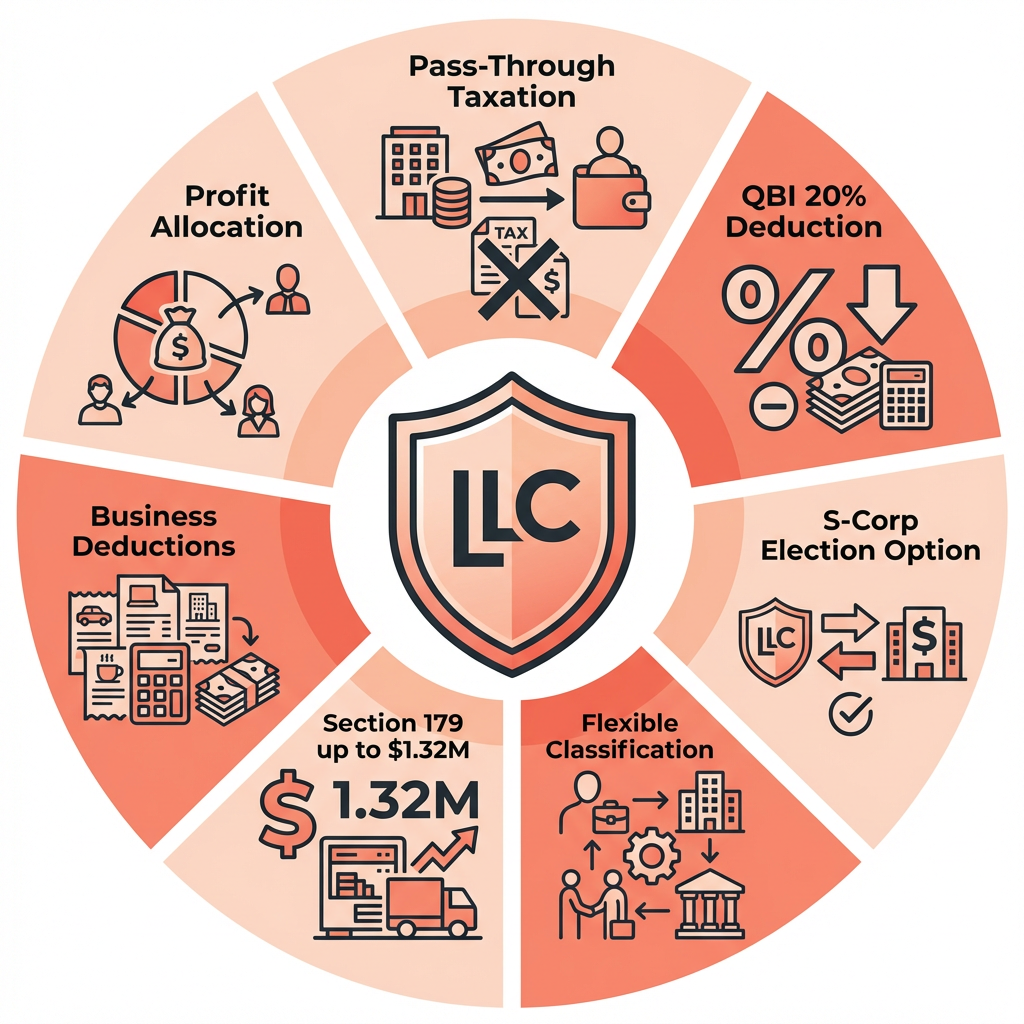

Key advantages available to LLC owners:

- Pass-through taxation — No corporate-level tax; profit taxed once on your personal return

- QBI deduction — Deduct up to 20% of qualified business income (now permanent under OBBBA)

- S Corp election — Reduce self-employment tax on profit above your reasonable salary

- Flexible profit allocation — Multi-member LLCs can allocate income and losses strategically

- Full business deductions — Deduct all ordinary and necessary business expenses

- Section 179 expensing — Write off up to $1,320,000 in equipment and assets in the first year

- Tax classification choice — Elect to be taxed as sole proprietor, partnership, S Corp, or C Corp

Tax savings potential (single-member LLC, $100,000 net profit):

QBI deduction (20%): saves ~$4,000-$6,000 in income tax

S Corp election: saves ~$4,000 in self-employment tax

Business deductions: varies (average $10,000-$30,000 in deductible expenses)

Combined potential savings: $18,000-$40,000+ in reduced taxable income

Legal basis: IRC §199A (QBI), IRC §301.7701-3 (entity classification), IRC §1361 (S Corp election), IRC §179 (expensing)

Benefit #1: Pass-Through Taxation (No Double Tax)

The single biggest tax advantage of an LLC is pass-through taxation. Unlike a C Corporation, which pays corporate income tax and then shareholders pay tax again on dividends, an LLC's income is taxed only once — on the owner's personal return.

How It Works

A single-member LLC is treated as a "disregarded entity" by the IRS. All income and expenses flow directly to Schedule C on your Form 1040. A multi-member LLC files Form 1065 and issues each member a Schedule K-1.

Why This Matters

C Corporations face an effective double tax:

C Corp double taxation at $100,000 profit:

Corporate income tax: $100,000 × 21% = $21,000

Remaining for distribution: $79,000

Dividend tax (qualified, 15%): $79,000 × 15% = $11,850

TOTAL TAX: $32,850 (32.85% effective rate)

LLC pass-through at $100,000 profit:

Self-employment tax: ~$14,130

Federal income tax: ~$12,657

TOTAL TAX: $26,787 (26.79% effective rate)

LLC advantage: ~$6,063 less in total tax

The LLC advantage grows at higher income levels because the corporate rate stays flat at 21% while pass-through income benefits from the QBI deduction and graduated individual tax rates.

Legal citation: IRC §301.7701-2 and §301.7701-3 establish default pass-through treatment for LLCs.

Benefit #2: QBI Deduction (20% Off Your Business Income)

The Qualified Business Income deduction under IRC §199A lets LLC owners deduct up to 20% of their qualified business income from their taxable income. This deduction was made permanent by the One Big Beautiful Bill Act (OBBBA), signed July 4, 2025.

2026 QBI Numbers

| Item | 2026 Amount |

|---|---|

| Maximum deduction | 20% of QBI |

| Full deduction threshold (single) | ~$200,000 |

| Full deduction threshold (MFJ) | ~$400,000 |

| Phase-out range (single) | $200,000-$275,000 |

| Phase-out range (MFJ) | $400,000-$550,000 |

| Minimum deduction | $400 (if QBI ≥ $1,000) |

QBI Calculation Example

Net business income: $80,000

QBI deduction: $80,000 × 20% = $16,000

Without QBI:

Taxable income: $80,000 - $15,700 (std deduction) = $64,300

Federal tax: ~$9,683

With QBI:

Taxable income: $80,000 - $15,700 - $16,000 = $48,300

Federal tax: ~$6,133

QBI savings: ~$3,550/year

The QBI deduction is available whether you take the standard deduction or itemize — it's an additional deduction, not part of either.

For a complete breakdown, see our QBI deduction guide.

Important for S Corp owners: If your LLC has elected S Corp status, only the pass-through distribution qualifies for QBI — not your W-2 salary. This is a factor when calculating whether the S Corp election makes sense for your situation.

Legal citation: IRC §199A establishes the QBI deduction. OBBBA (P.L. 119-XXX) made it permanent starting in 2026.

Benefit #3: S Corp Election (Reduce Self-Employment Tax)

An LLC can elect to be taxed as an S Corporation by filing Form 2553 with the IRS. This is arguably the most powerful tax benefit available to profitable LLC owners.

How It Saves Money

As a default LLC, you pay 15.3% self-employment tax on all net profit. With the S Corp election, you pay yourself a reasonable salary (subject to payroll taxes) and take remaining profit as distributions, which skip the 15.3% FICA tax.

$120,000 net profit comparison:

Default LLC:

SE tax: $120,000 × 92.35% × 15.3% = $16,956

S Corp (salary $65,000):

Payroll taxes: $65,000 × 15.3% = $9,945

Distribution: $55,000 (no FICA)

FICA savings: $7,011/year

Minus S Corp costs (~$2,500): Net savings ~$4,511

When to Elect

The S Corp election makes financial sense when net profit consistently exceeds $50,000-$60,000 — the point where FICA savings outweigh the added cost of payroll processing and corporate tax filing.

For a detailed comparison, see our S Corp vs LLC guide.

Legal citation: IRC §1362 governs the S Corp election process. Form 2553 deadline for 2026: March 16, 2026.

Benefit #4: Flexible Tax Classification

Unlike any other business structure, an LLC can choose how it's taxed. This flexibility is unique to LLCs and is one of their strongest advantages.

Available Tax Classifications

| Classification | How to Elect | Best For |

|---|---|---|

| Disregarded entity (default, single-member) | Automatic | Under $50K profit, simplicity |

| Partnership (default, multi-member) | Automatic | Multiple owners, flexible allocation |

| S Corporation | File Form 2553 | $60K+ profit, reducing SE tax |

| C Corporation | File Form 8832 | Retaining earnings, venture funding |

You can change your tax classification as your business evolves. Started as a simple freelancer filing Schedule C? When profits grow, elect S Corp status. Raising venture capital? Switch to C Corp treatment.

Sole proprietorships and partnerships can't do this. A sole proprietor is always a sole proprietor. A general partnership is always a partnership. Only an LLC (and corporations) can elect different tax treatment.

Legal citation: IRC §301.7701-3 allows LLCs to elect their tax classification via Form 8832.

Benefit #5: Full Business Expense Deductions

LLC owners can deduct all "ordinary and necessary" business expenses under IRC §162, reducing their taxable income dollar-for-dollar.

Common LLC Tax Deductions

| Deduction | Description | Potential Savings |

|---|---|---|

| Home office | Dedicated space for business | $1,500-$5,000/year |

| Vehicle/mileage | Business driving at 70 cents/mile (2026) | $2,000-$10,000/year |

| Health insurance | Self-employed health insurance deduction | $5,000-$30,000/year |

| Retirement contributions | SEP IRA, Solo 401(k), SIMPLE IRA | Up to $70,000/year |

| Business insurance | Liability, professional, E&O | $500-$5,000/year |

| Professional services | CPA, attorney, bookkeeping | $1,000-$10,000/year |

| Software and tools | Business software subscriptions | $500-$5,000/year |

| Marketing | Advertising, website, promotion | $1,000-$20,000/year |

While sole proprietors can also claim these deductions, the LLC structure provides better documentation and separation of personal and business expenses — which matters during an audit.

For detailed guidance on deductible expenses, see our Schedule C instructions guide.

Legal citation: IRC §162 defines deductible business expenses. IRC §280A covers home office deductions.

Benefit #6: Section 179 Expensing and Depreciation

LLC owners can immediately deduct the cost of qualifying business assets instead of depreciating them over several years. For 2026, the limits are generous:

2026 Section 179 Limits

| Item | 2026 Limit |

|---|---|

| Maximum Section 179 deduction | $1,320,000 |

| Phase-out threshold | $3,290,000 |

| Bonus depreciation rate | 60% (continuing phasedown) |

What Qualifies

- Business equipment (computers, machinery, tools)

- Office furniture

- Business vehicles (with limits — $21,200 max for passenger vehicles)

- Software

- Certain building improvements (HVAC, roofing, fire protection, security)

Example

You buy $50,000 in business equipment for your LLC:

Without Section 179:

Depreciate over 5-7 years

Year 1 deduction: ~$7,000-$10,000

With Section 179:

Year 1 deduction: $50,000 (full amount)

Tax savings at 24% bracket: $12,000 in Year 1

For assets you can't deduct under Section 179, bonus depreciation at 60% for 2026 still provides an accelerated write-off.

For more details, see our Section 179 depreciation guide.

Legal citation: IRC §179 establishes the expensing election. 2026 limits announced in IRS Rev. Proc. 2025-XX.

Benefit #7: Flexible Profit Allocation (Multi-Member LLCs)

Multi-member LLCs have a unique advantage: they can allocate profits and losses among members in proportions that differ from ownership percentages. This is called "special allocation" and it's governed by the LLC's operating agreement.

How Special Allocation Works

In a corporation, profits must be distributed proportionally to share ownership. If you own 50% of the stock, you get 50% of the dividends.

In an LLC, the operating agreement can specify different allocation ratios:

Two-member LLC, 50/50 ownership:

Corporate model:

Member A: 50% of profits

Member B: 50% of profits

LLC with special allocation:

Member A: 70% of profits (provides most of the work)

Member B: 30% of profits (provides most of the capital)

(Must have "substantial economic effect" under §704(b))

Tax Planning Opportunities

Special allocation allows multi-member LLCs to:

- Shift income to lower-bracket members — If one member has lower overall income, allocating more profit to them can reduce the total tax bill

- Allocate losses strategically — Direct losses to members who can use them against other income

- Reward sweat equity — Compensate members who contribute more time without changing ownership

Limitation: Special allocations must have "substantial economic effect" under IRC §704(b). The IRS will disregard allocations that exist solely to reduce taxes without reflecting the actual economic arrangement.

Legal citation: IRC §704(b) and Treas. Reg. §1.704-1(b)(2) govern partnership allocation rules.

LLC Tax Benefits: What They Don't Include

For an honest picture, here's what an LLC does NOT automatically give you:

No automatic tax reduction. Forming an LLC doesn't lower your tax rate. A single-member LLC pays the same taxes as a sole proprietor by default. The tax benefits come from elections and deductions, not from the LLC structure itself.

No escape from self-employment tax. Unless you elect S Corp status, you still pay 15.3% SE tax on all net profit. The LLC doesn't change this.

No protection from income tax. LLC income is still taxed as ordinary income at your marginal rate. There's no special "LLC tax rate."

No free compliance. LLCs have annual filing requirements, state fees, and potential franchise taxes. California charges $800/year regardless of income. See our LLC annual fee calculator for your state.

Common Mistakes to Avoid

Mistake #1: Assuming the LLC Itself Reduces Taxes

Problem: Many new business owners form an LLC expecting an immediate tax break. Online formation services reinforce this by marketing "LLC tax savings" without explaining that default tax treatment is identical to a sole proprietorship.

Impact: Paying $300+ in formation fees and $100-$800 in annual state fees with no actual tax benefit.

Solution: Understand that LLC tax benefits come from specific elections (like S Corp) and proper use of deductions — not from the LLC structure itself.

Mistake #2: Ignoring the QBI Deduction

Problem: LLC owners don't claim the QBI deduction because they don't know it exists or assume their tax software handles it.

Impact: Leaving a 20% deduction on the table. At $80,000 net profit, that's $16,000 in reduced taxable income — roughly $3,500 in tax savings.

Solution: Verify that your tax return includes the QBI deduction on Form 8995 or 8995-A. If you're using tax software, confirm the deduction appears. If you have a CPA, ask specifically about it.

Mistake #3: Electing S Corp Status Too Early

Problem: LLC owners hear about S Corp tax savings and file Form 2553 before their profit justifies the added complexity and cost.

Impact: Spending $2,000-$4,000/year on payroll and tax prep while saving only $1,000-$1,500 in FICA taxes.

Solution: Run the numbers first. The S Corp election typically breaks even around $50,000-$60,000 in net profit. Below that, keep the simplicity of default LLC taxation.

Mistake #4: Not Using Retirement Plan Deductions

Problem: LLC owners skip retirement contributions because they think only employees of large companies have access to tax-advantaged retirement accounts.

Impact: Missing deductions of $7,000-$70,000+ per year depending on the plan type.

Solution: Self-employed LLC owners can contribute to SEP IRAs (up to 25% of net earnings, max ~$70,000), Solo 401(k) plans (up to $23,500 employee + 25% employer contributions), or SIMPLE IRAs ($16,500 + employer match). See our retirement plan deductions guide.

Maximize Your LLC Tax Benefits With AI

Claiming every deduction you're entitled to requires tracking every business expense throughout the year — not scrambling to reconstruct records at tax time. The difference between a well-documented LLC and a poorly documented one can be thousands of dollars in missed deductions.

What makes Jupid different:

✅ Automatic transaction categorization — Our AI categorizes your business expenses with 95.9% accuracy, matching them to the correct Schedule C lines

✅ Real-time deduction tracking — Ask your AI accountant "How much have I spent on business meals this quarter?" and get instant answers via WhatsApp or iMessage

✅ Tax structure insights — Jupid monitors your income and flags when an S Corp election or other tax strategy could save you money

✅ Bank connection and auto-sync — Connect your business bank account and Jupid automatically identifies and categorizes deductible expenses

Example conversation:

- You: "What are my total business deductions so far this year?"

- Jupid: "Through October, you've categorized $34,200 in business deductions: $12,000 in home office, $8,400 in supplies, $6,800 in professional services, $4,200 in software, and $2,800 in marketing. Your estimated tax savings at the 24% bracket is $8,208."

Learn more about how Jupid keeps your business finances organized

Action Checklist: Maximizing LLC Tax Benefits

Immediately

- Verify you're claiming the QBI deduction (Form 8995 or 8995-A)

- Review all business expense categories — are you missing deductions?

- Check if your net profit exceeds $50,000 — consider S Corp election

- Open a dedicated business bank account if you haven't already

Quarterly

- Review and categorize all business expenses

- Estimate your quarterly tax payments using our Self-Employment Tax Calculator

- Track home office expenses if applicable

- Document business mileage

Annually

- Evaluate whether S Corp election makes sense for next year

- Maximize retirement plan contributions before December 31 (or April 15 for SEP IRA)

- Review Section 179 expensing for any business equipment purchased

- Check your state's LLC annual requirements and fees

- Consult with a CPA about tax planning for the upcoming year

Resources and Citations

IRS Publications (Official Sources)

- IRS Publication 334 — Tax Guide for Small Business

- IRS Publication 535 — Business Expenses

- IRS Publication 542 — Corporations

- IRS: Qualified Business Income Deduction — QBI overview

- Form 8995 — Qualified Business Income Deduction Simplified Computation

- Form 8832 — Entity Classification Election

- Form 2553 — Election by a Small Business Corporation

Tax Code and Regulations

- IRC §199A — Qualified Business Income deduction (made permanent by OBBBA 2025)

- IRC §301.7701-3 — Election of entity classification

- IRC §162 — Trade or business expenses

- IRC §179 — Election to expense certain depreciable business assets

- IRC §704(b) — Partnership allocations

- IRC §1361-1362 — S Corporation election

2026 Key Numbers

| Item | 2026 Amount |

|---|---|

| Self-employment tax rate | 15.3% (12.4% SS + 2.9% Medicare) |

| Social Security wage base | $176,100 |

| Standard deduction (single) | $15,700 |

| QBI deduction | Up to 20% of qualified business income |

| QBI full deduction threshold (single) | ~$200,000 |

| Section 179 maximum | $1,320,000 |

| Bonus depreciation | 60% |

| SEP IRA max contribution | ~$70,000 |

| Solo 401(k) employee contribution | $23,500 ($31,000 if 50+) |

Final Thoughts

LLC tax benefits are real, but they require action. The LLC structure itself doesn't reduce your taxes — it provides the framework for tax-saving strategies like the S Corp election, QBI deduction, and proper business expense tracking.

The key strategies:

- Claim the QBI deduction — It's now permanent and worth thousands of dollars annually for most LLC owners

- Evaluate the S Corp election — Once profit exceeds $50,000-$60,000, the FICA savings can be significant

- Track every business expense — Missed deductions are the most common way LLC owners overpay on taxes

The best time to optimize your LLC's tax position is before year-end, not at tax time. Review your situation quarterly and adjust as your business grows.

Disclaimer

This article provides general information about LLC tax benefits and should not be considered tax advice. Tax laws change frequently, and the benefits described depend on your specific income level, state of residence, and business circumstances. The QBI deduction, S Corp election, and Section 179 expensing all have specific eligibility requirements and limitations not fully detailed here. For advice specific to your situation, consult with a qualified tax professional.

Tax Year: 2026 Last Updated: February 4, 2026

Ready to simplify your finances?

Join 1,000+ businesses using Jupid to save time and money. Start simplifying your finances today.

30-day money-back guarantee