9 Credit Union Trends for 2026: Why Small Business Banking Is Your Biggest Opportunity

Table of Contents

Published: December 11, 2025

A Message from Anna

I've spent 18 years delivering digital banking solutions to credit unions. I've seen trends come and go. But 2026 feels different.

After reviewing over 200 industry sources, regulatory filings, and expert analyses, one conclusion is clear: the credit unions that thrive in 2026 will be those that capture small business members at scale.

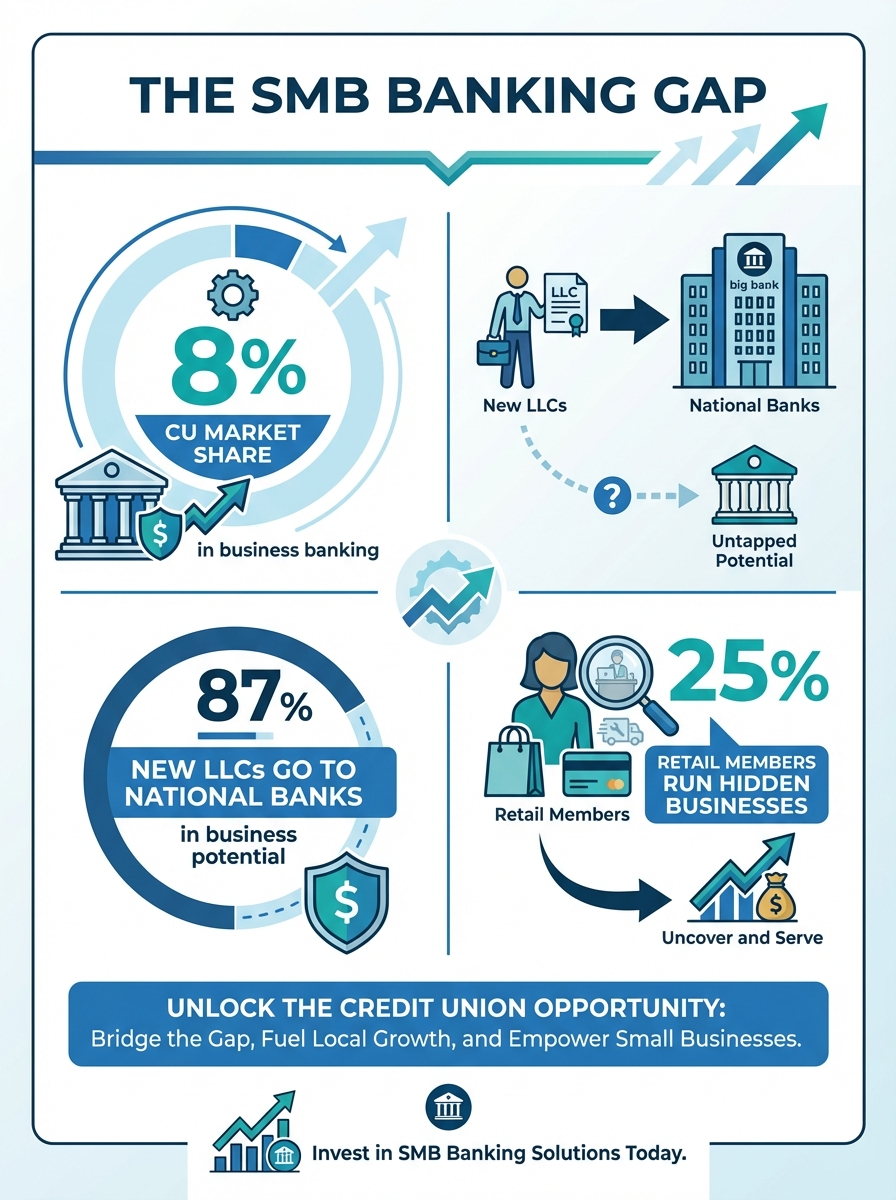

The data is stark: credit unions have only 8% market penetration in business banking. Meanwhile, 87% of new LLCs never see a credit union offer—they default to national banks or fintechs. That's a 7-year relationship lost at the formation stage.

Here are the 9 trends that will define 2026—and why small business banking is the thread that connects them all.

1. Small Business Lending Becomes a Strategic Imperative

Consumer loan demand is softening due to rate and price fatigue. The answer? SMB lending offers higher yields and stickier deposits.

Here's what makes this moment unique: small businesses are underserved by everyone.

- Megabanks want mid-market clients with $1M+ loan sizes

- Fintechs charge higher rates

- Community banks are consolidating

- Credit unions have built trust but lack the tools

The opportunity is automating the "small dollar" business loan—under $250K—using AI-driven cash flow analysis. This lets credit unions serve Main Street businesses profitably without massive internal teams.

2. The Year of Agentic AI

2024 was Generative AI experimentation. 2026 is the Year of the Agent.

Agentic AI refers to autonomous systems that reason, plan, and execute multi-step workflows with minimal human oversight. Unlike chatbots that wait for prompts, AI agents actively monitor, identify issues, and resolve them.

For credit unions, this shows up in three areas:

- Autonomous member service: Agents that resolve disputes, process requests, and modify settings within guardrails (PenFed resolves 20% of cases on first contact)

- Self-driving back office: Agents monitoring transactions, initiating reconciliation, drafting regulatory reports

- Proactive financial advice: AI that analyzes member spending and autonomously optimizes their finances

Capgemini reports nearly half of Tier 1 banks will deploy AI agents for back-office tasks by 2026. For credit unions, this technology is no longer "nice to have"—it's how you compete with institutions 100x your size.

3. Hyperautomation of the Lending Lifecycle

Efficiency is the primary strategic imperative for 2026—surpassing even deposit growth for many CEOs.

The standard for unsecured personal loans and simple auto loans is becoming "zero-touch" processing:

- AI decision engines analyze alternative data alongside credit scores

- RPA bots handle document verification

- Funding orchestration happens automatically

Case in point: Suncoast Credit Union automated document processing for auto loans and check fraud detection, saving nearly $800,000 in six months.

For small business lending, this is even more critical. Traditional underwriting for a $50K business loan costs nearly as much as a $500K loan. AI-powered automation changes the unit economics entirely.

4. Data Maturity: From Silos to Fabric

To fuel Agentic AI and hyperautomation, credit unions must solve their perennial data problem: fragmentation.

2026 marks the shift from traditional data warehouses to "Data Fabric" or "Data Mesh" architectures. These modern architectures allow institutions to connect disparate data sources (core banking, LOS, CRM, card processors) virtually, without the need for massive, monolithic migration projects.

The Member 360 Holy Grail:

The goal is a unified, real-time view of the member. Without this, AI agents cannot function effectively. Wings Financial Credit Union provides a case study in building an internal data warehouse that aggregates data across cores and origination systems to automate reporting.

In 2026, the focus shifts to ingesting unstructured data (call transcripts, emails) to feed Generative AI models for sentiment analysis and intent prediction. For business banking, this means connecting business transaction data, tax filings, and operational metrics to create comprehensive underwriting profiles.

5. The CUSO Economy and Shared Services 2.0

The "build vs. buy" debate has a third option: Collaborate.

Credit Union Service Organizations (CUSOs) are evolving from vendor aggregators to sophisticated shared-service platforms. For institutions under $1B in assets, this is often the only path to scale.

The trend includes:

- "Compliance as a Service" (CaaS) for regulatory burden

- "Fractional Executive" services (CISOs, CFOs at a fraction of cost)

- Embedded technology platforms for business banking

Member Support Services reports up to 30% reduction in operating expenses for partners. CUSOs like MDC are creating accelerator programs to bring vetted fintech solutions to their member credit unions.

The shift: From "can we build this?" to "who can we partner with to deliver this faster?"

6. Hyper-Personalization and the "Member 360"

Generic marketing is dead. 2026 is the era of "segment of one."

Instead of sending a generic business loan offer to everyone aged 30-50, AI analyzes transaction data to identify members who:

- Just paid for significant business expenses

- Are shopping for business equipment

- Show patterns of side-hustle income in their personal account

Real-time offers delivered via app notifications. The member feels "known" and "valued."

Alkami research shows tailored messaging drives significantly higher engagement and card usage. For business banking specifically, this means identifying hidden business owners within your retail membership—before they open a business account elsewhere.

7. Capturing the Great Wealth Transfer

An estimated $84 trillion will pass from Baby Boomers to Gen X and Millennials over the next two decades.

The risk: heirs move these assets to megabanks or fintechs they already use.

The retention strategy for 2026:

- Advisory pivot: Move from transactional service to holistic financial planning

- Digital parity: Meet the "Amazon standard" expected by younger generations

- Values alignment: ESG and green initiatives appeal to Millennials and Gen Z

For small business banking, this matters on two levels. First, young entrepreneurs are the fastest-growing segment of new business formation. Second—and this is often overlooked—heirs frequently inherit not just wealth but responsibility. They're starting businesses, managing family investments, or turning side hustles into real ventures. They're not just looking for a place to deposit inheritance; they're looking for a bank for their new business. If you don't offer business services, you lose them—and their families—to institutions that do.

8. Strategic Consolidation Accelerates

The nature of mergers is evolving. We're moving from "rescue mergers" of failing credit unions to "strategic mergers" of healthy mid-sized entities.

The driver? Scale. The cost of technology, compliance, and talent has made $1 billion in assets a new minimum threshold for long-term viability.

Credit unions acquiring community banks is also accelerating—to gain commercial lending expertise, branch networks, and business banking capabilities.

The message: If you can't achieve scale through organic growth, you need to achieve it through partnerships, CUSOs, or embedded platforms that deliver enterprise-grade capabilities at credit union prices.

9. Defending the Tax-Exempt Status

The political threat to federal tax exemption has escalated from periodic nuisance to central strategic risk.

The banking lobby highlights credit union acquisitions of community banks as evidence that the exemption is no longer justified. The defense strategy must shift from qualitative storytelling to data-driven impact reporting.

Credit unions must:

- Quantify value: Track exact dollar value returned to members vs. bank averages—localized by congressional district

- Reinforce mission: CDFI certification, serving "banking deserts," community investment

- Unify voice: America's Credit Unions (CUNA + NAFCU merger) is deploying full weight to protect tax status

What this means for small business banking: Serving small businesses—especially underserved entrepreneurs—is mission alignment. It creates a defensive moat of social capital that is politically difficult to attack.

The Common Thread: Small Business Is the Opportunity

Every one of these trends points to the same conclusion.

Credit unions have 8% market penetration in business banking. The institutions that move to capture small business members will:

- Diversify revenue away from compressed consumer margins

- Create sticky, long-term relationships (7-year average)

- Defend their mission and tax exemption through community impact

- Attract younger generations who are starting businesses at record rates

The technology exists to serve small businesses profitably at scale. AI-native accounting, automated compliance, embedded formation services—these tools turn the $50K business loan from loss leader into profit center.

The question isn't whether credit unions should pursue small business banking. It's whether they can afford not to.

I'm Anna Khalzova, Co-founder of Jupid. We help credit unions and community banks win and retain small business members through embedded AI-native financial services. If you're thinking about small business banking strategy for 2026, let's connect.

References

- TruStage Credit Union Trends Report (2025)

- America's Credit Unions 2026 Advocacy Priorities

- Forrester Predictions 2026: Financial Services

- Deloitte 2026 Banking and Capital Markets Outlook

- Jack Henry 2025 Strategy Insights

- Alkami Annual Budgeting & Strategies Playbook

- Capgemini: Agents of Change Report

- NCUA Strategic Plan 2022-2026

Ready to simplify your finances?

Join 1,000+ businesses using Jupid to save time and money. Start simplifying your finances today.

30-day money-back guarantee