Uber & Lyft Driver Tax Deductions 2026: Complete Guide for Rideshare Drivers

Table of Contents

Published: January 22, 2026 Tax Year: 2026

A Message from Slava

Rideshare driving seems simple—turn on the app, give rides, get paid. But when tax season comes, drivers discover they're running a business. You're an independent contractor, not an employee, which means you're responsible for tracking every expense, paying self-employment tax, and filing Schedule C.

The upside? Every mile you drive, every bottle of water you offer passengers, every phone charger in your car—it's all potentially deductible. Through my work with gig economy workers, I've seen drivers reduce their tax bills by $5,000-$10,000 per year just by understanding what they can write off.

This guide covers every deduction available to Uber and Lyft drivers, with exact IRS citations and real calculations.

Executive Summary: Rideshare Tax Deductions for 2026

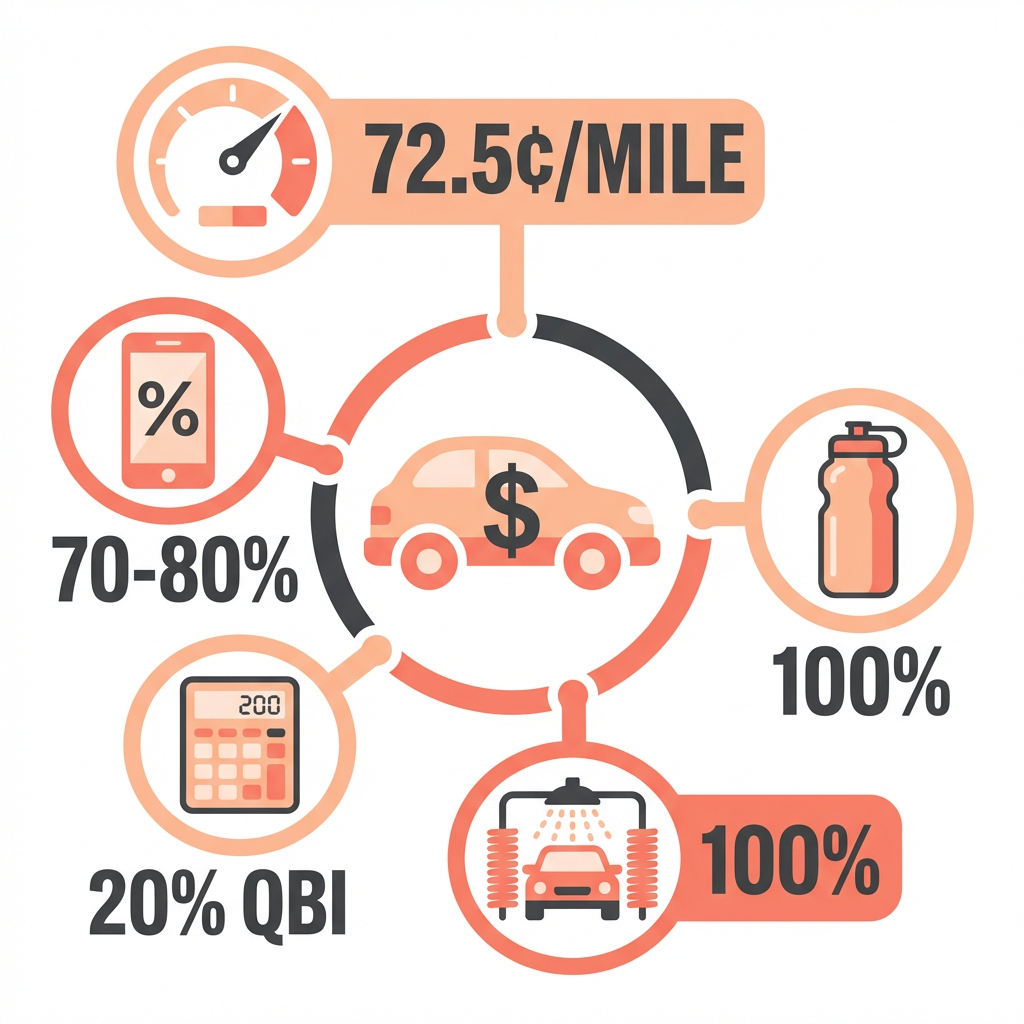

Key Deductions Available:

- Vehicle/Mileage: 72.5¢ per mile (IRS Notice 2026-10) or actual expenses

- Phone and Data: Business-use percentage (typically 50-75%)

- Passenger Amenities: Water, snacks, chargers—100% deductible

- Car Expenses: Insurance, registration, maintenance (if using actual method)

- QBI Deduction: 20% of qualified business income

Tax Savings Potential for 2026:

For a rideshare driver earning $50,000 in gross ride income:

Vehicle expenses (25,000 miles): $18,125

Phone and data (60% business): $720

Passenger amenities: $400

Car washes and cleaning: $300

Self-employment tax (50%): $3,532

QBI deduction (20%): $4,845

Total deductions: $27,922

Tax savings at 22% bracket: $6,143

Legal Basis: IRC Section 162, IRS Publication 463, IRS Publication 334, Schedule C (Form 1040)

Understanding Your Rideshare Tax Documents

Tax Documents from Uber

Uber provides several tax documents through the driver app:

| Document | Who Receives It | Purpose |

|---|---|---|

| 1099-K | Drivers with 200+ rides AND $20,000+ earnings | Reports gross payment volume |

| 1099-NEC | Drivers with $600+ in non-ride income (promotions, referrals) | Reports non-ride compensation |

| Tax Summary | All drivers | Annual summary of earnings, miles, fees |

Where to find your Uber tax documents:

- Open Uber Driver app

- Go to Account → Tax Info → Tax Documents

- Download your 1099s and Tax Summary

Tax Documents from Lyft

Lyft provides similar documentation:

| Document | Who Receives It | Purpose |

|---|---|---|

| 1099-K | Drivers with 200+ rides AND $20,000+ earnings | Reports gross payment volume |

| 1099-NEC | Drivers with $600+ in bonuses/referrals | Reports non-ride compensation |

| Annual Summary | All drivers | Detailed breakdown of earnings and expenses |

Accessing Lyft tax documents:

- Go to the Lyft Driver Dashboard (online)

- Navigate to Tax Information

- Download your documents

Important: Report ALL Income

Even if you don't receive a 1099 (earned less than $20,000 or had fewer than 200 rides), you must report all rideshare income to the IRS.

Vehicle and Mileage Deductions

For rideshare drivers, mileage is typically the largest deduction. You can easily drive 20,000-40,000 miles per year.

2026 Standard Mileage Rate

The IRS standard mileage rate for 2026 is 72.5 cents per mile.

Source: IRS Notice 2026-10

What Counts as Deductible Business Miles

✅ Deductible (app ON):

- Driving to pick up a passenger

- Driving the passenger to their destination

- Driving between rides while waiting for the next request

- Driving to a high-demand area ("surge zone")

✅ Also deductible:

- Driving to get car washed

- Driving to buy passenger amenities

- Driving for required vehicle inspections

❌ Not Deductible (app OFF):

- Commuting from home to your first ride area

- Personal trips between rideshare sessions

- Driving home at the end of the day (unless you have a home office)

The Home Office Strategy

If you maintain a qualified home office, your first trip of the day becomes a business trip—not a commute. This can add thousands of deductible miles per year.

Example:

- Without home office: 15 miles to first pickup = $0 (commute)

- With home office: 15 miles to first pickup = $10.88 (business)

Standard Mileage vs. Actual Expense Method

Standard Mileage (Simpler):

Annual business miles: 25,000

Standard mileage rate: × $0.725

Total vehicle deduction: $18,125

Actual Expense Method:

Annual vehicle expenses:

Gas: $6,000

Insurance: $2,400

Repairs/maintenance: $1,800

Depreciation: $4,000

Registration: $300

Car washes: $400

Total: $14,900

Business use percentage: × 80%

Total vehicle deduction: $11,920

In this example, standard mileage ($18,125) beats actual expenses ($11,920).

Use our Mileage Deduction Calculator to compare both methods.

Phone and Data Expenses

Your smartphone is essential for rideshare driving—you need it to accept rides, navigate, and communicate with passengers.

Calculating the Deduction

If you use your personal phone for rideshare:

Example:

Annual phone bill: $1,200

Business use: × 60%

Deductible amount: $720

Dedicated Business Phone

If you use a separate phone exclusively for driving:

- Phone purchase: 100% deductible

- Monthly service: 100% deductible

- Accessories: 100% deductible

Phone Accessories

✅ Deductible:

- Car phone mount

- Charging cables

- Portable battery packs

- Bluetooth earpiece (for navigation)

- Phone cases (business portion)

Passenger Amenities

Items you provide for passenger comfort are 100% deductible as ordinary and necessary business expenses.

Deductible Amenities

✅ Refreshments:

- Bottled water

- Mints and gum

- Individually wrapped snacks

✅ Convenience:

- Phone chargers (multi-type)

- Aux cables

- Phone mounts for passengers

- Tissues and hand sanitizer

✅ Comfort:

- Air fresheners

- Seat covers

- Floor mats (business portion)

Calculation Example

Bottled water (cases): $200

Mints and snacks: $100

Phone chargers: $50

Hand sanitizer and tissues: $50

Total amenities deduction: $400

Tax savings at 22% bracket: $88

Car Maintenance and Cleaning

Keeping your car clean and well-maintained is essential for good ratings—and it's deductible.

Deductible Expenses

✅ Cleaning:

- Car washes (exterior)

- Interior cleaning/detailing

- Vacuum services

- Cleaning supplies

✅ Maintenance (if using actual expense method):

- Oil changes

- Tire rotation

- Brake pads

- Wiper blades

- Other repairs

Note: If you use the standard mileage rate, maintenance is already included. You cannot deduct maintenance separately.

Car Wash Strategy

Many drivers get frequent car washes to maintain ratings. At $10-15 per wash, this adds up:

Weekly car washes (52 × $12): $624

Interior details (4 × $50): $200

Total cleaning deduction: $824

Tolls and Parking

Tolls and parking paid during rideshare driving are fully deductible—and they're separate from your mileage deduction.

What's Deductible

✅ Tolls:

- Highway tolls during rides

- Bridge tolls

- Express lane fees

✅ Parking:

- Parking while waiting for rides

- Airport parking (if picking up passengers)

- Parking meters during pickups

Strategy: Use a toll transponder (E-ZPass, FasTrak, etc.) to automatically track toll expenses.

Self-Employment Tax Deduction

Rideshare drivers are self-employed, meaning you pay 15.3% self-employment tax:

- 12.4% Social Security (on first $184,500 for 2026)

- 2.9% Medicare (no limit)

Deduct Half of Self-Employment Tax

You can deduct 50% of your self-employment tax on your Form 1040.

Example:

Net rideshare income: $40,000

Self-employment tax (15.3%): $6,120

Deductible portion (50%): $3,060

Tax savings at 22% bracket: $673

Use our Self-Employment Tax Calculator to calculate your exact liability.

QBI Deduction (20% Pass-Through)

The Qualified Business Income deduction allows self-employed individuals to deduct up to 20% of net business income.

Who Qualifies

Most rideshare drivers qualify if taxable income is below:

- $203,000 (single filers)

- $406,000 (married filing jointly)

Calculation Example

Net Schedule C income: $35,000

QBI deduction (20%): $7,000

Tax savings at 22% bracket: $1,540

For more details, see our QBI Deduction Guide 2026 and use our QBI Calculator.

Health Insurance Deduction

Self-employed rideshare drivers can deduct 100% of health insurance premiums.

Requirements

✅ You must show a net profit on Schedule C ✅ You cannot be eligible for an employer-subsidized plan

What's Deductible

- Health insurance premiums

- Dental and vision insurance

- Medicare premiums

For the complete guide, see Health Insurance Deduction for Self-Employed 2026.

Uber and Lyft Service Fees

The service fees Uber and Lyft deduct from your earnings are already subtracted from your income—you don't need to deduct them again.

What's Already Accounted For

When Uber/Lyft report your earnings, they report the NET amount after:

- Service fees

- Booking fees

- Safe Rides fees

You should NOT try to deduct these again. They're already reflected in your lower reported income.

What You CAN Deduct Separately

- Uber/Lyft subscription services (like Lyft Lux access)

- Background check fees you paid separately

- Vehicle inspection fees

Common Mistakes Rideshare Drivers Make

Mistake #1: Not Tracking Mileage

Problem: Using Uber/Lyft's "online miles" instead of total business miles

Impact: Missing miles between rides, to car washes, etc.

Solution: Use a separate mileage tracking app (Stride, Everlance) for complete tracking.

Mistake #2: Double-Counting Service Fees

Problem: Trying to deduct Uber/Lyft fees that are already subtracted

Impact: Overstating deductions—potential audit issue

Solution: Only report net earnings; fees are already accounted for.

Mistake #3: Missing the QBI Deduction

Problem: Not claiming the 20% pass-through deduction

Impact: Paying $1,000-$2,000+ more than necessary

Solution: Calculate QBI on Form 8995 or 8995-A.

Mistake #4: Not Paying Quarterly Taxes

Problem: Waiting until April to pay all taxes

Impact: Underpayment penalties (~8% annually)

Solution: Pay estimated taxes quarterly.

Track Your Rideshare Deductions With AI

Between driving passengers and tracking expenses, tax season can feel overwhelming. Jupid automates the entire process.

What makes Jupid different for rideshare drivers:

✅ AI accountant in WhatsApp - Ask tax questions anytime, get instant answers backed by IRS guidance

✅ 95.9% accuracy in categorization - Connect your bank; Jupid automatically categorizes gas, car washes, and supplies

✅ Real-time financial insights - See your deductions and estimated tax liability as you earn

✅ Automatic tax filing - From expense tracking to Schedule C, handled for you

Example conversation:

- You: "I bought a 3-pack of phone chargers for passengers for $25. Deductible?"

- Jupid: "Yes, passenger amenities are 100% deductible as business expenses under IRC § 162. I've categorized this as 'Supplies & Amenities' on your Schedule C."

Action Checklist: Maximizing Your 2026 Deductions

Start of Year

- Download a mileage tracking app

- Record January 1 odometer reading

- Set up a separate business bank account

- Download tax summary from Uber/Lyft

Throughout the Year

- Track every business mile (not just "online miles")

- Save all receipts (car wash, supplies, amenities)

- Track phone usage for business percentage

- Set aside 25-30% of earnings for taxes

Before Year End

- Make Q4 estimated tax payment

- Calculate annual mileage

- Compare standard mileage vs. actual expense method

- Record December 31 odometer reading

At Tax Time

- Download all 1099s and tax summaries

- Complete Schedule C with all income and expenses

- Complete Schedule SE for self-employment tax

- Calculate QBI deduction

- File by April 15 (or request extension)

Resources and Citations

IRS Publications (Official Sources)

- IRS Publication 463 - Travel, Gift, and Car Expenses

- IRS Publication 334 - Tax Guide for Small Business

- IRS Publication 535 - Business Expenses

- Schedule C Instructions - Profit or Loss From Business

Tax Code and Regulations

- IRC § 162 - Trade or Business Expenses

- IRC § 199A - Qualified Business Income Deduction

- IRS Notice 2026-10 - Standard Mileage Rates for 2026

2026 Key Numbers Summary

| Item | 2026 Limit |

|---|---|

| Standard mileage rate | 72.5¢ per mile |

| SE tax rate | 15.3% |

| SE tax deduction | 50% of SE tax |

| QBI deduction | 20% of qualified income |

| Social Security wage base | $184,500 |

| 1099-K threshold | 200 rides AND $20,000 |

Disclaimer

This article provides general information about tax deductions for Uber and Lyft drivers and should not be considered tax advice. Tax laws change frequently, and individual circumstances vary significantly. Rideshare drivers are typically classified as independent contractors; if your classification differs, different rules may apply. For advice specific to your situation, consult with a qualified tax professional.

Tax Year: 2026 Last Updated: January 22, 2026

Ready to simplify your finances?

Join 1,000+ businesses using Jupid to save time and money. Start simplifying your finances today.

30-day money-back guarantee