Multi-Member LLC Tax Filing 2026: Partnership Returns, K-1s, and Compliance

Table of Contents

Published: February 13, 2026 Tax Year: 2026

A Message from Slava

When you add a second member to your LLC, everything changes from a tax perspective. The IRS no longer treats your LLC as a "disregarded entity." It becomes a partnership — with a separate tax return, separate information reporting, and a different set of compliance requirements.

I've seen this transition catch business owners off guard. At Anna Money, where we served 60,000+ small businesses, a common pattern was two friends or colleagues starting a business together and assuming the tax filing would be as simple as a sole proprietorship. It's not. Form 1065 is an information return with its own deadline (March 15, not April 15), and the penalty for filing late is $235 per partner per month.

When we structured Jupid with multiple founders, the partnership tax return was one of the first compliance items we set up. Getting it wrong creates cascading problems: late K-1s delay every member's personal return, incorrect allocations create amended return headaches, and missing self-employment tax on guaranteed payments triggers IRS notices.

The good news: multi-member LLC tax filing is systematic. Once you understand the Form 1065 process, the K-1 flow, and the key allocation rules, the annual filing becomes routine. This guide walks through every step — from the partnership return to each member's personal tax reporting.

Executive Summary: Multi-Member LLC Tax Filing for 2026

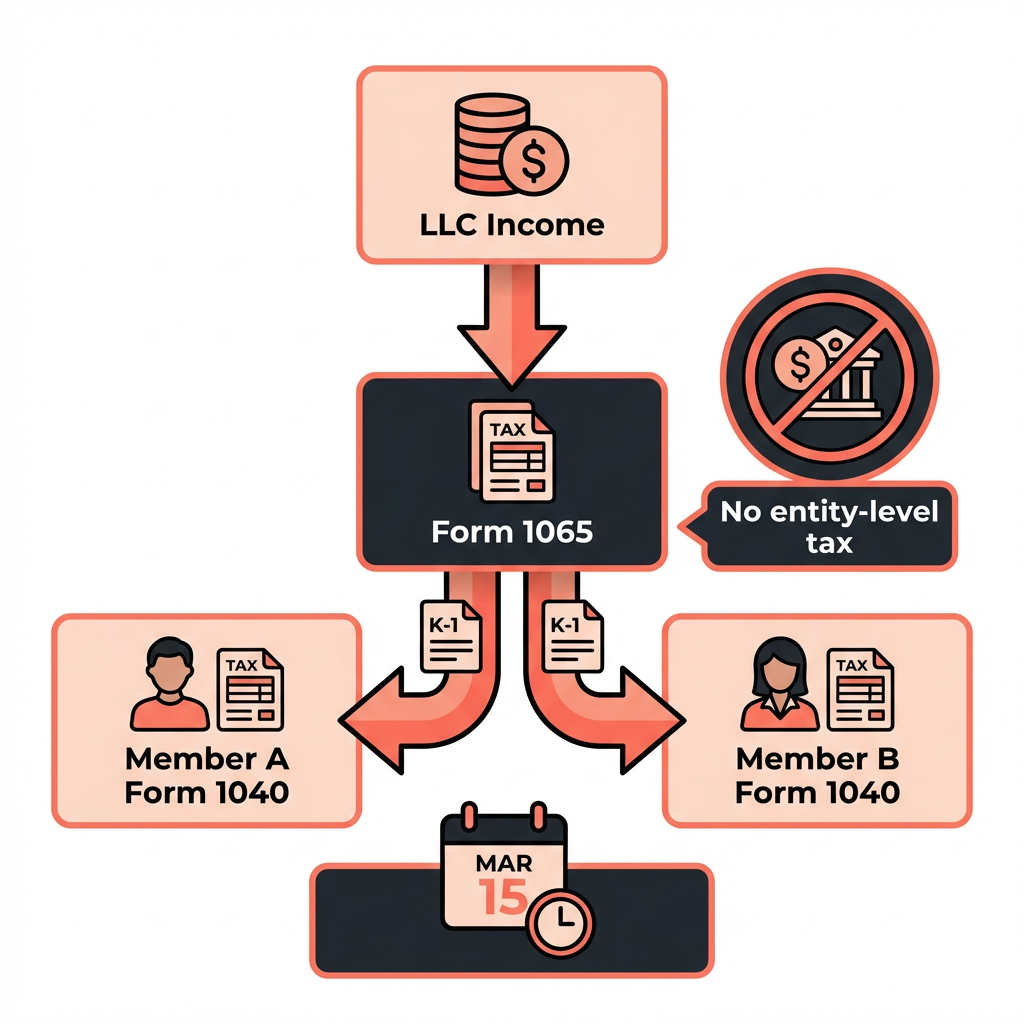

How multi-member LLCs are taxed: By default, the IRS treats a multi-member LLC as a partnership. The LLC files an information return (Form 1065) but pays no entity-level federal income tax. Income, deductions, and credits pass through to members via Schedule K-1.

2026 Filing Requirements:

| Requirement | Details |

|---|---|

| Entity return | Form 1065 (U.S. Return of Partnership Income) |

| Filing deadline | March 15, 2026 (for calendar year 2025 returns) |

| Extension deadline | September 15, 2026 (Form 7004) |

| Late filing penalty | $235 per partner per month (up to 12 months) |

| K-1 issuance | Schedule K-1 to each member by March 15 |

| Entity-level tax | $0 federal (some states impose entity-level taxes) |

| Members report on | Personal Form 1040, Schedule E, Part II |

| SE tax for active members | 15.3% on distributive share and guaranteed payments |

Key point: The multi-member LLC doesn't pay income tax — the members do. But the LLC must still file Form 1065 and issue K-1s. Missing this obligation creates penalties that compound monthly.

Legal basis: IRC §701-761 (partnership taxation), IRS Publication 541, Form 1065 Instructions

How Multi-Member LLCs Are Taxed

Default Classification: Partnership

When two or more people form an LLC, the IRS automatically classifies it as a partnership for federal tax purposes. No election is needed — this is the default treatment under the entity classification regulations.

What "partnership taxation" means:

-

The LLC files Form 1065 — This is an "information return," not a tax return. It reports the LLC's total income, deductions, and credits but calculates no tax liability.

-

Income passes through to members — Each member receives a Schedule K-1 showing their share of the LLC's income, deductions, and credits.

-

Members pay tax on their personal returns — Each member reports their K-1 amounts on their Form 1040 and pays both income tax and (for active members) self-employment tax.

-

No entity-level federal income tax — The LLC itself owes no federal income tax. (Some states, like California, impose an $800 minimum franchise tax on LLCs regardless of income.)

Legal citation: IRC §701 states that "a partnership as such shall not be subject to the income tax." Treasury Regulation §301.7701-3 establishes the default partnership classification for multi-member LLCs.

Alternative Classifications

A multi-member LLC can elect different tax treatment:

| Election | How to File | Best For |

|---|---|---|

| Partnership (default) | Automatic — no filing needed | Most multi-member LLCs |

| S Corporation | File Form 2553 | LLCs with $60K+ profit per active member |

| C Corporation | File Form 8832 | LLCs seeking venture capital or retained earnings |

For a detailed comparison, see our S Corp vs LLC guide.

Form 1065: The Partnership Return

What Form 1065 Reports

Form 1065 reports the LLC's total financial activity for the tax year. It looks similar to a corporate tax return, with sections for income, deductions, and other information — but Line 22 (Taxable Income/Loss) flows to K-1s, not to a tax calculation.

Key sections of Form 1065:

Page 1 — Income and Deductions

| Line | Item |

|---|---|

| 1a-8 | Gross income (sales, COGS, ordinary income) |

| 9-21 | Deductions (salaries, guaranteed payments, rent, depreciation, etc.) |

| 22 | Ordinary business income (loss) — flows to K-1 Box 1 |

Schedule B — Other Information

Questions about the partnership's structure, accounting method, foreign ownership, and other compliance items. Most small LLCs answer "No" to most questions, but review each one carefully.

Schedule K — Partners' Distributive Share Items

This schedule shows the LLC's total amounts for each income, deduction, and credit category. Each partner's share of these totals appears on their individual K-1.

Schedule L — Balance Sheets

Beginning and end-of-year balance sheets. Required if the LLC has $250,000+ in total receipts AND $250,000+ in total assets.

Schedule M-1 — Reconciliation

Reconciles book income to tax income. Required if Schedule L is required.

Filing Requirements and Deadlines

| Item | Details |

|---|---|

| Filing deadline | March 15 following the close of the tax year |

| Extension | 6-month extension via Form 7004 (automatic — no reason required) |

| Extended deadline | September 15 |

| How to file | E-file required for partnerships with 100+ partners; optional for smaller ones |

| Where to mail | IRS address depends on state (see Form 1065 instructions) |

Late Filing Penalties

The penalty for late-filed Form 1065 is $235 per partner per month (or fraction of a month), up to 12 months. For a two-member LLC, that's $470 per month — up to $5,640 for a full year late.

Example: Two-member LLC files Form 1065 three months late

Penalty: $235 × 2 partners × 3 months = $1,410

This penalty applies even if the LLC has no income. Form 1065 is required regardless of profitability.

First-time penalty abatement: If this is the first time the LLC has been penalized, you can request first-time penalty abatement by calling the IRS or writing a letter. The IRS grants this routinely for taxpayers with a clean compliance history.

Legal citation: IRC §6698 imposes the late filing penalty for partnership returns.

Schedule K-1: Reporting Each Member's Share

What the K-1 Contains

Each member receives a Schedule K-1 showing their share of the LLC's:

- Ordinary business income or loss (Box 1)

- Rental income or loss (Box 2-3)

- Guaranteed payments (Box 4)

- Interest, dividends, royalties (Box 5-7)

- Capital gains and losses (Box 8-9)

- Section 1231 gains (Box 10)

- Other income and deductions (Box 11-13)

- Self-employment earnings (Box 14)

- Credits (Box 15)

- Distributions (Box 19)

- QBI and other information (Box 20)

For a complete guide to reading every K-1 box, see our Schedule K-1 guide.

When K-1s Must Be Issued

K-1s must be sent to members by the Form 1065 filing deadline — March 15 for calendar-year partnerships. If the partnership files an extension, K-1s are typically issued when the return is completed (but should be available by September 15).

Late K-1s create a chain reaction: If the LLC doesn't issue K-1s by March 15, every member either files an extension on their personal return or estimates their K-1 amounts and potentially amends later.

How Members Report K-1 Income

Each member takes their K-1 and reports the amounts on their personal Form 1040:

Member's reporting process:

1. K-1 Box 1 (Ordinary income: $75,000) → Schedule E, Part II

2. K-1 Box 4a (Guaranteed payments: $36,000) → Schedule E, Part II

3. K-1 Box 14 (SE earnings: $111,000) → Schedule SE

4. K-1 Box 20, Code Z (QBI: $111,000) → Form 8995

Self-employment tax: $111,000 × 92.35% × 15.3% = $15,681

Half of SE tax deduction: $7,841 (Schedule 1, Line 15)

QBI deduction (20%): $22,200 (reduces taxable income)

Operating Agreement and Profit Allocation

Why the Operating Agreement Matters for Taxes

Your LLC's operating agreement determines how profits, losses, and distributions are allocated among members. Without an operating agreement, state default rules apply — typically splitting everything equally, regardless of capital contributions or labor.

The operating agreement should specify:

- Each member's ownership percentage

- How profits and losses are allocated

- How distributions are determined and timed

- Whether guaranteed payments are part of the compensation structure

- How capital accounts are maintained

- What happens when members join or leave

Standard Allocations

The simplest approach: allocate everything based on ownership percentages.

Two-member LLC with 60/40 split:

LLC net income: $200,000

Member A (60%):

K-1 Box 1: $120,000

K-1 Box 14: $120,000

Member B (40%):

K-1 Box 1: $80,000

K-1 Box 14: $80,000

Special Allocations Under IRC §704(b)

Partnerships can allocate income and deductions differently from ownership percentages — these are called "special allocations." However, the IRS has strict rules about when special allocations are valid.

The substantial economic effect test:

For a special allocation to be respected by the IRS, it must have "substantial economic effect" under IRC §704(b). This means:

- Economic effect — The allocation must actually affect the dollar amounts the partners receive, not just shift tax benefits

- Substantiality — The allocation must have a meaningful business purpose beyond tax avoidance

Common valid special allocations:

✅ Allocating depreciation to the partner who contributed the property

✅ Allocating income disproportionately to compensate a managing partner for services

✅ Allocating specific items (like rental income) to one partner based on their role

Allocations the IRS may challenge:

❌ Allocating losses to the highest-tax-bracket partner purely for tax savings

❌ Shifting income to a partner in a lower tax bracket with no economic substance

❌ Year-end reallocations that don't reflect the economic arrangement

Example: Valid special allocation

Member A contributed $300,000 in capital

Member B contributed $100,000 in capital + manages daily operations

Operating agreement:

Profits: 50/50

First $50,000 of profit: allocated to Member B as management compensation

Remainder: split 50/50

LLC net income: $150,000

Member A K-1 Box 1: $50,000

Member B K-1 Box 1: $50,000 + $50,000 guaranteed payment (Box 4a) = $100,000

Legal citation: IRC §704(b) and Treasury Regulation §1.704-1(b)(2) govern the rules for partnership allocations.

Self-Employment Tax for Active Members

Who Owes SE Tax

Active members of a multi-member LLC owe self-employment tax on their distributive share of LLC income plus any guaranteed payments. The SE tax rate is 15.3% (12.4% Social Security on the first $176,100 + 2.9% Medicare on all earnings).

Active vs. passive members:

| Member Type | SE Tax on Distributive Share | SE Tax on Guaranteed Payments |

|---|---|---|

| Active/managing member | ✅ Yes | ✅ Yes |

| Passive/investor member | ❌ Generally no | ✅ Yes |

The "active member" question: Most LLC members who participate in management or operations are treated as active for SE tax purposes. The IRS has not finalized regulations defining "limited partner" for LLC members, so the conservative (and widely practiced) approach is for active members to pay SE tax on their full distributive share.

Calculating SE Tax for LLC Members

Example: Two equal active members

LLC net income: $180,000

Guaranteed payments: $0

Each member's K-1:

Box 1: $90,000

Box 14: $90,000

Self-employment tax per member:

$90,000 × 92.35% × 15.3% = $12,711

Total SE tax for both members: $25,422

Compare this to a two-member LLC with S Corp election:

Same LLC with S Corp election:

LLC net income: $180,000

Reasonable salaries: $55,000 each (total $110,000)

Distributions: $35,000 each (total $70,000)

Payroll taxes per member:

$55,000 × 15.3% = $8,415

Total payroll taxes for both members: $16,830

SE tax savings: $25,422 - $16,830 = $8,592/year

Guaranteed Payments vs. Distributions

Understanding the difference between guaranteed payments and distributions is critical for multi-member LLC tax compliance.

Guaranteed Payments

Guaranteed payments are fixed amounts paid to a member for services or capital use, regardless of whether the LLC earns a profit. They function like a salary but don't create an employer-employee relationship.

Tax treatment:

- ✅ Deductible by the LLC (reduces net income before allocation)

- ✅ Reported on the recipient's K-1, Box 4a

- ✅ Always subject to self-employment tax

- ✅ Subject to income tax

- ❌ Not subject to payroll tax withholding (member pays through estimated taxes)

Example: Managing member receives guaranteed payments

LLC gross income: $300,000

LLC expenses (excluding guaranteed payments): $80,000

Guaranteed payment to managing member: $60,000

Net income after guaranteed payment: $300,000 - $80,000 - $60,000 = $160,000

Two-member LLC (50/50 split):

Managing Member K-1:

Box 1: $80,000 (50% of $160,000)

Box 4a: $60,000

Box 14: $140,000

Total SE tax: $140,000 × 92.35% × 15.3% = $19,779

Other Member K-1:

Box 1: $80,000

Box 4a: $0

Box 14: $80,000

Total SE tax: $80,000 × 92.35% × 15.3% = $11,304

Distributions

Distributions are payments of cash or property from the LLC to members. They represent the LLC returning profit that has already been allocated (and taxed) to the member.

Tax treatment:

- ❌ NOT deductible by the LLC

- ❌ NOT additional income to the member (already included in K-1 income)

- ❌ NOT subject to self-employment tax

- ✅ Reduce the member's basis in the LLC

- ✅ Taxable as capital gain if they exceed the member's basis

Critical distinction: Guaranteed payments increase a member's total taxable income. Distributions do not — they're a return of income already reported on the K-1.

When to Use Each

| Use Guaranteed Payments When | Use Distributions When |

|---|---|

| Compensating a member for specific services | Distributing profits to all members |

| One member works full-time, others don't | Members contribute equally |

| You want to deduct the payment at the entity level | No deduction needed at entity level |

| Payment should continue regardless of profit | Payment depends on available cash |

Filing Deadlines and Extensions

Key 2026 Deadlines for Multi-Member LLCs

| Deadline | What's Due | Penalty for Missing |

|---|---|---|

| January 31, 2026 | Issue 1099-NEC to independent contractors | $60-$310 per form |

| March 15, 2026 | File Form 1065 + issue K-1s to members | $235/partner/month (up to 12 months) |

| March 15, 2026 | File Form 2553 for S Corp election (for current year) | Election may be late — use late relief |

| April 15, 2026 | Members file personal Form 1040 | 5% per month late filing penalty |

| September 15, 2026 | Extended Form 1065 due | Same penalty as original deadline |

| October 15, 2026 | Extended personal Form 1040 due | Same penalties apply |

How to File an Extension

For the LLC return (Form 1065): File Form 7004 by March 15. The extension is automatic — no reason required. This extends the filing deadline to September 15.

For members' personal returns: Each member files Form 4868 by April 15 for an automatic extension to October 15.

Pro tip: If the LLC needs an extension, all members should also file personal extensions. Late K-1s make it impossible to file accurate personal returns by April 15.

When to Elect S Corp Status for a Multi-Member LLC

The SE Tax Savings Opportunity

The primary reason multi-member LLCs elect S Corp status is to reduce self-employment tax. As a partnership, active members pay SE tax on their entire distributive share. As an S Corp, they pay payroll taxes only on their reasonable salary — distributions bypass SE tax.

The Breakeven Analysis

Two-member LLC — each member earns $80,000 distributive share

As Partnership:

SE tax per member: $80,000 × 92.35% × 15.3% = $11,304

Total SE tax: $22,608

As S Corp (each member takes $50,000 salary):

Payroll taxes per member: $50,000 × 15.3% = $7,650

Total payroll taxes: $15,300

Annual SE tax savings: $22,608 - $15,300 = $7,308

Additional S Corp costs:

Payroll service: ~$1,200/year

S Corp tax return (Form 1120-S): ~$1,500-$2,500

Total additional costs: ~$2,700-$3,700

Net savings: $7,308 - $3,700 = $3,608/year minimum

When to Elect

✅ Each active member's distributive share exceeds $50,000-$60,000

✅ The LLC has consistent profitability (not losing money)

✅ Members are willing to run payroll and file Form 1120-S

✅ The tax savings exceed the added compliance costs

❌ The LLC is in early stages with unpredictable income

❌ Members want maximum flexibility in profit allocations (S Corps can only have one class of stock)

❌ The LLC has foreign members (not eligible for S Corp status)

How to elect: File Form 2553 by March 15 for the current tax year (or within 75 days of formation for new LLCs). For a detailed comparison, see our S Corp vs LLC guide.

State-Level Tax Considerations

States That Tax LLCs at the Entity Level

While the federal government doesn't tax partnership-level income, several states impose their own taxes on LLCs:

| State | LLC Tax |

|---|---|

| California | $800 minimum franchise tax + fee based on gross receipts ($900-$11,790) |

| New York | Annual filing fee ($25-$4,500 based on NY-source gross income) |

| Texas | Franchise tax (0.375%-0.75% of taxable margin over $2.47M) |

| Illinois | 1.5% personal property replacement tax on partnership income |

State Filing Requirements

Most states require multi-member LLCs to file a state-level partnership return in addition to the federal Form 1065. Members may also need to file state income tax returns in any state where the LLC conducts business — not just the state of formation.

Example: An LLC formed in Delaware that operates in California and New York may need to file:

- Federal Form 1065

- Delaware annual report ($300)

- California Form 565 + $800 franchise tax

- New York IT-204 + filing fee

- Members file personal returns in each state with LLC-sourced income

Common Mistakes to Avoid

Mistake #1: Not Filing Form 1065

Problem: A two-member LLC earns $50,000 and the members split the income on their personal returns without filing Form 1065.

Impact: Late filing penalty of $235 × 2 partners × 12 months = $5,640, plus IRS notice and potential audit.

Solution: Every multi-member LLC must file Form 1065, regardless of income level. Even an LLC with zero income must file if it's in existence. Set up a March 15 reminder and file on time or request an extension.

Mistake #2: Missing the March 15 Deadline

Problem: The LLC owner assumes the filing deadline is April 15 (the personal return deadline) and files Form 1065 one month late.

Impact: One month of late filing penalties: $235 × number of partners.

Solution: Partnership returns (Form 1065) are due March 15, one month before personal returns. File Form 7004 by March 15 if you need more time.

Mistake #3: Allocating Profits Without an Operating Agreement

Problem: Two members each contributed different amounts of capital but have no operating agreement. State default rules split profits 50/50, but the members intended a 70/30 split.

Impact: The IRS follows the operating agreement. Without one, state default rules apply — which may not match the members' intent. This creates disputes and potentially incorrect K-1s.

Solution: Draft an operating agreement before the first tax year. Specify ownership percentages, profit/loss allocations, guaranteed payments, and distribution policies.

Mistake #4: Ignoring Self-Employment Tax on K-1 Income

Problem: Active LLC members report K-1 income on Schedule E but don't file Schedule SE, missing the 15.3% self-employment tax.

Impact: Underpayment of $11,000+ on $80,000 of K-1 income. The IRS will assess the missing SE tax plus penalties and interest.

Solution: Check K-1 Box 14. If it shows SE earnings, complete Schedule SE and include SE tax in your quarterly estimated payments. Use the Self-Employment Tax Calculator for accurate numbers.

Mistake #5: Confusing Distributions With Salary

Problem: An LLC member treats distributions as if they were salary — including them on a W-2 or reporting them as employment income.

Impact: Incorrect reporting creates a mess: unnecessary payroll tax filings, incorrect K-1s, and confused personal returns.

Solution: Multi-member LLC members receive distributions (reported on K-1 Box 19) and possibly guaranteed payments (K-1 Box 4a). They do NOT receive W-2s unless the LLC has elected S Corp status. For guidance on owner compensation, see our how to pay yourself from an LLC guide.

Streamline Multi-Member LLC Taxes With AI

Multi-member LLC tax filing involves coordinating between entity-level reporting and each member's personal return. Tracking income, allocations, guaranteed payments, and distributions requires organized financial data.

What makes Jupid different:

Jupid is an AI-powered financial assistant that handles the bookkeeping complexity of multi-member LLCs — tracking income, expenses, and each member's share in real time.

✅ Automatic transaction categorization — Jupid categorizes business expenses with 95.9% accuracy, building the foundation for accurate Form 1065 reporting

✅ Real-time profit tracking — Monitor your LLC's net income throughout the year so K-1 estimates are accurate well before March 15

✅ Quarterly estimated tax calculations — Jupid calculates each member's estimated tax payments based on their projected K-1 income, including self-employment tax

✅ WhatsApp and iMessage access — Ask "What's our LLC's net profit through Q3?" and get an instant answer from your phone

✅ Bank connection and auto-sync — Connect your LLC's business accounts and Jupid tracks all income and expenses automatically

Example conversation:

- You: "What should my Q3 estimated payment be based on our LLC income?"

- Jupid: "Your LLC's net profit through August is $142,000. Your 50% share is $71,000. With your $24,000 in guaranteed payments, your total K-1 SE earnings are projected at $95,000. Your Q3 estimated payment should be $6,800."

Start tracking your LLC finances with Jupid

Action Checklist: Multi-Member LLC Tax Filing

Formation and Setup

- Draft and sign an operating agreement with profit/loss allocation terms

- Obtain an EIN for the LLC (required for Form 1065)

- Open a dedicated business bank account

- Set up a bookkeeping system to track income and expenses

- Calendar the March 15 filing deadline

Throughout the Year

- Track all income and expenses by category

- Record guaranteed payments to members

- Track distributions to each member

- Make quarterly estimated tax payments (each member individually)

- Maintain capital account records for each member

- Issue 1099-NEC forms to independent contractors by January 31

Tax Filing (By March 15)

- Prepare or have your CPA prepare Form 1065

- Generate Schedule K-1 for each member

- File Form 1065 with the IRS by March 15 (or file Form 7004 for extension)

- Distribute K-1s to all members by March 15

- File state partnership returns if required

Each Member's Personal Return (By April 15)

- Report K-1 income on Schedule E, Part II

- Complete Schedule SE for self-employment earnings (K-1 Box 14)

- Calculate QBI deduction using Form 8995 (K-1 Box 20, Code Z)

- Report estimated tax payments on Form 1040, Line 26

- Consider filing Form 4868 if K-1 is not yet received

Resources and Citations

IRS Publications (Official Sources)

- IRS Publication 541 — Partnerships (comprehensive guide)

- Form 1065 Instructions — Line-by-line instructions for the partnership return

- Schedule K-1 (Form 1065) Instructions — How to read and issue K-1s

- Form 7004 — Application for Automatic Extension

- IRS Publication 334 — Tax Guide for Small Business

- IRS: Partnerships — Overview of partnership tax rules

Tax Code and Regulations

- IRC §701 — Partners, not partnership, subject to tax

- IRC §702 — Income and credits of partner (distributive share)

- IRC §703 — Partnership computations

- IRC §704(a) — Effect of partnership agreement on allocations

- IRC §704(b) — Substantial economic effect test for special allocations

- IRC §704(d) — Limitation on allowance of losses

- IRC §706 — Taxable years of partner and partnership

- IRC §707(c) — Guaranteed payments

- IRC §731 — Distribution rules

- IRC §6698 — Late filing penalty for partnership returns

- IRC §1402(a) — Self-employment tax on partnership income

Related Jupid Guides

- Schedule K-1 Guide 2026 — How to read and file your K-1

- S Corp vs LLC Guide 2026 — When to elect S Corp status

- How to Pay Yourself from an LLC 2026 — Owner compensation methods

- How to Stay Tax Compliant as an LLC — Ongoing compliance requirements

- Self-Employment Tax Calculator — Calculate SE tax on K-1 income

2026 Key Numbers

| Item | 2026 Amount |

|---|---|

| Form 1065 filing deadline | March 15 |

| Late filing penalty | $235 per partner per month |

| SE tax rate | 15.3% |

| Social Security wage base | $176,100 |

| Additional Medicare Tax | 0.9% over $200,000 (single) |

| QBI deduction | Up to 20% of qualified business income |

| Standard deduction (single) | $15,700 |

| California LLC franchise tax | $800 minimum |

Final Thoughts

Multi-member LLC tax filing is more involved than single-member LLC filing, but the underlying concept is straightforward: the LLC reports its income on Form 1065, passes that income through to members via K-1s, and each member pays tax on their share.

The key priorities:

- File Form 1065 on time (March 15) — The late filing penalty compounds monthly and applies per partner. This is the most expensive compliance mistake for multi-member LLCs

- Get the operating agreement right — It controls how income is allocated, which drives every K-1 and every member's tax bill

- Account for self-employment tax — Active members owe 15.3% on their K-1 distributive share and guaranteed payments, which is often the largest component of their tax bill

Once these three elements are in place, multi-member LLC tax filing becomes a routine annual process.

Disclaimer

This article provides general information about multi-member LLC tax filing and should not be considered tax advice. Partnership tax rules, allocation requirements, and self-employment tax treatment are complex areas with ongoing regulatory development. State-level LLC taxes and filing requirements vary significantly. Special allocations require careful structuring to meet the substantial economic effect test. For advice specific to your multi-member LLC, consult with a qualified tax professional.

Tax Year: 2026 Last Updated: February 13, 2026

Ready to simplify your finances?

Join 1,000+ businesses using Jupid to save time and money. Start simplifying your finances today.

30-day money-back guarantee