2025 Year in Review: 5 Moments That Redefined Credit Union Fintech

Table of Contents

Published: December 14, 2025

A Message from Anna

2025 was supposed to be a year of caution. Rising rates, regulatory uncertainty, and post-pandemic normalization suggested a pullback.

Instead, credit unions doubled down on fintech—and the results speak for themselves.

After 18 years working in this space, I've never seen a year where so much changed so fast. From the largest fintech fundraise in credit union history to a fundamental shift in how fintechs view credit unions as partners, 2025 redefined what's possible.

Here are the 5 moments that mattered most—and what they mean for 2026.

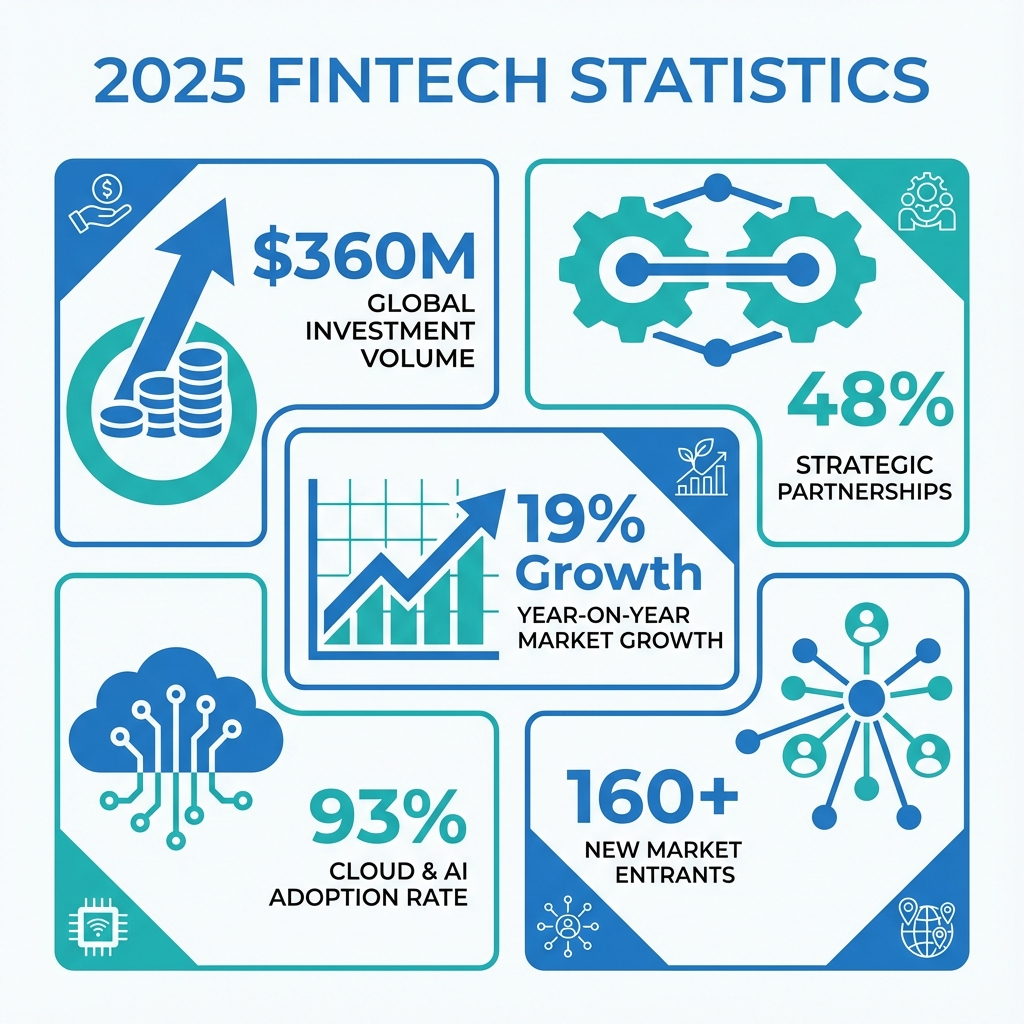

1. Curql Fund II: $360 Million and a Movement

In August 2025, Curql announced the final close of Fund II at $360 million—the largest fintech fundraise in credit union history.

The numbers tell the story:

- 160+ credit unions investing collectively

- 40% larger than Fund I ($252 million in 2021)

- Top 25 U.S. venture capital raises in H1 2025 (per Pitchbook)

- $600 million+ total AUM across both funds

But the real story isn't the dollars—it's the model.

Curql isn't just writing checks. Member credit unions get preferred pricing, early access to new technologies, and influence over product roadmaps. Portfolio companies like Zest AI (AI underwriting), Eltropy (digital communications), and ModernFi (deposit network management) are already deployed across 30%+ of the U.S. credit union market.

As Nick Evens, President and CEO of Curql Collective, put it: "This is the next chapter of credit unions leading digital transformation rather than chasing it."

Why it matters: Credit unions are no longer waiting for fintechs to solve their problems. They're funding the solutions themselves—collectively.

2. The Partnership Pivot: 48% of Fintechs Now Work With CUs

If 2024 was about fintechs wondering whether credit unions were worth pursuing, 2025 answered decisively.

According to PYMNTS Intelligence, 48% of fintechs that distribute products through partners now work with credit unions—up from 40% in 2024, a 19% increase.

Meanwhile, fintechs partnering with national banks dropped 56% year-over-year.

The shift is structural, not cyclical:

- Large banks are building in-house, squeezing out vendors

- Credit unions offer access to 10% of the U.S. banking market

- 42% of fintechs selling to CUs report zero obstacles

- Only 1.9% of fintechs now view credit unions as competitors (down from 16%)

The most successful fintechs aren't leading with features—they're leading with strategy. Those that frame their value as "helping credit unions compete" are twice as likely to win deals (34% vs. 14%).

Why it matters: Fintechs are choosing credit unions. The question for CUs is whether they're ready to choose the right fintechs.

3. Agentic AI: From Chatbots to Autonomous Agents

2024 was the year everyone talked about AI. 2025 was the year it started working autonomously.

The industry consensus from CU Times' 2025 Fintech Expert Survey is clear: Agentic AI was the breakthrough of the year.

Unlike chatbots that wait for prompts, AI agents reason, plan, and execute multi-step workflows with minimal human oversight.

Where credit unions deployed agentic AI in 2025:

- Autonomous member service: Red Rocks Credit Union launched "Roxie," an AI assistant that handles account inquiries, processes requests, and routes complex issues—without waiting for human intervention

- Back-office automation: AI agents now monitor transactions, initiate reconciliation, and draft regulatory reports

- Proactive financial guidance: Platforms analyzing member spending to automatically suggest optimizations

As Mitch Rutledge, CEO of Vertice AI, noted: "Agents, agents and more agents—all the leading fintechs are embracing agentic AI functions to empower consumers and staff members."

The caution: Many credit unions that claimed AI readiness weren't ready at all. MDT's 2025 analysis found significant gaps in governance, monitoring, and oversight. The institutions that moved fastest weren't necessarily the best prepared—they were the ones with clear guardrails.

Why it matters: AI is no longer experimental. The winners in 2026 will be institutions that deployed agents in 2025 with proper controls—and learned from the inevitable mistakes.

4. The Digital Transformation Reality Check

Here's the number no one wants to talk about: 93% of bank digital transformation initiatives fell short of expectations in 2025.

CCG Catalyst's analysis identified the pattern:

- Leadership gaps at the executive level

- Reliance on legacy systems that couldn't integrate

- Focus on surface-level features without solid foundations

- Budgets allocated for technology but not for the labor to implement it

MDT's 2025 Credit Union Trends report puts it bluntly: "Credit unions are budgeting for technology investment, but not for the internal lift required to execute it."

The real bottlenecks:

- Resource constraints: Same staff expected to run operations AND manage major implementations

- Vendor fatigue: Technology costs rose far beyond CPI, with some institutions seeing 600%+ increases post-Broadcom/VMware acquisition

- Integration complexity: APIs between fintech partners, core systems, and cloud providers created troubleshooting nightmares

The silver lining: The failures created clarity. Credit unions learned that modernization isn't a project—it's a capability. The institutions that thrived built internal capacity alongside external partnerships.

Why it matters: 2026 planning should start with an honest assessment of execution capacity, not just technology wishlists.

5. Small Business Lending Goes Embedded

The $1.7 trillion U.S. SMB lending market finally got the attention it deserved.

According to Rapid Finance CEO Will Tumulty: "The growing adoption of embedded finance capabilities for small business lending has been one of the most significant advancements in credit union technology this year."

Credit unions discovered they don't need to build everything in-house. Third-party platforms now cover:

- Full underwriting using alternative data

- Risk assessment with AI-driven cash flow analysis

- Servicing and collections

- Compliance and regulatory reporting

The economics finally work. Traditional underwriting for a $50K business loan costs nearly as much as a $500K loan. Embedded platforms change that equation entirely.

For credit unions constrained by balance sheets or operational capacity, embedded lending offers a path to serve small businesses profitably—without massive internal investment.

Why it matters: The technology barrier to small business banking has collapsed. The only remaining barrier is strategic commitment.

The Common Thread: Credit Unions Are Leading, Not Following

Five years ago, credit unions were portrayed as slow-moving, risk-averse institutions struggling to keep up with fintechs.

2025 told a different story.

- $360 million invested collectively in purpose-built fintech

- 19% growth in fintech partnership rates

- Agentic AI deployed at scale—not just piloted

- Embedded lending making small business banking accessible

- Honest reckoning with what transformation actually requires

The institutions that will thrive in 2026 aren't the ones that deployed the most technology. They're the ones that built the capacity to execute—and the partnerships to scale.

Credit unions have always been about collective action. In 2025, they proved they can extend that principle to innovation itself.

I'm Anna Khalzova, Co-founder of Jupid. We help credit unions and community banks win and retain small business members through embedded AI-native financial services. If you're building your 2026 strategy, let's connect.

Sources

- Curql Fund II Press Release - August 6, 2025

- Global Venturing: How a $360m mega fund will give US credit unions access to startup innovation - August 14, 2025

- PYMNTS Intelligence: Nearly Half of FinTechs Now Partner With Credit Unions - October 6, 2025

- CU Times: Fintech Experts Reflect on 2025 & Share Their 2026 Predictions - December 19, 2025

- MDT: 2025 Credit Union Trends and Lessons - December 17, 2025

- CCG Catalyst: Lessons from 2025's Banking Tech Triumphs and Tribulations - 2025

Ready to simplify your finances?

Join 1,000+ businesses using Jupid to save time and money. Start simplifying your finances today.

30-day money-back guarantee