Truck Driver Tax Deductions 2026: Complete Guide for Owner-Operators and Company Drivers

Table of Contents

Published: January 20, 2026 Tax Year: 2026

A Message from Slava

Truck drivers spend weeks away from home, logging thousands of miles, and keeping the economy moving. Yet when tax season comes, many truckers—especially owner-operators—leave thousands of dollars in deductions unclaimed.

The trucking industry has special tax rules that work in your favor. Unlike most self-employed workers who can only deduct 50% of meal expenses, truck drivers operating under DOT hours-of-service regulations can deduct 80%. Combined with per diem rates, mileage deductions, and equipment write-offs, the tax savings add up fast.

Through my work with small business owners, I've seen owner-operators save $10,000-$20,000 per year just by understanding what they can deduct. This guide covers every deduction you're entitled to, with exact IRS citations and real calculations.

Executive Summary: Truck Driver Tax Deductions for 2026

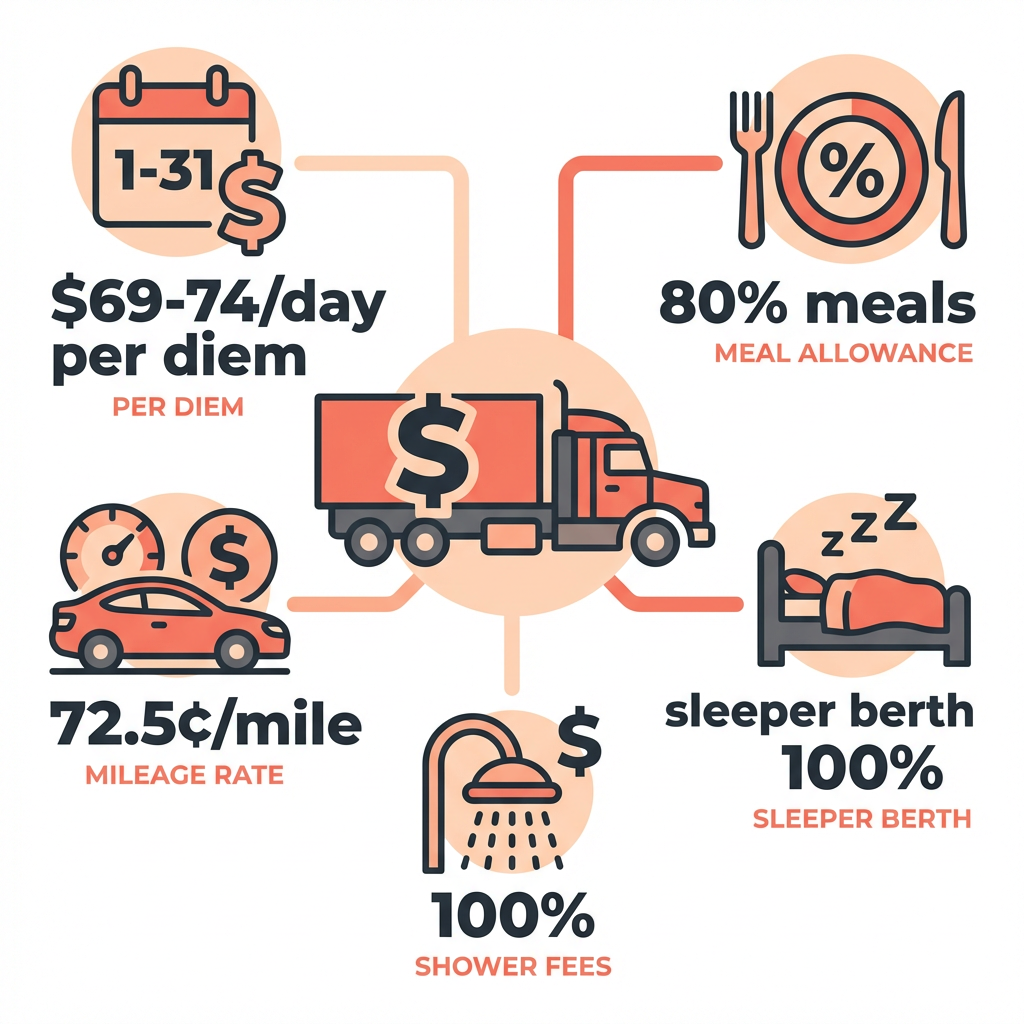

Key Deductions Available:

- Per Diem: $69-$74/day (GSA rates) for meals while away from home

- Meal Deduction: 80% for DOT-regulated drivers (vs. 50% for others)

- Vehicle Expenses: 72.5¢/mile OR actual expenses (fuel, maintenance, depreciation)

- Sleeper Berth: Lodging and related expenses 100% deductible

- Equipment: CB radios, GPS, ELD devices, safety gear

Tax Savings Potential for 2026:

For an owner-operator earning $80,000 net income with 280 days away from home:

Per diem meals (280 days × $69): $19,320

Deductible portion (80%): $15,456

Truck expenses (if not using mileage): $25,000

Sleeper berth/lodging: $2,500

Equipment and supplies: $1,500

License and permits: $1,200

Self-employment tax (50%): $5,652

Total deductions: $51,308

Tax savings at 22% bracket: $11,288

Legal Basis: IRC Section 162, IRC Section 274(n)(3), IRS Publication 463, IRS Publication 529

Understanding Your Tax Status as a Truck Driver

Owner-Operator vs. Company Driver

Your tax deductions depend heavily on your employment classification:

| Factor | Owner-Operator (1099) | Company Driver (W-2) |

|---|---|---|

| Tax forms received | 1099-NEC | W-2 |

| Business deductions | Full Schedule C | Very limited |

| Per diem method | Tax deduction | Must receive from employer |

| Truck expenses | Fully deductible | Not deductible |

| Self-employment tax | Yes (15.3%) | No (split with employer) |

Important: After the 2017 Tax Cuts and Jobs Act, W-2 company drivers lost most deductions. If you're a company driver, the main way to claim per diem is if your employer provides it (often as a non-taxable reimbursement).

Owner-operators and 1099 independent contractors can deduct all ordinary and necessary business expenses on Schedule C.

Per Diem Deduction: The Trucker's Biggest Tax Break

Per diem is a daily allowance for meals and incidental expenses while traveling away from your tax home. For truck drivers, this is often the largest deduction.

2026 Per Diem Rates

The GSA (General Services Administration) sets per diem rates annually. For transportation workers:

| Location | Per Diem Rate (M&IE) |

|---|---|

| Continental US (standard) | $69/day |

| High-cost areas | $74-$79/day |

Source: GSA Per Diem Rates

The 80% Meals Deduction for Truckers

Here's the advantage for DOT-regulated truck drivers: you can deduct 80% of meal expenses, compared to the standard 50% for other businesses.

Legal Citation: IRC § 274(n)(3) provides this special rule for transportation workers subject to DOT hours-of-service limits.

Calculation Example: Per Diem Method

Days away from tax home: 280

Per diem rate: × $69

Total meal expenses: $19,320

Deductible portion (80%): $15,456

Tax savings at 22% bracket: $3,400

Actual Expense Method

Instead of per diem, you can track actual meal costs. This requires keeping all receipts but may result in a larger deduction if you eat at more expensive locations.

Total meal receipts while traveling: $22,000

Deductible portion (80%): $17,600

Tax savings at 22% bracket: $3,872

Strategy: Compare both methods. If your actual meals exceed $69/day, use the actual expense method. If not, per diem is simpler and often better.

Vehicle and Mileage Deductions

For owner-operators, truck expenses are a major deduction category. You have two options:

Standard Mileage Method

The 2026 IRS standard mileage rate is 72.5 cents per mile.

Important limitation: The standard mileage rate is for vehicles under 6,000 pounds. Most commercial trucks exceed this weight, so owner-operators typically use the actual expense method for their primary rig.

However, if you use a personal vehicle for business (driving to pick up your truck, etc.), you can use the standard mileage rate for those trips.

Actual Expense Method (Most Common for Truckers)

Track all truck-related expenses and deduct the business-use percentage:

✅ Deductible truck expenses:

- Fuel

- Oil and lubricants

- Tires

- Repairs and maintenance

- Insurance

- Registration and licensing

- Truck payments (interest portion)

- Depreciation

- Truck washes

- Tolls and scales

Calculation Example: Actual Expenses

Annual truck expenses:

Fuel: $45,000

Repairs and maintenance: $8,000

Insurance: $6,000

Depreciation: $12,000

Tires: $3,500

Registration/permits: $2,500

Tolls and scales: $1,500

Total truck expenses: $78,500

Business use (typically 100% for OTR): $78,500

Tax savings at 22% bracket: $17,270

Use our Mileage Deduction Calculator for personal vehicle trips.

Sleeper Berth and Lodging

When you sleep in your truck's sleeper berth, you can deduct related expenses:

✅ Deductible sleeper expenses:

- Bedding and pillows

- Sleeping bag

- Mattress pad or upgrade

- 12V appliances (microwave, refrigerator)

- Curtains and privacy screens

- Cleaning supplies

- Laundromat expenses

Hotel/Motel Stays

When you stay in hotels (during home time, truck repairs, etc.), lodging is 100% deductible as a business expense.

Annual hotel expenses: $2,400

Deductible: $2,400 (100%)

Tax savings at 22% bracket: $528

Equipment and Supplies

All ordinary and necessary equipment for trucking is 100% deductible.

Deductible Equipment

✅ Communication and navigation:

- CB radio

- GPS unit

- Smartphone (business portion)

- Satellite radio subscription (if business-related)

✅ Compliance and logging:

- ELD (Electronic Logging Device)

- ELD subscription fees

- Logbook and trip sheets

- Permit book and organizer

✅ Safety gear:

- Load securement equipment (chains, straps, binders)

- Gloves, boots, safety vest

- Hard hat

- Flashlight and warning triangles

- Fire extinguisher

✅ Comfort and convenience:

- Cooler

- Coffee maker

- Portable stove

- Power inverter

- Tool kit

Calculation Example

ELD device: $300

GPS unit: $200

CB radio: $150

Safety equipment: $300

Load securement: $400

Power inverter: $150

Tools: $200

Total equipment deduction: $1,700

Tax savings at 22% bracket: $374

License, Permits, and Compliance

Professional licenses and permits required for trucking are fully deductible.

Deductible Fees

✅ Licenses:

- CDL renewal fees

- CDL endorsement fees

- Medical examination (DOT physical)

- Drug testing fees

- Background check fees

✅ Permits and registrations:

- IFTA (International Fuel Tax Agreement) fees

- IRP (International Registration Plan) fees

- Oversize/overweight permits

- Hazmat endorsement and fees

- State-specific permits

✅ Insurance:

- Cargo insurance

- Bobtail insurance

- Occupational accident insurance

- Health insurance (self-employed deduction)

Typical Annual Costs

| Expense | Typical Cost |

|---|---|

| CDL renewal | $50-$150 |

| DOT physical | $75-$150 |

| Drug test | $50-$100 |

| IFTA stickers | $5-$15/quarter |

| IRP registration | $500-$2,500+ |

| Hazmat endorsement | $100-$200 |

| Total | $780-$3,115+ |

All 100% deductible on Schedule C.

Self-Employment Tax Deductions

Owner-operators pay 15.3% self-employment tax on net earnings:

- 12.4% Social Security (on first $184,500 for 2026)

- 2.9% Medicare (no limit)

Deduct Half of Self-Employment Tax

You can deduct 50% of your self-employment tax as an adjustment to income.

Example:

Net trucking income: $75,000

Self-employment tax (15.3%): $11,475

Deductible portion (50%): $5,738

Tax savings at 22% bracket: $1,262

Use our Self-Employment Tax Calculator to calculate your exact liability.

Health Insurance Deduction

Self-employed owner-operators can deduct 100% of health insurance premiums for themselves, their spouse, and dependents.

Requirements

✅ You must show a net profit on Schedule C ✅ You cannot be eligible for an employer-subsidized plan

What's Deductible

- Health insurance premiums

- Dental and vision insurance

- Medicare premiums

- Long-term care insurance (with age-based limits)

For the complete guide, see Health Insurance Deduction for Self-Employed 2026.

Retirement Contributions

Owner-operators can contribute to tax-advantaged retirement accounts that reduce taxable income.

SEP IRA

- Contribute up to 25% of net self-employment income

- Maximum contribution: $70,000 for 2026

- Simple to set up, flexible contributions

Solo 401(k)

- Employee contribution: Up to $23,500 (2026)

- Catch-up contribution (age 50+): Additional $7,500

- Employer contribution: Up to 25% of net income

- Total maximum: $70,000 (or $77,500 with catch-up)

Example:

Net income: $75,000

SEP IRA contribution (20%): $15,000

Tax savings at 22% bracket: $3,300

Home Office and Administrative Expenses

If you maintain a home office for administrative tasks (scheduling loads, paperwork, bookkeeping), you may qualify for the home office deduction.

Simplified Method

$5 per square foot, up to 300 square feet = $1,500 maximum

What Counts

✅ Administrative activities:

- Load planning and scheduling

- Invoicing and bookkeeping

- Compliance paperwork

- Route planning

Try our Home Office Tax Deduction Calculator.

Common Mistakes Truck Drivers Make

Mistake #1: Not Tracking Per Diem Days

Problem: Estimating days away from home instead of keeping a log

Impact: IRS can disallow per diem deduction—potentially $15,000+ lost

Solution: Use your ELD records or logbooks to verify days away from your tax home.

Mistake #2: Missing the 80% Meals Rule

Problem: Deducting only 50% of meals like other businesses

Impact: Losing 30% of your meal deduction

Solution: As a DOT-regulated driver, you're entitled to the 80% deduction under IRC § 274(n)(3).

Mistake #3: Not Separating Business and Personal

Problem: Mixing personal and business expenses

Impact: Difficulty proving deductions in an audit

Solution: Separate business bank account for all trucking income and expenses.

Mistake #4: Ignoring Quarterly Taxes

Problem: Waiting until April to pay taxes owed

Impact: Underpayment penalties (~8% annually)

Solution: Pay estimated taxes quarterly: April 15, June 15, September 15, January 15.

Track Your Trucking Deductions With AI

Between driving, logging miles, and managing paperwork, tracking expenses is a full-time job. Jupid automates the process so you can focus on the road.

What makes Jupid different for truck drivers:

✅ AI accountant in WhatsApp - Ask tax questions anytime, get instant answers backed by IRS guidance

✅ 95.9% accuracy in categorization - Connect your bank; Jupid automatically categorizes fuel stops, repairs, and expenses

✅ Real-time financial insights - See your deductions and estimated tax liability throughout the year

✅ Automatic tax filing - From expense tracking to Schedule C, handled for you

Example conversation:

- You: "I spent $180 on truck tires today. Is this deductible?"

- Jupid: "Yes, tire expenses are 100% deductible as a vehicle operating expense under IRC § 162. I've categorized it as 'Truck Maintenance' on your Schedule C."

Action Checklist: Maximizing Your 2026 Deductions

Start of Year

- Set up a separate business bank account

- Track your "tax home" (where you regularly live when not on the road)

- Download ELD records from previous year

- Gather all 1099 forms from carriers/brokers

Throughout the Year

- Save all fuel receipts or track through fuel card

- Log days away from tax home

- Keep receipts for meals if using actual expense method

- Track equipment purchases

- Set aside 25-30% of earnings for taxes

Before Year End

- Make Q4 estimated tax payment

- Calculate total per diem days

- Review all deductible expenses

- Consider retirement contributions (SEP IRA)

At Tax Time

- Complete Schedule C with all income and expenses

- Complete Schedule SE for self-employment tax

- Calculate per diem deduction (remember 80% for truckers)

- Claim the 50% SE tax deduction on Schedule 1

- File by April 15 (or request extension)

Resources and Citations

IRS Publications (Official Sources)

- IRS Publication 463 - Travel, Gift, and Car Expenses

- IRS Publication 529 - Miscellaneous Deductions

- IRS Publication 535 - Business Expenses

- Schedule C Instructions - Profit or Loss From Business

- GSA Per Diem Rates - Current rates by location

Tax Code and Regulations

- IRC § 162 - Trade or Business Expenses

- IRC § 274(n)(3) - 80% Meal Deduction for DOT Transportation Workers

- IRC § 162(l) - Self-Employed Health Insurance Deduction

- IRC § 199A - Qualified Business Income Deduction

- IRS Notice 2026-10 - Standard Mileage Rates for 2026

2026 Key Numbers Summary

| Item | 2026 Limit |

|---|---|

| Standard mileage rate | 72.5¢ per mile |

| Per diem (CONUS standard) | $69/day |

| Per diem (high-cost areas) | $74-$79/day |

| Trucker meal deduction | 80% (vs. 50% standard) |

| SE tax rate | 15.3% |

| SE tax deduction | 50% of SE tax |

| Social Security wage base | $184,500 |

| SEP IRA maximum | $70,000 or 25% of net |

Disclaimer

This article provides general information about tax deductions for truck drivers and should not be considered tax advice. Tax laws change frequently, and individual circumstances vary significantly. The deductions described apply primarily to owner-operators and independent contractors; W-2 company drivers have limited deduction options. Per diem rates and rules vary—consult IRS guidance and a tax professional for your specific situation.

Tax Year: 2026 Last Updated: January 20, 2026

Ready to simplify your finances?

Join 1,000+ businesses using Jupid to save time and money. Start simplifying your finances today.

30-day money-back guarantee