Small Business Tax Preparation Checklist 2026: Everything You Need Before Filing

Table of Contents

Published: February 13, 2026 Tax Year: 2026

A Message from Slava

Tax preparation for small business owners is 80% organization and 20% actual filing. The filing itself is mechanical — put the right number on the right line. The hard part is gathering, verifying, and organizing everything before you start.

When I was scaling Anna Money to serve 60,000+ small businesses in the UK, the most common complaint during tax season wasn't about complexity — it was about the scramble. Business owners spent hours hunting for receipts, reconciling bank statements, and tracking down 1099s that never arrived. The tax preparer had what they needed, but the business owner didn't have what the preparer needed.

At Jupid, we built our system specifically to eliminate this scramble. Every transaction is categorized throughout the year, every receipt is captured in real time, and every tax-relevant number is available on demand. But whether you use Jupid or a spreadsheet, the preparation process is the same.

This checklist covers everything a small business owner needs to gather and verify before filing their 2026 tax return. Print it. Check items off as you go. Start early — February is better than April. The business owners who file first are the ones who prepared all year.

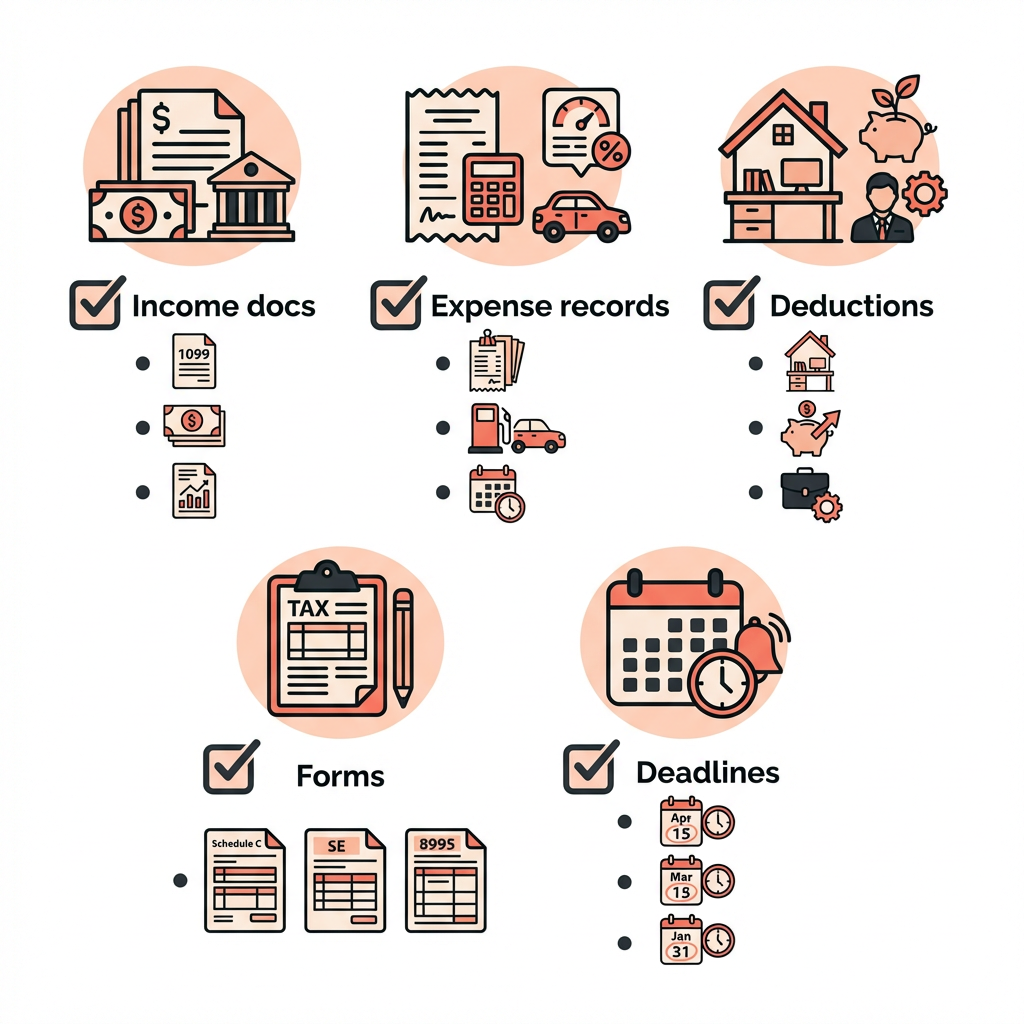

Executive Summary: Tax Preparation Checklist Overview

Who this checklist is for: Sole proprietors, single-member LLCs, multi-member LLCs, S Corp owners, and any small business owner preparing their federal tax return.

2026 Filing Deadlines:

| Return Type | Standard Deadline | Extended Deadline |

|---|---|---|

| Schedule C (sole proprietor) | April 15, 2026 | October 15, 2026 |

| Form 1065 (partnership/multi-member LLC) | March 15, 2026 | September 15, 2026 |

| Form 1120-S (S Corporation) | March 15, 2026 | September 15, 2026 |

| Form 1120 (C Corporation) | April 15, 2026 | October 15, 2026 |

2026 Key Tax Numbers:

| Item | 2026 Amount |

|---|---|

| SE tax rate | 15.3% |

| Social Security wage base | $176,100 |

| Standard deduction (single) | $15,700 |

| Standard deduction (MFJ) | $31,400 |

| QBI deduction | Up to 20% |

| Standard mileage rate | 70 cents/mile |

| Section 179 limit | $1,320,000 |

| Home office simplified method | $5/sq ft (max $1,500) |

Legal basis: IRS Publication 334, IRS Publication 583, IRC §162

Phase 1: Pre-Filing Preparation

Before you touch a single tax form, gather and organize these items. Missing documentation is the #1 cause of filing delays, missed deductions, and unnecessary CPA fees.

Personal Information

- Social Security number (SSN) or Individual Taxpayer Identification Number (ITIN)

- Spouse's SSN/ITIN (if married filing jointly)

- Dependents' SSNs and dates of birth

- Prior year tax return (Form 1040 with all schedules)

- Prior year AGI (needed for e-file verification)

- Identity Protection PIN (if issued by the IRS)

Business Information

- Business name and address

- Employer Identification Number (EIN)

- Business principal activity code (6-digit NAICS code)

- Date business started (if first year)

- Accounting method (cash or accrual)

- State business registration details

- Operating agreement (for multi-member LLCs)

Banking and Financial Access

- Business bank account statements (all 12 months)

- Business credit card statements (all 12 months)

- Payment processor reports (Stripe, PayPal, Square, Venmo for Business)

- Loan statements with interest amounts

- Investment account statements

Phase 2: Income Documentation

Forms You Should Receive

Every dollar of income must be reported — even income not reported on an information return. But these forms are your starting point:

| Form | What It Reports | Who Issues It | Due to You By |

|---|---|---|---|

| 1099-NEC | Nonemployee compensation ($2,000+) | Clients who paid you | January 31 |

| 1099-K | Payment card/third-party network payments ($2,500+ for 2026) | Payment processors | January 31 |

| 1099-MISC | Rent, royalties, other income | Various payers | January 31 |

| 1099-INT | Interest income ($10+) | Banks, financial institutions | January 31 |

| 1099-DIV | Dividend income ($10+) | Brokerage accounts | January 31 |

| 1099-B | Proceeds from stock sales | Brokers | February 15 |

| W-2 | Employment wages (if you also have a job) | Employer | January 31 |

| Schedule K-1 | Partnership/S Corp pass-through income | Entity | March 15 |

Income Verification Checklist

- Collect all 1099-NEC forms — compare to your records. If a client paid you $2,000+ and didn't send a 1099, report the income anyway

- Collect all 1099-K forms from payment processors

- Cross-reference 1099 amounts against bank deposits — identify any income not covered by a 1099

- Document cash income and direct payments that won't appear on any 1099

- Record product/inventory sales revenue

- Record any bartered goods or services received (fair market value is taxable income)

- Note any refunds, rebates, or returned merchandise that reduce income

- Compile interest and dividend income from business accounts

What If a 1099 Is Wrong?

If a 1099-NEC or 1099-K shows an incorrect amount:

- Contact the issuer and request a corrected form (1099 with "CORRECTED" checked)

- If they refuse or don't respond, report the correct amount on your return and attach an explanation

- Keep documentation (invoices, contracts, payment records) to support your numbers

- The IRS matches 1099s to returns — a discrepancy will trigger a notice, so be ready to respond

Phase 3: Expense Documentation by Category

Organized expense records are where most small businesses either save thousands or lose thousands. Every legitimate business expense reduces your taxable income — but only if you can document it.

Advertising and Marketing (Schedule C, Line 8)

- Online advertising (Google Ads, Facebook, Instagram, LinkedIn)

- Website hosting and domain fees

- Business cards, flyers, and printed materials

- Email marketing software (Mailchimp, ConvertKit)

- Social media management tools

- SEO and content marketing services

- Trade show booth fees and promotional materials

Vehicle Expenses (Schedule C, Line 9)

Two methods — choose one per vehicle:

Standard mileage rate (70 cents/mile for 2026):

- Mileage log with date, destination, business purpose, and miles

- Total business miles for the year

- Total personal miles (to calculate business use percentage)

- Parking fees and tolls (deductible in addition to mileage rate)

Actual expense method:

- Gas and oil receipts

- Repair and maintenance receipts

- Insurance premiums

- Registration and license fees

- Depreciation (or lease payments)

- Business use percentage based on mileage

For a complete vehicle deduction guide, see our car mileage deduction guide.

Contract Labor (Schedule C, Line 11)

- Payments to independent contractors ($600+ requires 1099-NEC)

- Verify you issued 1099-NEC to all qualifying contractors

- Retain contractor W-9 forms

- Contracts or agreements documenting the work

For guidance on contractor vs. employee classification, see our employees vs. contractors guide.

Depreciation and Section 179 (Schedule C, Line 13)

- List of assets placed in service during the year (computers, equipment, furniture, vehicles)

- Purchase date and cost of each asset

- Business use percentage for each asset

- Prior year depreciation schedules (Form 4562)

- Section 179 election amounts (up to $1,320,000 for 2026)

For Section 179 details, see our Section 179 depreciation guide.

Insurance (Schedule C, Line 15)

- Business liability insurance premiums

- Professional liability / E&O insurance

- Commercial property insurance

- Workers' compensation insurance

- Business interruption insurance

- Cyber liability insurance

Note: Health insurance premiums for self-employed individuals are deducted on Schedule 1, Line 17 — not Schedule C. See our health insurance deduction guide.

Interest (Schedule C, Line 16b)

- Business loan interest statements

- Business credit card interest (on business purchases only)

- Line of credit interest

- Equipment financing interest

Legal and Professional Services (Schedule C, Line 17)

- CPA/accountant fees for business tax preparation

- Attorney fees for business matters

- Bookkeeping service fees

- Consulting fees

- Tax preparation software costs

Office Expenses and Supplies (Schedule C, Lines 18, 22, 23)

- Office supplies (paper, ink, pens, filing materials)

- Computer software and subscriptions (under $2,500 per item)

- Postage and shipping costs

- Cleaning and janitorial services

- Small tools and equipment (under $2,500 de minimis safe harbor)

Rent (Schedule C, Lines 20-21)

- Office or retail space lease payments

- Equipment rental payments

- Coworking space membership

- Storage unit rental

Travel (Schedule C, Line 24a)

- Airfare for business trips

- Hotel/lodging for business travel

- Car rental during business trips

- Taxi, rideshare, and public transit for business

- Travel documentation: business purpose, dates, locations

For complete travel deduction rules, see our business travel deduction guide.

Meals (Schedule C, Line 24b)

- Business meal receipts (50% deductible for 2026)

- Documentation: date, location, attendees, business purpose

- Client entertainment meals

- Business meeting meals

For details, see our business meal deduction guide.

Utilities (Schedule C, Line 25)

- Business phone and mobile service

- Internet service (business portion)

- Website hosting and cloud services

- Electricity and gas (for business premises — not home office, which goes on Form 8829)

Home Office (Schedule C, Line 30 / Form 8829)

- Square footage of home office

- Total square footage of home

- Rent or mortgage interest allocated to home office

- Utilities allocated to home office

- Home insurance allocated to home office

- Choose: simplified method ($5/sq ft, max $1,500) or actual expense method (Form 8829)

For complete home office deduction guidance, see our home office deduction guide.

For a full breakdown of all expense categories, see our business expense categories guide.

Phase 4: Forms Needed by Business Type

Sole Proprietor / Single-Member LLC

| Form | Purpose |

|---|---|

| Form 1040 | Personal tax return |

| Schedule C | Profit or Loss from Business |

| Schedule SE | Self-Employment Tax |

| Schedule 1 | Additional Income and Adjustments (half SE tax deduction) |

| Form 8995 or 8995-A | Qualified Business Income Deduction |

| Form 1040-ES | Estimated tax payment vouchers |

| Form 8829 | Home office deduction (if using actual expense method) |

| Form 4562 | Depreciation and Amortization (if claiming Section 179 or depreciation) |

For a line-by-line guide, see our Schedule C instructions guide.

Multi-Member LLC (Partnership)

| Form | Purpose |

|---|---|

| Form 1065 | U.S. Return of Partnership Income |

| Schedule K-1 (1065) | Each Partner's Share of Income |

| Form 1040 | Each member's personal return |

| Schedule E, Part II | Report K-1 income |

| Schedule SE | Self-employment tax on K-1 earnings |

| Form 8995 or 8995-A | QBI deduction |

Deadline: March 15 (partnership return), then April 15 (personal returns).

S Corporation

| Form | Purpose |

|---|---|

| Form 1120-S | U.S. Income Tax Return for S Corporation |

| Schedule K-1 (1120-S) | Shareholder's Share of Income |

| Form W-2 | Shareholder-employee salary |

| Form 940 | Federal Unemployment Tax |

| Form 941 | Quarterly payroll tax return |

| Form 1040 | Each shareholder's personal return |

| Schedule E, Part II | Report K-1 income |

Deadline: March 15 (S Corp return), then April 15 (personal returns).

Phase 5: Key Deductions to Verify

Don't file until you've verified these high-value deductions. Missing any one of them could cost you hundreds or thousands of dollars.

Qualified Business Income (QBI) Deduction

Potential savings: Up to 20% of net business income deducted from taxable income.

Net business income: $100,000

QBI deduction: $100,000 × 20% = $20,000

Tax savings at 22% bracket: $4,400

- Verify your business qualifies (most do, with income-phase-out limits for specified service trades)

- Calculate using Form 8995 (simplified) or Form 8995-A (detailed)

- Confirm your income is below the phase-out threshold ($191,950 single / $383,900 MFJ for 2026)

For complete QBI guidance, see our QBI deduction guide.

Legal citation: IRC §199A

Home Office Deduction

Potential savings: $1,500 (simplified method) to $5,000+ (actual expense method).

- Confirm your home office is used regularly and exclusively for business

- Calculate both methods and choose the larger deduction

- If using actual expenses, complete Form 8829

For details, see our home office deduction guide.

Legal citation: IRC §280A

Vehicle Deduction

Potential savings: $3,000-$15,000+ depending on mileage.

Business miles: 15,000

Standard mileage rate: $0.70

Deduction: 15,000 × $0.70 = $10,500

- Verify your mileage log is complete and contemporaneous

- Calculate both standard mileage and actual expense methods

- Choose the method that gives the larger deduction

Legal citation: IRC §162, IRC §274(d) (substantiation requirements)

Retirement Plan Contributions

Potential savings: Up to $23,500 (employee) + 25% of compensation (employer) for Solo 401(k).

- SEP IRA: Contributions up to 25% of net self-employment income (max $70,000 for 2026)

- Solo 401(k): Employee contributions up to $23,500 + employer contributions up to 25%

- Traditional IRA: Up to $7,000 ($8,000 if age 50+)

- Verify contributions were made by the applicable deadline

For details, see our retirement plan deductions guide.

Legal citation: IRC §404 (SEP IRA), IRC §401(k)

Self-Employed Health Insurance Deduction

Potential savings: Full premium amount deducted above-the-line.

- Health insurance premiums for you, your spouse, and dependents

- Dental and vision insurance premiums

- Long-term care insurance premiums (age-based limits)

- Verify you're not eligible for employer-subsidized health insurance through a spouse's employer

For details, see our health insurance deduction guide.

Legal citation: IRC §162(l)

Half of Self-Employment Tax

Automatically calculated: The deductible half of your SE tax reduces AGI.

Net profit: $90,000

SE tax: $90,000 × 92.35% × 15.3% = $12,716

Deductible half: $6,358 (reported on Schedule 1, Line 15)

Tax savings at 22%: $1,399

- Confirm this deduction is claimed on Schedule 1, Line 15

- This is an above-the-line deduction (reduces AGI)

Startup Expenses (First-Year Businesses)

Potential savings: Up to $5,000 deducted immediately (remaining amortized over 180 months).

- Business formation costs (legal fees, state filing fees)

- Market research costs

- Pre-opening advertising

- Training expenses

- Travel costs for scouting business locations

For details, see our startup expenses tax deduction guide.

Legal citation: IRC §195

Phase 6: Important 2026 Deadlines

Federal Filing Deadlines

| Date | Action Required |

|---|---|

| January 15, 2026 | Q4 2025 estimated tax payment due |

| January 31, 2026 | Issue W-2s and 1099-NEC to recipients |

| January 31, 2026 | File 1099-NEC with IRS (if paper filing) |

| February 28, 2026 | File 1099-MISC/1099-K with IRS (paper) |

| March 15, 2026 | File Form 1065 / 1120-S (or file extension Form 7004) |

| March 31, 2026 | File 1099-NEC/1099-MISC/1099-K with IRS (e-file) |

| April 15, 2026 | File Form 1040 / 1120 (or file extension Form 4868/7004) |

| April 15, 2026 | Q1 2026 estimated tax payment due |

| April 15, 2026 | Last day for prior year IRA and SEP IRA contributions |

| June 15, 2026 | Q2 2026 estimated tax payment due |

| September 15, 2026 | Extended Form 1065 / 1120-S due |

| September 15, 2026 | Q3 2026 estimated tax payment due |

| October 15, 2026 | Extended Form 1040 / 1120 due |

| October 15, 2026 | Last day for SEP IRA contributions (if extension filed) |

| January 15, 2027 | Q4 2026 estimated tax payment due |

State Filing Deadlines

Most states follow federal deadlines, but several have different dates:

| State | Personal Return Deadline | Partnership/S Corp Return |

|---|---|---|

| Most states | April 15 | March 15 |

| Iowa | April 30 | March 15 |

| Virginia | May 1 | March 15 |

| Louisiana | May 15 | April 15 |

| Hawaii | April 20 | April 20 |

Check your state's specific requirements — some states also require separate estimated tax payments with different rules than federal.

Phase 7: State Filing Requirements

Does Your State Require a Business Tax Return?

| State Type | What You File |

|---|---|

| No income tax states (AK, FL, NV, NH, SD, TN, TX, WA, WY) | No state income tax return, but franchise or gross receipts tax may apply |

| States with income tax | State equivalent of Schedule C, Form 1065, or Form 1120-S |

| States with entity-level tax (CA, TX, NY, IL, etc.) | Separate entity-level return in addition to personal return |

Multi-State Filing

If your business operates in multiple states, you may need to file in each state where you:

- Have physical presence (office, warehouse, employees)

- Have significant sales

- Are registered to do business

Each state has its own rules for apportioning income — typically based on sales, payroll, and property in the state.

- Identify all states where you have filing obligations

- Determine how each state apportions income

- Gather state-specific forms and instructions

- Note different state deadlines

Phase 8: Common Audit Triggers to Avoid

The IRS selects returns for audit based on several factors. Avoiding these red flags doesn't mean hiding income or inflating deductions — it means filing accurately and documenting thoroughly.

High Audit-Risk Items

Excessive Schedule C losses — Reporting net losses year after year triggers the hobby loss rule review. If you show a profit in at least 3 out of 5 years, the IRS presumes a profit motive.

Legal citation: IRC §183 (hobby loss rules)

Large meal and entertainment deductions — Meal deductions that are disproportionate to revenue draw scrutiny. Keep receipts with the date, location, attendees, and business purpose for every meal over $75.

Home office deduction — The IRS knows this deduction is commonly abused. Strict documentation of "regular and exclusive" business use is essential. Use measurements and photos.

Round numbers everywhere — Reporting exactly $5,000 in supplies, $3,000 in travel, and $2,000 in meals suggests estimation rather than actual records. Use exact amounts from receipts and records.

High deductions relative to income — Deductions that exceed 50-60% of gross income may trigger review, especially for service businesses with low overhead. This doesn't mean you shouldn't claim legitimate deductions — just be ready to document them.

Cash-intensive businesses — Restaurants, retail stores, and service businesses that handle significant cash receive extra scrutiny. Maintain daily cash logs and deposit all cash income.

Misclassified workers — Treating employees as independent contractors is a major audit target. The IRS loses revenue when workers are classified as contractors instead of employees. Follow the IRS classification guidelines carefully.

Documentation Standards

The IRS requires "adequate records" under IRC §274(d) for:

- Travel expenses (date, destination, business purpose, amount)

- Meal expenses (date, location, attendees, business purpose, amount)

- Vehicle expenses (mileage log or actual expense records)

- Listed property (business use percentage documentation)

The general rule: If you can't prove it, you can't deduct it. Keep records for at least 3 years from the filing date (6 years if you underreported income by more than 25%).

Phase 9: When to Hire a CPA vs. DIY

DIY Filing Makes Sense When

✅ You have a simple sole proprietorship with straightforward income and expenses

✅ Your annual revenue is under $75,000-$100,000

✅ You have no employees and no complex transactions

✅ You use accounting software or a service like Jupid that categorizes everything

✅ You're comfortable with Schedule C and have filed before

✅ You have no multi-state filing obligations

Hire a CPA When

✅ You have a multi-member LLC or S Corporation (Form 1065 or 1120-S)

✅ Your business has employees (payroll taxes, W-2s, Form 940/941)

✅ You have complex transactions (real estate, investments, international income)

✅ You made the S Corp election this year and need guidance on reasonable salary

✅ Your revenue exceeds $200,000+ and the risk of errors is high

✅ You have multi-state filing obligations

✅ You have inventory or cost of goods sold calculations

✅ You're being audited or received an IRS notice

The Cost of Professional Preparation

| Service | Typical Cost (2026) |

|---|---|

| Schedule C preparation | $200-$500 |

| Form 1065 preparation | $800-$2,000 |

| Form 1120-S preparation | $1,000-$3,000 |

| Quarterly estimated tax calculations | $200-$500/year |

| Bookkeeping (monthly) | $300-$1,000/month |

| Full-service CPA (prep + advisory) | $2,000-$5,000/year |

Pro tip: Even if you prepare your own return, consider a one-time CPA review of your first filing. They can catch structural mistakes (like missing the S Corp election or incorrectly classifying workers) that compound over years.

Common Mistakes to Avoid

Mistake #1: Mixing Personal and Business Expenses

Problem: Using a personal bank account and credit card for business transactions, making it impossible to cleanly separate business expenses from personal spending.

Impact: Missed deductions (because you can't identify which personal card purchases were business expenses), inflated deductions (because personal expenses accidentally get categorized as business), and audit risk.

Solution: Use a dedicated business bank account and business credit card. Every business transaction should flow through business accounts. This single step eliminates the most common source of tax preparation chaos.

Mistake #2: Not Tracking Mileage Throughout the Year

Problem: Trying to reconstruct a year's worth of business driving in March by looking at calendar entries and guessing distances.

Impact: The IRS requires a "contemporaneous" mileage log — created at or near the time of the trip. Reconstructed logs from memory are less defensible in an audit and often undercount actual business miles.

Solution: Use a mileage tracking app (MileIQ, Stride, or similar) that logs trips automatically. At minimum, maintain a simple spreadsheet with date, destination, purpose, and miles.

Mistake #3: Missing the Quarterly Estimated Payment Deadlines

Problem: Paying all taxes at filing time instead of quarterly throughout the year.

Impact: Estimated tax penalty of approximately 8% annual rate on the underpaid amount, calculated per quarter. On $20,000 of tax, a full year of missed payments costs roughly $800-$1,000 in penalties.

Solution: Calculate and pay quarterly estimated taxes by April 15, June 15, September 15, and January 15. Use the prior year safe harbor method for simplicity. For penalty details, see our estimated tax penalty guide.

Mistake #4: Overlooking the QBI Deduction

Problem: Filing Schedule C and calculating self-employment tax without claiming the Qualified Business Income deduction on Form 8995.

Impact: Missing up to 20% deduction on net business income. On $80,000 of QBI, that's a $16,000 deduction — worth $3,520 in tax savings at the 22% bracket.

Solution: Complete Form 8995 or 8995-A with every return that includes business income. Most sole proprietors and LLC members qualify. See our QBI deduction guide.

Mistake #5: Filing Without Reconciling Bank Statements

Problem: Entering income and expenses from memory or rough estimates without comparing to bank and credit card statements.

Impact: Underreported income triggers IRS matching notices (the IRS receives copies of your 1099s and compares them to your return). Overreported expenses trigger audit scrutiny.

Solution: Reconcile every business bank account and credit card statement against your records before filing. Every deposit should have an income source. Every business charge should have a category.

Prepare Your Taxes Year-Round With AI

Tax preparation shouldn't happen once a year in a panicked scramble. The business owners who pay the least tax and spend the least time preparing are the ones who stay organized all year.

What makes Jupid different:

Jupid is an AI-powered financial assistant that turns tax preparation from a yearly ordeal into a background process. Every transaction is categorized as it happens. Every tax-relevant number is ready when you need it.

✅ 95.9% categorization accuracy — Jupid automatically sorts every transaction into the correct IRS expense category, building your Schedule C data in real time

✅ Real-time tax liability tracking — Ask "What's my estimated tax bill?" at any point during the year and get a current answer

✅ Quarterly estimated tax calculations — Jupid calculates your quarterly payments based on actual income, not guesswork

✅ Bank connection and auto-sync — Connect your business bank accounts and credit cards for automatic transaction import

✅ WhatsApp and iMessage access — Text "How much have I spent on advertising this year?" and get the number instantly

✅ Tax-ready reports — Export organized income and expense reports that your CPA (or you) can use directly for filing

Example conversation:

- You: "Am I ready to file my taxes?"

- Jupid: "Here's your summary: $127,400 gross income, $38,200 total expenses, $89,200 net profit. You have 3 uncategorized transactions totaling $340. Your estimated tax liability is $24,100, and you've paid $18,000 in estimated payments. You'll owe approximately $6,100 at filing."

Start organizing your business finances with Jupid

Action Checklist: Complete Tax Preparation Workflow

January (4+ Weeks Before Filing)

- Collect all W-2s, 1099-NEC, 1099-K, and 1099-MISC forms

- Reconcile bank statements for all 12 months

- Verify all business expenses are categorized

- Gather receipts for deductions over $75

- Update mileage log and calculate total business miles

- Compile home office measurements and expenses

- Review prior year return for deductions you claimed last year

February (Preparation Month)

- Calculate gross income from all sources

- Calculate total expenses by category

- Calculate net profit (income minus expenses)

- Determine SE tax using Self-Employment Tax Calculator

- Calculate QBI deduction (Form 8995)

- Review estimated tax payments made during the year

- Decide: file yourself or send organized data to CPA

March (Partnership / S Corp Returns Due)

- File Form 1065 or Form 1120-S by March 15 (or request extension)

- Issue Schedule K-1s to all partners/shareholders by March 15

- Begin personal return preparation with K-1 data

April (Personal Returns Due)

- Complete Form 1040 with all schedules

- File by April 15 or request extension (Form 4868)

- Pay any balance due by April 15 (even if filing extension)

- Make Q1 2026 estimated tax payment

- Make IRA or SEP IRA contributions for prior year (by April 15)

After Filing

- Save a copy of your complete return (all schedules and forms)

- Store supporting documentation for at least 3 years

- Set up quarterly estimated payments for the current year

- Implement any process improvements identified during preparation

- Review whether your business structure is optimal for next year

Resources and Citations

IRS Publications (Official Sources)

- IRS Publication 334 — Tax Guide for Small Business (comprehensive reference)

- IRS Publication 583 — Starting a Business and Keeping Records

- IRS Publication 535 — Business Expenses

- IRS Publication 505 — Tax Withholding and Estimated Tax

- IRS Publication 463 — Travel, Gift, and Car Expenses

- Schedule C Instructions — Profit or Loss from Business

- IRS: Small Business and Self-Employed Tax Center — Hub for all small business tax resources

- IRS Free File — Free filing options for qualifying taxpayers

Tax Code and Regulations

- IRC §162 — Trade or business expenses (general deduction authority)

- IRC §167, §168 — Depreciation rules

- IRC §179 — Election to expense certain business assets

- IRC §195 — Startup expenses

- IRC §199A — Qualified Business Income deduction

- IRC §274 — Meals, travel, and entertainment limitations and substantiation

- IRC §280A — Home office deduction

- IRC §1401 — Self-employment tax rates

- IRC §6654 — Estimated tax penalty

Related Jupid Guides

- Schedule C Instructions Guide 2026 — Line-by-line Schedule C walkthrough

- Business Expense Categories Guide 2026 — Every IRS expense category explained

- Tax Write-Offs for LLC 2026 — LLC-specific deductions

- QBI Deduction Guide 2026 — Qualified Business Income deduction

- Home Office Deduction Guide 2026 — Simplified and actual expense methods

- Self-Employment Tax Calculator — Calculate SE tax and estimated payments

2026 Key Numbers

| Item | 2026 Amount |

|---|---|

| SE tax rate | 15.3% |

| Social Security wage base | $176,100 |

| Standard deduction (single) | $15,700 |

| Standard deduction (MFJ) | $31,400 |

| QBI deduction | Up to 20% |

| Standard mileage rate | 70 cents/mile |

| Section 179 limit | $1,320,000 |

| Home office simplified | $5/sq ft (max $1,500) |

| Business meal deduction | 50% |

| De minimis safe harbor | $2,500/item |

| Form 1065 late penalty | $235/partner/month |

Final Thoughts

Tax preparation is a process, not an event. The business owners who spend the least time and money on their tax return are the ones who organize their finances throughout the year — not the ones who scramble in March.

The key priorities:

- Separate business and personal finances — A dedicated business bank account eliminates the largest source of preparation headaches

- Categorize expenses as they happen — Real-time categorization means your tax data is ready when you are

- Don't leave deductions on the table — The QBI deduction, home office deduction, retirement contributions, and vehicle expenses are the most commonly missed items for small business owners

Start with this checklist. Work through it methodically. If you get stuck, bring organized records to a CPA — you'll pay less for their time when your data is clean.

Disclaimer

This article provides general information about small business tax preparation and should not be considered tax advice. Tax rules, deduction limits, filing deadlines, and form requirements change annually. Your specific tax situation depends on your business structure, state of residence, income level, and individual circumstances. State filing requirements vary significantly. For advice specific to your situation, consult with a qualified tax professional.

Tax Year: 2026 Last Updated: February 13, 2026

Ready to simplify your finances?

Join 1,000+ businesses using Jupid to save time and money. Start simplifying your finances today.

30-day money-back guarantee