The State of Community Banking: 2025 Edition

Table of Contents

Published: December 16, 2025

A Message from Anna

Every year, I try to step back and look at the big picture: where does community banking actually stand?

Not the hype. Not the vendor pitches. The reality.

2025 has been a year of contrasts. Optimism about technology adoption coexists with sobering data about execution challenges. Digital-first strategies clash with legacy system constraints. Confidence in the future meets daily operational friction.

Here's my annual assessment of where community banking stands—based on surveys, industry data, and hundreds of conversations with bankers and credit union leaders.

The Digital Adoption Picture

E-Signatures Finally Go Mainstream

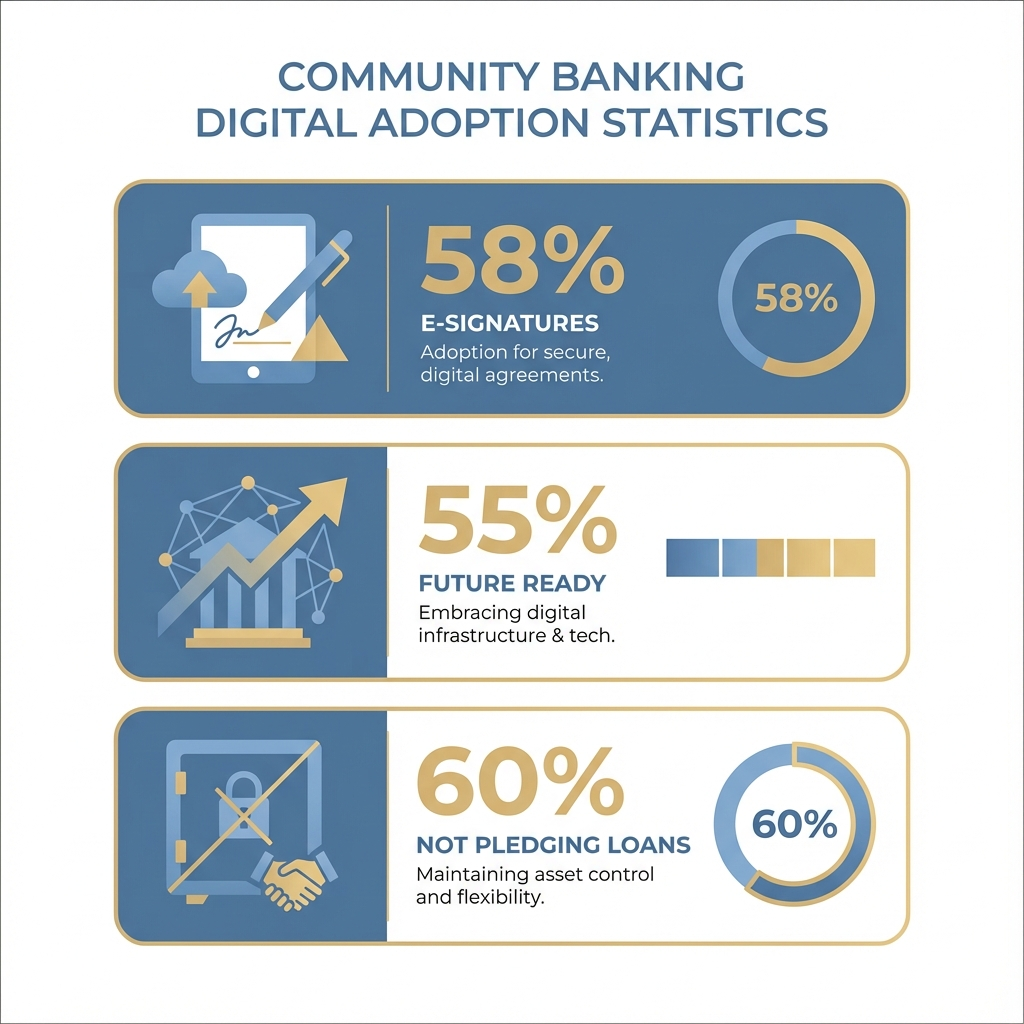

According to the Wolters Kluwer 2025 Community Banking Digital Transformation Survey, e-signature adoption has reached a tipping point:

58% of community banks are currently using or plan to use electronic signatures for commercial real estate, multi-family, and agricultural real estate loans.

This is significant. These aren't simple consumer products—they're complex lending classes that historically resisted digitization.

Platform preferences:

- DocuSign: 59% (dominant player)

- Adobe/OneSpan: 30%

- Other platforms: 11%

But Barriers Remain

For institutions that haven't adopted e-signatures, the obstacles aren't primarily about cost:

| Barrier | % of Non-Adopters |

|---|---|

| System integration challenges | 10% |

| Cost concerns | 7% |

| Lack of Federal Reserve/FHLB acceptance | 7% |

| Lack of secondary market acceptance | 5% |

| Lack of internal resources | 5% |

The real story: integration complexity and regulatory acceptance are bigger obstacles than budget. This suggests the industry has moved past "should we digitize?" to "how do we make everything work together?"

Technology Confidence vs. Reality

The Optimism

The Treasury Prime 2025 Banking Innovation Index found surprising confidence:

55% of community bank decision-makers say their banking technology is "fully future-ready."

That's a bold claim. It suggests over half of community banks believe their current infrastructure can support whatever comes next.

The Reality Check

But when you dig deeper, a different picture emerges:

From the CSI Banking Priorities Report:

- 44% of banks identified operational efficiency as their top strategic goal

- 40% focused on deposit growth

- 98% planned to modernize core systems within the year

If 98% of banks need to modernize, can 55% really be "future-ready"?

The disconnect suggests that "future-ready" might mean "ready for the near future" rather than "prepared for fundamental transformation."

The AI Adoption Gap

What Banks Say

AI has become a board-level conversation at most community banks. The CSBS 2025 Annual Survey of Community Banks confirmed that 33% of bankers recognize AI as a top-three technology trend.

Use cases gaining traction:

- Fraud detection and anti-money laundering

- Customer service enhancement (chatbots, routing)

- Lending decisioning and risk assessment

- Document processing and verification

What Banks Do

The gap between recognition and implementation remains significant:

Challenges blocking AI adoption:

- Inadequate data infrastructure: Most community banks lack the unified data environments AI requires

- Conservative corporate cultures: Risk aversion delays experimentation

- Regulatory uncertainty: Unclear guidance on AI use in lending decisions

- Talent gaps: Few community banks have AI/ML expertise in-house

As CCG Catalyst noted: "AI has been limited in broader application" despite widespread interest.

Cybersecurity: The Constant Threat

Attack Surface Expanding

As digital engagement expands, so does vulnerability. The data is concerning:

From the CSI Banking Priorities Survey:

- 44% of banks reported card and check fraud

- ~40% experienced fraudulent account openings

- Phishing, AI-generated scams, and social engineering increased

The Real Risk

What keeps security professionals up at night isn't just external attacks—it's the assumption gap:

"Many institutions assume cloud providers fully manage security. In reality, shared-responsibility models can leave gaps around configuration, monitoring, and access controls."

— MDT Product and Partner Insights Board

2025 taught us: Third-party and cloud security gaps are more dangerous than many bankers realize. The "someone else handles that" assumption is often wrong.

Lending and Loan Activity

What Community Banks Are Doing

Despite economic uncertainty, lending activity remained robust:

Most common loan products (by annual volume):

- Auto loans: 23%

- Mortgages: 20%

- Multi-family loans: 18%

Volume distribution:

- 35% of banks complete 100-200 loans per year

- 20% exceed 200 loans annually

The Strategic Shift: Pledging for Liquidity

A notable trend: community banks are rethinking how they manage collateral.

Current state: 60% of respondents are NOT pledging CRE/MF/Ag RE loans.

Future plans: 59% of non-pledgers plan to begin pledging within the next 24 months.

This signals an emerging awareness of collateral pledging as a key liquidity strategy—something that will become more important if deposit competition intensifies.

The Leadership Profile

Who's driving these decisions?

Survey respondent breakdown:

- Directors: 41%

- Managers: 25%

- Other senior roles: 34%

Primary functions:

- Consumer lending: 24%

- Mortgage lending: 23%

- Operations/Technology: 28%

- Other: 25%

The takeaway: Mid-to-senior leadership is actively driving technology and lending strategy. These aren't decisions being delegated down.

What It All Means for 2026

The Optimistic View

Community banking is in better shape than critics suggest:

- Digital adoption is accelerating across complex product lines

- Leadership teams are engaged with technology decisions

- AI awareness has reached critical mass

- Embedded finance partnerships are expanding access to capabilities

The Realistic View

But significant challenges remain:

- Integration complexity limits transformation speed

- The AI gap between aspiration and execution is still wide

- Cybersecurity threats are outpacing defensive capabilities

- Talent constraints limit what institutions can absorb

My Assessment

Community banking enters 2026 in transition, not transformation.

The industry has moved past denial about digital necessity. But the hard work of execution—integrating systems, building capabilities, managing vendor relationships—is where most institutions still struggle.

Winners in 2026 will be those that:

- Focus on integration before adding more tools

- Build AI foundations (data, governance) before deploying AI products

- Invest in security as a strategic priority, not a compliance checkbox

- Develop internal capacity alongside external partnerships

The foundation is being laid. The question is whether institutions have the patience and resources to build on it properly.

I'm Anna Khalzova, Co-founder of Jupid. We help credit unions and community banks win and retain small business members through embedded AI-native financial services. If you're planning your 2026 strategy, let's connect.

Sources

- ABA Banking Journal: Community Banks Navigate Digital Adoption, Liquidity Management Challenges - December 17, 2025

- Treasury Prime: 2025 Banking Innovation Index - 2025

- CSBS: 2025 Annual Survey of Community Banks - 2025

- CSI: Banking Priorities Report 2025 - 2025

- CCG Catalyst: Lessons from 2025's Banking Tech Triumphs and Tribulations - 2025

- MDT: 2025 Credit Union Trends and Lessons - December 17, 2025

Ready to simplify your finances?

Join 1,000+ businesses using Jupid to save time and money. Start simplifying your finances today.

30-day money-back guarantee