2025: The Year AI Stopped Being a Pilot Project

Table of Contents

Published: December 22, 2025

A Message from Anna

In January 2025, every financial institution had an "AI strategy."

By December 2025, the gap between strategy and execution had widened into a chasm. Some institutions deployed AI at scale. Others were still running pilots. The distance between them may take years to close.

This is the story of the year AI stopped being a pilot project—and what that means for everyone still experimenting.

The Scale Shift: From Experiments to Infrastructure

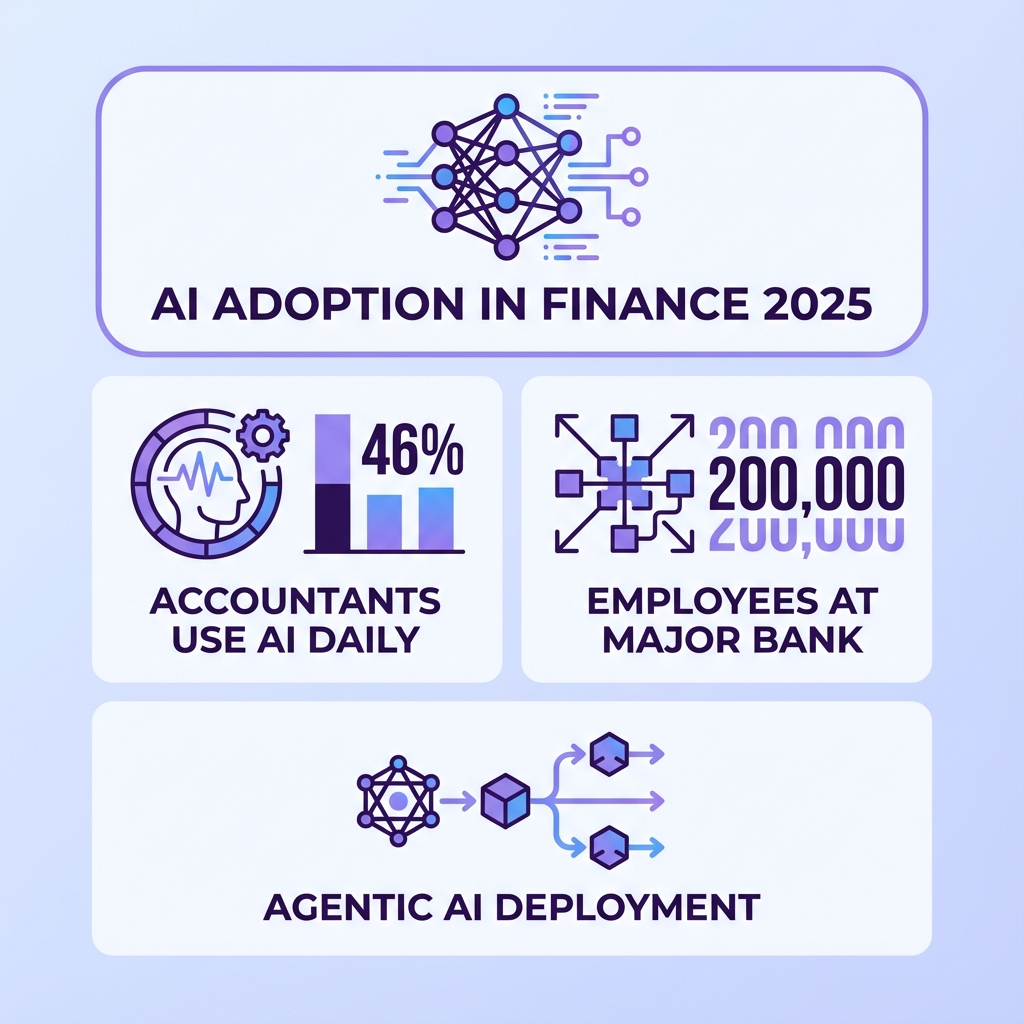

JPMorgan: 200,000 Employees on LLM Suite

The clearest signal that AI had moved from pilot to production came from the largest U.S. bank.

JPMorgan Chase deployed its LLM Suite to 200,000 employees and ran over 450 proof-of-concept projects through 2025.

What LLM Suite does:

- Research and analysis assistance

- Document summarization

- Code generation

- Communication drafting

- Knowledge retrieval across enterprise data

Why it matters:

When the world's largest bank gives 200,000 employees access to AI tools, it's not an experiment. It's a statement: AI is infrastructure now.

The 450 proof-of-concept projects signal something equally important—JPMorgan isn't just deploying what works today. They're systematically discovering what will work tomorrow.

Cash App: Moneybot Goes Live

Square's Cash App introduced Moneybot, described as an "advanced financial chatbot."

What Moneybot does:

- Analyzes user spending patterns

- Recommends financial decisions

- Creates personalized savings plans

- Executes trades in stocks and cryptocurrencies

- All within a conversational interface

The shift:

Previous financial chatbots waited for questions. Moneybot actively monitors, identifies opportunities, and takes action within user-defined parameters.

This is agentic AI in consumer finance—not just answering questions, but making things happen.

Accountants: 46% Daily AI Usage

The Intuit QuickBooks 2025 Accountant Technology Survey revealed that AI adoption among accountants outpaces nearly every other profession:

| Metric | Accountants | Small Businesses |

|---|---|---|

| Daily AI usage | 46% | 28% |

| AI boosts productivity | 81% | — |

| AI reduces mental load | 86% | — |

| Use AI for advisory | 93% | — |

What changed:

AI moved from "optional enhancement" to "competitive requirement." Firms not using AI daily are falling behind on speed, accuracy, and capacity.

The Agentic AI Emergence

2024 was Generative AI experimentation. 2025 was the Year of the Agent.

What's Different About Agentic AI

Traditional AI (including chatbots):

- Waits for input

- Processes single requests

- Returns output

- Stops

Agentic AI:

- Monitors continuously

- Identifies issues proactively

- Reasons about multi-step solutions

- Executes within guardrails

- Learns from outcomes

As Mitch Rutledge, CEO of Vertice AI, put it:

"Agents, agents and more agents—all the leading fintechs are embracing agentic AI functions to empower consumers and staff members."

Where Agentic AI Deployed in 2025

Autonomous member service:

- Red Rocks Credit Union launched "Roxie," an AI assistant handling account inquiries, processing requests, and routing complex issues—without waiting for human intervention

- PenFed reported resolving 20% of member cases on first contact through AI agents

Self-driving back office:

- Transaction monitoring

- Automatic reconciliation

- Regulatory report drafting

- Compliance alert generation

Proactive financial guidance:

- Spending pattern analysis

- Automatic savings optimization

- Real-time tax impact calculations

- Cash flow predictions with intervention suggestions

The Guardrail Requirement

The institutions that deployed successfully weren't necessarily the most aggressive. They were the ones with proper controls:

"Many think they're ready for AI, but they're not. Guardrails, monitoring, oversight—most credit unions haven't even started." — Bill Illis, MDT

What successful deployment required:

- Clear boundaries on AI authority

- Human escalation triggers

- Audit trails for all AI decisions

- Continuous monitoring for drift

- Regular model validation

The Widening Gap

Leaders vs. Laggards

The gap between AI leaders and laggards widened significantly in 2025:

AI Leaders:

- Deployed multiple AI systems in production

- Built internal AI expertise

- Established governance frameworks

- Accumulated months of operational data

- Identified next-generation use cases

AI Laggards:

- Still running pilot projects

- Relying entirely on vendor AI

- No formal governance

- Limited data on AI performance

- Uncertain about next steps

Why the gap is hard to close:

AI systems improve with use. The institutions that deployed in 2025 now have:

- Training data from real interactions

- Learned understanding of edge cases

- Calibrated confidence thresholds

- Staff experienced in AI oversight

- Proven ROI to justify further investment

Those still piloting have none of this. Every month they delay, the gap widens.

The 93% Failure Rate Context

CCG Catalyst reported that 93% of bank digital transformation initiatives fell short of expectations.

But here's the nuance: AI initiatives were not the primary failure mode.

What failed:

- Legacy system modernization projects

- Large-scale core transformations

- Integration-dependent initiatives

- Projects requiring organizational change

What succeeded:

- Targeted AI deployments with clear scope

- Point solutions with measurable ROI

- Incremental automation of specific workflows

- AI tools deployed to prepared teams

The lesson: AI works when deployed with focus. It fails when treated as a magic solution for systemic problems.

What We Learned About AI That Works

1. Context Beats Capability

The most powerful AI models in the world still fail without context.

Example:

Generic AI: "Transaction of $14,457. Category: Miscellaneous."

Context-aware AI: "Conference expenses at Jack Henry Connect, September 13-15. Categories: Travel ($4,200), Lodging ($3,800), Meals ($2,100), Booth ($4,357). Total deductible: $14,457."

Same data. Radically different value.

2. Guardrails Enable Speed

Institutions with strong governance deployed faster, not slower.

Why:

Clear boundaries mean less fear. When everyone knows what AI can and can't do:

- Approval processes are faster

- Scope creep is prevented

- Failures are contained

- Learning is systematic

3. Small Wins Beat Big Visions

The successful AI deployments of 2025 were often modest:

- Automate this one report

- Handle these routine inquiries

- Categorize these transactions

- Draft these responses

Institutions that tried to "transform everything with AI" mostly ended up with PowerPoints.

4. Human + AI > Either Alone

The most effective implementations kept humans in the loop:

- AI handles routine cases; humans handle exceptions

- AI drafts; humans approve

- AI analyzes; humans decide

- AI suggests; humans verify

Pure automation without oversight created risks. Pure manual processes missed the efficiency gains. The sweet spot was hybrid.

What This Means for 2026

For Financial Institutions

If you deployed in 2025:

- Expand scope based on what worked

- Build on your data advantage

- Develop next-generation use cases

- Share learnings across the organization

If you're still piloting:

- Pick one high-value, well-scoped use case

- Deploy in production (with guardrails)

- Accumulate real operational experience

- Accept that you're playing catch-up

For Small Businesses

What to expect:

- Your bank/credit union may offer AI-powered services

- Your accountant likely uses AI (even if they don't say so)

- AI-native financial tools are increasingly available

- Real-time, context-aware services are becoming the norm

What to look for:

- Systems that understand your business context

- Proactive insights, not just reactive reporting

- Integration across your financial ecosystem

- Clear explanations of AI-driven recommendations

For the Industry

2025 established that AI is infrastructure, not innovation.

The conversation in 2026 won't be "should we use AI?" It will be "how do we use AI better than our competitors?"

This shift has implications:

- Vendor selection will prioritize AI capabilities

- Talent strategies must include AI expertise

- Governance becomes a competitive advantage

- Data quality determines AI effectiveness

The Uncomfortable Truth

Here's what nobody wants to say publicly:

Many institutions that claim to be "AI-first" are actually "AI-adjacent." They have AI features in vendor products. They've run demos. They've attended conferences.

But they haven't deployed AI in a way that changes their operations.

The institutions that actually deployed—that accumulated real data, learned real lessons, and proved real ROI—have a head start that will be very hard to overcome.

The pilot phase is over. The deployment phase has begun.

Those still experimenting need to decide: join the leaders, or accept the growing gap.

I'm Anna Khalzova, Co-founder of Jupid. We built Jupid to be AI-native from day one—not AI-assisted, not AI-enhanced, but AI at the core. Because we believe that's what small businesses deserve, and that's where finance is headed. If you're interested in what AI-native accounting looks like, let's connect.

Sources

Ready to simplify your finances?

Join 1,000+ businesses using Jupid to save time and money. Start simplifying your finances today.

30-day money-back guarantee