Car and Mileage Deduction 2026: Complete Guide to Maximizing Your Business Vehicle Tax Savings

Table of Contents

Published: December 3, 2025 Tax Year: 2026

A Message from Slava

As founder of Jupid, I've seen thousands of small business owners leave money on the table when it comes to vehicle deductions. Last year, the average self-employed person drove 12,000 business miles—that's over $8,000 in potential deductions at the 2025 rate. Yet many either don't track their mileage properly or choose the wrong deduction method, costing them thousands in tax savings.

This guide will show you exactly how to maximize your car and mileage deductions using the updated 2026 IRS rules, including the new standard mileage rate of 70¢ per mile—a 3-cent increase from 2025.

Executive Summary: What You Need to Know for 2026

Key Updates:

- Standard mileage rate increased to 70¢ per mile (up from 67¢ in 2024 and 2025)

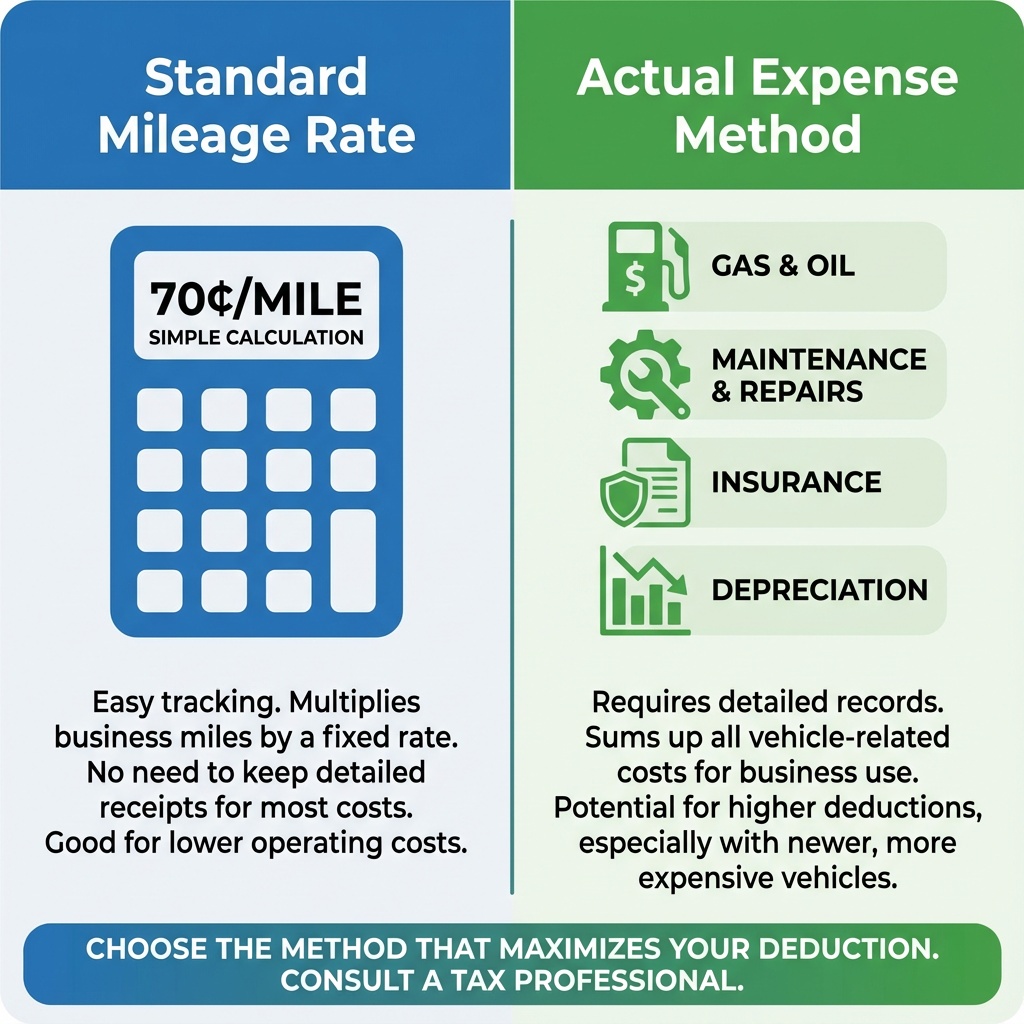

- Two deduction methods available: Standard Mileage Rate vs. Actual Expense Method

- Average savings: $8,400 per year for someone driving 12,000 business miles

- Critical: You must choose your method in the first year you use a vehicle for business

Quick Decision Guide:

- Choose Standard Mileage if: You drive many miles, have a lower-cost vehicle, or want simple record-keeping

- Choose Actual Expense if: You have an expensive vehicle, high operating costs, or drive fewer business miles

Understanding Business Mileage: What Counts and What Doesn't

What IS Deductible Business Travel

Business mileage is any driving you do for business purposes. According to IRS Publication 463 and IRC Section 162, deductible business locations include:

✅ Deductible trips:

- Driving from your home office to client meetings

- Visiting suppliers or vendors

- Traveling to business banking appointments

- Attending work-related classes or seminars

- Going to the store for business supplies

- Traveling between multiple work locations in one day

- Driving to temporary work sites (expected to last less than 1 year)

What is NOT Deductible: The Commuting Rule

❌ Non-deductible trips:

- Driving from home to your regular office (commuting)

- Personal errands, even if you make a business call during the drive

- Placing advertising on your vehicle doesn't make commuting deductible

- Listening to business podcasts during your commute doesn't count

Legal Citation: IRC § 262 - Personal, living, and family expenses are not deductible.

The Home Office Advantage: Convert Commuting to Business Miles

This is the biggest tax hack most business owners miss.

If you have a qualified home office that serves as your principal place of business, the commuting rule doesn't apply. Every trip from your home office becomes a deductible business trip.

Real-World Example

Without Home Office:

- Kam drives 20 miles each way to her downtown office (40 miles/day)

- These are non-deductible commuting miles

- Annual loss: 10,400 miles × $0.70 = $7,280 in lost deductions

With Home Office:

- Kam establishes a home office for administrative work

- Same 20-mile trip is now a business trip between two work locations

- Annual deduction: 10,400 miles × $0.70 = $7,280 deduction

- Tax savings at 25% tax bracket: $1,820/year

Source: IRS Publication 587, Business Use of Your Home - states that travel from a home office that qualifies as a principal place of business is deductible.

Method 1: Standard Mileage Rate (70¢ per Mile for 2026)

How the Standard Mileage Rate Works

The standard mileage rate is the simplest method. The IRS sets a rate each year that factors in:

- Gas and oil

- Maintenance and repairs

- Tires

- Insurance

- Registration fees

- Depreciation

2026 Rate: 70¢ per business mile

Source: IRS Notice 2025-05 - announces the standard mileage rates for 2026.

Standard Mileage Calculation Example

Business Miles Driven: 15,000 miles

Standard Mileage Rate: $0.70

Total Deduction: 15,000 × $0.70 = $10,500

What You CAN Still Deduct

Even when using the standard mileage rate, you can deduct:

| Expense | Deductible? | Notes |

|---|---|---|

| Interest on car loan | ✅ Yes | Business-use percentage only |

| Parking fees | ✅ Yes | For business trips only |

| Tolls | ✅ Yes | For business trips only |

| Personal property tax | ✅ Yes | Vehicle value-based tax only |

| Gas, maintenance, insurance | ❌ No | Already included in standard rate |

Requirements to Use Standard Mileage Rate

⚠️ Critical First-Year Rule:

You MUST use the standard mileage rate in the first year you use a vehicle for business, or you're permanently barred from using it for that vehicle.

Additional requirements:

- Cannot operate 5+ vehicles simultaneously for business

- Cannot have used actual expense method with accelerated depreciation, Section 179, or bonus depreciation on this vehicle

- For leased vehicles: Must use standard mileage for entire lease period

Source: IRS Revenue Procedure 2019-46 - establishes the first-year requirement.

Method 2: Actual Expense Method

How the Actual Expense Method Works

With the actual expense method, you deduct the actual costs of operating your vehicle for business, multiplied by your business-use percentage.

Deductible Expenses

Operating Expenses:

- ⛽ Gas and oil

- 🔧 Repairs and maintenance

- 🚗 Tires

- 📋 Insurance

- 📝 Registration fees

- 🚗 License fees

- 🅿️ Parking and tolls (business)

- 🚙 Lease payments

- 💰 Loan interest

Plus: Vehicle Depreciation

- The yearly decline in your vehicle's value

- Calculated using IRS depreciation tables

- Subject to "luxury auto" limits

- Alternative: Section 179 expensing (up to certain limits)

Actual Expense Calculation Example

Annual Vehicle Expenses:

Gas: $3,500

Oil changes: $200

Repairs: $800

Tires: $600

Insurance: $1,800

Registration: $150

Depreciation: $4,000

TOTAL EXPENSES: $11,050

Business Use: 75%

Deductible Amount: $11,050 × 75% = $8,287.50

When to Use Actual Expenses

The actual expense method typically works better when you have:

✓ An expensive vehicle (over $30,000) ✓ High operating costs (repairs, insurance) ✓ Lower annual mileage (under 12,000 miles) ✓ Business use over 50% ✓ SUV/truck over 6,000 lbs (higher Section 179 limits)

Comparing the Two Methods: Which Saves More?

Side-by-Side Comparison

| Factor | Standard Mileage | Actual Expense |

|---|---|---|

| Record keeping | Track miles only | Track all expenses + miles |

| Best for | High mileage, lower-cost cars | Expensive cars, high costs |

| IRS Form | Simpler reporting | Form 4562 for depreciation |

| Switching | Can switch after year 1 | Hard to switch back |

| Calculation | Miles × $0.70 | Expenses × business % |

Real-World Scenarios

Scenario 1: High-Mileage Salesperson

- Vehicle: 2023 Honda Accord ($28,000)

- Business miles: 20,000

- Total miles: 25,000 (80% business)

- Actual expenses: $6,500/year

Standard Mileage: 20,000 × $0.70 = $14,000 deduction ✅ Winner

Actual Expense: $6,500 × 80% = $5,200 deduction

Scenario 2: Expensive SUV, Moderate Mileage

- Vehicle: 2024 BMW X5 ($75,000)

- Business miles: 8,000

- Total miles: 12,000 (67% business)

- Actual expenses: $18,000/year (including depreciation)

Standard Mileage: 8,000 × $0.70 = $5,600 deduction

Actual Expense: $18,000 × 67% = $12,060 deduction ✅ Winner

Special Rules and Limits

Luxury Auto Depreciation Limits

The IRS imposes annual depreciation limits on "passenger automobiles" (generally vehicles under 6,000 lbs). For 2026:

| Year | Maximum Depreciation |

|---|---|

| 1st year | $20,200 (with bonus depreciation) |

| 1st year | $12,200 (without bonus) |

| 2nd year | $19,500 |

| 3rd year | $11,700 |

| Each year after | $6,960 |

Source: IRC § 280F - limits depreciation deductions for passenger automobiles.

Heavy SUVs and Trucks (Over 6,000 lbs)

Vehicles with a gross vehicle weight rating (GVWR) over 6,000 lbs have different rules:

- Not subject to luxury auto limits

- Can qualify for Section 179 expensing up to $30,500 (2026 limit)

- Full depreciation available after Section 179 limit

Examples of vehicles over 6,000 lbs GVWR:

- Ford F-150

- Chevy Suburban

- BMW X7

- Mercedes GLS

- Cadillac Escalade

Record-Keeping Requirements: What the IRS Demands

IRC Section 274(d): The Strict Substantiation Rule

Vehicle expenses are subject to heightened scrutiny under IRC § 274(d). You must maintain contemporaneous records showing:

-

Mileage:

- Date of each trip

- Business destination

- Business purpose

- Miles driven

- Starting and ending odometer readings (annually)

-

Expenses (if using actual expense method):

- Receipts for all expenses over $75

- Credit card statements

- Canceled checks

- Invoices

Best Practices

✅ Do This:

- Use a mileage tracking app (MileIQ, Everlance, TripLog)

- Log trips within 24 hours (contemporaneous requirement)

- Keep a physical logbook as backup

- Record odometer readings on January 1 and December 31

- Save all receipts digitally

- Note business purpose for each trip

❌ Don't Do This:

- Recreate mileage logs from memory (IRS will disallow)

- Use rough estimates

- Claim 100% business use (red flag for audits)

- Forget to separate personal and business trips

Case Law: Sanford v. Commissioner, T.C. Memo 2013-212 - Taxpayer's entire mileage deduction disallowed due to inadequate records, despite admitting some business use occurred.

Electric Vehicles and Tax Benefits

EV-Specific Deduction Rules

Standard Mileage Rate:

- Same 70¢ per mile applies to EVs

- May be less favorable for EVs due to lower operating costs

Actual Expense Method:

- Electricity costs (business %)

- Maintenance (typically lower for EVs)

- Full depreciation available

- Higher insurance costs

Additional EV Tax Credits

Commercial Clean Vehicle Credit:

- Up to $7,500 for qualifying EVs

- Must be used >50% for business

- Subject to vehicle price limits

EV Charger Credit:

- 30% of installation cost

- Up to $1,000 per charger (residential)

- Business use percentage applies

Source: IRC § 30C and § 30D - establish clean vehicle credits.

Making the First-Year Decision

The Decision Matrix

Choose Standard Mileage (70¢/mile) if:

- ✅ You drive many business miles

- ✅ You have an average or low-cost vehicle

- ✅ You want simple record-keeping

- ✅ Your operating costs are average

- ✅ You use the vehicle less than 50% for business

Choose Actual Expenses if:

- ✅ You have an expensive vehicle (>$40,000)

- ✅ You drive fewer business miles

- ✅ Your operating costs are high

- ✅ You use the vehicle more than 50% for business

- ✅ You have an SUV/truck over 6,000 lbs

Pro Tip: Calculate Both Methods

In your first year, calculate your deduction both ways before you file. Once you file using a method, you've made your election for that vehicle.

Many tax software programs (including Jupid) will calculate both methods for you and recommend the one that saves you more.

Common Mistakes That Cost Thousands

Mistake #1: Not Establishing a Home Office

Lost Opportunity: Converting 10,000 commuting miles to business miles Cost: 10,000 × $0.70 = $7,000 in lost deductions Tax Impact: $1,750 - $2,625 (depending on tax bracket)

Mistake #2: Switching Methods Incorrectly

The Problem: Using actual expense method in Year 1, then trying to switch to standard mileage Result: Permanently barred from standard mileage rate for that vehicle

Mistake #3: Poor Record-Keeping

IRS Audit Statistics:

- 75% of mileage deductions are disallowed due to inadequate records

- Average adjustment: $6,800 per year

- Plus penalties and interest

Mistake #4: Mixing Personal and Business Without Proper Documentation

Red Flags for IRS:

- Claiming 100% business use

- Round numbers (exactly 10,000 miles)

- No personal vehicle available

- Claiming commuting as business

Simplify Your Car Deductions With AI

Tracking mileage, choosing the right method, and maintaining IRS-compliant records shouldn't consume hours of your time. At Jupid, our AI-powered platform automates the entire process.

What makes Jupid different for vehicle deductions:

✅ Automatic mileage tracking - GPS-based tracking that distinguishes business from personal trips

✅ Smart method comparison - We calculate both methods in real-time and show you which saves more

✅ IRS-compliant logging - Every trip automatically includes date, destination, purpose, and miles

✅ Receipt capture - Snap photos of gas receipts, they're auto-categorized and stored

✅ Real-time tax savings - See your running deduction total throughout the year

✅ Chat with your AI accountant - Ask questions like "Should I use standard mileage or actual expenses?" and get instant, personalized answers

Example conversation:

- You: "I drove 15,000 business miles this year in my 2023 Toyota Camry. Which method saves me more?"

- Jupid: "Based on your vehicle and mileage, the standard mileage rate would give you a $10,500 deduction (15,000 × $0.70). If your actual expenses are less than $14,000, standard mileage is better. I can help you calculate actual expenses if you'd like to compare."

Annual value: Business owners using Jupid save an average of $3,200 more on vehicle deductions compared to manual tracking, simply by:

- Not missing deductible trips

- Choosing the optimal method each year

- Maintaining audit-proof records

- Maximizing first-year deductions

Learn more about how Jupid can maximize your vehicle deductions →

Checklist: Your Action Plan for 2026

Before January 1, 2026:

- Decide if you'll use standard mileage or actual expense method

- If actual expenses: Set up a system to track all vehicle costs

- Record your vehicle's odometer reading on January 1

- Set up a mileage tracking app or logbook

- Determine if you qualify for a home office deduction

Throughout 2026:

- Log every business trip within 24 hours

- Save all vehicle-related receipts (if using actual expenses)

- Review your method quarterly - are you on track?

- Keep personal and business use separate

Before Filing Your 2026 Tax Return:

- Calculate total business miles for the year

- Record December 31 odometer reading

- If actual expenses: Total all vehicle costs

- Calculate deduction using both methods (first year only)

- Choose the method that gives you the largest deduction

- Ensure you have documentation for all deductions

Final Thoughts

Car and mileage deductions represent one of the largest potential tax savings for small business owners and self-employed individuals. With the 2026 standard mileage rate at 70¢ per mile, someone driving just 12,000 business miles can deduct $8,400—resulting in $2,100 to $3,360 in tax savings depending on their bracket.

The key is choosing the right method in year one, maintaining meticulous records, and never treating your commute as a business trip unless you have a qualified home office.

Remember: The IRS scrutinizes vehicle deductions more than almost any other business expense. Proper documentation isn't just recommended—it's required by law under IRC § 274(d).

Sources and Additional Reading:

- IRS Publication 463, "Travel, Gift, and Car Expenses"

- IRS Publication 587, "Business Use of Your Home"

- IRC § 162, "Trade or Business Expenses"

- IRC § 274(d), "Substantiation Requirements"

- IRC § 280F, "Limitation on Depreciation for Luxury Automobiles"

- IRS Notice 2025-05, "Standard Mileage Rates for 2026"

Disclaimer: This article provides general tax information and should not be considered legal or tax advice. Tax laws change frequently, and individual circumstances vary. Consult with a qualified tax professional or use Jupid's AI-powered platform for personalized guidance.

Ready to simplify your finances?

Join 1,000+ businesses using Jupid to save time and money. Start simplifying your finances today.

30-day money-back guarantee