DoorDash Tax Deductions 2026: Complete Guide for Delivery Drivers

Table of Contents

Published: January 19, 2026 Tax Year: 2026

A Message from Slava

When I talk to gig economy workers about taxes, the same frustration comes up: "I made $30,000 delivering, but after taxes I barely kept $20,000." That's often because they're not claiming all their deductions—and in the delivery business, deductions can cut your tax bill by 30-50%.

DoorDash drivers are independent contractors, not employees. This means you're responsible for tracking expenses, paying quarterly taxes, and filing Schedule C. The flip side? You can deduct every ordinary and necessary business expense—mileage, phone, hot bags, even the subscription to your mileage tracking app.

Through my work building financial tools for small business owners, I've seen Dashers leave thousands on the table simply because they didn't know what qualified. This guide covers every deduction you're entitled to, with exact IRS citations and real calculations.

Executive Summary: DoorDash Tax Deductions for 2026

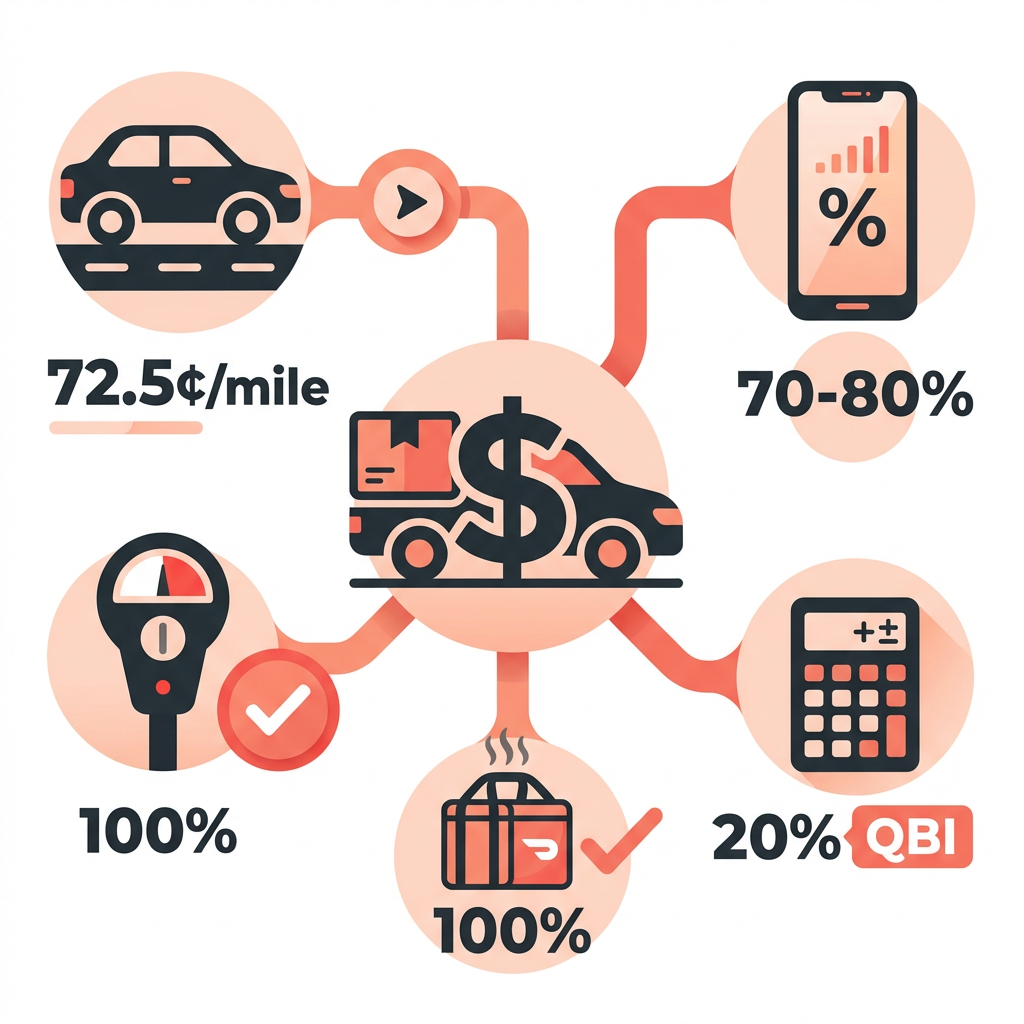

Key Deductions Available:

- Vehicle/Mileage: 72.5¢ per mile (IRS Notice 2026-10) or actual expenses

- Phone and Data: Business-use percentage (typically 50-80%)

- Equipment: Hot bags, phone mounts, chargers—100% deductible

- Self-Employment Tax: Deduct half of the 15.3% SE tax

- QBI Deduction: 20% of qualified business income

Tax Savings Potential for 2026:

For a DoorDash driver earning $40,000 in gross delivery income:

Vehicle expenses (18,000 miles): $13,050

Phone and data (70% business): $840

Hot bags and equipment: $150

Parking and tolls: $300

Self-employment tax (50%): $2,826

QBI deduction (20%): $4,547

Total deductions: $21,713

Tax savings at 22% bracket: $4,777

Legal Basis: IRC Section 162, IRS Publication 463, IRS Publication 334, Schedule C (Form 1040), Form 1099-NEC

Understanding Your DoorDash Tax Documents

Form 1099-NEC: Your Earnings Statement

If you earned $600 or more from DoorDash in a tax year, you'll receive Form 1099-NEC (Nonemployee Compensation) by January 31. This form reports your total earnings to both you and the IRS.

Where to find your DoorDash tax forms:

- Log into the Dasher app

- Go to the Earnings tab

- Select Tax Information

- Download your 1099-NEC

Important: Even if you earned less than $600 and don't receive a 1099, you must still report all income to the IRS.

Tax Forms You'll File

| Form | Purpose |

|---|---|

| Form 1099-NEC | DoorDash earnings statement (you receive this) |

| Schedule C | Report business income and deductions |

| Schedule SE | Calculate self-employment tax |

| Form 1040-ES | Quarterly estimated tax payments |

| Form 1040 | Your annual income tax return |

Legal Citation: IRS Publication 334 - Tax Guide for Small Business

Vehicle and Mileage Deductions

For most Dashers, mileage is the largest deductible expense. You're driving constantly—to restaurants, to customers, and back again.

2026 Standard Mileage Rate

The IRS standard mileage rate for 2026 is 72.5 cents per mile—up 2.5 cents from 2025.

Source: IRS Notice 2026-10

What Counts as Deductible Business Miles

✅ Deductible:

- Driving to pick up an order

- Driving to deliver an order

- Driving between deliveries while app is on

- Driving to and from delivery zones

- Driving to get supplies (hot bags, phone charger)

❌ Not Deductible:

- Personal trips with the app off

- Driving home at the end of a shift (if no home office)

- Trips unrelated to deliveries

Standard Mileage vs. Actual Expense Method

You have two options for deducting vehicle expenses:

Standard Mileage Method (Simpler):

- Multiply business miles by 72.5¢

- Includes gas, insurance, repairs, depreciation in one rate

- You can also add parking fees and tolls separately

Actual Expense Method (Complex but sometimes larger):

- Track all vehicle expenses: gas, insurance, repairs, depreciation

- Calculate business-use percentage

- Deduct that percentage of total expenses

Calculation Example: Standard Mileage

Annual business miles driven: 18,000

Standard mileage rate (2026): × $0.725

Vehicle deduction: $13,050

Plus parking fees: $180

Plus tolls: $120

Total vehicle deduction: $13,350

Tax savings at 22% bracket: $2,937

Mileage Tracking is Critical

The IRS requires "contemporaneous" records—meaning you must log miles at or near the time of the trip. Using a mileage tracking app is the easiest way to stay compliant.

Popular options include Stride, Everlance, and MileIQ. The cost of these apps is also tax-deductible.

Use our Mileage Deduction Calculator to estimate your savings.

Phone and Data Expenses

Your smartphone is essential for DoorDash—you need it to accept orders, navigate to locations, and track earnings.

How to Calculate the Deduction

If you use your personal phone for deliveries, you deduct the business-use percentage of your phone and data costs.

Example:

Annual phone bill: $1,200

Data plan: $600

Total: $1,800

Estimated business use: × 70%

Deductible amount: $1,260

Dedicated Business Phone

If you use a separate phone exclusively for DoorDash, the entire cost is deductible:

- Phone purchase price (or monthly payment)

- Service plan

- Cases and accessories

Legal Citation: IRS Publication 463 - Travel, Gift, and Car Expenses

Equipment and Supplies

DoorDash drivers need specific equipment to do the job efficiently. All ordinary and necessary equipment is 100% deductible.

Deductible Delivery Equipment

✅ Hot bags and coolers:

- Insulated delivery bags

- Pizza bags

- Cooler bags for cold items

- Ice packs

✅ Phone accessories:

- Car phone mount

- Portable chargers

- Extra charging cables

- Phone cases (business portion)

✅ Safety and convenience:

- Flashlight for night deliveries

- Hand sanitizer and cleaning supplies

- Delivery backpacks

- Collapsible carts for large orders

✅ Vehicle accessories:

- DoorDash car decals (if used)

- Cargo organizers

- Floor mats (business portion)

Calculation Example

Insulated hot bags (3): $75

Phone mount and charger: $40

Portable battery: $35

Cleaning supplies: $25

Flashlight: $15

Total equipment deduction: $190

Tax savings at 22% bracket: $42

Parking and Tolls

Parking fees and tolls paid during deliveries are fully deductible—and they're deducted separately from your mileage.

What's Deductible

✅ Parking:

- Paid parking while picking up orders

- Parking meters

- Parking garage fees

✅ Tolls:

- Highway tolls during deliveries

- Bridge tolls

- Express lane fees

Tip: Use a toll transponder and dedicated parking apps to automatically track these expenses.

Self-Employment Tax Deduction

As an independent contractor, you pay 15.3% self-employment tax on your net earnings:

- 12.4% Social Security (on first $184,500 for 2026)

- 2.9% Medicare (no limit)

Deduct Half of Self-Employment Tax

The IRS allows you to deduct 50% of your self-employment tax as an adjustment to income. This reduces your taxable income—and it doesn't require itemizing.

Example:

Net DoorDash income: $35,000

Self-employment tax (15.3%): $5,355

Deductible portion (50%): $2,678

Tax savings at 22% bracket: $589

This deduction goes on Schedule 1, Line 15 of your Form 1040.

Use our Self-Employment Tax Calculator to calculate your exact liability.

QBI Deduction (20% Pass-Through Deduction)

The Qualified Business Income (QBI) deduction allows self-employed individuals to deduct up to 20% of their net business income.

Who Qualifies

Most DoorDash drivers qualify for the full QBI deduction if their taxable income is below:

- $203,000 (single filers)

- $406,000 (married filing jointly)

Calculation Example

Net Schedule C income: $30,000

QBI deduction (20%): $6,000

Tax savings at 22% bracket: $1,320

Legal Citation: IRC § 199A

For a complete breakdown, see our QBI Deduction Guide 2026 and use our QBI Calculator.

Health Insurance Deduction

If you're self-employed and pay for your own health insurance, you can deduct 100% of your premiums—including coverage for your spouse and dependents.

Requirements

✅ You must show a net profit on Schedule C ✅ You cannot be eligible for an employer-subsidized plan (through a spouse's job, for example)

What's Deductible

- Health insurance premiums

- Dental and vision insurance

- Medicare premiums (Parts A, B, C, D)

- Long-term care insurance (with age-based limits)

Example:

Annual health insurance premiums: $6,000

Net DoorDash profit: $30,000

Deductible amount: $6,000 ✅

Tax savings at 22% bracket: $1,320

For the complete guide, see Health Insurance Deduction for Self-Employed 2026.

Home Office Deduction

Many Dashers use part of their home for business purposes—tracking earnings, managing expenses, or planning routes. If you meet the IRS requirements, you can claim the home office deduction.

Eligibility Requirements

The space must be:

- Used regularly and exclusively for business

- Your principal place of business OR used to meet clients

For Dashers, a desk area where you handle administrative tasks can qualify.

Simplified Method

The simplified method allows a deduction of $5 per square foot, up to 300 square feet (maximum $1,500).

Example:

Home office size: 100 sq ft

Rate: × $5

Annual deduction: $500

For more details, try our Home Office Tax Deduction Calculator.

Quarterly Estimated Taxes

As an independent contractor, the IRS expects you to pay taxes throughout the year—not just at filing time.

Who Must Pay Quarterly

You should make quarterly estimated tax payments if you expect to owe $1,000 or more in federal taxes for the year.

2026 Payment Deadlines

| Quarter | Income Period | Due Date |

|---|---|---|

| Q1 | Jan 1 - Mar 31 | April 15, 2026 |

| Q2 | Apr 1 - May 31 | June 16, 2026 |

| Q3 | Jun 1 - Aug 31 | September 15, 2026 |

| Q4 | Sep 1 - Dec 31 | January 15, 2027 |

Avoiding Penalties

If you don't pay enough during the year, you may face underpayment penalties. Use Form 1040-ES to calculate and pay estimated taxes.

Try our Quarterly Tax Calculator to estimate your payments.

Common Mistakes DoorDash Drivers Make

Mistake #1: Not Tracking Mileage

Problem: Trying to reconstruct mileage from memory at tax time

Impact: IRS can disallow your entire vehicle deduction—potentially $10,000+ lost

Solution: Use a mileage tracking app from day one. The IRS requires contemporaneous records.

Mistake #2: Missing Deductions

Problem: Only claiming mileage and ignoring phone, equipment, and other expenses

Impact: Leaving $1,000-$3,000 on the table

Solution: Track every business expense, no matter how small. $20 here, $50 there—it adds up.

Mistake #3: Not Separating Business and Personal

Problem: Mixing business and personal expenses in one account

Impact: Difficulty proving deductions in an audit

Solution: Open a separate bank account and credit card for DoorDash income and expenses.

Mistake #4: Ignoring Quarterly Taxes

Problem: Waiting until April to pay all taxes owed

Impact: Underpayment penalties (currently ~8% annually)

Solution: Set aside 25-30% of each payout for taxes and pay quarterly.

Track Your DoorDash Deductions With AI

Between dashing, tracking miles, and saving receipts, tax season can feel overwhelming. Jupid automates the process so you can focus on earning.

What makes Jupid different for delivery drivers:

✅ AI accountant in WhatsApp - Ask tax questions anytime, get instant answers backed by IRS guidance

✅ 95.9% accuracy in categorization - Connect your bank; Jupid automatically categorizes transactions into IRS-compliant expense categories

✅ Real-time financial insights - See your deductions and estimated tax liability as you earn

✅ Automatic tax filing - From expense tracking to Schedule C, handled for you

Example conversation:

- You: "I bought a $45 insulated delivery bag. Can I deduct it?"

- Jupid: "Yes, delivery equipment is 100% deductible as a business expense under IRC § 162. I've categorized it as 'Supplies & Equipment' on your Schedule C."

Action Checklist: Maximizing Your 2026 Deductions

Start of Year

- Download a mileage tracking app

- Record January 1 odometer reading

- Open a separate business bank account

- Save your 1099-NEC from DoorDash

Throughout the Year

- Track every business mile within 24 hours

- Save all receipts (photos count)

- Log parking and toll expenses

- Track phone usage for business percentage

- Set aside 25-30% of earnings for taxes

Before Year End

- Make Q4 estimated tax payment

- Calculate annual mileage

- Review all deductible expenses

- Record December 31 odometer reading

At Tax Time

- Complete Schedule C with all income and expenses

- Complete Schedule SE for self-employment tax

- Claim the 50% SE tax deduction on Schedule 1

- Calculate QBI deduction

- File by April 15 (or request extension)

Resources and Citations

IRS Publications (Official Sources)

- IRS Publication 463 - Travel, Gift, and Car Expenses

- IRS Publication 334 - Tax Guide for Small Business

- IRS Publication 535 - Business Expenses

- Schedule C Instructions - Profit or Loss From Business

- Form 1099-NEC - Nonemployee Compensation

Tax Code and Regulations

- IRC § 162 - Trade or Business Expenses

- IRC § 162(l) - Self-Employed Health Insurance Deduction

- IRC § 199A - Qualified Business Income Deduction

- IRS Notice 2026-10 - Standard Mileage Rates for 2026

2026 Key Numbers Summary

| Item | 2026 Limit |

|---|---|

| Standard mileage rate | 72.5¢ per mile |

| Simplified home office | $5/sq ft (max $1,500) |

| SE tax rate | 15.3% |

| SE tax deduction | 50% of SE tax |

| QBI deduction | 20% of qualified income |

| Social Security wage base | $184,500 |

| 1099-NEC threshold | $600 |

Disclaimer

This article provides general information about tax deductions for DoorDash delivery drivers and should not be considered tax advice. Tax laws change frequently, and individual circumstances vary significantly. DoorDash drivers are classified as independent contractors; if your classification differs, different rules may apply. For advice specific to your situation, consult with a qualified tax professional.

Tax Year: 2026 Last Updated: January 19, 2026

Ready to simplify your finances?

Join 1,000+ businesses using Jupid to save time and money. Start simplifying your finances today.

30-day money-back guarantee