Business Travel Deduction 2026: Complete Guide to Writing Off Travel Expenses

Table of Contents

Published: December 3, 2025 Tax Year: 2026

A Message from Slava

Last quarter, I traveled to three banking conferences to pitch Jupid to credit unions. Between flights, hotels, meals, and conference fees, I spent over $8,500. Thanks to proper documentation and understanding IRS travel rules, I deducted 100% of my transportation and lodging costs, plus 50% of my meals—saving over $3,000 in taxes.

Yet I constantly see business owners either:

- Leave money on the table by not deducting legitimate travel expenses, or

- Over-claim by treating vacations as business trips, risking IRS audits

This guide will show you exactly how to maximize your business travel deductions while staying 100% compliant with IRS rules for 2026.

Executive Summary: What Counts as Business Travel

Quick Definition: Business travel is any trip where you travel away from your "tax home" overnight for business purposes.

Key Rules for 2026:

- You must travel outside your city limits and stay overnight (or long enough to require rest)

- Trip must be primarily for business (more than 50% business days)

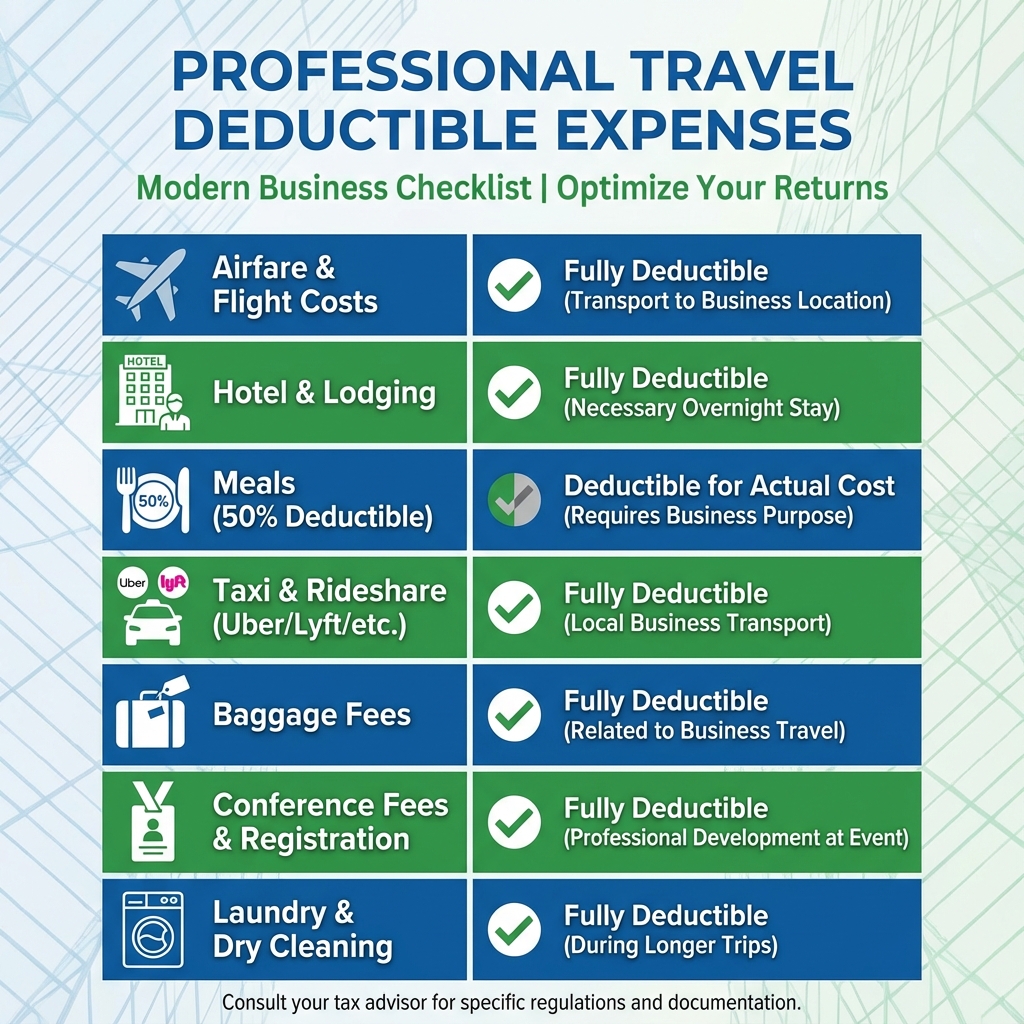

- Deductible expenses include: airfare, hotels, 50% of meals, taxis, rental cars, tips, laundry

- Different rules apply for U.S. vs. international travel

- Entertainment expenses are NOT deductible (eliminated in 2018)

Average Savings: Business owners who travel 6 times per year save an average of $4,200 in taxes by properly deducting travel expenses.

What Qualifies as Business Travel?

The Three Requirements

To claim business travel deductions, you must meet ALL three requirements established by IRS Publication 463:

✅ 1. Travel Away From Tax Home

- You must leave the general area of your tax home

- Your tax home = your principal place of business (not where you live)

- Must be outside your city limits

- If you live outside a city: must be more than ~40 miles away

✅ 2. Overnight Stay Required

- Must be overnight or long enough to require sleep/rest

- Napping in your car doesn't count

- Same-day trips are "local transportation," not business travel

✅ 3. Business Purpose

- Primary purpose must be business (not vacation)

- Must spend more than 50% of time on business activities

- Need clear business intent before leaving

Legal Citation: IRC § 162(a)(2) - allows deductions for traveling expenses while away from home in pursuit of a trade or business.

Understanding Your "Tax Home"

What is a Tax Home?

Your tax home is not where you live—it's where you do business.

Example 1: Tax Home ≠ Family Home

- Tim is a lobbyist with his office in Washington, D.C.

- His family lives in New York City

- He spends weekdays in D.C., weekends in NYC

- Tax Home: Washington, D.C. (his principal place of business)

- Result: Trips between D.C. and NYC are non-deductible commuting

Example 2: Multiple Work Locations

- Lee is a dentist with an office in Houston and works part-time in Dallas

- Houston: 3 weeks/month, $150,000 income

- Dallas: 1 week/month, $50,000 income

- Tax Home: Houston (more time + more income)

- Result: Trips from Houston to Dallas are deductible business travel

Legal Citation: Rev. Rul. 73-529 - establishes factors for determining tax home.

No Tax Home? You're a "Transient"

If you have no principal place of business, you might have no tax home—making you a "transient" for tax purposes.

Warning: Transients cannot deduct ANY travel expenses because they're never considered "away from home."

To avoid transient status, you must meet 2 of 3 factors:

- You perform business at your home and live there

- You have duplicate living expenses (home + travel costs)

- You maintain family at home, work in the area, or haven't abandoned the location

Case Study: Henderson v. Commissioner, 143 F.3d 497 (9th Cir. 1998)

- Stagehand traveled with ice skating show

- Spent 2-3 months/year at parents' home in Boise (rent-free)

- Did no work in Boise

- Court ruling: Transient status—NO travel deductions allowed

- Reason: Failed factors 1 & 2 (no work in Boise, no duplicate expenses)

What Travel Expenses Are Deductible?

Transportation Expenses (100% Deductible)

✅ Deductible transportation costs:

- Airfare, train, or bus tickets

- Car rental fees

- Mileage on your personal car (70¢/mile for 2026)

- Uber/Lyft/taxi to/from airport

- Airport parking

- Baggage fees

- Shipping costs for business materials, samples, or displays

Note: These are 100% deductible if your trip is primarily for business.

Destination Expenses

Once you arrive at your destination, you can deduct:

| Expense Category | Deductibility | Notes |

|---|---|---|

| Hotel/lodging | 100% | Business days only |

| Meals | 50% | Business days only |

| Taxi/Uber | 100% | Local transportation |

| Rental car | 100% | Business use |

| Parking & tolls | 100% | Business portion |

| Laundry | 100% | On trips 7+ days |

| Dry cleaning | 100% | On trips 7+ days |

| Tips | 50% (meals) or 100% | Depends on service |

| Internet/phone | 100% | Business use |

| Conference fees | 100% | Registration costs |

What is NOT Deductible

❌ Non-deductible expenses:

- Entertainment (concerts, sporting events, golf) - ELIMINATED in 2018 by Tax Cuts and Jobs Act

- Sightseeing tours

- Personal fitness/spa services

- Personal shopping

- Souvenirs

- Family members' travel costs (unless they're employees with genuine business purpose)

Legal Citation: IRC § 274(a)(1)(A) - no deduction for entertainment expenses.

The 50% Meal Deduction Rule

How the Meal Deduction Works

Meals while traveling for business are only 50% deductible.

Example:

- Dinner with client: $100

- Deductible amount: $50

Three ways to calculate meal deductions:

Method 1: Actual Expenses

- Keep all receipts

- Deduct 50% of actual cost

- Best when you have expensive business meals

Method 2: Standard Per Diem Rates

- IRS publishes daily meal allowances by city

- No receipts required

- Deduct 50% of per diem amount

- Best for frequent travelers

Method 3: Simplified Method

- Fixed rate regardless of location

- No receipts required

- Deduct 50% of simplified rate

2026 Per Diem Rates (Examples):

- High-cost cities (NYC, San Francisco, D.C.): $86/day for meals

- Low-cost cities: $68/day for meals

- Deductible amount: 50% of per diem rate

Source: IRS Notice 2025-54 - establishes per diem rates for 2025-2026.

Meals Without Overnight Stay

General Rule: Meals are only deductible if you stay overnight on a business trip.

Exception: Meals during local business activities (meetings with clients, etc.) are also 50% deductible, even without overnight travel.

Mixing Business and Pleasure: The Critical Rules

U.S. Travel: The "More Than Half" Rule

For travel within the United States, you can deduct transportation costs if you spend more than half your time on business.

The calculation:

- Count business days vs. personal days

- If business days exceed personal days: 100% of airfare/transportation is deductible

- Lodging and meals: deductible only for business days

Example: Mostly Business Trip

Tom travels from Atlanta to New Orleans by train

Business days: 6 days (New Orleans business meetings)

Personal days: 3 days (visiting parents in Mobile)

Total days: 9

Business %: 6/9 = 67% (MORE than 50%)

DEDUCTIONS:

✅ 100% of train fare ($250)

✅ $3,000 for hotel/meals during 6 business days in New Orleans

❌ $900 for lodging/meals during personal days in Mobile

Total deduction: $3,250

Example: Mostly Personal Trip

Tom travels from Atlanta to New Orleans by train

Business days: 2 days

Personal days: 7 days (visiting parents)

Total days: 9

Business %: 2/9 = 22% (LESS than 50%)

DEDUCTIONS:

❌ $0 train fare (primarily personal trip)

✅ $50 mailing business documents while in New Orleans

Total deduction: $50

Legal Citation: Treas. Reg. § 1.162-2(b)(2) - establishes the "more than half" rule for U.S. travel.

International Travel: More Flexible Rules

Travel outside the United States has different rules based on trip length:

Trips 7 Days or Less:

- Deduct 100% of transportation, even if you spend most time on vacation

- Must have at least some business purpose

- Deduct lodging/meals for business days only

Example:

Billie flies from Portland to Vancouver (6 days total)

Days sightseeing: 4 days

Days meeting suppliers: 1 day

DEDUCTIONS:

✅ 100% of airfare (trip 7 days or less)

✅ Lodging/meals for 1 business day only

Trips More Than 7 Days with More Than 75% Business:

- Deduct 100% of transportation

- Deduct 100% of lodging/meals for business days

Example:

Sean flies from Boston to Dublin (10 days total)

Days sightseeing: 1 day

Days in business meetings: 9 days

Business %: 9/10 = 90% (more than 75%)

DEDUCTIONS:

✅ 100% of airfare to Dublin

✅ Lodging/meals for 9 business days

❌ Lodging/meals for 1 personal day

Trips More Than 7 Days with 51-75% Business:

- Deduct business % of transportation

- Deduct lodging/meals for business days only

Example:

Sam flies from Las Vegas to London (10 days total)

Days sightseeing: 4 days

Days on business: 6 days

Business %: 6/10 = 60% (between 51-75%)

DEDUCTIONS:

✅ 60% of round-trip airfare ($3,000 × 60% = $1,800)

✅ Lodging/meals for 6 business days only

Trips More Than 7 Days with Less Than 51% Business:

- ❌ $0 transportation deduction

- ✅ Direct business expenses at destination (copying, mailing, etc.)

What Counts as a "Business Day"?

The Eight Types of Business Days

According to IRS Publication 463, the following count as business days:

✅ 1. Days working - Any day you work 4+ hours on business

✅ 2. Travel days - Days spent traveling to/from destination

✅ 3. Weekends between business days - The "Sandwich Day Rule"

✅ 4. Holidays between business days

✅ 5. Standby days - Days waiting for meetings that couldn't be avoided

✅ 6. Days where business was intended but circumstances prevented it (illness, strikes, etc.)

✅ 7. Days attending required conventions/conferences

✅ 8. Days working from hotel/temporary office (even if you don't meet anyone)

The "Sandwich Day Rule"

This is a powerful strategy: Weekends and holidays "sandwiched" between business days count as business days, even if you do nothing business-related.

Example:

Monday-Friday: Business meetings in Las Vegas

Saturday-Sunday: No business activities (personal time)

Monday: Business meeting before flying home

RESULT: All 8 days count as business days

DEDUCTIONS: 8 days of lodging + 50% of meals

Strategy: Schedule business meetings on Friday and Monday to convert the weekend into deductible business days.

Special Rules and Limits

Taking Family Members on Business Trips

General Rule: You CANNOT deduct expenses for family members traveling with you.

Exception: You CAN deduct if your family member:

- Is your employee

- Has a genuine business reason for the trip

- Would be allowed to deduct the expenses themselves

What doesn't qualify:

- Typing notes

- Social entertaining

- "Moral support"

What CAN qualify:

- Sales calls by an employee-child

- Business negotiations by an employee-spouse

- Essential business tasks

Good News: You can still deduct YOUR expenses at the single-person rate, even if your family comes along.

Example:

Yamiko travels from New Orleans to Sydney for business

She brings her husband and son

Airfare for 3 people: $2,500 total

DEDUCTIONS:

✅ Cost of single ticket for Yamiko: $1,000

❌ Husband's ticket: $750 (not deductible)

❌ Son's ticket: $750 (not deductible)

Hotel: $500/night for 2-bedroom suite

DEDUCTIONS:

✅ Cost of single room: $250/night

❌ Extra cost for larger room: $250/night (not deductible)

Conventions and Conferences

General Rules:

- Conference must be related to your trade or business

- Agenda must show business connection

- Location must be reasonable for the conference topic

- Can't claim conventions purely for investment advice or political purposes

Special Rule for Cruises:

- Maximum deduction: $2,000 per year

- Ship must be U.S.-registered

- All ports must be in U.S. or U.S. possessions

- Must file special form with W-2s from speakers

- Very restrictive—most cruise conventions don't qualify

Legal Citation: IRC § 274(h) - establishes convention deduction limits.

Temporary Work Assignments

If you work at a location away from home temporarily (expected to last 1 year or less), your travel there is deductible.

Example:

Sadie (computer trainer) works from downtown office

She's hired to train Acme Corp employees for 3 months

Acme's office is 50 miles away

DEDUCTIONS:

✅ Daily mileage: 100 miles × 70¢ = $70/day

✅ Meals during training days (50%)

✅ Hotel if she stays near Acme (saves commute time)

Warning: If the assignment is expected to last more than 1 year, that location becomes your new tax home and travel is NOT deductible.

Documentation Requirements: What the IRS Demands

IRC § 274(d): The Strictest Substantiation Rules

Travel expenses face heightened documentation requirements under IRC § 274(d). You must prove:

1. Amount:

- Receipts for lodging and all expenses $75+

- Credit card statements acceptable for expenses under $75

2. Time:

- Dates of departure and return

- Number of business days

- Number of personal days

3. Place:

- Name of city/destination

- Hotels where you stayed

- Business locations visited

4. Business Purpose:

- Reason for travel

- Nature of business conducted

- Expected business benefit

- People you met with (names, business relationships)

Best Practices for Record-Keeping

✅ Do This:

- Take photos of receipts immediately

- Use travel expense tracking apps (Expensify, Concur, Jupid)

- Create trip reports within 24 hours of return

- Calendar all business meetings before you go

- Save flight confirmations and itineraries

- Keep conference agendas and materials

- Document business purpose in writing before departure

❌ Don't Do This:

- Recreate records months later from memory

- Claim personal vacation days as business days

- Deduct entertainment costs (not allowed since 2018)

- Take family "business trips" without legitimate business purpose

- Fail to separate business and personal days

Case Law: Sanford v. Commissioner, T.C. Memo 1983-729 - Taxpayer's entire travel deduction disallowed due to failure to substantiate business purpose, despite having receipts.

Maximizing Your Business Travel Deductions

Strategy #1: Use the Sandwich Day Rule

Schedule business activities on Friday and Monday to make the intervening weekend deductible.

Before:

Monday-Wednesday: Business in San Francisco

Deductible: 3 days

Annual savings (4 trips): 12 business days

After:

Friday-Monday: Business in San Francisco (+ weekend sightseeing)

Deductible: 4 days (weekend counts as business via sandwich rule)

Annual savings (4 trips): 16 business days = 33% more deductions!

Strategy #2: Plan International Trips Strategically

For trips abroad longer than 7 days, ensure you hit the 75% business threshold to deduct 100% of airfare.

Example:

- 10-day trip to London

- Need 8 business days for 80% (more than 75%)

- Can have 2 personal days and still get 100% airfare deduction

Strategy #3: Combine Multiple Business Purposes

Visit multiple clients or attend conferences in the same trip to strengthen your business purpose documentation.

Example:

Los Angeles Trip (5 days):

- Day 1: Client meeting #1

- Day 2: Industry conference

- Day 3: Client meeting #2

- Day 4: Visit supplier

- Day 5: Tour competitor's facility

All 5 days = clear business days

100% of transportation + lodging deductible

Strategy #4: Per Diem Method for Frequent Travelers

If you travel often, use per diem rates instead of tracking actual meal costs.

Benefits:

- No meal receipts required

- Simpler record-keeping

- Often results in larger deduction than actual expenses

Strategy #5: Extend Business Trips Over Weekends

Smart Play: If airfare is the same (or less) for staying through the weekend, do it.

Example:

Business meeting Thursday-Friday in Miami

Option A: Fly Thursday, return Friday

- 2 business days

- Weekend airfare: $800

Option B: Fly Thursday, return Monday

- 4 business days (includes weekend via sandwich rule)

- Weekday airfare: $600

Result: LOWER airfare + MORE deductions!

Common Mistakes That Trigger Audits

Mistake #1: Claiming 100% Business on Obvious Vacation Destinations

Red Flag Example:

"10-day business trip to Hawaii"

- 2 business meetings

- 8 days at beach resort

IRS Response: This will be challenged. You'll need extraordinary documentation to prove this wasn't primarily a vacation.

Mistake #2: Deducting Entertainment

Entertainment has been non-deductible since 2018 (Tax Cuts and Jobs Act).

❌ Not deductible:

- Ball games with clients

- Golf outings

- Concert tickets

- Nightclub expenses

✅ Still deductible:

- 50% of meals during entertainment events (if separately stated on bill)

Mistake #3: Inadequate Documentation of Business Purpose

Simply writing "business meeting" isn't enough. You need:

- WHO you met with (name, company, title)

- WHAT you discussed (specific business topics)

- EXPECTED OUTCOME (new sales, partnerships, etc.)

Mistake #4: Deducting Spouse Travel Without Business Purpose

Unless your spouse is an employee with genuine business duties, their expenses aren't deductible—even if they attend dinners with you.

Mistake #5: Not Allocating Days Between Business and Personal

You MUST track which days were business and which were personal. Claiming "all business" on a 10-day Hawaii trip will not survive IRS scrutiny.

Simplify Your Travel Expense Tracking With AI

Tracking receipts, calculating deduction limits, and documenting business purpose shouldn't consume hours after each trip. At Jupid, our AI-powered platform automates the entire business travel deduction process.

What makes Jupid different for travel expenses:

✅ Auto-capture receipts - Take photo of any receipt, instantly categorized (airfare, hotel, meals, taxi)

✅ Smart trip tracking - Log your trip once, we calculate business vs. personal days automatically

✅ 50% meal calculation - Automatic 50% reduction for meal expenses (no mental math)

✅ Per diem integration - We look up IRS per diem rates for your destination and calculate the deduction

✅ Sandwich day detection - We automatically count weekends between business days

✅ IRS-compliant documentation - Every expense includes business purpose, date, location, and amount

✅ Travel summary reports - Generate audit-ready trip reports in seconds

✅ Chat with your AI accountant - Ask questions like "Can I deduct my spouse's airfare?" and get instant answers

Example conversation:

- You: "I'm traveling to San Francisco for 3 days of meetings, then staying the weekend. Can I deduct the hotel for Saturday and Sunday?"

- Jupid: "Yes! Since your weekend is 'sandwiched' between business days (you arrive Thursday for Friday meetings, then have Monday meetings before leaving), Saturday and Sunday count as business days. Your hotel for those days is 100% deductible. I've already added this to your travel expense report."

Annual value: Business owners using Jupid save an average of $2,100 more on travel deductions compared to manual tracking, simply by:

- Not missing deductible expenses (average: 18 receipts per trip)

- Properly applying the sandwich day rule

- Maximizing per diem deductions

- Maintaining audit-proof records

Learn more about how Jupid can maximize your travel deductions →

Checklist: Your Pre-Trip and Post-Trip Action Plan

Before Your Trip

- Document business purpose in writing (email to yourself)

- Calendar all business meetings/conferences

- Research IRS per diem rates for your destination

- Set up expense tracking app

- Brief family members if they're traveling (clarify non-deductibility)

- Save flight confirmation and hotel reservation

During Your Trip

- Take photo of every receipt immediately

- Document who you met with (names, companies)

- Note business purpose for each meeting

- Save conference agendas and materials

- Track business vs. personal activities daily

- Keep lodging receipts separate

After Your Trip

- Create trip summary within 24 hours (while memory is fresh)

- Calculate total business days vs. personal days

- Determine deduction method (actual vs. per diem)

- Calculate 50% reduction for meals

- Generate trip expense report

- Store all documentation for 7 years

Quick Reference: Deduction Limits Summary

| Expense Type | Deduction Limit | Notes |

|---|---|---|

| Airfare/transportation | 100% or business % | Depends on business days |

| Hotel/lodging | 100% | Business days only |

| Meals | 50% | Business days only |

| Rental car | 100% or business % | Track business vs. personal miles |

| Parking/tolls | 100% | Business portion only |

| Tips | 50% (meals) or 100% | Follows underlying expense |

| Laundry/dry cleaning | 100% | Trips 7+ days |

| Conference fees | 100% | Must be business-related |

| Internet/phone | 100% | Business use only |

| Entertainment | 0% | Not deductible since 2018 |

Final Thoughts

Business travel deductions can save thousands of dollars annually—but only if you understand the rules and maintain proper documentation.

The three keys to maximizing your business travel deductions:

- Ensure your trip is primarily for business (more than 50% business days)

- Document everything (receipts + business purpose)

- Use strategies like the sandwich day rule and per diem rates

Remember: The IRS scrutinizes travel deductions closely because of past abuses. Having a legitimate business purpose and contemporaneous records isn't just smart—it's required by law under IRC § 274(d).

Sources and Additional Reading:

- IRS Publication 463, "Travel, Gift, and Car Expenses"

- IRC § 162(a)(2), "Trade or Business Expenses - Travel"

- IRC § 274(d), "Substantiation Requirements"

- IRC § 274(a), "Entertainment Disallowance"

- IRC § 274(h), "Convention Expense Limitations"

- IRS Notice 2025-54, "Per Diem Rates for 2025-2026"

- Treas. Reg. § 1.162-2, "Traveling Expenses"

Disclaimer: This article provides general tax information and should not be considered legal or tax advice. Tax laws change frequently, and individual circumstances vary. Consult with a qualified tax professional or use Jupid's AI-powered platform for personalized guidance.

Ready to simplify your finances?

Join 1,000+ businesses using Jupid to save time and money. Start simplifying your finances today.

30-day money-back guarantee