Single-Member LLC Taxes 2026: How to File and What You Owe

Table of Contents

Published: February 5, 2026 Tax Year: 2026

A Message from Slava

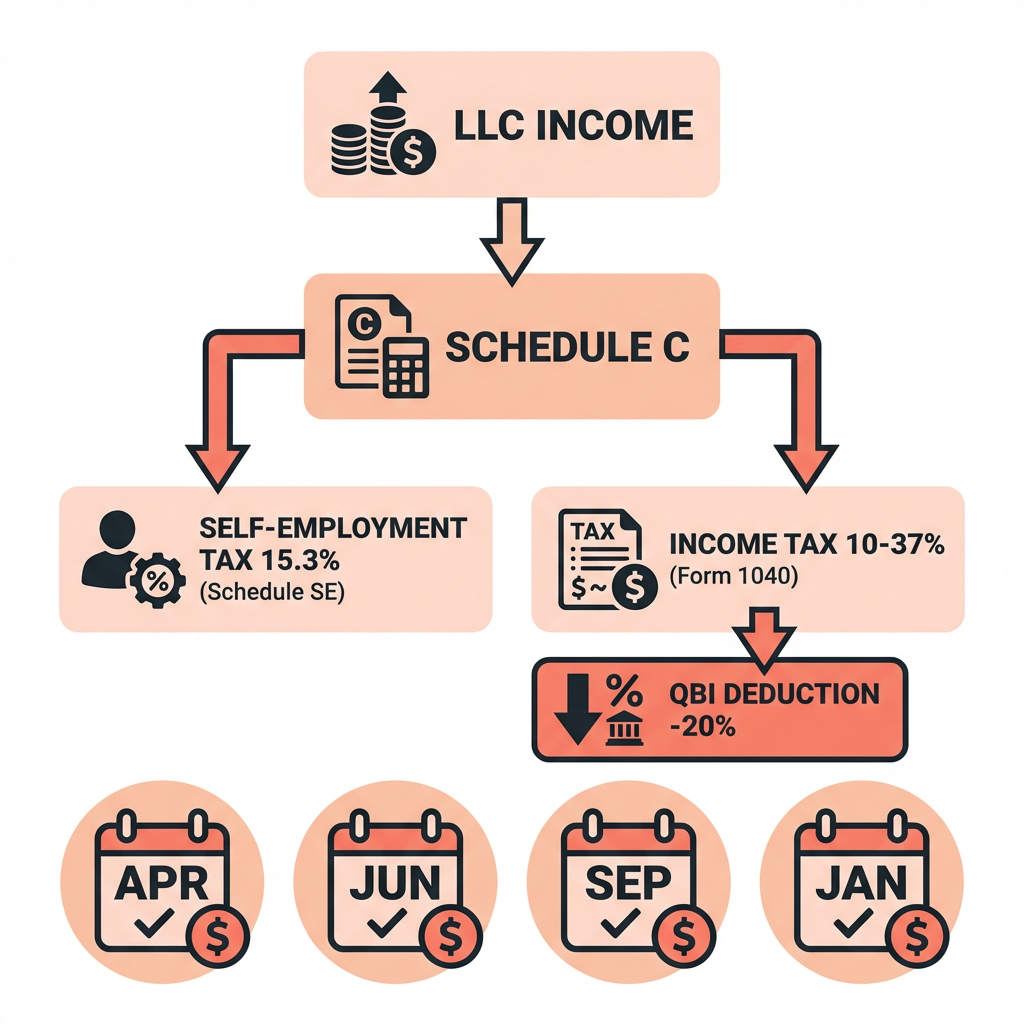

Filing taxes for a single-member LLC should be straightforward — and mechanically, it is. You fill out Schedule C, calculate self-employment tax on Schedule SE, and attach both to your 1040. That's the core of it.

But when I talk to business owners through my work at Jupid and from my experience building Anna Money for 60,000+ small businesses, the confusion isn't about which forms to file. It's about the details: Do I need a separate tax return for my LLC? How much should I set aside for taxes? When are estimated payments due? Can I still deduct my home office?

These are practical questions that most guides skip. They jump straight to "you're a disregarded entity" without explaining what that actually means for your bank account on April 15.

This guide walks through single-member LLC taxes from start to finish — every form, every calculation, every deadline. If you've been putting off understanding your LLC tax obligations, this is where you start.

Executive Summary: Single-Member LLC Taxes for 2026

How the IRS sees your single-member LLC: As a "disregarded entity" — meaning the LLC doesn't exist for income tax purposes. You and your LLC are the same taxpayer.

What you file:

- Schedule C (Form 1040) — Report all business income and expenses

- Schedule SE — Calculate self-employment tax

- Form 1040 — Your personal income tax return

- Form 1040-ES — Quarterly estimated tax payments (if applicable)

What you owe:

| Tax Type | Rate | Applies To |

|---|---|---|

| Self-employment tax | 15.3% | Net profit × 92.35% |

| Federal income tax | 10-37% | Taxable income (after deductions) |

| State income tax | 0-13.3% | Varies by state |

| Additional Medicare | 0.9% | Earnings over $200,000 |

Example at $75,000 net profit (single filer):

Self-employment tax: $75,000 × 92.35% × 15.3% = $10,597

Federal income tax: ~$7,500

Total federal tax: ~$18,097 (before QBI deduction)

Effective rate: ~24.1%

Legal basis: IRC §301.7701-2 (entity classification), IRS Publication 3402 (Taxation of LLCs), Schedule C (Form 1040)

How Single-Member LLC Taxation Works

When you form an LLC with one owner, the IRS classifies it as a "disregarded entity" by default. This means the LLC is ignored for federal income tax purposes. All income, expenses, profits, and losses are reported on your personal tax return.

Your LLC does not file its own tax return. There's no separate corporate return, no partnership return, no Form 1120 or 1065. Everything goes on your Form 1040 via Schedule C.

What "Disregarded Entity" Actually Means

| What Changes | What Doesn't Change |

|---|---|

| You have liability protection | Tax filing is the same as sole proprietor |

| You have a formal business entity | Same self-employment tax rate |

| You can open a business bank account | Same income tax rates |

| You have an operating agreement | Same Schedule C filing |

The LLC gives you legal protection. It does not, by default, change how you're taxed. You pay the same taxes whether you're a sole proprietor or a single-member LLC.

The exception: If you file Form 8832 or Form 2553, you can elect different tax treatment (C Corp or S Corp). See our S Corp vs LLC guide for details on when that makes sense.

Legal citation: IRS Publication 3402 and IRC §301.7701-3(b)(1)(ii) establish default disregarded entity treatment.

Step-by-Step: Filing Your Single-Member LLC Taxes

Step 1: Gather Your Records

Before touching any tax forms, assemble:

- All income records — 1099-NEC forms from clients, 1099-K from payment processors, bank statements showing all deposits

- All expense records — Receipts, bank statements, credit card statements for business purchases

- Mileage log — If you drove for business (70 cents/mile for 2026)

- Home office measurements — Square footage of office and total home (if claiming home office deduction)

- Asset purchases — Records of equipment, furniture, or other business property bought during the year

- Prior year return — For reference and carryforward amounts

Step 2: Complete Schedule C

Schedule C has five parts. Here's what goes where:

Part I: Income

- Line 1: Gross receipts (total revenue before expenses)

- Line 2: Returns and allowances

- Line 4: Cost of goods sold (if applicable)

- Line 7: Gross income

Part II: Expenses Common categories on Schedule C:

| Line | Category | Examples |

|---|---|---|

| 8 | Advertising | Google Ads, Facebook ads, website hosting |

| 10 | Car and truck expenses | Business mileage or actual vehicle costs |

| 11 | Commissions and fees | Contractor payments, platform fees |

| 13 | Depreciation | Equipment, furniture (Form 4562) |

| 15 | Insurance | Business liability, professional insurance |

| 17 | Legal and professional | CPA fees, attorney fees, bookkeeping |

| 18 | Office expense | Supplies, software subscriptions |

| 22 | Supplies | Materials used in your business |

| 24a | Travel | Flights, hotels for business trips |

| 24b | Meals | Business meals (50% deductible) |

| 25 | Utilities | Business portion of phone, internet |

| 27a | Other expenses | Anything that doesn't fit above |

| 30 | Home office | Form 8829 or simplified method |

Line 31: Net profit (or loss) — This number flows to your Form 1040 and Schedule SE.

For detailed line-by-line instructions, see our Schedule C guide.

Step 3: Calculate Self-Employment Tax (Schedule SE)

Self-employment tax is your contribution to Social Security and Medicare. As a W-2 employee, your employer pays half. As a single-member LLC owner, you pay both halves.

2026 self-employment tax calculation:

Schedule C net profit: $75,000

Step 1: Multiply by 92.35%

$75,000 × 0.9235 = $69,263 (net earnings from self-employment)

Step 2: Apply 15.3% rate

$69,263 × 0.153 = $10,597

Self-employment tax owed: $10,597

The 92.35% multiplier (100% minus the 7.65% employer-equivalent portion) accounts for the fact that employees don't pay income tax on the employer's share of FICA.

Half of your SE tax is deductible. You'll deduct $5,299 on Schedule 1, Line 15 — this reduces your adjusted gross income (AGI).

For detailed SE tax calculations, see our guide on Schedule SE.

Legal citation: IRC §1401 establishes self-employment tax rates. IRC §164(f) allows the deduction for half of SE tax.

Step 4: Calculate Federal Income Tax

After self-employment tax, calculate your income tax:

Net profit from Schedule C: $75,000

Minus half of SE tax: -$5,299

Adjusted Gross Income (AGI): $69,701

Minus standard deduction: -$15,700

Minus QBI deduction (20%): -$15,000

Taxable income: $39,001

2026 federal income tax (single):

10% on first $11,925 = $1,193

12% on $11,926-$48,475 = $3,249

Total income tax: $4,442

Step 5: Pay Quarterly Estimated Taxes

The IRS expects you to pay taxes as you earn income — not in one lump sum on April 15. If you expect to owe $1,000 or more in tax for the year, you must make quarterly estimated payments.

2026 estimated tax deadlines:

| Quarter | Income Period | Payment Due |

|---|---|---|

| Q1 | January-March | April 15, 2026 |

| Q2 | April-May | June 15, 2026 |

| Q3 | June-August | September 15, 2026 |

| Q4 | September-December | January 15, 2027 |

Use Form 1040-ES to calculate and submit payments.

Safe harbor rule: To avoid estimated tax penalties, pay at least 100% of your prior year's tax liability (110% if your AGI exceeded $150,000) in four equal quarterly installments.

Use our Self-Employment Tax Calculator to estimate your quarterly payments.

Single-Member LLC Deductions

Your single-member LLC can deduct all ordinary and necessary business expenses. These deductions directly reduce your net profit, lowering both your self-employment tax and income tax.

Top Deductions for Single-Member LLCs

1. Home Office Deduction

If you use a dedicated space in your home regularly and exclusively for business:

- Simplified method: $5/sq ft, up to 300 sq ft = max $1,500/year

- Regular method: Actual expenses (rent/mortgage interest, utilities, insurance, repairs) × business percentage

For a full breakdown, see our home office deduction guide.

2. Self-Employed Health Insurance

Deduct 100% of health insurance premiums for yourself, your spouse, and dependents. This is an "above the line" deduction — it reduces your AGI, not just your Schedule C profit.

See our health insurance deduction guide.

3. Retirement Contributions

| Plan Type | 2026 Max Contribution |

|---|---|

| SEP IRA | 25% of net earnings (up to ~$70,000) |

| Solo 401(k) | $23,500 employee + 25% employer |

| SIMPLE IRA | $16,500 + employer match |

| Traditional IRA | $7,000 ($8,000 if 50+) |

4. Vehicle Expenses

Choose one method:

- Standard mileage: 70 cents/mile for 2026

- Actual expenses: Gas, insurance, repairs, depreciation × business percentage

5. Professional Services

CPA fees, legal fees, bookkeeping services, and tax preparation costs are fully deductible.

EIN, Business Bank Accounts, and Record-Keeping

Do You Need an EIN?

A single-member LLC doesn't always need an Employer Identification Number (EIN), but you should get one anyway. You'll need it if you:

- Have employees

- File excise tax returns

- Have a Keogh plan

- Open a business bank account (most banks require it)

Apply for free at IRS.gov/EIN. For more details, see our EIN guide.

Separate Your Finances

Open a dedicated business bank account and business credit card. This is critical for:

- Audit protection — Clear separation of personal and business transactions

- Liability protection — Prevents "piercing the corporate veil"

- Easier bookkeeping — Every transaction in the business account is a business transaction

- Tax preparation — Your CPA (or tax software) can work directly from business statements

Record Retention

Keep business records for at least:

- 3 years — Standard IRS audit window

- 6 years — If you underreported income by more than 25%

- 7 years — If you claimed a loss from worthless securities or bad debt

- Indefinitely — If you didn't file a return or filed a fraudulent return

State Tax Obligations

Your federal filing is only part of the picture. Most states have additional requirements:

State Income Tax

Most states tax LLC income on your personal state return, just like the federal government. Nine states have no income tax: Alaska, Florida, Nevada, New Hampshire (dividends/interest only), South Dakota, Tennessee, Texas, Washington, and Wyoming.

State LLC Fees and Franchise Taxes

| State | Annual Fee | Notes |

|---|---|---|

| California | $800 minimum | Franchise tax regardless of income |

| New York | $25 biennial | Plus publication requirement |

| Texas | $0 annual | But franchise tax may apply on revenue >$2.47M |

| Florida | $138.75 | Annual report fee |

| Delaware | $300 | Annual franchise tax |

Check our LLC Annual Tax and Fee Calculator for your state's specific costs.

Local Business Taxes

Some cities and counties impose additional business taxes, gross receipts taxes, or business license fees. Check with your local jurisdiction.

Common Mistakes to Avoid

Mistake #1: Not Making Estimated Tax Payments

Problem: A single-member LLC owner waits until April 15 to pay all taxes for the year.

Impact: Underpayment penalty (currently ~8% annual rate). On a $20,000 tax bill, that's roughly $400-$800 in avoidable penalties.

Solution: Calculate your estimated tax liability and pay quarterly. The IRS safe harbor: pay 100% of last year's tax in four equal payments (110% if AGI > $150,000).

Mistake #2: Missing the QBI Deduction

Problem: Single-member LLC owners don't realize they qualify for the 20% QBI deduction, or their tax software miscalculates it.

Impact: Overpaying income tax by 20% of what you could deduct. At $80,000 net profit, that's $16,000 in QBI deduction — worth roughly $3,500 in tax savings.

Solution: Verify Form 8995 or 8995-A is included in your return. The QBI deduction applies to all single-member LLCs (subject to income phase-outs above ~$200,000 for single filers).

Mistake #3: Mixing Personal and Business Expenses

Problem: Using the same bank account and credit card for personal and business purchases.

Impact: Difficulty categorizing expenses at tax time, increased audit risk, and potential loss of liability protection if a court determines you didn't treat the LLC as a separate entity.

Solution: Open a business bank account and use it exclusively for business transactions. Pay yourself through documented owner draws.

Mistake #4: Forgetting About State Requirements

Problem: Filing federal taxes correctly but missing state annual reports, franchise taxes, or business license renewals.

Impact: Late fees, penalties, or administrative dissolution of your LLC — losing your liability protection.

Solution: Calendar your state's annual filing deadlines. Set reminders 30 days in advance. Review our guide on staying tax compliant as an LLC.

Simplify Your LLC Tax Filing With AI

The hardest part of single-member LLC taxes isn't the forms — it's tracking every deductible expense throughout the year. Most LLC owners miss deductions because they don't categorize transactions in real time.

What makes Jupid different:

✅ Automatic transaction categorization — Our AI categorizes your business expenses with 95.9% accuracy, mapping each one to the correct Schedule C line

✅ Real-time tax estimates — Ask your AI accountant "How much do I owe in estimated taxes this quarter?" and get an answer via WhatsApp or iMessage

✅ Deduction tracking — Jupid identifies potential deductions you might miss and keeps a running total throughout the year

✅ Bank connection and auto-sync — Connect your business bank account and Jupid separates business transactions automatically

Example conversation:

- You: "What's my net profit for Schedule C so far?"

- Jupid: "Through September, your LLC has $92,400 in gross income and $28,600 in categorized expenses, giving you a net profit of $63,800. Your estimated self-employment tax is $9,017 and estimated income tax is $6,200."

Learn more about how Jupid keeps your business finances organized

Action Checklist: Single-Member LLC Tax Filing

Before Tax Season

- Ensure all income is documented (1099-NECs, 1099-Ks, bank deposits)

- Categorize all business expenses by Schedule C line

- Calculate home office percentage (if applicable)

- Compile mileage log for business driving

- Gather receipts for any large purchases or asset acquisitions

Filing Your Return

- Complete Schedule C (Profit or Loss from Business)

- Complete Schedule SE (Self-Employment Tax)

- Complete Form 8995 or 8995-A (QBI Deduction)

- Complete Form 8829 (if using regular home office method)

- Report net profit on Form 1040, Schedule 1

- Deduct half of SE tax on Schedule 1, Line 15

- File by April 15, 2026 (or October 15 with extension)

Throughout the Year

- Make quarterly estimated tax payments (April 15, June 15, Sept 15, Jan 15)

- Keep business and personal finances separate

- Track all business expenses in real time

- File state annual reports and pay franchise taxes on time

- Review whether S Corp election makes sense for next year

Resources and Citations

IRS Publications (Official Sources)

- IRS Publication 3402 — Taxation of Limited Liability Companies

- IRS Publication 334 — Tax Guide for Small Business

- IRS: Single Member LLCs — Disregarded entity overview

- Schedule C (Form 1040) — Profit or Loss From Business

- Schedule SE (Form 1040) — Self-Employment Tax

- Form 1040-ES — Estimated Tax for Individuals

Tax Code and Regulations

- IRC §301.7701-3(b)(1)(ii) — Default classification for single-member LLCs

- IRC §1401 — Rate of self-employment tax

- IRC §164(f) — Deduction for half of self-employment tax

- IRC §199A — Qualified Business Income deduction

- IRC §162 — Trade or business expenses

- IRC §280A — Home office deduction rules

2026 Key Numbers

| Item | 2026 Amount |

|---|---|

| Self-employment tax rate | 15.3% (12.4% SS + 2.9% Medicare) |

| Social Security wage base | $176,100 |

| Standard deduction (single) | $15,700 |

| QBI deduction | Up to 20% of QBI (permanent) |

| Standard mileage rate | 70 cents/mile |

| Home office simplified method | $5/sq ft (max $1,500) |

| Additional Medicare tax | 0.9% on earnings over $200,000 |

| Tax filing deadline | April 15, 2026 |

Final Thoughts

Single-member LLC taxes follow the same mechanics as sole proprietor taxes — Schedule C, Schedule SE, and quarterly estimated payments. The LLC structure adds liability protection without changing your tax obligations by default.

The key strategies:

- Track expenses throughout the year — Real-time categorization beats reconstructing records in March

- Make quarterly estimated payments — Avoid the underpayment penalty by staying current

- Claim every deduction — Home office, vehicle, health insurance, retirement contributions, and the QBI deduction can reduce your tax bill by thousands

As your profit grows past $50,000-$60,000, evaluate whether an S Corp election could reduce your self-employment tax burden further.

Disclaimer

This article provides general information about single-member LLC taxation and should not be considered tax advice. Tax laws and rates change annually, and state tax obligations vary significantly. The calculations shown use 2026 federal rates and may not reflect your specific situation including state taxes, credits, or other factors. For advice specific to your situation, consult with a qualified tax professional.

Tax Year: 2026 Last Updated: February 5, 2026

Ready to simplify your finances?

Join 1,000+ businesses using Jupid to save time and money. Start simplifying your finances today.

30-day money-back guarantee