Realtor Tax Deductions 2026: Complete Guide to Write-Offs for Real Estate Agents

Table of Contents

Published: January 19, 2026 Tax Year: 2026

A Message from Slava

When I built Anna Money and served over 60,000 small business owners, real estate agents were among the most underserved when it came to tax guidance. The average agent leaves $5,000-$15,000 in legitimate deductions on the table every year—not because they're trying to pay more taxes, but because no one told them what they could deduct.

Real estate is unique: you're typically classified as an independent contractor (not an employee), which means you're responsible for tracking your own expenses, paying self-employment tax, and filing a Schedule C. The good news? This same classification unlocks dozens of tax deductions that W-2 employees can't access.

Through my work at Jupid and conversations with small business owners, the patterns are clear: agents who understand their deductions save an average of $8,400 per year compared to those who don't. This guide covers every deduction you're entitled to, backed by IRS publications and real calculations.

Executive Summary: Real Estate Agent Tax Deductions for 2026

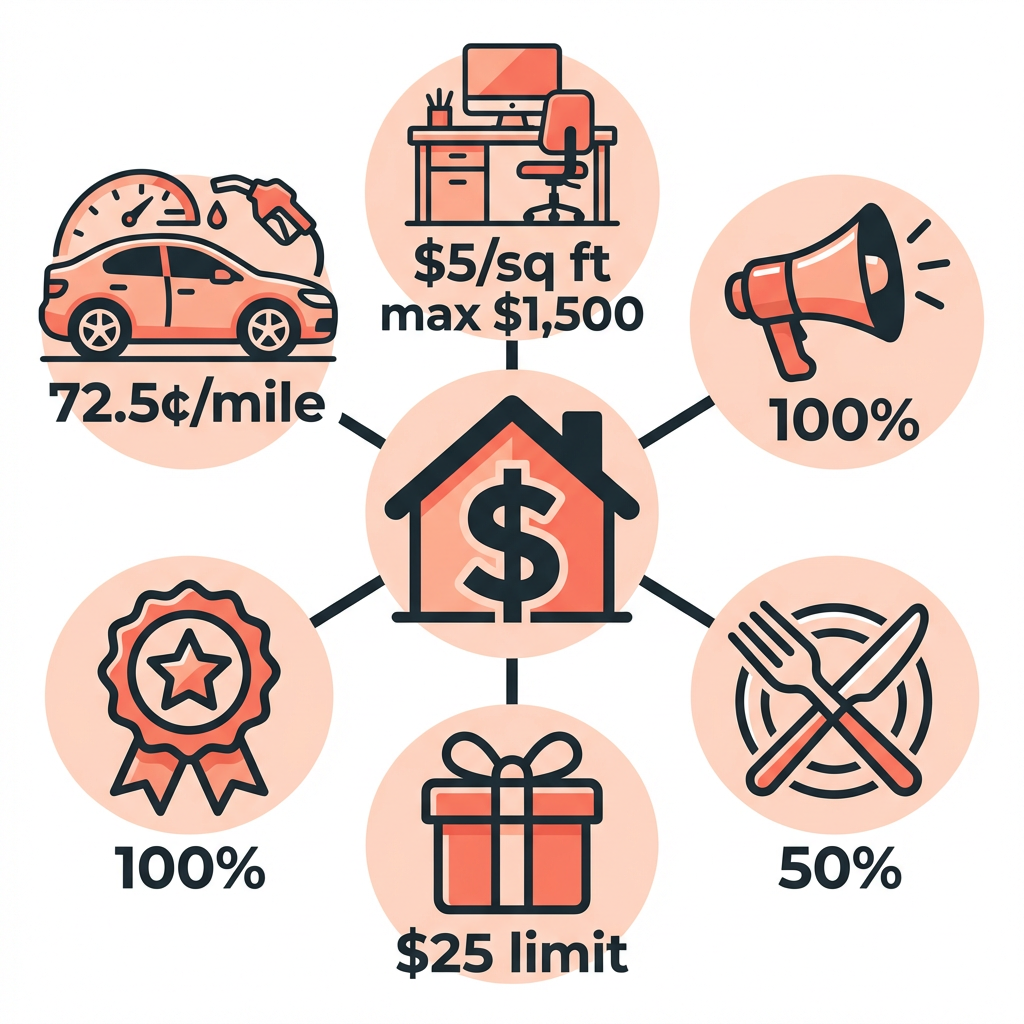

Key Deductions Available:

- Vehicle/Mileage: 72.5¢ per mile (IRS Notice 2026-10) or actual expenses

- Home Office: $5 per sq ft simplified method (max $1,500) or actual expenses

- Marketing: 100% deductible (advertising, signage, staging, open houses)

- Professional Fees: MLS dues, license fees, NAR/association membership

- Self-Employment Health Insurance: 100% deductible (up to net profit)

Tax Savings Potential for 2026:

For a real estate agent earning $100,000 net commission income:

Vehicle expenses (15,000 miles): $10,875

Home office (200 sq ft): $1,000

Marketing and advertising: $3,000

MLS and professional dues: $2,400

Phone and internet (75% business): $900

Continuing education: $500

Business insurance: $1,200

Total deductions: $19,875

Tax savings at 24% bracket: $4,770

SE tax savings (half of 15.3%): $1,520

TOTAL TAX SAVINGS: ~$6,290

Legal Basis: IRC Section 162, IRS Publication 463, IRS Publication 587, Schedule C (Form 1040), Schedule SE (Form 1040)

Understanding Your Tax Status as a Real Estate Agent

Independent Contractor vs. Employee

Most real estate agents are classified as independent contractors, not employees. This distinction matters for taxes:

| Factor | Independent Contractor | Employee |

|---|---|---|

| Tax forms received | 1099-NEC | W-2 |

| Self-employment tax | Yes (15.3%) | No (split with employer) |

| Business deductions | Full Schedule C | Very limited |

| Quarterly taxes | Required | Withheld by employer |

| Health insurance | Self-paid, deductible | Often employer-provided |

Legal Citation: IRC § 3508(b) specifically identifies "qualified real estate agents" as statutory non-employees for federal tax purposes.

Why This Classification Benefits You

As an independent contractor, you can deduct all ordinary and necessary business expenses under IRC § 162. Employees lost most of their deduction ability after the 2017 Tax Cuts and Jobs Act.

The trade-off: you pay the full 15.3% self-employment tax (Social Security + Medicare), but you can deduct half of it on your Form 1040.

Vehicle and Mileage Deductions

For most real estate agents, vehicle expenses represent the largest deductible category. You're constantly driving to showings, client meetings, inspections, and open houses.

2026 Standard Mileage Rate

The IRS standard mileage rate for 2026 is 72.5 cents per mile—up 2.5 cents from 2025.

Source: IRS Notice 2026-10

What Counts as Deductible Business Miles

✅ Deductible:

- Driving to property showings

- Client meetings (lunch, coffee, office visits)

- Property inspections

- Open houses

- Visiting vendors (photographers, stagers)

- Picking up marketing materials

- Driving between properties in one day

- Travel to continuing education classes

❌ Not Deductible:

- Driving from home to your brokerage office (commuting)

- Personal errands during work hours

- Driving while on vacation (even if you check listings)

Calculation Example

Annual business miles driven: 15,000

Standard mileage rate (2026): × $0.725

Total vehicle deduction: $10,875

Tax savings at 22% bracket: $2,393

The Home Office Exception

Here's a strategy many agents miss: if you have a qualified home office (more on this below), trips from home to your first property become deductible business trips—not commuting.

Example:

- Without home office: Drive 15 miles to showing = non-deductible commute

- With home office: Drive 15 miles to showing = $10.88 deduction

Over a year, this converts thousands of "commuting" miles into deductible business miles.

For more details, see our complete Car and Mileage Deduction Guide 2026 and use our Mileage Deduction Calculator to calculate your savings.

Home Office Deduction

Real estate agents have unique eligibility for the home office deduction. The IRS allows it if you regularly and exclusively use a portion of your home for business, and it's your principal place of business OR you regularly meet clients there.

Legal Citation: IRS Publication 587

Two Methods to Calculate

Simplified Method:

- $5 per square foot

- Maximum 300 square feet = $1,500 deduction

- No depreciation recapture when you sell

Actual Expense Method:

- Calculate business-use percentage of home

- Deduct that percentage of: rent/mortgage interest, utilities, insurance, repairs, depreciation

- More complex but often larger deduction

Calculation Example: Simplified Method

Home office size: 200 sq ft

Rate: × $5

Annual deduction: $1,000

Calculation Example: Actual Expense Method

Home square footage: 1,800 sq ft

Office square footage: 200 sq ft

Business use percentage: 11.1%

Annual expenses:

Rent/Mortgage interest: $24,000

Utilities: $3,600

Insurance: $800

Repairs: $1,200

Depreciation: $5,000

Total: $34,600

Deductible amount (11.1%): $3,841

The actual expense method yields $2,841 more in this example—but requires more record-keeping.

Try our Home Office Tax Deduction Calculator to see which method works better for your situation.

Marketing and Advertising Expenses

Marketing is fully deductible under IRC § 162 as an ordinary and necessary business expense. Real estate agents typically spend 10-15% of their gross commission income on marketing.

Deductible Marketing Expenses

✅ Advertising:

- Yard signs and sign riders

- Print ads (newspapers, magazines)

- Digital ads (Facebook, Instagram, Google)

- Direct mail campaigns

- Branded promotional items

- Vehicle wraps and magnets

- Billboard advertising

✅ Staging and Photography:

- Professional photography fees

- Videography and drone footage

- Virtual tour creation

- Staging furniture rental

- Staging consultations

- Home preparation supplies

✅ Digital Presence:

- Website hosting and development

- IDX/MLS website integration

- CRM software subscriptions

- Email marketing platforms

- Social media management tools

- Lead generation services (Zillow, Realtor.com)

✅ Open House Expenses:

- Food and beverages for guests

- Signage and directional signs

- Printed materials

- Decorations

- Cleaning services before showing

Calculation Example

Annual marketing expenses:

Zillow/Realtor.com leads: $6,000

Facebook/Google ads: $3,600

Photography (12 listings × $200): $2,400

Yard signs: $800

Print materials: $500

Open house supplies: $400

Total marketing deduction: $13,700

Tax savings at 24% bracket: $3,288

Professional Fees and Licensing

Fully Deductible Professional Expenses

✅ License and Membership Fees:

- State real estate license fees

- License renewal costs

- National Association of Realtors (NAR) dues

- State association dues

- Local board dues

- MLS access fees

- SUPRA/lockbox fees

- E&O insurance premiums

✅ Professional Services:

- Transaction coordinator fees

- Virtual assistant services

- Bookkeeping and accounting

- Legal fees for business matters

- Tax preparation fees (business portion)

Typical Annual Costs

| Expense | Typical Cost |

|---|---|

| MLS dues | $500-$1,200/year |

| NAR + state + local dues | $800-$1,500/year |

| E&O insurance | $300-$800/year |

| Lockbox fees | $100-$300/year |

| License renewal | $100-$400/year |

| Total | $1,800-$4,200/year |

All of these are 100% deductible on Schedule C.

Technology and Office Expenses

Deductible Technology Costs

✅ Devices and Equipment:

- Laptop or computer (business-use percentage)

- Smartphone (business-use percentage)

- Tablet for showing presentations

- Printer and scanner

- Camera equipment

- Drone (if used for listings)

✅ Software and Subscriptions:

- CRM software (Follow Up Boss, kvCORE, etc.)

- Transaction management (Dotloop, SkySlope)

- Electronic signature (DocuSign, Authentisign)

- Accounting software

- Cloud storage (Dropbox, Google Drive)

- Video conferencing (Zoom, Google Meet)

- Design tools (Canva, Adobe)

✅ Office Supplies:

- Paper, folders, presentation materials

- Business cards

- Desk supplies

- Storage and filing systems

Phone and Internet Allocation

Most agents use personal phones and home internet for business. You can deduct the business-use percentage.

Example:

Annual phone bill: $1,200

Business use: × 70%

Deductible amount: $840

Annual internet: $720

Business use: × 60%

Deductible amount: $432

Total tech deduction: $1,272

Continuing Education and Training

Real estate license renewal requires continuing education, and the IRS considers these costs fully deductible.

Deductible Education Expenses

✅ Required:

- License renewal courses

- State-mandated CE credits

- Ethics training (NAR requirement)

✅ Optional but Deductible:

- Designation courses (CRS, ABR, GRI)

- Coaching programs

- Industry conferences

- Webinars and online courses

- Books and educational materials

- Training subscriptions

What's NOT Deductible

❌ Pre-license education (costs to get your initial license are not deductible—they're considered personal education to enter a new field)

Once you're licensed, ongoing education to maintain or improve your skills is fully deductible.

Client Entertainment and Gifts

The $25 Gift Limit

The IRS limits the deduction for business gifts to $25 per recipient per year. This applies to:

- Closing gifts to clients

- Referral thank-you gifts

- Holiday gifts to clients

Strategy: Gift cards for $25 or less are fully deductible. Gifts over $25? Only the first $25 is deductible.

Meals with Clients

Business meals with clients are 50% deductible under IRC § 274.

Example:

Lunch with buyer client (discussing offer): $80

Deductible portion: × 50%

Deduction: $40

Documentation required:

- Date and location

- Names of attendees

- Business purpose discussed

- Receipt

Self-Employment Tax Deductions

As an independent contractor, you pay 15.3% self-employment tax on net earnings:

- 12.4% Social Security (on first $184,500 for 2026)

- 2.9% Medicare (no limit)

- 0.9% Additional Medicare (on income over $200,000/$250,000)

Deduct Half of Self-Employment Tax

You can deduct 50% of your self-employment tax as an adjustment to income on Form 1040. This isn't a Schedule C deduction—it goes on line 15 of Schedule 1.

Example:

Net commission income: $100,000

Self-employment tax: $14,130

Deductible portion (50%): $7,065

Tax savings at 24% bracket: $1,696

Use our Self-Employment Tax Calculator to see your exact liability and deduction.

Health Insurance Deduction

Self-employed real estate agents can deduct 100% of health insurance premiums for themselves, their spouse, and dependents. This is one of the most valuable deductions available.

Legal Citation: IRC § 162(l)

What's Deductible

✅ Fully deductible:

- Health insurance premiums (medical, dental, vision)

- Long-term care insurance premiums (with limits by age)

- Medicare premiums (Parts A, B, C, D)

- Marketplace insurance premiums

Limitations

The deduction cannot exceed your net self-employment income from the business. If your premiums are $15,000 but your Schedule C profit is only $10,000, you can only deduct $10,000.

For a complete breakdown, see our Health Insurance Deduction Guide for Self-Employed 2026.

Retirement Contributions

Real estate agents can contribute to tax-advantaged retirement accounts that reduce both income tax and (in some cases) self-employment tax.

SEP IRA

- Contribute up to 25% of net self-employment income

- Maximum contribution: $70,000 for 2026

- Deadline: Tax filing deadline (including extensions)

- Simple to set up, no employee requirements

Solo 401(k)

- Employee contribution: Up to $23,500 (2026)

- Catch-up contribution (age 50+): Additional $7,500

- Employer contribution: Up to 25% of net self-employment income

- Total maximum: $70,000 (or $77,500 with catch-up)

Example: Tax Savings from Retirement Contributions

Net income: $100,000

SEP IRA contribution (20%): $20,000

Taxable income reduction: $20,000

Tax savings at 24% bracket: $4,800

SE tax savings (7.65%): $1,530

Total tax savings: $6,330

Common Mistakes Real Estate Agents Make

Mistake #1: Not Tracking Mileage

Problem: Reconstructing mileage logs from memory or using estimates

Impact: IRS can disallow entire vehicle deduction (average $8,000+ lost)

Solution: Use a mileage tracking app daily. The IRS requires "contemporaneous" records—meaning logged at or near the time of the trip.

Mistake #2: Missing the Home Office Deduction

Problem: Thinking you don't qualify because you have a desk at the brokerage

Impact: Missing $1,500-$4,000 in annual deductions

Solution: If you do administrative work from a dedicated home space, you likely qualify. Meeting clients at home also qualifies you.

Mistake #3: Mixing Personal and Business Expenses

Problem: Using one credit card for everything, making personal purchases with business accounts

Impact: Difficulty substantiating deductions in an audit, potential disallowance

Solution: Separate business bank account and credit card. Period.

Mistake #4: Not Making Quarterly Tax Payments

Problem: Waiting until April to pay taxes owed

Impact: Underpayment penalties (currently ~8% annually)

Solution: Pay estimated taxes quarterly: April 15, June 15, September 15, January 15

Simplify Your Real Estate Tax Deductions With AI

Tracking every expense, maintaining IRS-compliant records, and maximizing deductions is a part-time job on top of your real estate career. Jupid automates the entire process.

What makes Jupid different for real estate agents:

✅ AI accountant in WhatsApp - Ask tax questions anytime, get instant answers backed by IRS guidance

✅ 95.9% accuracy in categorization - Connect your bank; Jupid automatically categorizes transactions into IRS-compliant expense categories

✅ Real-time financial insights - See your deductions and tax liability as they happen, not just at tax time

✅ Automatic tax filing - From bookkeeping to Schedule C, handled for you

Example conversation:

- You: "I spent $350 on staging supplies for a listing. Is this deductible?"

- Jupid: "Yes, staging supplies are 100% deductible as a marketing expense under IRC § 162. This reduces your taxable income by $350. I've categorized it as 'Marketing - Staging' on your Schedule C."

Action Checklist: Maximizing Your 2026 Deductions

Start of Year

- Record January 1 odometer reading

- Set up mileage tracking app

- Establish home office space (if applicable)

- Open separate business bank account and credit card

- Document square footage of home office

Throughout the Year

- Track every business mile within 24 hours

- Save all receipts (digital photos count)

- Keep client meeting notes for meal deductions

- Log all professional dues and fees paid

- Track phone/internet usage percentage

Before Year End

- Make retirement contributions (SEP, Solo 401k)

- Pay any outstanding business expenses

- Calculate estimated Q4 tax payment

- Record December 31 odometer reading

At Tax Time

- Complete Schedule C with all income and expenses

- Complete Schedule SE for self-employment tax

- Calculate home office deduction (compare both methods)

- Report health insurance premiums on Schedule 1

- Attach Form 8829 if using actual home office method

Resources and Citations

IRS Publications (Official Sources)

- IRS Publication 463 - Travel, Gift, and Car Expenses

- IRS Publication 587 - Business Use of Your Home

- IRS Publication 535 - Business Expenses

- Schedule C Instructions - Profit or Loss From Business

Tax Code and Regulations

- IRC § 162 - Trade or Business Expenses (all ordinary and necessary expenses)

- IRC § 162(l) - Self-Employed Health Insurance Deduction

- IRC § 274 - Disallowance of Certain Entertainment, etc., Expenses

- IRC § 280A - Disallowance of Certain Expenses in Connection with Business Use of Home

- IRC § 3508(b) - Qualified Real Estate Agents as Statutory Non-Employees

- IRS Notice 2026-10 - Standard Mileage Rates for 2026

2026 Key Numbers Summary

| Item | 2026 Limit |

|---|---|

| Standard mileage rate | 72.5¢ per mile |

| Simplified home office | $5/sq ft (max $1,500) |

| Business gift limit | $25 per person |

| Meal deduction | 50% of cost |

| SE tax rate | 15.3% |

| Social Security wage base | $184,500 |

| SEP IRA maximum | $70,000 or 25% of net income |

| Solo 401(k) employee limit | $23,500 |

Disclaimer

This article provides general information about tax deductions for real estate agents and should not be considered tax advice. Tax laws change frequently, and individual circumstances vary significantly. The deductions described assume you are classified as an independent contractor; employee agents have different rules. For advice specific to your situation, consult with a qualified tax professional.

Tax Year: 2026 Last Updated: January 19, 2026

Ready to simplify your finances?

Join 1,000+ businesses using Jupid to save time and money. Start simplifying your finances today.

30-day money-back guarantee