Inventory Tax Deductions 2026: Complete Guide for Product Sellers

Table of Contents

Published: December 8, 2025 Tax Year: 2026

A Message from Slava

When I advised e-commerce sellers at Anna Money, I saw countless business owners overpaying taxes because they didn't understand inventory deductions. One client was sitting on $2.3M in unsold inventory and using the wrong accounting method—costing them $85,000 in unnecessary taxes every year.

The inventory tax rules changed dramatically in 2018 with the Tax Cuts and Jobs Act. If your business has gross receipts under $30 million, you now have powerful new options that can immediately deduct inventory costs instead of waiting until items sell. Yet most business owners don't know these rules exist.

This guide will show you exactly how to maximize your inventory deductions in 2026, choose the optimal accounting method, and potentially save tens of thousands of dollars in taxes.

Executive Summary: Inventory Deduction Options

Three Ways to Deduct Inventory in 2026:

Option 1: Cash Method + No Inventory Tracking

- Best for: Businesses under $30M in receipts with minimal inventory tracking

- Deduction: Immediate when purchased

- Requirement: Don't use inventory records for cost allocation or creditor reports

- Advantage: Simplest method, maximum cash flow

Option 2: Nonincidental Materials & Supplies

- Best for: Manufacturers with raw materials

- Deduction: When materials move into production

- Requirement: Gross receipts under $30M

- Advantage: Deduct earlier than traditional COGS

Option 3: Traditional Inventory Method (COGS)

- Best for: Businesses over $30M or with complex inventory needs

- Deduction: Only when inventory is sold

- Accounting methods: FIFO, LIFO, Average Cost, Specific Identification

- Advantage: Matches revenue with expenses

Key Threshold for 2026:

- $30,000,000 in average annual gross receipts (past 3 years)

- Under $30M = Eligible for simplified cash method

- Over $30M = Must use traditional inventory accounting

What Is Inventory? Understanding the Basics

Inventory Definition

Inventory (merchandise) includes goods and products that a business owns to sell to customers in the ordinary course of business.

What counts as inventory:

- ✅ Finished goods ready for sale

- ✅ Work-in-process (partially finished goods)

- ✅ Raw materials and components

- ✅ Goods you've purchased but not yet received (if you own title)

- ✅ Goods on consignment that you own

- ✅ Goods in transit that you own

What is NOT inventory:

- ❌ Equipment, tools, and machinery used in your business

- ❌ Office supplies

- ❌ Goods you're holding on consignment (but don't own)

- ❌ Real estate

- ❌ Materials and supplies that don't become part of finished products

Legal Citation: IRS Publication 334, Chapter 7 - Inventory

What Is NOT Inventory: Materials, Supplies, and Assets

Materials and Supplies

Not counted as inventory:

- Parts for maintaining/repairing equipment

- Fuel, lubricants, and consumables (used within 12 months)

- Items with useful life of 12 months or less

- Items costing $200 or less

Tax Treatment:

- Deduct when used or consumed (not when purchased)

- Exception: "Incidental supplies" can be deducted when purchased if:

- You don't track usage

- You don't take physical inventory counts

- Deducting when purchased doesn't distort income

Long-Term Assets

Examples:

- Equipment and machinery

- Tools

- Office furniture

- Vehicles

- Buildings

Tax Treatment:

- NOT part of inventory

- Deducted via Section 179, bonus depreciation, or regular depreciation

- (See our Section 179 & Depreciation Guide)

The $30 Million Threshold: Why It Matters

Historical Context

Before 2018:

- ALL businesses (regardless of size) had to maintain inventory

- Deduct inventory ONLY when sold (not when purchased)

- Complex uniform capitalization (UNICAP) rules applied

- Cash method of accounting prohibited for most inventory businesses

After 2018 (Tax Cuts and Jobs Act):

- Businesses under $30M can use cash method

- Two new simplified inventory deduction options available

- UNICAP rules don't apply to qualifying small businesses

- Earlier deductions = better cash flow

Legal Citation: IRC § 471(c) - Simplified dollar-value LIFO method for certain small businesses

Calculating Your Average Annual Gross Receipts

Formula:

Average Annual Gross Receipts =

(Year 1 Receipts + Year 2 Receipts + Year 3 Receipts) ÷ 3

Example:

2024 gross receipts: $22,000,000

2025 gross receipts: $28,000,000

2026 gross receipts: $31,000,000

Average: ($22M + $28M + $31M) ÷ 3 = $27,000,000

Result: UNDER $30M threshold ✅

→ Eligible for simplified inventory methods

Important: You use the average over 3 years, not just the current year. So even if 2026 exceeds $30M, you still qualify if the 3-year average is under $30M.

Option 1: Cash Method Without Inventory Tracking

How It Works

If your business has gross receipts under $30M and uses the cash method of accounting, you can immediately deduct inventory when purchased—as long as you don't maintain inventory records for cost allocation or creditor reporting.

Requirements:

- Gross receipts under $30M (3-year average)

- Use cash method of accounting

- Don't track inventory in books/records for:

- Allocating costs to ending inventory

- Calculating COGS

- Reporting inventory value to banks/creditors

What you CAN do:

- ✅ Track inventory for reordering purposes

- ✅ Use point-of-sale systems for sales tracking

- ✅ Monitor stock levels for operations

What you CANNOT do (if you want immediate deduction):

- ❌ Take physical inventory counts for financial reporting

- ❌ Allocate costs between sold and unsold inventory

- ❌ Report inventory value to lenders

- ❌ Calculate year-end inventory value in your books

Legal Citation: IRS Reg. 1.471-1(b)(6) - Inventory rules for small business taxpayers

Example 1: Qualifies for Immediate Deduction

Scenario:

Business: Small online clothing retailer

Gross receipts: $18M (3-year average)

Accounting: Cash method

Inventory tracking: Point-of-sale for reordering only

Tax Treatment:

December 2026: Purchases $500,000 in inventory

Books: Expense $500,000 when purchased

Tax return: Deduct $500,000 in 2026

✅ Full immediate deduction

Why it qualifies:

- Uses inventory tracking ONLY for reordering

- Doesn't allocate costs to ending inventory

- Doesn't report inventory value to creditors

- Cash method in books matches tax method

Example 2: Does NOT Qualify for Immediate Deduction

Scenario:

Business: Liquor store chain

Gross receipts: $25M (3-year average)

Accounting: Cash method

Inventory tracking: Physical counts on Dec 31

Bank reporting: Provides inventory valuations to lender

Tax Treatment:

December 2026: Purchases $500,000 in inventory

Year-end physical count: $200,000 unsold inventory

Deduction 2026: $300,000 (COGS only)

✅ Can only deduct what was SOLD

Why it doesn't qualify:

- Takes physical counts for financial reporting

- Reports inventory value to creditors

- Allocates costs between sold and unsold inventory

- Must use traditional COGS method

Option 2: Nonincidental Materials & Supplies Method

How It Works

Businesses under $30M can treat inventory as nonincidental materials and supplies and deduct costs when the materials are first used or consumed in business operations.

Key Advantage: For manufacturers, "used or consumed" means when materials move from raw material storage into work-in-process—NOT when the finished product is sold.

Who benefits most:

- Manufacturers

- Custom fabricators

- Businesses that transform raw materials

Who doesn't benefit:

- Retailers (inventory "consumed" only when sold to customers)

- Resellers of finished goods

Legal Citation: IRC § 471(c)(1)(A) - Materials and supplies

Manufacturing Example

Scenario:

Business: Custom furniture manufacturer

Gross receipts: $22M

Purchases: $800,000 in lumber and hardware (December 2026)

Traditional method (COGS):

December 2026: Purchase $800,000 lumber

January 2027: Use lumber in production

March 2027: Sell finished furniture

Deduction: March 2027 (when sold) ❌

Materials & supplies method:

December 2026: Purchase $800,000 lumber

January 2027: Move lumber into production

Deduction: January 2027 (when consumed) ✅

Savings: 2-3 month earlier deduction

Additional Benefits:

- Uniform Capitalization (UNICAP) rules DON'T apply

- All direct labor and overhead deductible when incurred

- Simpler record-keeping than traditional method

Option 3: Traditional Inventory Method (COGS)

When You Must Use This Method

Required if:

- ✅ Gross receipts exceed $30M (3-year average)

- ✅ You want to match revenue with expenses precisely

- ✅ You report inventory to creditors or for financial statements

- ✅ You take physical inventory counts

Cost of Goods Sold (COGS) Formula

Standard COGS calculation:

Beginning Inventory (Jan 1)

+ Purchases during the year

+ Cost of labor (if manufacturing)

+ Materials and supplies

+ Other costs (freight, storage)

- Ending Inventory (Dec 31)

= Cost of Goods Sold (COGS)

Example:

Beginning inventory (Jan 1, 2026): $500,000

Purchases during 2026: $2,000,000

Ending inventory (Dec 31, 2026): $400,000

COGS = $500,000 + $2,000,000 - $400,000

COGS = $2,100,000 ← Deductible in 2026

Tax Treatment:

- COGS is deducted on Schedule C (Line 4)

- Reduces gross income

- Only sold inventory is deductible

- Unsold inventory remains an asset on your balance sheet

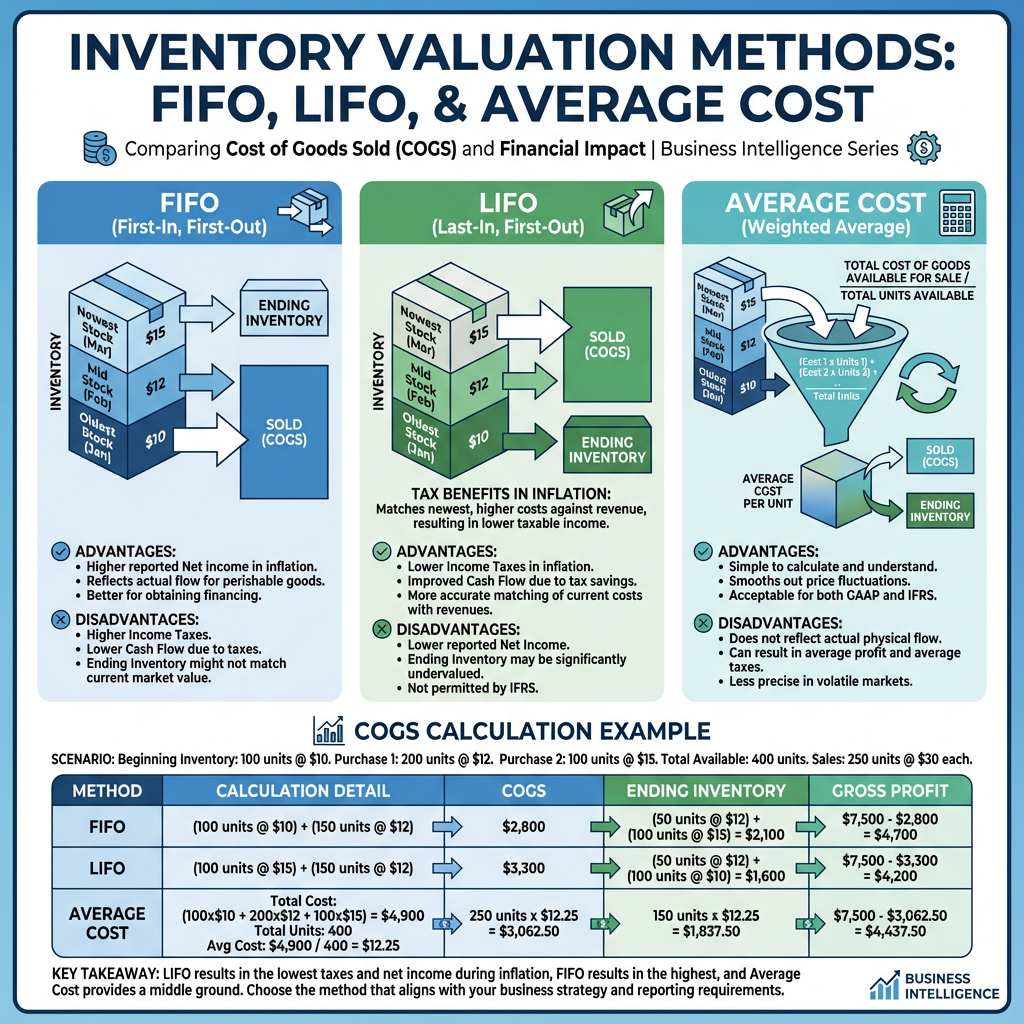

Inventory Accounting Methods: FIFO, LIFO, Average Cost

Choosing Your Inventory Valuation Method

When you maintain traditional inventory, you must choose an accounting method to value your ending inventory. This choice affects your COGS and taxable income.

Method 1: FIFO (First-In, First-Out)

Assumption: The first items purchased are the first items sold

How it works:

January: Purchase 100 units @ $10 each = $1,000

June: Purchase 100 units @ $12 each = $1,200

December: Sell 150 units

FIFO assumes you sold:

- 100 units from January @ $10 = $1,000

- 50 units from June @ $12 = $600

COGS = $1,600

Ending inventory:

- 50 units from June @ $12 = $600

Advantages:

- ✅ Reflects actual physical inventory flow (for most businesses)

- ✅ Higher ending inventory value in inflationary times

- ✅ Simpler to calculate and explain

- ✅ No IRS approval needed to adopt

Disadvantages:

- ❌ Higher taxable income during inflation (older, cheaper costs matched against current revenue)

- ❌ Higher taxes paid sooner

Best for:

- Perishable goods businesses

- Businesses experiencing stable or declining prices

- Businesses wanting to show higher profits to lenders

Method 2: LIFO (Last-In, First-Out)

Assumption: The last items purchased are the first items sold

How it works:

January: Purchase 100 units @ $10 each = $1,000

June: Purchase 100 units @ $12 each = $1,200

December: Sell 150 units

LIFO assumes you sold:

- 100 units from June @ $12 = $1,200

- 50 units from January @ $10 = $500

COGS = $1,700

Ending inventory:

- 50 units from January @ $10 = $500

Advantages:

- ✅ Matches current costs with current revenue

- ✅ Lower taxable income during inflation

- ✅ Tax deferral (pay taxes later)

- ✅ Better cash flow

Disadvantages:

- ❌ More complex to calculate

- ❌ Requires IRS Form 970 and special election

- ❌ Must use LIFO for financial statements too (LIFO conformity rule)

- ❌ Lower ending inventory value

- ❌ May reduce borrowing capacity (lower assets)

Legal Citation: IRC § 472 - Last-in, first-out inventories

Best for:

- Businesses with rising costs

- High-volume commodity businesses

- Businesses prioritizing tax minimization over financial statement profit

Method 3: Average Cost (Weighted Average)

Assumption: All units have the same average cost

How it works:

January: Purchase 100 units @ $10 each = $1,000

June: Purchase 100 units @ $12 each = $1,200

Total: 200 units for $2,200

Average cost = $2,200 ÷ 200 = $11 per unit

December: Sell 150 units

COGS = 150 × $11 = $1,650

Ending inventory:

- 50 units × $11 = $550

Advantages:

- ✅ Simple to calculate

- ✅ Smooths out price fluctuations

- ✅ Reduces record-keeping complexity

- ✅ No IRS approval required

Disadvantages:

- ❌ Doesn't match actual physical flow

- ❌ Moderate tax impact (between FIFO and LIFO)

Best for:

- Businesses with many similar items

- Businesses with stable prices

- Businesses wanting simple administration

Method 4: Specific Identification

Assumption: Track the actual cost of each specific item sold

How it works:

Purchase Item #1: $100

Purchase Item #2: $150

Purchase Item #3: $120

Sell Item #2:

COGS = $150 (the actual cost of that specific item)

Advantages:

- ✅ Most accurate matching of costs to revenue

- ✅ Works for unique, high-value items

Disadvantages:

- ❌ Extremely labor-intensive

- ❌ Only practical for limited inventory types

- ❌ Allows manipulation (cherry-picking which items to sell)

Best for:

- Car dealerships

- Jewelry stores

- Art galleries

- Custom equipment sellers

- Real estate developers

Comparative Example: FIFO vs. LIFO Tax Impact

Scenario

Business: Electronics retailer

Annual sales: $5,000,000

Beginning inventory: $400,000

Purchases during year:

- Q1: 500 units @ $200 = $100,000

- Q2: 500 units @ $220 = $110,000

- Q3: 500 units @ $240 = $120,000

- Q4: 500 units @ $260 = $130,000

Total purchases: 2,000 units for $460,000

Total goods available for sale: $860,000

Units sold: 1,800

Sales revenue: $5,000,000

FIFO Method

COGS (first 1,800 units):

- Beginning inventory: $400,000 (800 units)

- Q1 purchase: $100,000 (500 units)

- Q2 purchase: $110,000 (500 units)

COGS = $610,000

Ending inventory (200 units from Q4):

200 units × $260 = $52,000

Gross profit: $5,000,000 - $610,000 = $4,390,000

LIFO Method

COGS (last 1,800 units):

- Q4 purchase: $130,000 (500 units)

- Q3 purchase: $120,000 (500 units)

- Q2 purchase: $110,000 (500 units)

- Q1 purchase: $60,000 (300 units @ $200)

COGS = $420,000 + $400,000 (from beginning inventory)

COGS = $820,000

Ending inventory (200 units from Q1):

200 units × $200 = $40,000

Gross profit: $5,000,000 - $820,000 = $4,180,000

Tax Comparison

| Metric | FIFO | LIFO | Difference |

|---|---|---|---|

| COGS | $610,000 | $820,000 | $210,000 more COGS |

| Gross Profit | $4,390,000 | $4,180,000 | $210,000 less profit |

| Taxable Income | Higher | Lower | - |

| Taxes (35% rate) | $1,536,500 | $1,463,000 | $73,500 savings |

Conclusion: LIFO saves $73,500 in taxes during inflationary periods by matching higher recent costs against current revenue.

Physical Inventory Counts: Requirements and Best Practices

Why Physical Counts Matter

Even if you use computerized tracking, the IRS requires periodic physical inventory verification to ensure accuracy.

When physical counts are required:

- At least annually (typically December 31)

- When starting to maintain inventory

- When changing inventory methods

- During IRS audits

How to Conduct a Physical Count

Step 1: Plan the count

- Choose a date (usually year-end)

- Assign count teams

- Prepare count sheets or use mobile apps

- Organize inventory by category/location

Step 2: Perform the count

- Count every item in inventory

- Record quantities and item descriptions

- Use two-person teams for accuracy

- Tag counted items to avoid duplication

Step 3: Value the inventory

- Apply unit costs based on your method (FIFO, LIFO, etc.)

- Calculate total value

- Compare to computerized records

- Investigate significant variances

Step 4: Adjust your books

- Adjust for shrinkage (theft, damage, errors)

- Update inventory accounts

- Document all adjustments

- File supporting documentation

Common Inventory Adjustments

| Adjustment Type | Example | Tax Treatment |

|---|---|---|

| Shrinkage | Shoplifting, employee theft | Increase COGS (deductible loss) |

| Obsolete goods | Outdated technology | Write down to fair market value or zero |

| Damaged goods | Broken/unsellable items | Write down to salvage value |

| Spoiled goods | Expired food/medicine | Write off completely (deductible loss) |

Legal Citation: IRS Publication 538 - Accounting Periods and Methods

Changing Your Inventory Accounting Method

When You Need IRS Permission

IRS Form 3115 required when:

- Switching from accrual to cash method

- Changing from FIFO to LIFO (or vice versa)

- Starting to use materials & supplies method

- Changing from one LIFO method to another

When no permission needed:

- First year of business (choose any method)

- Within same method class (e.g., different FIFO variations)

Form 3115: Application for Change in Accounting Method

Key Information Required:

- Current accounting method

- Proposed accounting method

- Reason for change

- Section 481(a) adjustment calculation

Section 481(a) Adjustment:

- Ensures you don't double-deduct or omit income

- Typically spread over 4 years (if positive adjustment)

- Immediate deduction (if negative adjustment)

Example:

You switch from accrual to cash method

Accrual method: $800,000 in unsold inventory (not yet deducted)

Cash method: Deduct when purchased

Section 481(a) adjustment: +$800,000 (deduction)

Spread over 4 years: $200,000 per year additional deduction

Legal Citation: Rev. Proc. 2018-40 - Simplified procedures for changing accounting methods

Important: Form 3115 is complex. Strongly recommend working with a tax professional.

Special Situations and Advanced Topics

Manufacturing: Uniform Capitalization (UNICAP) Rules

Who it applies to:

- Manufacturers with gross receipts over $30M

- Businesses producing or reselling inventory

What it requires:

- Allocate indirect costs to inventory

- Include overhead, storage, handling, repackaging

- Can't deduct these costs until inventory is sold

Who is EXEMPT:

- Businesses with gross receipts under $30M (since 2018)

- Retailers and wholesalers under $30M

Legal Citation: IRC § 263A - Capitalization and inclusion in inventory costs of certain expenses

Obsolete and Damaged Inventory

When can you write off inventory?

Obsolete inventory:

- Outdated products with no market value

- Write down to fair market value or zero

- Must document decline in value

- Deduct as business loss

Damaged inventory:

- Calculate salvage value or scrap value

- Write down to salvage value

- Deduct the difference as loss

Spoiled/expired inventory:

- Perishable goods past expiration

- Write off completely

- Document with photos and disposal records

Example:

Original cost: $50,000 (500 units @ $100 each)

Problem: Technology obsolete, unsellable

Salvage value: $5,000 (parts/scrap)

Deductible loss: $45,000

Documentation required:

- Photos of damaged/obsolete goods

- Vendor statements (if applicable)

- Disposal records

- Valuation reports (for large write-offs)

Consignment Inventory

Goods you own but are held by others:

- ✅ Include in YOUR inventory

- Calculate COGS when consignee sells the items

- You own title until sale occurs

Goods you hold for others (consignment sales):

- ❌ NOT in your inventory

- You don't own the goods

- Commission income only when sold

Goods in Transit

Determining ownership:

FOB (Free on Board) Shipping Point:

- Buyer owns goods once they leave seller's location

- Buyer includes in inventory during transit

FOB Destination:

- Seller owns goods until they reach buyer

- Seller includes in inventory during transit

Example:

You purchase $100,000 in inventory on December 28, 2026

Terms: FOB Shipping Point

Goods arrive January 3, 2027

✅ Include in YOUR December 31, 2026 inventory

(You owned the goods on Dec 31)

Tax Reporting: Forms and Schedules

Schedule C (Sole Proprietors)

Cost of Goods Sold section (Part III):

- Line 35: Inventory at beginning of year

- Line 36: Purchases

- Line 37: Cost of labor

- Line 38: Materials and supplies

- Line 39: Other costs

- Line 40: Add lines 35-39

- Line 41: Inventory at end of year

- Line 42: Cost of Goods Sold (Line 40 minus Line 41)

Inventory method question:

- Must specify method used (FIFO, LIFO, Average Cost, etc.)

- Consistent method required year-to-year

Form 1125-A (Partnerships, S-Corps, C-Corps)

Cost of Goods Sold form:

- More detailed than Schedule C

- Required for all business entities

- Includes inventory valuation method

- Section 263A (UNICAP) information

What to report:

- Beginning and ending inventory

- Purchases

- Labor costs

- Materials and supplies

- Other costs

- Inventory valuation method

- Writedowns of subnormal goods

Common Mistakes and How to Avoid Them

Mistake #1: Not Knowing About the $30M Exception

❌ Problem: Business with $15M in receipts continues using accrual method and traditional COGS

Consequences:

- Delayed deductions (only when inventory sells)

- Missed opportunity for immediate deduction

- Worse cash flow

✅ Solution:

- Calculate your 3-year average gross receipts

- If under $30M, consider switching to cash method

- File Form 3115 to change methods

- Potentially deduct unsold inventory immediately

Potential savings: $50,000+ in accelerated deductions for businesses with substantial inventory

Mistake #2: Mixing Inventory Tracking Methods

❌ Problem: Using cash method in QuickBooks but taking physical inventory counts for bank reports

Consequences:

- IRS will require you to use traditional COGS method

- Lose immediate deduction eligibility

- Must recalculate taxes for prior years

✅ Solution:

- Use inventory tracking ONLY for reordering

- Don't report inventory values to creditors

- Don't perform year-end physical counts for financial reporting

- Expense inventory when purchased in your books

Mistake #3: Not Documenting Inventory Method Choice

❌ Problem: No documentation of which method you're using (FIFO vs LIFO)

Consequences:

- IRS can impose its own method

- Inconsistent year-to-year treatment

- Audit adjustments and penalties

✅ Solution:

- Document your inventory method choice in writing

- File Form 970 if electing LIFO

- Use the same method consistently

- Keep detailed records

Mistake #4: Forgetting Section 481(a) Adjustment

❌ Problem: Switching from accrual to cash method without Section 481(a) adjustment

Consequences:

- Double-deduct or miss deductions

- IRS adjustments

- Penalties and interest

✅ Solution:

- Always calculate Section 481(a) adjustment when changing methods

- Work with tax professional on Form 3115

- Track adjustment over 4-year period

Mistake #5: Not Writing Off Obsolete Inventory

❌ Problem: Keeping unsellable inventory on books at original cost

Consequences:

- Overstated inventory value

- Overstated assets

- Missing legitimate deduction

- Higher taxes

✅ Solution:

- Regularly review inventory for obsolescence

- Document market value decline

- Write down to fair market value

- Photograph and dispose of worthless inventory

- Deduct the loss

Simplify Inventory Management With AI

Tracking inventory, calculating COGS, choosing the right accounting method, and managing physical counts shouldn't consume weeks of your time every year. At Jupid, our AI-powered platform automates the entire inventory management process.

What makes Jupid different for inventory management:

✅ Automatic inventory tracking - Sync with your e-commerce platform, point-of-sale, or accounting system

✅ Smart method selection - We analyze your business and recommend the optimal inventory method (cash, materials & supplies, or COGS)

✅ Real-time COGS calculation - See your cost of goods sold update in real-time with every sale

✅ Multi-method comparison - Calculate your taxes using FIFO, LIFO, and Average Cost to see which saves most

✅ Obsolescence detection - AI flags slow-moving or obsolete inventory for potential write-offs

✅ Physical count management - Mobile app for easy physical inventory counts with auto-reconciliation

✅ Form 3115 assistance - Guided wizard for changing inventory methods with automatic Section 481(a) calculations

✅ Chat with your AI accountant - Ask questions like "Should I use FIFO or LIFO for my inventory?" and get instant, personalized answers

Example conversation:

- You: "I have $2.3M in inventory. My gross receipts are $18M. Can I deduct inventory when I buy it?"

- Jupid: "Yes! Since your gross receipts are under $30M, you're eligible to use the cash method and deduct inventory when purchased—as long as you don't track inventory for financial reporting or bank statements. Want me to help you switch to this method? It could save you approximately $800,000 in immediate deductions this year."

Annual value: Product sellers using Jupid save an average of $34,000 more on inventory deductions compared to manual tracking, simply by:

- Choosing the optimal accounting method each year

- Not missing inventory write-off opportunities

- Maximizing the cash method exception

- Avoiding costly method-change errors

Learn more about how Jupid can optimize your inventory tax strategy →

Action Checklist: Optimizing Your Inventory Deductions

Before Year-End

- Calculate your 3-year average gross receipts

- Determine if you're under the $30M threshold

- Review your current inventory accounting method

- Decide if you should change methods (file Form 3115 if needed)

- Review inventory for obsolete/damaged items

- Plan year-end purchases strategically

At Year-End

- Conduct physical inventory count (if required)

- Calculate ending inventory value

- Write off obsolete/damaged inventory

- Reconcile physical count with records

- Calculate Cost of Goods Sold

- Document inventory method used

When Filing Taxes

- Complete Schedule C Part III or Form 1125-A

- Report correct inventory method

- Include beginning and ending inventory

- Calculate COGS correctly

- File Form 3115 if changing methods

- Calculate Section 481(a) adjustment if applicable

Throughout the Year

- Track all inventory purchases

- Monitor inventory levels

- Review for obsolescence quarterly

- Maintain consistent accounting method

- Keep detailed purchase records

- Document any inventory losses

Resources and Citations

IRS Publications (Official Sources)

- IRS Publication 334 - Tax Guide for Small Business (Chapter 7: Inventory)

- IRS Publication 538 - Accounting Periods and Methods

- Form 1125-A - Cost of Goods Sold

- Form 3115 - Application for Change in Accounting Method

- Form 970 - Application to Use LIFO Inventory Method

Tax Code and Regulations

- IRC § 471 - General rule for inventories

- IRC § 471(c) - Exception for certain small businesses

- IRC § 472 - Last-in, first-out inventories

- IRC § 263A - Capitalization and inclusion in inventory costs of certain expenses (UNICAP)

- IRS Reg. 1.471-1 - Need for inventories

- IRS Reg. 1.471-1(b)(6) - Simplified inventory method for small businesses

- IRS Reg. 1.162-3 - Materials and supplies

Revenue Procedures

- Rev. Proc. 2018-40 - Simplified procedures for changing accounting methods under IRC § 471(c)

- Rev. Proc. 2025-10 - Inflation adjustments for 2026

Final Thoughts

Inventory tax deductions are one of the most overlooked opportunities for product-based businesses. With the 2018 tax law changes, businesses under $30M in gross receipts can now deduct inventory immediately when purchased—potentially freeing up hundreds of thousands of dollars in cash flow that was previously tied up in unsold inventory.

The key is understanding your options:

- Cash method without inventory tracking (immediate deduction)

- Nonincidental materials & supplies (deduct when consumed)

- Traditional COGS with FIFO, LIFO, or Average Cost

Your choice depends on:

- Your gross receipts (above or below $30M)

- Whether you manufacture or resell goods

- Your need for financial statement reporting

- Your cash flow priorities

- Current economic conditions (inflation/deflation)

Remember: If you're under $30M and still using the old accrual method with traditional COGS, you're likely paying taxes on inventory you haven't even sold yet. Consider switching to the cash method and immediately deducting inventory purchases—it could be one of the most valuable tax planning moves you make this year.

Disclaimer

This article provides general information about tax deductions and should not be considered tax advice. Tax laws change frequently, and individual circumstances vary significantly. Inventory accounting method changes require careful analysis and IRS Form 3115 filing. For advice specific to your situation, consult with a qualified tax professional.

Tax Year: 2026 Last Updated: December 8, 2025

Ready to simplify your finances?

Join 1,000+ businesses using Jupid to save time and money. Start simplifying your finances today.

30-day money-back guarantee