Schedule K-1 Guide 2026: What It Is, How to Read It, and How to File

Table of Contents

Published: February 12, 2026 Tax Year: 2026

A Message from Slava

Schedule K-1 is one of those tax forms that confuses people more than it should. You receive it because you own a piece of a partnership, S Corporation, or trust — and it tells you your share of that entity's income, deductions, and credits. But reading the form is another matter entirely.

When I structured Jupid as a multi-member entity, K-1s became part of our annual tax process. The form itself isn't complicated once you understand the layout, but it creates real problems for people who don't know what to do with it. Where does Box 1 income go on your 1040? Is your K-1 income subject to self-employment tax? What happens when the K-1 arrives late?

At Anna Money, where we served 60,000+ small businesses in the UK, I saw the same confusion around partnership self-assessment returns. The concept is universal: when a business has multiple owners, each owner receives a statement showing their share of income and deductions. In the US, that statement is Schedule K-1.

The biggest misconception about K-1s: the entity already paid the tax. It didn't. Partnerships and S Corporations are pass-through entities — they report income but don't pay income tax at the entity level. You, the partner or shareholder, pay the tax on your personal return. The K-1 tells you how much to report.

This guide covers all three types of K-1, how to read every important box, and exactly where each number goes on your Form 1040.

Executive Summary: Schedule K-1 for 2026

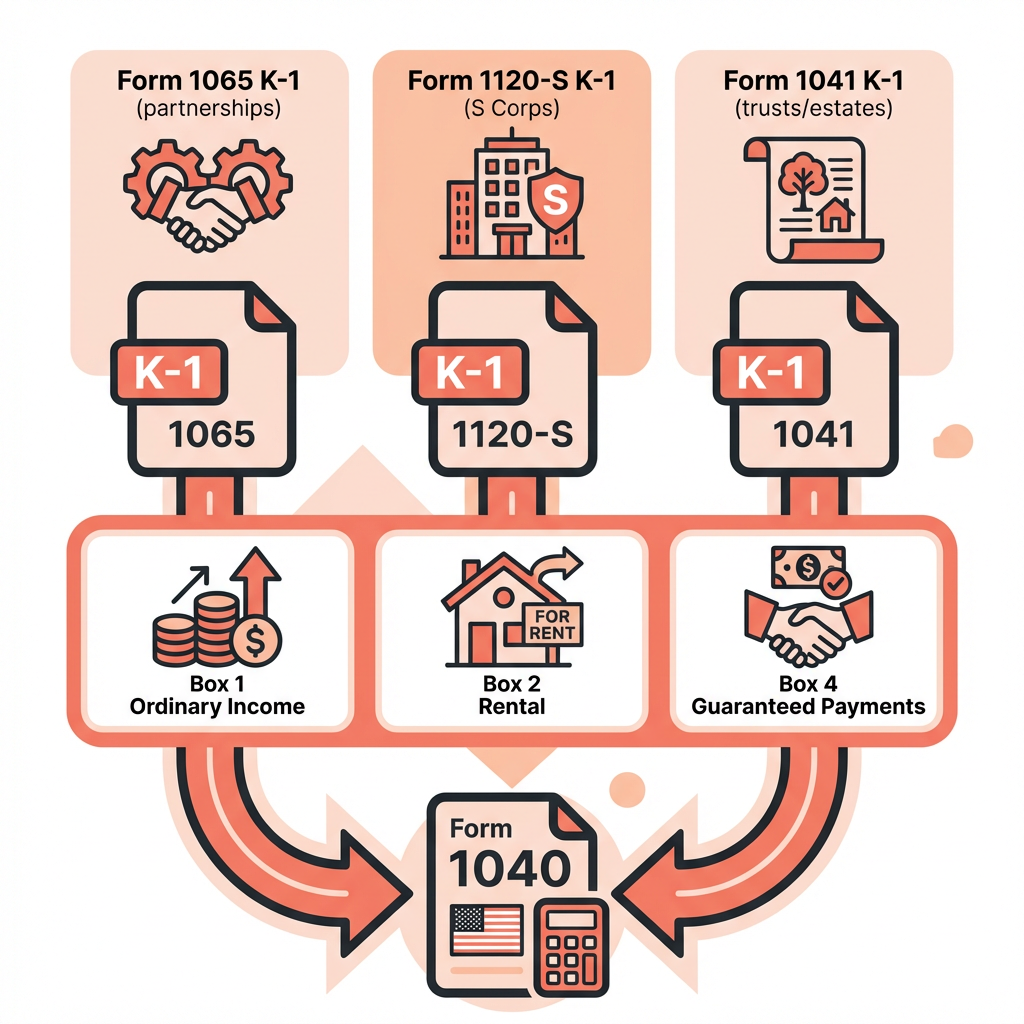

What is Schedule K-1? A tax form issued by a pass-through entity (partnership, S Corporation, or trust) that reports your share of the entity's income, deductions, credits, and other tax items.

Three Types of Schedule K-1:

| K-1 Type | Issued By | Form Filed By Entity | Who Receives It |

|---|---|---|---|

| K-1 (Form 1065) | Partnerships, multi-member LLCs | Form 1065 | Partners/members |

| K-1 (Form 1120-S) | S Corporations | Form 1120-S | Shareholders |

| K-1 (Form 1041) | Trusts, estates | Form 1041 | Beneficiaries |

Key Facts:

| Item | Details |

|---|---|

| When you receive it | By March 15 (partnerships, S Corps) or April 15 (trusts) |

| Where it goes | Various schedules on your Form 1040 |

| Self-employment tax | K-1 from partnership: usually yes. K-1 from S Corp: no. K-1 from trust: depends. |

| Entity pays income tax? | No — you pay on your personal return |

| Can you file without it? | Yes (with estimates), but you may need to amend later |

Legal basis: IRC §702 (partner's distributive share), IRC §704 (allocation rules), IRS Publication 541, Schedule K-1 Instructions

What Is Schedule K-1?

Schedule K-1 is an information document — similar to a W-2 or 1099 — that reports your share of income and deductions from a pass-through entity. The entity itself doesn't pay income tax. Instead, income "passes through" to you, and you report it on your personal tax return.

Think of it this way: A W-2 tells you what your employer paid you. A 1099 tells you what a client paid you. A K-1 tells you what your share of a business earned (or lost), regardless of whether you received any cash.

This last point is critical. You owe tax on your K-1 income even if the business didn't distribute any money to you. If the partnership earned $100,000 and your share is 50%, you report $50,000 on your return — even if the partnership kept all the cash for operations.

Legal citation: IRC §702(a) requires each partner to include in their gross income their distributive share of partnership income, gain, loss, deduction, or credit.

The Three Types of Schedule K-1

K-1 (Form 1065) — Partnerships and Multi-Member LLCs

This is the most common type. You receive it if you're a partner in a partnership or a member of a multi-member LLC (which the IRS treats as a partnership by default).

Who files it: The partnership files Form 1065 (an information return) and issues a K-1 to each partner.

Key characteristic: Partnership K-1 income is generally subject to self-employment tax for active partners. This makes it different from the S Corp K-1.

Deadline: The partnership must file Form 1065 and issue K-1s by March 15 (or September 15 with an extension).

For a complete guide on multi-member LLC tax filing, see our multi-member LLC tax filing guide.

K-1 (Form 1120-S) — S Corporations

You receive this K-1 if you're a shareholder in an S Corporation (or an LLC that elected S Corp tax treatment).

Who files it: The S Corporation files Form 1120-S and issues a K-1 to each shareholder.

Key characteristic: S Corp K-1 income is NOT subject to self-employment tax. Shareholders pay SE tax only on their W-2 salary from the S Corp — not on their K-1 distributive share. This is the primary tax advantage of S Corp election.

Deadline: The S Corp must file Form 1120-S and issue K-1s by March 15 (or September 15 with an extension).

K-1 (Form 1041) — Trusts and Estates

You receive this K-1 if you're a beneficiary of a trust or estate that distributed income to you.

Who files it: The trust or estate files Form 1041 and issues a K-1 to each beneficiary.

Key characteristic: Trust K-1 income is generally not subject to self-employment tax (unless it represents income from a trade or business the trust actively operates).

Deadline: The trust or estate must file Form 1041 and issue K-1s by April 15 (or October 15 with an extension).

How to Read Your K-1: Key Boxes Explained

The K-1 form has three sections: information about the entity (Part I), information about you (Part II), and your share of income, deductions, and credits (Part III). Part III is where the numbers live.

K-1 (Form 1065) — Partnership Key Boxes

| Box | Label | What It Reports | Where It Goes on Your 1040 |

|---|---|---|---|

| 1 | Ordinary business income (loss) | Your share of the partnership's net profit or loss | Schedule E, Part II, or Schedule SE if subject to SE tax |

| 2 | Net rental real estate income (loss) | Your share of rental property income/loss | Schedule E, Part II |

| 3 | Other net rental income (loss) | Rental income from non-real estate sources | Schedule E, Part II |

| 4a | Guaranteed payments for services | Fixed payments to you regardless of profit | Schedule E, Part II + Schedule SE |

| 4b | Guaranteed payments for capital | Interest-like payments on your capital | Schedule E, Part II |

| 4c | Total guaranteed payments | Sum of 4a and 4b | Informational |

| 5 | Interest income | Your share of interest earned by partnership | Schedule B |

| 6a | Ordinary dividends | Your share of dividends received | Schedule B |

| 6b | Qualified dividends | Portion eligible for lower tax rates | Schedule B, qualified dividends worksheet |

| 7 | Royalties | Your share of royalty income | Schedule E, Part I |

| 8 | Net short-term capital gain (loss) | Your share of short-term gains/losses | Schedule D |

| 9a | Net long-term capital gain (loss) | Your share of long-term gains/losses | Schedule D |

| 10 | Net section 1231 gain (loss) | Gains/losses from business property sales | Form 4797 |

| 11 | Other income (loss) | Various items with codes (see K-1 instructions) | Varies by code |

| 12 | Section 179 deduction | Your share of expensed asset costs | Form 4562, then Schedule E |

| 13 | Other deductions | Various deductions with codes | Varies by code |

| 14 | Self-employment earnings (loss) | Amount subject to SE tax | Schedule SE |

| 15 | Credits | Tax credits passed through to you | Various credit forms |

| 19 | Distributions | Cash and property you actually received | Not directly taxable (affects basis) |

| 20 | Other information | QBI information, foreign transactions, etc. | Varies by code |

Box 1: Ordinary Business Income

This is the most important box for most partners. It represents your share of the partnership's net ordinary income — revenue minus deductible expenses. If the partnership earned $200,000 and you own 40%, your Box 1 shows $80,000.

Self-employment tax: If you are a general partner or an active LLC member, Box 1 income is subject to self-employment tax at 15.3%. Limited partners are generally exempt from SE tax on Box 1 income (though this distinction is complex for LLC members).

Box 4a: Guaranteed Payments for Services

Guaranteed payments are fixed amounts the partnership pays you regardless of profit — similar to a salary, but you're not an employee. Common examples:

- Monthly management fees

- Fixed payments for specific services

- Payments based on time rather than profit share

Guaranteed payments are always subject to self-employment tax, even for limited partners. They're reported separately from your distributive share.

Example K-1 boxes for an active LLC member:

Box 1 (Ordinary income): $60,000

Box 4a (Guaranteed payments): $48,000

Box 14 (SE earnings): $108,000

Box 19 (Distributions): $80,000

Tax impact:

- Report $108,000 on Schedule E, Part II

- Self-employment tax on $108,000 × 92.35% × 15.3% = $15,275

- Income tax on $108,000 (minus deductions)

- The $80,000 distribution is NOT additional income

Box 19: Distributions

Distributions show the actual cash (or property) you received from the partnership during the year. Distributions are generally not taxable income — they reduce your basis in the partnership.

The critical rule: you've already been taxed on the income through Boxes 1-11. Distributions are simply the partnership sending you money that you've already reported as income. However, if distributions exceed your basis, the excess is taxable as a capital gain.

Box 20: QBI and Other Information

Box 20 with Code Z reports your share of Qualified Business Income (QBI) for the Section 199A deduction. This deduction can reduce your taxable income by up to 20% of QBI.

How to Read K-1 (Form 1120-S) — S Corporation Key Boxes

S Corp K-1 boxes are similar to partnership K-1 boxes, with one critical difference: Box 1 income is NOT subject to self-employment tax.

| Box | What's Different from Partnership K-1 |

|---|---|

| 1 | Ordinary income — reported on Schedule E, Part II. NOT subject to SE tax. |

| 4 | Does not exist on S Corp K-1 — S Corps don't have guaranteed payments |

| 14 | Does not exist — S Corp shareholders don't report SE earnings on K-1 |

| 16 | Distributions — same concept as partnership Box 19 |

| 17 | Other information (QBI, etc.) — similar to partnership Box 20 |

S Corp shareholders pay self-employment tax only on their W-2 salary from the S Corp, not on their K-1 distributive share. This is the core tax advantage of the S Corp structure.

S Corp owner with $120,000 total compensation:

W-2 Salary: $60,000 → Subject to payroll taxes (15.3%)

K-1 Box 1: $60,000 → NOT subject to SE tax

K-1 Box 16 (Distributions): $55,000 → NOT taxable income (reduces basis)

Payroll taxes: $60,000 × 15.3% = $9,180

vs. LLC SE tax: $120,000 × 92.35% × 15.3% = $16,956

SE tax savings: $7,776/year

Where K-1 Amounts Go on Your Form 1040

Step-by-Step Filing Process

Step 1: Receive all K-1s from entities you're invested in

Step 2: Report K-1 income on Schedule E, Part II (Supplemental Income and Loss)

- Enter the entity name, EIN, and your share of income/loss

- Check whether it's a passive or nonpassive activity

Step 3: Transfer specific items to their respective forms:

| K-1 Item | Goes To |

|---|---|

| Ordinary business income (Box 1) | Schedule E, Part II |

| Rental income (Box 2, 3) | Schedule E, Part II |

| Guaranteed payments (Box 4a) | Schedule E, Part II |

| Interest income (Box 5) | Schedule B |

| Dividends (Box 6) | Schedule B |

| Capital gains/losses (Box 8, 9) | Schedule D |

| Section 1231 gains (Box 10) | Form 4797 |

| Self-employment earnings (Box 14) | Schedule SE |

| QBI information (Box 20, Code Z) | Form 8995 or 8995-A |

Step 4: Calculate self-employment tax on Schedule SE using Box 14 amounts (partnership K-1 only)

Step 5: Claim the QBI deduction using Form 8995 or 8995-A based on Box 20 information

Step 6: Report the net income from Schedule E on Schedule 1, which flows to Form 1040

Self-Employment Tax on K-1 Income

Whether your K-1 income is subject to self-employment tax depends on two factors: the type of entity and your role in it.

Partnership / Multi-Member LLC

| Partner Type | Box 1 Subject to SE Tax? | Guaranteed Payments Subject to SE Tax? |

|---|---|---|

| General partner | ✅ Yes | ✅ Yes |

| Active LLC member | ✅ Yes (in most cases) | ✅ Yes |

| Limited partner | ❌ No (with exceptions) | ✅ Yes |

The LLC member question: The IRS has not issued final regulations on whether LLC members are "limited partners" for SE tax purposes. In practice, most active LLC members (those who participate in management) treat their distributive share as subject to SE tax. This is the conservative and widely accepted position.

Legal citation: IRC §1402(a)(13) excludes limited partner income from SE tax, but the definition of "limited partner" for LLC members remains unsettled.

S Corporation

| Role | K-1 Income Subject to SE Tax? |

|---|---|

| S Corp shareholder | ❌ No — K-1 income bypasses SE tax |

| S Corp shareholder-employee | ✅ W-2 salary only (not K-1 share) |

The S Corp election exists primarily for this SE tax benefit.

Trust / Estate

Trust K-1 income is generally not subject to self-employment tax unless the trust operates an active trade or business and the beneficiary materially participates.

Passive vs. Nonpassive Activity Rules

Your K-1 income is classified as either passive or nonpassive, which affects how losses are treated on your return.

Nonpassive (Active) Income/Loss

You materially participate in the business — you work in it regularly and substantially. Nonpassive income is reported as ordinary income. Nonpassive losses can offset your other income (W-2, interest, etc.) without limitation.

Passive Income/Loss

You don't materially participate — you're an investor or silent partner. Passive losses can only offset passive income. Excess passive losses carry forward to future years.

The material participation tests (IRC §469):

✅ You work 500+ hours per year in the activity

✅ You do substantially all the work

✅ You work 100+ hours and no one else works more

✅ You materially participated in 5 of the last 10 tax years

❌ Merely investing money and reviewing financial statements is NOT material participation

Impact on Your Return

Example: Partner with passive K-1 loss

K-1 Box 1: ($25,000) loss — passive activity

W-2 income: $80,000

Other passive income: $10,000

Passive loss allowed against passive income: $10,000

Suspended passive loss carried forward: $15,000

Taxable income: $80,000 (W-2) + $10,000 (passive) - $10,000 (passive loss) = $80,000

The $15,000 suspended loss carries forward until you have passive income to offset or you dispose of your entire interest in the activity.

Common Issues and How to Handle Them

Issue #1: Your K-1 Arrives Late

The partnership or S Corp must issue K-1s by March 15. Many don't make this deadline — especially if the entity files an extension.

What to do:

- File your personal return using estimated K-1 amounts based on prior year data or interim financial statements

- File an extension (Form 4868) to buy time until October 15

- When the K-1 arrives, verify it against your estimates

- If your estimates were wrong, file an amended return (Form 1040-X)

Pro tip: If you know the K-1 will be late, file Form 4868 by April 15. This extends your filing deadline to October 15, which is usually enough time.

Issue #2: Errors on Your K-1

If you believe your K-1 contains errors:

- Contact the partnership or S Corp's tax preparer immediately

- Request a corrected K-1

- Do NOT file your return with numbers you know are wrong

- If you can't get a corrected K-1, file with the numbers you believe are correct and attach an explanation

Issue #3: Multiple K-1s

If you're involved in multiple partnerships or S Corps, you receive a separate K-1 from each. Report each one on a separate line of Schedule E, Part II. The totals flow to your Form 1040 in aggregate.

Issue #4: K-1 Shows Income But No Cash Distribution

This is called "phantom income." You owe tax on your share of business income even if the business didn't distribute cash to cover your tax bill.

How to handle it:

- Check whether the operating agreement requires tax distributions

- Budget for the tax liability from other sources

- Discuss with partners about implementing a tax distribution policy

Issue #5: Basis Limitations

You can only deduct losses from a K-1 up to your basis in the entity. Basis includes your capital contributions and your share of entity debt (for partnerships). Losses in excess of basis are suspended and carried forward.

Example: Basis limitation

Your basis in the partnership: $30,000

K-1 Box 1 loss: ($50,000)

Deductible loss: $30,000

Suspended loss: $20,000 (carried forward to next year)

Remaining basis: $0

Legal citation: IRC §704(d) limits partner losses to basis. IRC §1366(d) limits S Corp shareholder losses to basis.

Multi-Member LLC Specific Guidance

If you're a member of a multi-member LLC, your K-1 comes from Form 1065 (partnership return). Here are the LLC-specific considerations:

Operating Agreement Controls Allocations

Your K-1 reflects the income allocation specified in your LLC operating agreement. If the agreement allocates 60% of profits to Member A and 40% to Member B, the K-1s reflect those percentages.

Without an operating agreement, state law typically allocates profits equally among members — regardless of capital contributions. Make sure your operating agreement is in place and up to date.

Self-Employment Tax for LLC Members

Active LLC members generally owe self-employment tax on their K-1 distributive share. This applies to Box 1 (ordinary income) and Box 4a (guaranteed payments).

If you're evaluating whether to elect S Corp status for your multi-member LLC, the SE tax savings from S Corp treatment could be significant at higher income levels.

Tax Compliance Requirements

Multi-member LLCs must:

- File Form 1065 by March 15

- Issue K-1s to all members by March 15

- Report guaranteed payments on each member's K-1

- Maintain accurate records of each member's capital account

For a complete guide to multi-member LLC tax filing, see our multi-member LLC tax filing guide.

Common Mistakes to Avoid

Mistake #1: Treating K-1 Distributions as Income

Problem: A partner receives $50,000 in distributions and reports $50,000 as income on their return, in addition to the K-1 Box 1 income.

Impact: Double taxation. You report the Box 1 income (your share of partnership profit). The distribution is a return of that income — not additional income.

Solution: Report only the amounts shown in K-1 Boxes 1-13 as income/deductions. Distributions (Box 19) reduce your basis but are not separately reported as income (unless they exceed basis).

Mistake #2: Ignoring K-1 Income Because You Got No Cash

Problem: A partner's K-1 shows $40,000 of ordinary income (Box 1), but the partnership didn't make any distributions. The partner doesn't report the income.

Impact: Underreporting income. The IRS receives a copy of your K-1 and matches it against your return. Not reporting K-1 income triggers a notice.

Solution: Report all K-1 income regardless of whether you received cash. Negotiate with partners for tax distributions if this is a recurring issue.

Mistake #3: Missing the Self-Employment Tax on Partnership K-1

Problem: An active LLC member reports their K-1 income on Schedule E but doesn't file Schedule SE, missing the 15.3% self-employment tax.

Impact: Underpaying tax by thousands of dollars. On $80,000 of K-1 SE earnings, the missed SE tax is $11,304.

Solution: Check Box 14 (self-employment earnings) on your partnership K-1. If it has an amount, you owe SE tax on it. Complete Schedule SE. Use the Self-Employment Tax Calculator to estimate your liability.

Mistake #4: Filing Before All K-1s Arrive

Problem: Filing your return based on K-1s from some entities while still waiting for others. The missing K-1 arrives later with different numbers than expected.

Impact: Amended return required, potential penalties if the missing K-1 increased your tax liability significantly.

Solution: Either wait for all K-1s or file an extension (Form 4868). The extension gives you until October 15, which is almost always enough time.

Mistake #5: Not Tracking Basis

Problem: A partner doesn't track their basis year to year. When they receive a K-1 with a loss, they deduct the full amount without checking whether they have sufficient basis.

Impact: Incorrectly deducting losses in excess of basis. The IRS can disallow the excess loss and assess additional tax plus penalties.

Solution: Maintain a running basis calculation. Start with your initial capital contribution, add income allocations, subtract losses and distributions. Your tax preparer should do this, but verify it annually.

Simplify K-1 Income Tracking With AI

K-1 income creates a unique challenge: you owe tax on income that may not match your cash flow. Tracking the tax impact requires monitoring your share of business income separately from the distributions you receive.

What makes Jupid different:

Jupid is an AI-powered financial assistant that tracks all your income sources — including K-1 pass-through income — and calculates your total tax liability in real time.

✅ Multi-entity income tracking — Jupid tracks income from multiple K-1s alongside your W-2, 1099, and other income sources

✅ Self-employment tax calculations — For partnership K-1 income subject to SE tax, Jupid calculates the 15.3% liability automatically

✅ Quarterly estimated payment calculations — Jupid factors in your K-1 income when calculating quarterly estimated tax payments

✅ 95.9% categorization accuracy — Business expenses are categorized correctly, reducing errors in net income calculations

✅ WhatsApp and iMessage access — Ask "What's my total tax liability including K-1 income?" and get an instant answer

✅ Bank connection and auto-sync — Connect all your accounts for a complete financial picture across entities

Example conversation:

- You: "My partnership K-1 shows $65,000 in ordinary income. What's my total tax impact?"

- Jupid: "Your K-1 ordinary income of $65,000 adds approximately $9,189 in self-employment tax and $8,500 in federal income tax at your marginal rate. Combined with your other income, your estimated Q3 payment should be $7,200."

Start tracking your K-1 income with Jupid

Action Checklist: Handling Your Schedule K-1

Before Tax Season

- Confirm you'll receive K-1s from all entities you're invested in

- Request the expected delivery date from each entity's accountant

- Review your operating agreements for allocation percentages

- Update your basis schedule from the prior year

When K-1s Arrive

- Compare Box 1 income to your expectations and interim financials

- Check Box 14 (SE earnings) on partnership K-1s — file Schedule SE for these amounts

- Verify Box 19/16 distributions match your bank records

- Look for Box 20 Code Z for QBI deduction information

- Contact the entity's accountant if any numbers look wrong

Filing Your Return

- Report each K-1 on a separate line of Schedule E, Part II

- Transfer interest and dividends (Boxes 5-6) to Schedule B

- Transfer capital gains (Boxes 8-9) to Schedule D

- Complete Schedule SE for partnership SE earnings

- Calculate the QBI deduction using Form 8995 or 8995-A

- Verify your basis supports any claimed losses

If K-1s Are Late

- File Form 4868 for a personal extension to October 15

- Make estimated tax payments to avoid underpayment penalties

- Use prior year K-1 amounts as a temporary estimate

- File an amended return if actual K-1 differs significantly from estimate

Resources and Citations

IRS Publications (Official Sources)

- IRS Publication 541 — Partnerships (comprehensive partnership tax guide)

- Schedule K-1 (Form 1065) Instructions — Partnership K-1 line-by-line guide

- Schedule K-1 (Form 1120-S) Instructions — S Corp K-1 line-by-line guide

- Schedule K-1 (Form 1041) Instructions — Trust/estate K-1 guide

- Schedule E Instructions — Supplemental Income and Loss

- IRS: About Schedule K-1 — Overview and recent changes

Tax Code and Regulations

- IRC §702 — Income and credits of partner (distributive share rules)

- IRC §704 — Partner's distributive share (allocation rules)

- IRC §704(d) — Partner's basis limitation on losses

- IRC §706 — Taxable years of partner and partnership

- IRC §731 — Extent of recognition of gain or loss on distribution

- IRC §1366 — Pass-through of items to S Corp shareholders

- IRC §1366(d) — S Corp shareholder basis limitation

- IRC §1402(a)(13) — Limited partner exclusion from SE tax

Related Jupid Guides

- S Corp vs LLC Guide 2026 — When S Corp treatment saves money

- Multi-Member LLC Tax Filing Guide 2026 — Partnership returns and K-1 issuance

- How to Stay Tax Compliant as an LLC — LLC compliance requirements

- Self-Employment Tax Calculator — Calculate SE tax on K-1 income

2026 Key Numbers

| Item | 2026 Amount |

|---|---|

| SE tax rate | 15.3% |

| Social Security wage base | $176,100 |

| Additional Medicare Tax | 0.9% over $200,000 (single) |

| QBI deduction | Up to 20% of qualified business income |

| Standard deduction (single) | $15,700 |

| Partnership/S Corp return due | March 15 (or September 15 with extension) |

| Trust/estate return due | April 15 (or October 15 with extension) |

| Personal return due | April 15 (or October 15 with extension) |

Final Thoughts

Schedule K-1 is a reporting mechanism, not a tax calculation. The entity earns income and passes it through to you. Your job is to report it correctly on your personal return — in the right places, with the right SE tax treatment, and within the limits of your basis.

The key takeaways:

- K-1 income is taxable regardless of cash received — You owe tax on your share of entity profits even if the partnership or S Corp kept the money

- Know your SE tax exposure — Partnership K-1 income (Box 14) is subject to self-employment tax for active members. S Corp K-1 income is not

- Track your basis — You can only deduct losses up to your basis. Distributions in excess of basis create taxable gain

If you receive K-1s and feel overwhelmed, the operating agreement and the K-1 instructions are your two most important references. Between them, every box and every allocation has an explanation.

Disclaimer

This article provides general information about Schedule K-1 and should not be considered tax advice. K-1 reporting rules vary by entity type, activity type, and individual circumstances. The self-employment tax treatment of LLC member income is an area of ongoing regulatory uncertainty. Passive activity rules, basis limitations, and at-risk rules add additional complexity. For advice specific to your situation, consult with a qualified tax professional.

Tax Year: 2026 Last Updated: February 12, 2026

Ready to simplify your finances?

Join 1,000+ businesses using Jupid to save time and money. Start simplifying your finances today.

30-day money-back guarantee